tadamichi

The Calamos Dynamic Convertible and Income Fund (NASDAQ:CCD) invests in convertible and high-yield fixed income securities with the goal of generating returns through both capital appreciation and income.

CCD typically invests at least 50% in convertibles and the fund seeks upside equity market participation with less downside exposure over a full market cycle.

Currently, CCD is rated a Hold by Seeking Alpha analysts. There are four reasons why I believe CCD is a sell:

1. High Management Fee

2. Weak historical risk-adjusted performance

3. Trading at a premium to NAV

4. Tax inefficient vehicle

1. High Management Fee

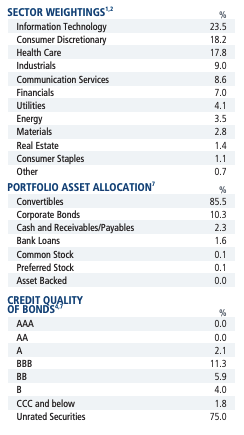

CCD charges a management fee of 1.00% on total and has other expenses of 0.08%. Thus, CCD has a total expense ratio of 1.08% on total assets (excluding leverage costs.) However, the fund is highly levered with a current leverage of 36.75%. Thus, the fund’s total expense ratio on total common share assets is currently ~1.71%. This compares to an average expense ratio of 0.44% for equity mutual funds and 0.37% for bond mutual funds.

Comparably, investors have access to low-fee convertible-focused ETFs such as the SPDR Bloomberg Convertible Securities ETF (CWB) and the iShares Convertible Bond ETF (ICVT) which charge expense ratios of 0.40% and 0.20% respectively.

I am generally skeptical of high-fee products as the vast majority of actively managed funds have failed to outperform their benchmarks over the long term.

2. Weak Historical Risk-Adjusted Performance

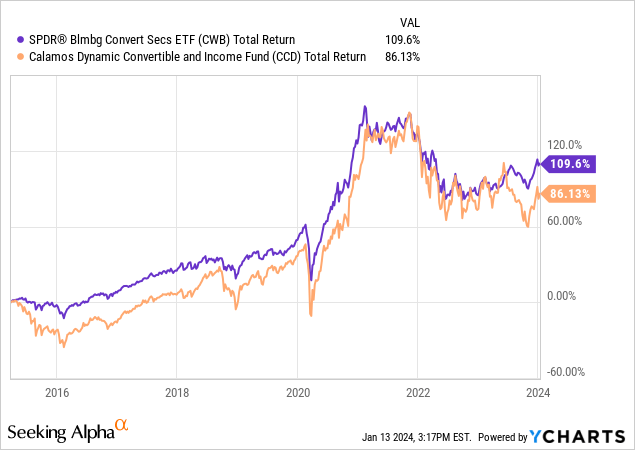

Since its inception in March 2015, CCD has delivered a total return of 86.13%. Comparably, CWB has delivered a total return of 109.6%.

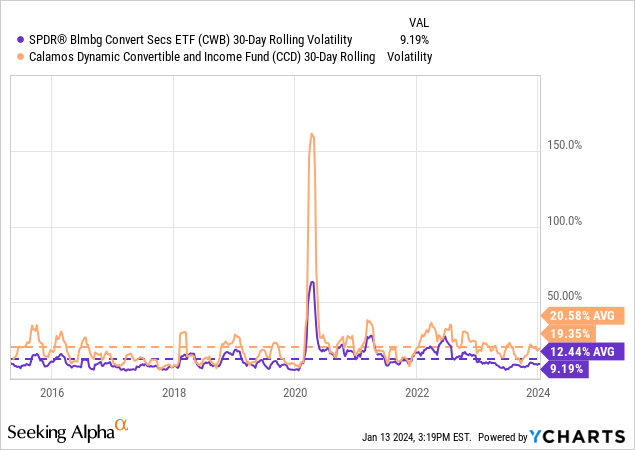

CCD’s relative performance is even worse on a risk-adjusted basis. As shown below, CCD has realized an average 30-day volatility of 20.58% since inception. Comparably, CWB has realized an average 30-day volatility of 12.44% over the same time period.

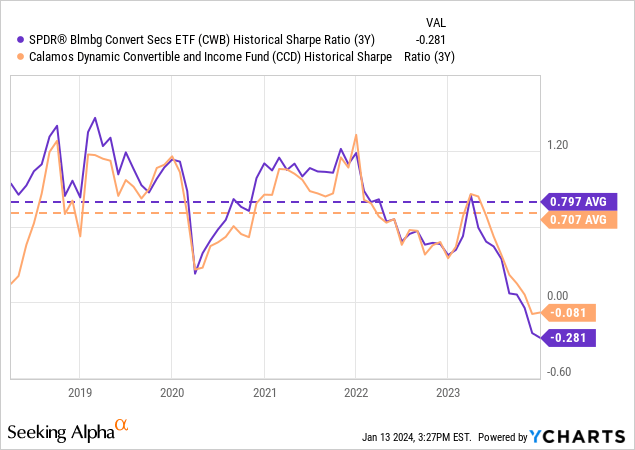

The result of this is that, since inception, CCD has delivered an average 3yr sharpe ratio of 0.71 which compares to an average 3yr sharpe ratio of 0.80 delivered by CWB over the same time period.

