Marco Bello

Introduction

The controversial CEO/CIO of ARK Invest, Catherine Wood, published a letter on March 7th titled “The Journey From Monetary Shock To An Innovation-Led Economic Boom.”

In this article, I am going to break down her major talking points and provide my own commentary atop hers to create a better-rounded picture of the state of the “innovation” sector.

Wood and Me

It is important to note where I stand on ARK funds and Wood’s investing philosophy in general, since I am going to be giving my commentary here — some of it is negative.

I believe that ARK’s vision of global trends is very idealized and that many of their investment theses are obfuscated by technical jargon and hype built by media narratives.

That being said, Wood’s macroeconomic commentary has proven insightful in the past, and her background in economics shouldn’t be discounted because of disagreements on investments.

In the past, Wood has provided contrarian commentary on the economy that I have not seen elsewhere in media outlets, and her criticism of the Fed strays from orthodox narratives in interesting ways. This is the primary reason I read and analyze her letters because she has a voice that I generally do not hear elsewhere. I find it valuable to the overall discussion on macroeconomics.

Side note, I bought a jacket from their store when they were running a charity event for a girls’ STEM summer camp back in 2020. I also found that very valuable. It was very soft, 5/5.

The Fed Under Fire

Cathie starts her letter with an immediate firing off at the Fed.

Last year began the journey back from what we believe will be deemed one of the biggest mistakes in monetary policy history…the U.S. Federal Reserve…shocked the financial system with an unprecedented, and unexpected, 24-fold surge in the Fed funds rate…[The] Fed’s moves did arrest the price shock caused by COVID-related supply chain bottlenecks and pushed commodity prices…back into the deflationary trend that has been in place since the Great Financial Crisis (GFC) in July 2008…

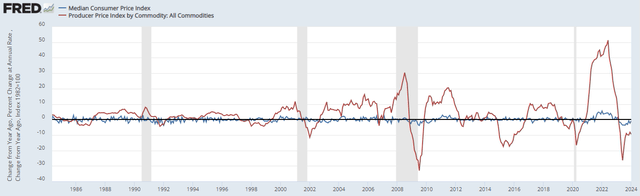

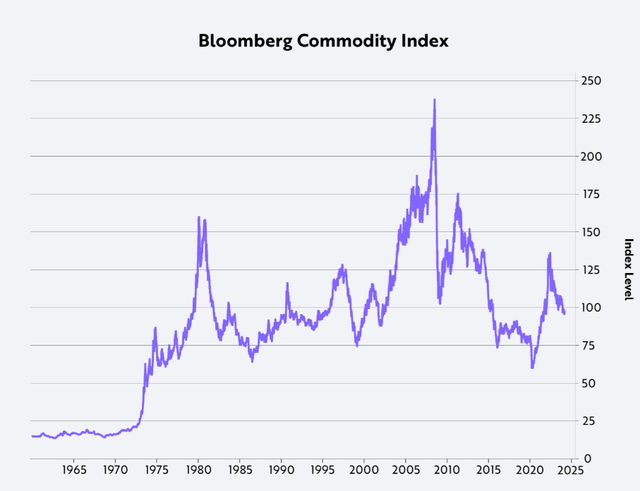

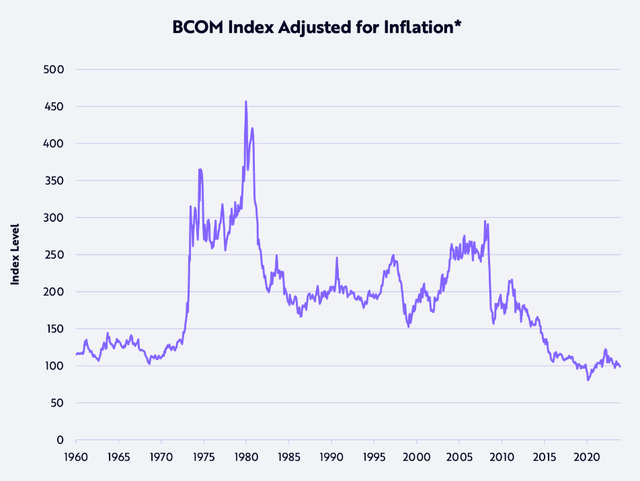

Following this, Cathie cites two charts: the gross and real Bloomberg Commodities Index (“BCOM”).

