NooMUboN

Celsius Holdings (NASDAQ:CELH) isn’t a meme stock, and any hype associated with the brand is warranted. CELH went from generating $52.6 million in revenue for their 2018 fiscal year to delivering $1.15 billion in revenue over the trailing twelve months (TTM). CELH is clearly executing on its strategic plan, and the brand has so much momentum that PepsiCo (PEP) took a $550 million stake in CELH back in August of 2022. PepsiCo has more knowledge about the beverage industry than most entities, and its distribution chain can help CELH with its global expansion targets. Short interest has climbed to over 25%, and while the valuation may be a bit too rich for my blood, I don’t think this is a company worth shorting. CELH has tremendous growth potential, and PepsiCo has a vested interest in CELH’s success. CELH is one of those stocks that came out of nowhere, and the people who did the homework and took the risk generated enormous returns. Obviously, I wish I got in earlier as CELH has done nothing but gone up and to the right, but for now, I will be waiting on the sidelines for a better entry point.

Seeking Alpha

The Penny Stock that took the market by storm

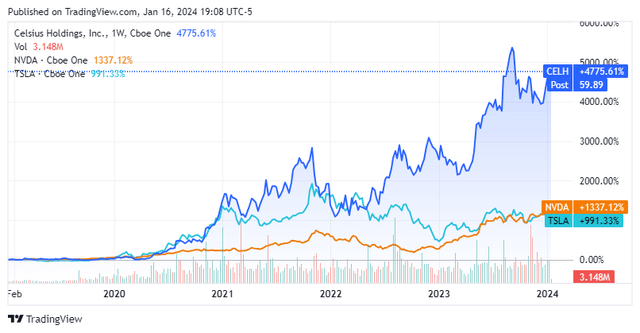

To be honest, I am not sure if I have seen this large of a return from any other company over the last 5-years or the past decade. When it comes to growth, I feel like Nvidia (NVDA) and Tesla (TSLA) have a continuous spotlight shining on them, but the real story is CELH. Any CELH shareholder that has held for the past 5 or 10 years, I just want to say congratulations because this has been an absolute monster. Over the past 5-years, TSLA has generated a 991.33% return, while NVDA has appreciated by 1,337.12%. These are incredible results that shatter the appreciation from both the Invesco QQQ Trust ETF (QQQ) of 152.40% and the SPDR S&P 500 ETF Trust (SPY) as it returned 82.65%. CELH didn’t just beat the market, it went into another stratosphere compared to TSLA and NVDA, as it has appreciated by 4,775.61% over the past 5 years. What may be even crazier is that over the past decade, shares of CELH are up 52,816.63%. On January 20th, 2014, shares of CELH traded for $0.11 and traded for under $1 until roughly January 9th, 2017.

CELH has taken the market by storm, and I can understand why there are so many bulls. CELH seems like it’s just getting started, and with PepsiCo behind them, there is a strong opportunity to expand its footprint. What CELH has achieved is nothing short of amazing, considering they are going head-to-head with established brands, including Red Bull and Monster Energy, and coming home with a piece of the pie. Being able to generate YoY revenue growth for a decade isn’t a fluke, and now CELH is turning the page on profitability. The real question now is, can the rally continue?

Seeking Alpha

Why I think Celsius Holdings has a bright future

CELH is tackling the functional energy drink and liquid supplement categories in the United States and internationally. Its core offerings include pre and post-workout functional energy drinks and protein bars. One of the big differentiators between CELH and its competitors is that six self-funded studies published in various journals, including the Journal of the International Society of Sports Nutrition, the Journal of the American College of Nutrition, and the Journal of Strength and Conditioning Research, concluded that a single serving of CELSIUS burns 100-140 calories. This is accomplished by increasing a consumer’s resting metabolism by an average of 12% while providing sustained energy for up to three hours. These studies have also indicated that a single serving of CELSIUS prior to exercising may improve cardiovascular health and fitness and enhance the loss of fat and gain of muscle from exercise.

