We talked about Bitcoin last week, but I didn’t get to my favorite story. Let’s start with a little background on Cathie Brown.

Let me make something clear. Cathie Wood is good at what she does. You don’t get Cathie Wood status by losing a lot of money. Over the years, her portfolios have ballooned in size because of her ability to generate out-of-this-world gains, which always catches the attention of Wall Street.

I feel the need to say that because the well-known investor was turned into the market’s punching bag in 2022 for holding true to her convictions and investment style.

Full disclosure, her Ark Innovation Fund (ARKK) is still trading at a third of the price of its 2021 highs while the Nasdaq 100 is making new highs.

Here’s a bold statement for you, Cathie Wood’s Ark Innovation Fund stopped outperforming the market because of you. Well, maybe. If you were one of the millions of investors that were trying to mimic her fund performance by buying the stocks she held then yeah, it might you.

We’ll get into why it is so hard for Cathie Wood to beat the market now next week. For now, let’s stick to her move on Bitcoin.

Ark Invest is one of the companies that was approved to offer the new Bitcoin ETFs. The fund is called the Ark 21shares Bitcoin ETF (ARKB). Like the others, they’re out there attracting new funds into the ETF as fast as possible. At this point in the game, there’s a limited amount of money that is going to allocate to spot Bitcoin funds, get it while you can.

ARKB shares are separating themselves from the crowd in one way that should make your ears perk. Ark Investments is going with a low 0.21% management fee for their new Bitcoin offering. That puts it as one of the lowest fees in the Bitcoin ETF universe.

Cathie Wood also created a splash last week when she started selling the firm’s shares of the Proshares Bitcoin Strategy ETF (BITO) and immediately depositing those funds into her company’s newly minted ARKB shares.

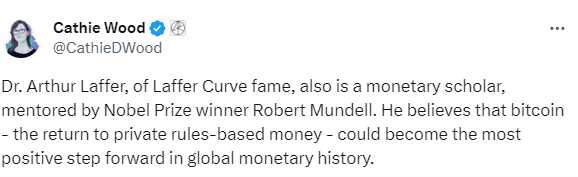

Doubling down even further, Cathie Wood made the following comments on Twitter over the weekend.

They were directed at Jamie Dimon’s claim that Bitcoin has no value beyond that of a “Pet Rock.”

I could go on and on, but here’s my bottom line:

Cathie Wood has fallen into the same category as Jim Cramer, Bill Miller, and countless other analysts that have made a career of generating outstanding performance only to have “The Street” bring them down. Again, we’ll get into the “Whys and Hows” behind that over the next week, but let’s just say that the market has thrown the baby out with the bathwater when it comes to Cathie Wood and Ark Investments.

I’m adding to my Bitcoin ETF allocation on the recent technical consolidation as my charts, and the crowd’s interest in Bitcoin, tell me that the cryptocurrency is likely to see $100,000 in the next six months.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from Money Map Press LLC and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.