Figure 1 (ARK Invest) Figure 2 (ARK Invest)

This second chart is the most important for Wood’s argument: technologically-driven deflation has left commodities at the cheapest they have been since the 1960s in real terms.

This means that input costs, with its inflation measured by the producer price index, are getting cheaper in terms of purchasing power. This is proper deflation.

Today, BCOM is trading at the same level as it was more than 40 years ago in the early eighties, suggesting that the Fed’s fears about inflation are misplaced. In our view, deflation should be the concern. Indeed, adjusted for inflation as measured by the Producer Price Index (PPI), BCOM is lower than its level when the US abandoned the gold-exchange standard in 1971…

Producer pricing is far more volatile than consumer pricing, as shown in the comparison charts between CPI and PPI. These massive swings cause periods of mild deflation for these commodities.

When the Fed has to bring these rates down, money will become cheaper to borrow, favoring these smaller growth businesses held in ARK’s portfolios. Wood’s argument is that they will have no choice but to bring rates back down, as real deflation is too dangerous for the Fed to let run wild.

I don’t know if I believe this deflation narrative. Wood claims that the inflationary battle was won in 2008, and that all of the inflation noise since 2020 has been just that: noise.

Rising Rates Hurt ARK Badly

Instead, she asserts that we have deflated, and she says that we can see this in several markets.

As it observed the deflationary strains on housing, autos, commercial real estate, and capital spending, the Fed paused its tightening moves last summer. At the same time, in the technology realm, ChatGPT began to dramatize the seemingly miraculous breakthroughs that are likely to tip the scales even further toward broad-based deflation. Although creative destruction—the transition from gas-powered vehicles to electric vehicles, for example—could obfuscate the boom associated with AI and other disruptive technologies evolving today, the waves of growth associated with the convergence among the 14 technologies involved in our five major platforms—robotics, energy storage, AI, blockchain technology, and [DNA/genetic] sequencing—should start moving the needle on macro metrics increasingly and significantly during the next five to ten years.

Here comes the sales pitch: technology stocks ARK is invested in will benefit from falling interest rates as the Fed needs to tackle the deflation their rate increases have caused.

She says ARK is positioned to benefit from that switch in the Fed’s stance.

Because the Fed still seems to be fighting the inflation war that we believe ended in 2008, the equity market has been somewhat unsettled this year. Deflation would punish companies with leverage, and reward those with cash piles. In our view, the deflationary ramifications of current Fed policy already are surfacing through bankruptcies in commercial real estate, both office and multi-family, and could culminate in another round of regional bank failures. If the Fed were to lower interest rates in response, companies sacrificing short-term profitability to invest and potentially capitalize on technologically enabled super exponential growth opportunities should be prime beneficiaries.

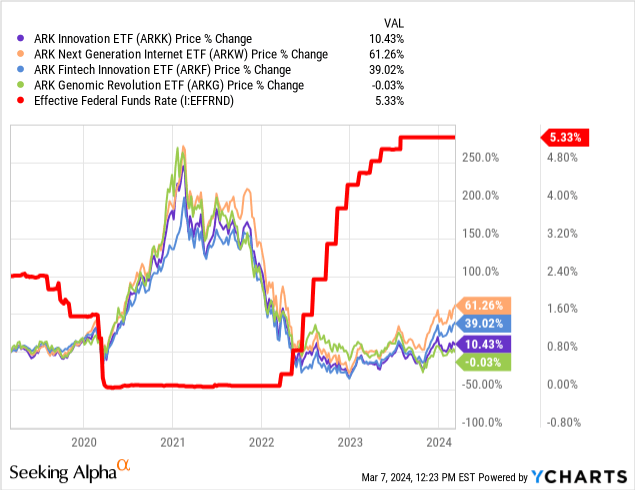

This is where we get an explanation of why the ARK funds have underperformed since the rate hikes began (and a bit before that), since they were punished as interest rates made money more and more expensive with each passing month.

On this point: the Fed Funds Rate rising punishes ARK funds, and it is falling rewards ARK funds, I agree. The data is clear.

