simarik

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund [CEF] market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the fourth week of March. Be sure to check out our other weekly updates covering the business development company [BDC] as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

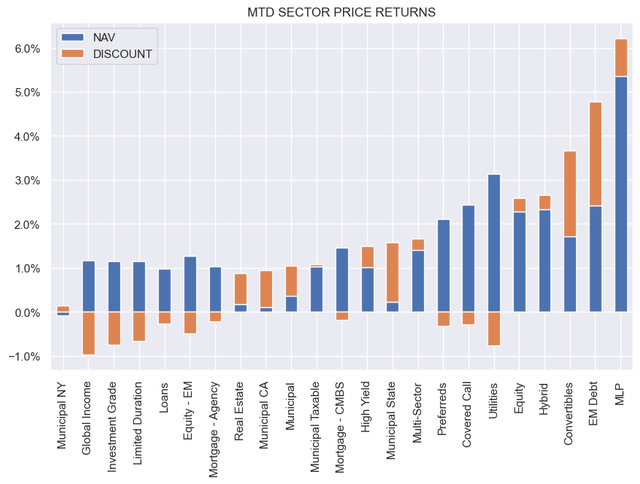

The CEF market was up solidly over the week with equity-linked sectors like convertible and MLP funds in the lead. Month-to-date, all CEF sectors are in the green.

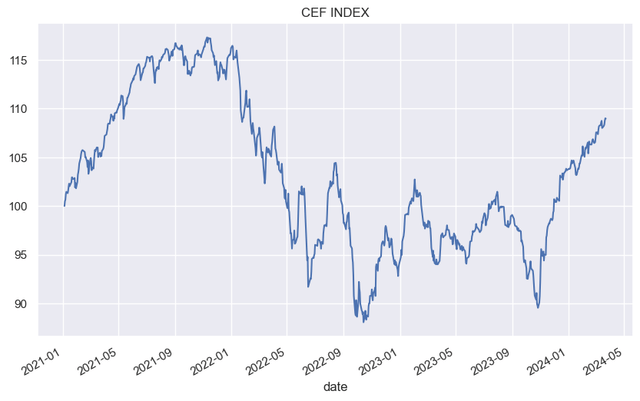

The CEF market has enjoyed the longest sustained rally since 2021.

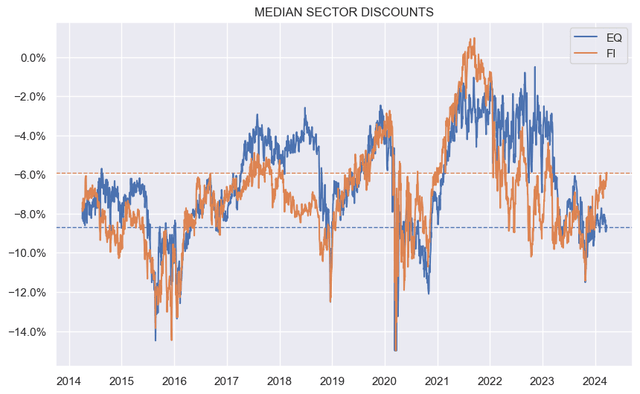

Equity CEF sector discounts continue to lag.

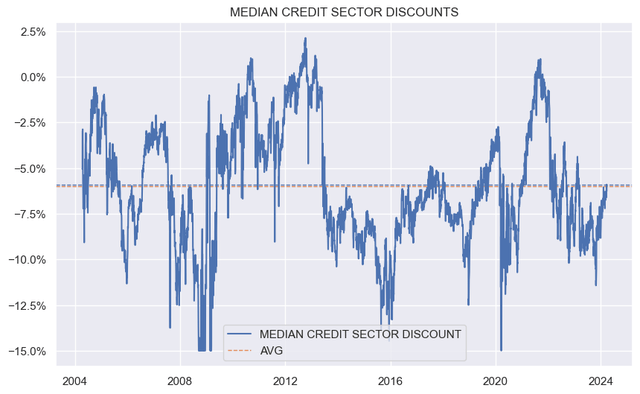

Credit CEF sectors are now back to their median historic level.

Market Themes

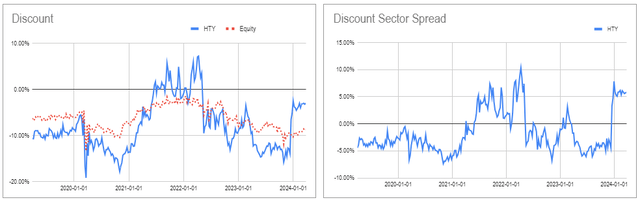

A John Hancock Equity CEF (HTY) is proposing a merger with its equity mutual fund JGYIX. Shareholders can vote on the merger in mid-April. The discount of the fund has already tightened in anticipation of the likely approval. This move makes a lot of sense for everyone, particularly the manager.

First, it reduces the possibility of an activist takeover for the manager. CEF activists continue to push managers to improve the valuations for their CEFs. An open-end fund, particularly mutual funds, either do not trade or don’t trade at sizable discounts so they are not targets of activism.

Two, it keeps the assets in the fund family, earning fees. There are other ways to monetize a CEF discount such as a tender offer or a termination. However, in these scenarios the manager loses assets and, hence, fees.

Three, a fund like HTY has not distinguished itself with its long-term track record. For example, it’s 10 year total NAV return is just 2.5% per annum – well below that of popular equity benchmarks. By merging HTY into another fund, the manager can effectively erase this history of underperformance.

For shareholders, the benefit is also clear. The merger will fully monetize the wide discount. We have already seen a sharp tightening in the discount in anticipation of the merger from a double-digit level.

More open-end fund mergers (together with more CEF IPOs) would be a continuing benefit to CEF shareholders.

Market Commentary

CEF activist Saba is running a proxy against the Nuveen preferred CEF (JPI). Normally, Saba would want a fund to terminate or run a tender offer at NAV which is exactly what JPI is doing. The likely scenario of the current process JPI is undertaking is that it will carry on as a smaller but perpetual fund – what JPT did not too long ago.

However Saba is advocating for a No vote on this because, presumably, they want to ensure that JPI in fact fully terminates as opposed to carrying on as a smaller perpetual fund. Saba is still annoyed that Nuveen tried to strip Saba of voting rights across some of their CEFs. So Saba is just trying to stick it to Nuveen and want them to have fewer CEFs.

JPI remains a decent option in the preferred CEF space with a 3.5% discount which will be a tailwind into the tender offer. In our view, the best option would be to vote yes and then to tender all shares, monetizing the discount.

Stance and Takeaways

With credit spreads trading at historically tight levels, credit CEF discounts now back to their longer-term average level and leverage costs remaining expensive, we recently reduced our exposure to CEFs in favor of income securities without explicit leverage or discount features. We expect better entry points over the medium term.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.