I believe the poor relative performance has been driven by three factors. Firstly, CCD has experienced significant volatility related to its trading level relative to NAV. Second, CCD has experienced additional volatility in NAV itself due to its substantial use of leverage. Third, CCD’s high management fees have created an additional performance drag.

I do not believe any of these factors are set to change anytime soon and thus I expect CCD to continue to underperform on a risk-adjusted basis going forward.

3. Trading At a Premium To NAV

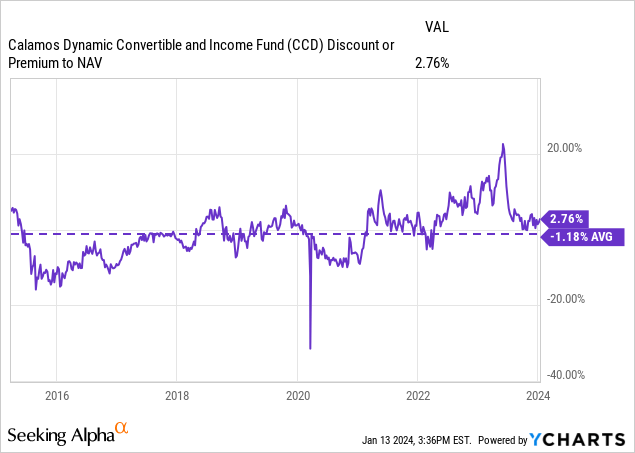

CCD is currently trading at a 2.76% premium to its NAV. I do not find this attractive relative to the fund’s historical average discount to NAV of 1.2%. Furthermore, I view CCD’s discount to NAV as especially unattractive relative to the wide discounts that many CEFs are currently trading at.

The average CEF discount for convertible securities funds is currently 6.3% and the average discount for all CEFs is currently 9.02%. Comparably, the median 10-year discount of all CEFs is 7.3%.

Thus, in this context do not see any reason why CCD should be trading at a premium to NAV. I view a modest discount (3%-7%) as more appropriate given CCD’s historical average discount to NAV and current CEF discount environment.

One important thing to note regarding CCD is that it includes a time-limit structure. Unless the Termination Date is amended by shareholders, CCD will be terminated on the 15th anniversary of its effective date. The Termination Date is expected to be March 26th, 2030. While it is difficult to predict whether or not shareholders will decide to extend the duration of the fund, the current termination date may help to minimize any potential discount to NAV as that date approaches. However, given that 2030 is still 6 years away I am not confident that this anchor date will prevent CCD from trading at a discount to NAV over the next few years.

4. Tax Inefficient Vehicle

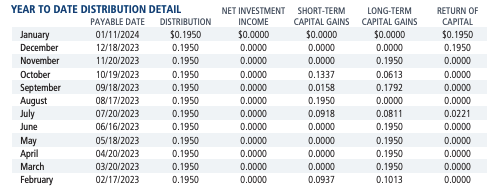

CCD has a managed distribution policy which means that it seeks to provide a high current level of income through a mix of net investment income, net realized short-term and long-term capital gains, and a return on capital.

Currently, CCD has an annual distribution rate of 11.88%. Over the past 12 months, as shown by the table below, CCD has paid out total distributions of $2.34. Of this amount, $0.53 consisted of short-term capital gains while $1.40 and $0.41 consisted of long-term capital gains and return on capital, respectively. Of note, none of CCD’s distributions consisted of net investment income. The reason for this is that convertible securities tend to have relatively low yields as investors receive significant compensation in the form of the convertible option. CCD’s significant use of leverage has likely resulted in a situation where the fund is not currently producing any net investment income as the cost of leverage exceeds the yield on its portfolio.

I view CCD’s high level of distributions as highly tax inefficient as investors are forced to pay tax on these distributions when they occur. CCD’s high rate of short-term capital gains is especially concerning given the fact that these distributions are taxed at higher rates (as high as 37% for those in the highest income tax brackets.) Long-term capital gains are taxed at a maximum rate of 20%. The result of CCD’s distribution policy is that long-term holders will face a tax drag in terms of compounding their investment relative to low distribution products such as CWB or ICVT. CCD’s distribution policy also results in a situation in which shareholders do not have control over the timing of tax realization. This is particularly relevant for investors who anticipate being in a lower tax bracket at a later date or investors who plan to hold CCD until death and might benefit from a step-up in basis.

Comparably, CWB and ICVT have distribution rates of 1.99% and 1.87% respectively. Moreover, CWB and ICVT fund their distributions via investment income and have not realized any short-term or long-term capital gains over the past year.

Thus, I view CCD as a highly tax inefficient way to get exposure to convertible securities relative to passive alternatives.