If the Fed lowers rates, which I believe will start happening within the year, we should expect ARK to appreciate in sympathy.

Profits Have Been Hurt Too

Cathie cites the lowering of profit margins as a potential driver for large firms to adopt automation and innovative tech that could replace the cost of human capital and legacy business solutions.

After boosting profitability with higher prices during the supply-chain-related bottlenecks in 2021-22, and again as unit growth disappointed in 2023, corporations now seem to be losing pricing power, to the detriment of profit margins. As measured by Bloomberg, the S&P 500’s gross profit margin dropped from 34.8% on average during the past five years and 34.6% during the fourth quarter of 2022 to 33.5% during the fourth quarter of 2023. In our view, this setback will intensify until the Fed cuts interest rates significantly and unless companies harness innovation like artificial intelligence aggressively, not only to drive productivity growth but also to create new products and services that replace legacy solutions.

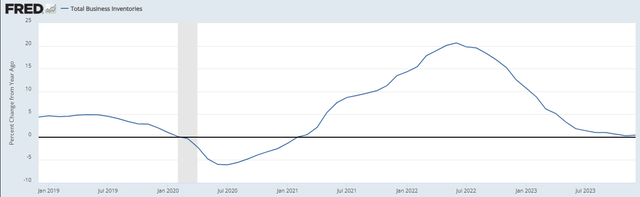

So it seems like firms are having to accept lower profits despite the price increases in consumer goods and services. Wood says this is partially caused by an excess of inventory, which is a legacy of overcoming pandemic-related shortages.

Seemingly expecting continued pricing power, companies never disgorged inventories after purchasing managers double- and triple-ordered goods in response to shortages during 2021-22. In real terms, nonfarm inventory accumulation swung ~$345 billion, from -$138 billion in the second quarter of 2021 to +$207 billion in the fourth quarter of 2021, and has yet to drop back into negative territory. Since then, the accumulation has continued apace, totaling another $913 billion. As a result, total inventory accumulation has hit 4% of real [GDP] over the past two and a half years, a rate which typically has not declined until the onset of a recession. If prices do fall and inventory losses mount, corporate gross margins will continue to suffer, potentially breaking down toward the 30.1% low hit in 2009.

Lo and behold, we haven’t seen a negative YoY change in inventories since Jan 2021, three years ago.

Wood cites some individual names that prove her point.

After what we have characterized as a “rolling recession” in the last few years, the damage is not likely to cascade uncontrollably. Both in the US and the rest of the world, much of the damage has been done. Belying the “soft landing” thesis that dominated “Wall Street’s” narrative, the revenues of many global bellwethers actually dropped on a year-over-year basis during the fourth quarter: 3M (-1.8%), UPS (-7.8%), Kraft-Heinz (-7.1%), Exxon Mobil (-12.3%), Thermo Fisher (-4.9%), Home Depot (-2.9%), Cisco (-5.9%), Texas Instruments (-12.7%).

A negative trend in revenue, especially one that is in or close to double digits, highlights the deflation point and hammers it home. There must be more to the story than just this if we are to believe that ARK is positioned to take advantage of this.

Cashing in on AI

Cathie moves on to discuss AI and brings up AOL’s history and evoking the Dot Com Bubble.

Roughly 30 years after America Online (AOL) first connected its proprietary email service to the internet in 1993, creating one of the most important “aha moments” in technology history, ChatGPT has captured the imagination of consumers, businesses, and the financial markets. Given lessons learned from internet history, the capital that has plowed into all-things-AI during the past year could get a reality check as companies become focused on the need to develop strategic plans for a breakthrough technology that is likely to separate winners from losers in the years ahead.

I disagree with this point, although my evidence for my claim is far more anecdotal: I don’t believe Large Language Models (“LLMs,” AI chatbots like ChatGPT, Bing, and Gemini are LLMs) are ready for any kind of meaningful roll out into society.

Microsoft hasn’t figured out how to stop bad actors from producing gore yet.

Google had a mishap with Gemini, where its internal “political correctness” setting was turned up to eleven, and it refused to generate images of white people, and men more specifically.

The second link in the paragraph above has examples of images I encourage you to check out. Currently, Gemini refuses to generate images, instead telling users, “We are working to improve Gemini’s ability to generate images of people. We expect this feature to return soon and will notify you in release updates when it does.”