Celsius Holdings

The key differentiator between CELH and its leading competitors is its focus on the fitness industry. At the end of 2019, there were an estimated 205,180 health and fitness clubs worldwide, with roughly 184.59 million gym memberships. In 2024, the global health and fitness market is expected to reach $96.6 billion as it grows at roughly 7.7% on an annual basis. The pre-workout supplement market is valued at around 15 billion dollars and is expected to nearly double by 2028. A critical aspect of the supplement market is that 75% of Americans take supplements in general, with pre-workout supplements being the most popular. CELH is targeting a specific audience rather than trying to compete against coffee and other products that offer a caffeine boost. By engineering a drink that burns calories and body fat, while providing an energy boost and being supported by essential vitamins, individuals who already take a pre-workout may be inclined to switch to a can of Celsius. CELH is also tackling the post-workout side, and while it’s common for individuals to have a protein shake after working out, Branched-chain amino acids (BCAAs) are essential nutrients, including leucine, isoleucine, and valine that stimulate the building of protein in muscle and possibly reduce muscle breakdown. CELH has a full BCAA+ line that can be consumed during a workout or as a post-workout recovery protocol. If CELH can convert a consumer on one end, they may be able to become part of someone’s pre and post-workout routine.

Celsius Holdings

The deal with PepsiCo was massive for CELH. On August 1st, 2022, CELH and PepsiCo entered into multiple agreements where CELH issued 1,466,666 shares of Series A Convertible Preferred Stock to PepsiCo for $550 million. The Transition Agreement specifies payments to be made by Pepsi to Celsius for transitioning certain existing distribution rights to PepsiCo. The Distribution Agreement resulted in PepsiCo becoming the Company’s primary distribution supplier for CELH products in the United States. When I look at what has occurred since this deal closed, it’s certainly compelling. CELH has generated $1.15 billion in revenue for the trailing twelve months (TTM), which is an additional $49.9 million more than their previous three fiscal years combined. In 2020, 2021, and 2022, CELH generated a combined total of $1.1 billion in revenue. There is no question in my mind that PepsiCo’s distribution footprint played a significant role in CELH’s expansion. The results didn’t stop at revenue, CELH was able to increase its gross profit by 101.51% to $545.9 million YoY and generate $155.5 million in net income compared to losing -$187.3 million in 2022.

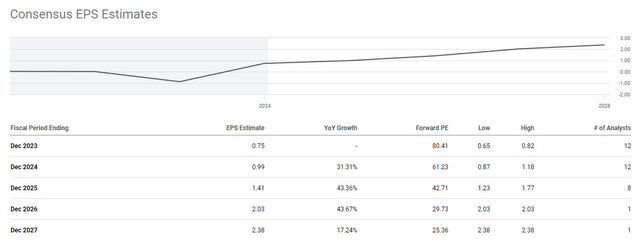

On Wednesday January 10th, CELH announced that the brand officially launched in Canada. Since PepsiCo has been a stakeholder, this is CELH’s first global expansion endeavor. When I read through the Q3 earnings call, management specifically addressed that international growth would be critical for their growth story over the next three years to five years. Management indicated that they were aiming to execute on a handful of countries in 2024 and then set their sights on additional global markets in 2025 and 2026. Consumers vote with their wallets, and if CELH wasn’t making a good product, its sales growth wouldn’t be this robust. With PepsiCo behind them, I think that CELH could have years of growth on the horizon as they continue to expand domestically and break into new global markets one at a time. The analyst community seems to agree, as 12 analysts have a consensus EPS estimate of $0.99 in 2024, which would be a YoY growth rate of 31.31%. Looking out to 2025, there are eight analysts that are calling for $1.41 in EPS, which would be an additional 43.36% of EPS growth in 2025. These numbers could actually be conservative if CELH can deliver on its global expansion goals.