Calamos Investments

Holdings Overview

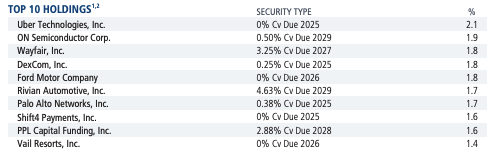

One key difference to note between CCD and passive convertible products such as CWB and ICVT is that CCD is able to hold corporate bonds and loans in addition to convertible securities. However, non-convertible securities currently account for a small portion of CCD’s assets.

Convertible securities currently account for 85% of CCD’s assets while corporate bonds account for 10.3% of assets. The remaining 4.7% of fund assets primarily consist of cash and bank loans. One might expect that the ability to actively manage relative exposure between corporate bonds and convertible securities would allow CCD to generate superior risk-adjusted returns relative to convertible-only funds. However, as previously discussed, that has not been the case.

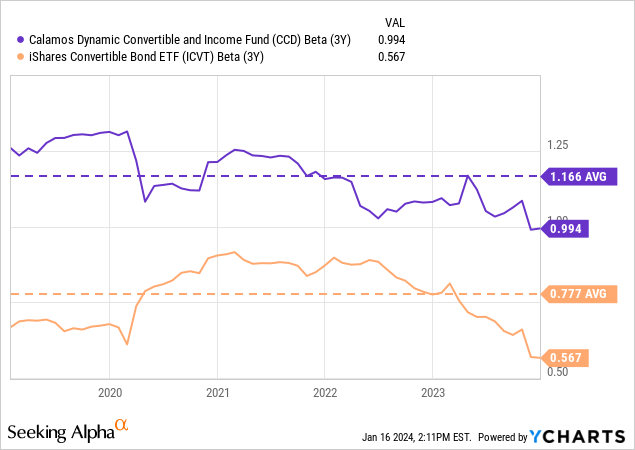

Convertible bonds generally have a high degree of equity market sensitivity as convertibles tend to be issued with low coupons and conversion premiums of ~25%-45%. Convertibles are issued with an average of ~5 years to maturity providing ample time for many issues to end in the money. As shown by the chart below, pure play un-levered convertible funds such as ICVT have historically had a beta of 0.78 to equities. CCD has experienced an average beta to equities above 1x due to the use of leverage. Given the high degree of exposure to underlying equity movements, I view sector and security allocation as an important factor when forming a view on CCD.

In terms of individual security exposure, CCD is well diversified with no position making up more than 2.1% of the fund. Technology companies account for 23.5% of the fund while consumer discretionary companies account for 18.2% of the fund. Comparably, technology sector holdings make up 40.3% of ICVT. ICVT’s technology sector exposure is well diversified with 124 holdings and no single technology company making up more than 2.9% of ICVT’s total assets.

On a relative basis, CCD is significantly underweight technology exposure.

I view this as something of a negative as my market view is that technology companies are well-positioned to continue outperforming other sectors. One reason for this view is that AI represents a significant positive secular growth opportunity for many technology companies. AI is accelerating the digital transformation and some estimates suggest as much as ~$6 trillion in offline spending could be poised to transition online over the long term.

Additionally, I believe many technology companies have higher-quality business models than companies in other sectors. For example consider software & services companies which account for ~42% of the entire technology equity market sector. These companies tend to have high share of recurring revenue and customers often face high switching costs due to software integration with other products. Further evidence for the general strength in technology company business models can be seen in the fact that the technology sector has net profit margins of ~25% compared to ~11% for the S&P 500.

Fitch Ratings estimates that technology sector experienced a loan default rate of ~2% during FY 2023 which ranks technology among the lowest default sectors for FY 2023. The technology sector experienced default rates of 1.3%, 1%, and 1.6% respectively for FY 2020 – 2022. Comparably, the broader leveraged loan market experienced default rates of 4.5%, 0.6%, and 1.6% respectively. Thus, while loans are different than convertible bonds, I believe the strong credit performance of the sector suggests it is of higher quality in nature which is relevant here given the fact that many convertible issues have at least moderate credit risk.

Calamos Investments Calamos Investments

What Would Make Me More Bullish on CCD

The most significant change that would make me more positive on CCD is if the fund were to go from trading at a slight premium to NAV to a moderate discount. I view a discount to NAV of 3%-7% as reasonable and would view any discount greater than that would make the shares attractive in my view.

Another change that would make me more bullish is if Calamos were to reduce its relatively high management fee on CCD. I view this as unlikely but I would find a management fee of 0.50% or less as much more attractive.

Conclusion

CCD has failed to deliver solid risk-adjusted performance since inception. I believe this has been driven by a combination of factors including significant volatility related to the fund’s trading price vs NAV and a very high management fee. I expect these key factors to continue going forward and thus expect CCD to continue underperforming passive convertible products on a risk-adjusted basis.

CCD’s managed distribution policy results in the fund being highly tax inefficient as investors have no control over the timing of large distributions. Moreover, CCD’s distribution policy means that long-term holdings will face a tax drag if they plan to reinvest distribution proceeds to compound their investment.

CCD trades at a modest premium to NAV which I do not believe is warranted. I believe the shares should trade at a modest discount to NAV.

I am initiating CCD with a sell rating and would consider upgrading my rating if the fund to hold if the fund were to trade at a moderate discount to NAV.