Another example is the AI Air Canada used to replace its customer service reps, which changed company policy by mistake. A court ruled that Air Canada had to honor their chatbot’s mistake.

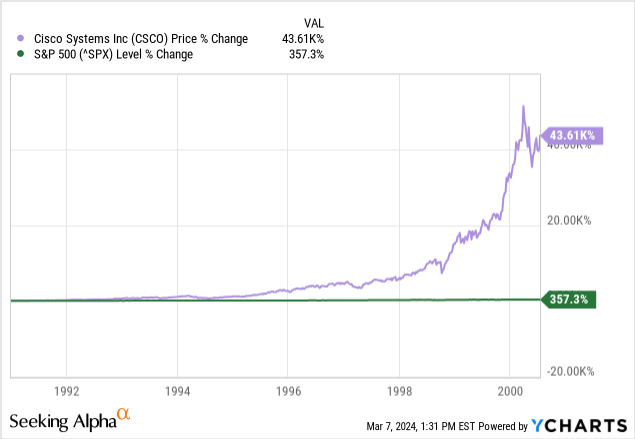

Adding to the Dot Com Bubble comparison, Cathie directly compares Cisco Systems to NVIDIA.

Cisco Systems (CSCO) offers a good history lesson…In the three and a half years leading to March 9, 1994, CSCO soared ~31-fold…The capital markets began to fund competitors, even those with systems inferior to Cisco’s, which confused strategic planners in corporations and cast a short-term pall on spending…After the coast cleared, CSCO entered another ~73-fold run into the peak of the internet bubble during 2000.

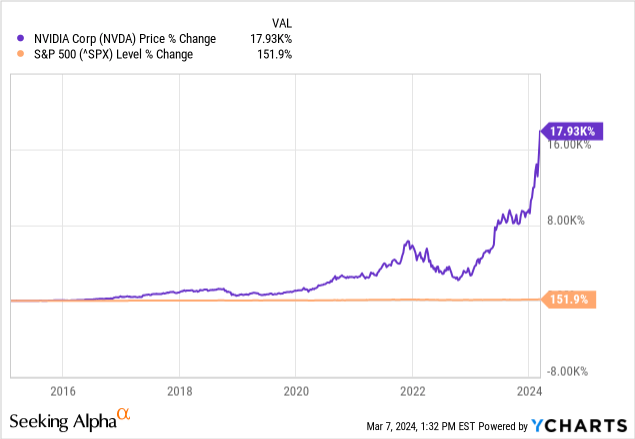

Today, Nvidia (NVDA) is that company…NVDA has soared ~117-fold in the roughly nine years since February 8, 2015, when analysts were beginning to understand that breakthroughs in Deep Learning…NVDA also had appreciated 23-fold in the five years since its last inventory correction…

The launch of ChatGPT…has fueled several quarters of unprecedented growth for Nvidia as cloud service providers, other consumer internet companies, and well-funded startups have scrambled…to acquire Nvidia’s hardware and train AI models. Today, Nvidia is guiding expectations to a sequential deceleration in growth and, reportedly, the lead time for its GPUs has dropped from 8-11 months to 3-4 months, suggesting that supply is increasing relative to demand. Without an explosion in software revenue to justify the overbuilding of GPU capacity, we would not be surprised to see a pause in spending, compounding a correction in excess inventories, particularly among the cloud customers that account for more than half of Nvidia’s data center sales. Longer term, unlike the history with Cisco, competition could intensify, not only because AMD is finding success but also because Nvidia’s customers—cloud service providers and companies like Tesla—are designing their own AI chips.

She may be onto something. Here are the charts of those two timeframes.