Seeking Alpha

While I like everything I am seeing, I am sitting on the sidelines because of the valuation

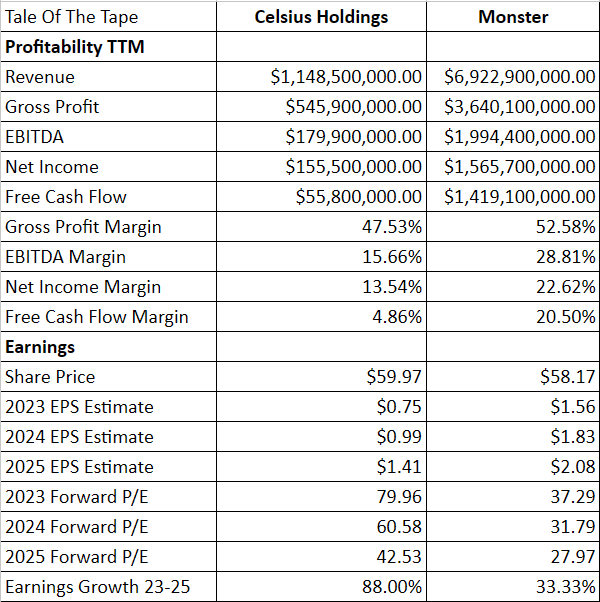

I wouldn’t bet against CELH as they are delivering on their business plan, but I will be waiting for a better entry point before adding them to my growth portfolio. When I compare CELH to Monster Beverage Corporation (MNST) it’s hard for me to justify adding CELH at these levels. MNST is generating $502.78% more revenue ($5.77 billion), 566.81% more gross profit ($3.09 billion), 906.88% more net income ($1.41 billion), and 2,443.19% more free cash flow (FCF) ($1.36 billion) than CELH with better margins. MNST is operating at a 5.05% higher gross profit margin, they have a 9.08% higher profit margin, and a 15.64% larger FCF yield on every dollar of revenue produced. When I look at the earnings growth, MNST is still growing at a double-digit rate YoY and trades at 31.79x 2024 earnings, and 27.97x 2025 earnings. CELH, on the other hand, trades at 60.58x 2024 earnings and 42.53x 2025 earnings. I may be incorrect, but I am not willing to pay these valuations for CELH.

Steven Fiorillo, Seeking Alpha

The risks of sitting on the sidelines

I could be 100% wrong, and CELH drive more EPS than expected over the next year by capitalizing on international expansion while taking additional market share domestically. PepsiCo is the ace in the hole, and they have a vested monetary interest in CELH’s success. It’s entirely possible that CELH can beat earnings estimates and cause shares to continue up and to the right. The other aspect is the short interest. More than 25% of the shares are sold short as a significant portion of the investment community thinks shares are overvalued. If CELH has an outstanding quarter or releases any type of compelling news from a product line that opens up new markets or global expansion ahead of their previous timeline, there could be a short squeeze. I wouldn’t bet against CELH, and the risk for me is losing out on upside appreciation. I never invest because of the fear of missing out (FOMO), and I think there are other opportunities that I am more comfortable with at this point.

Conclusion

CELH is now on my growth watchlist as this is a company I am very interested in. CELH has a $14 billion market cap, and this is something that I could see PepsiCo acquiring in the future if they think it will be a strong asset to their portfolio. In 2020, PepsiCo acquired Rockstar Energy for $3.85 billion, so this wouldn’t be their first venture into the space. CELH has a lot of things going for it as there is double-digit growth in both EPS and revenue on the horizon for years to come. They have shown they can deliver on international expansion and have plans to enter additional markets over the next several years, and they have found a way to differentiate themselves from the competition. Consumers are speaking with their wallets, and PepsiCo owns a stake in CELH, making them have a vested interest in CELH’s success. Right now, I am staying on the sidelines, but if shares sell off, I will be very interested in starting a position.