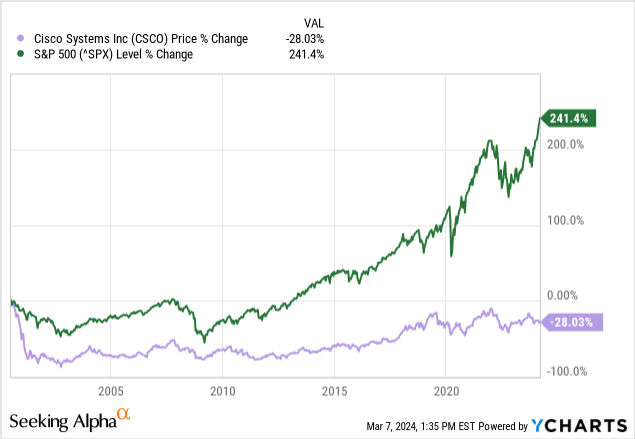

But if we are supposed to learn from history, we should take a look at the other half of CSCO’s chart. Let’s take a look at the CSCO chart, starting where the earlier one left off in July 2000.

Will this be NVDA’s fate?

Super-Exponential Growth

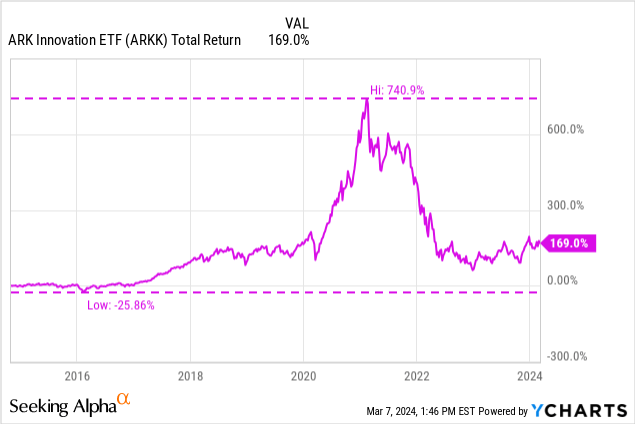

This phrase “super-exponential growth” was used twice in this letter to describe ARK’s trajectory. This is a large claim to make given ARK’s performance in the last few years.

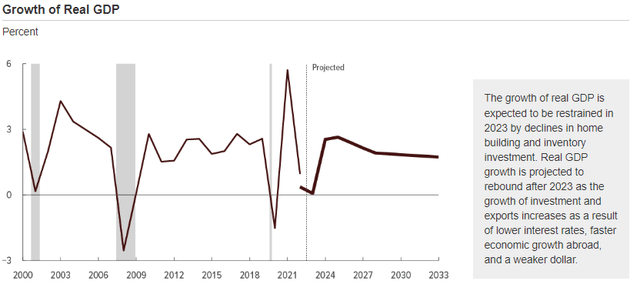

Once the cyclical correction is complete, AI should continue to take off and catalyze other technologies—including robotics, energy storage, blockchains, and [DNA/genetics] sequencing—creating convergences that we believe will lead not to exponential growth, but to super-exponential growth—already rapid growth rates that accelerate over time. In Big Ideas 2024, we have detailed the likely impact of these convergences on each of the technology platforms and on global economic growth between now and 2030. The upshot is that real [GDP] growth is unlikely to decelerate from 3% on average…but instead should accelerate to 6-8%+ growth…Moreover, if the five innovation platforms…evolve as our research suggests during the next seven years, the equity market cap associated with them should scale ~40% at an annual rate, from $15-20 trillion today to ~$220 trillion in 2030.

We are privileged to be researching disruptive innovation at the crossroads between the old world and the new world. Innovation solves problems, of which we have no shortage in 2024.

This 6-8% projection for real GDP must be accounting for this projected deflation ARK believes we are and will face more of until rates come down, which makes me dubious of these claims.

The Congressional Budget Office (“CBO”) estimates far lower.

The other claim that the five major ARK funds will see 40% market cap growth p.a. for the next seven years is also an incredible claim, and one that will be very hard to achieve even if Wood is correct about her “super-exponential growth” thesis.

Her past returns have been far lower, at least if you held through the incredible climb in 2020 and 2021, which is the last time I personally owned any ARK funds.

That doesn’t mean that we don’t have insight to gain from this letter, or that her words are hollow, despite how outlandish a 40% p.a. claim is. I believe that Cathie Wood is onto something with her narrative on commodities and how we are close to an inflection point in artificial intelligence.

That doesn’t make her fund a good investment, even if she’s right.

What do you think of her letter and her thoughts on the current state of the innovation market? Let me know in the comments.

Thanks for reading.