LukaTDB

Carrier Global (NYSE:CARR) announced its Q4 FY23 results on February 6th, with flat organic revenue growth and a 7.9% increase in adjusted profit. I presented my ‘Strong Buy’ thesis in my previous article, highlighting their strong margin expansion and structural growth from the heat pump market. I maintain my ‘Strong Buy’ rating with a fair value of $65 per share.

Q4 FY23 Results and Key Takeaways

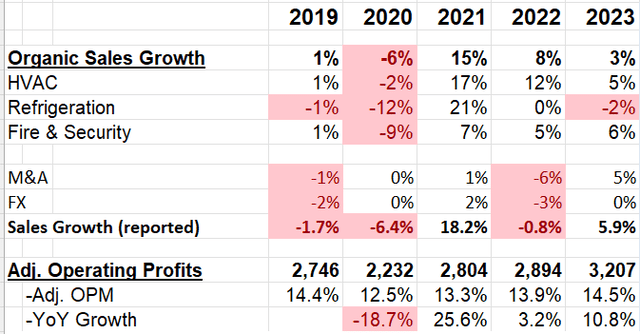

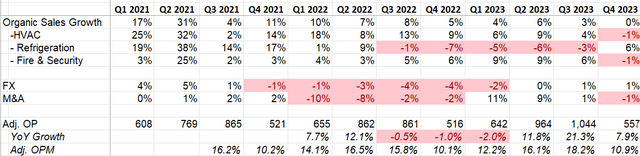

In Q4 FY23, Carrier Global delivered flat organic revenue growth and a 7.9% increase in adjusted operating profit, demonstrating strong margin expansion. For the entire year, they achieved 3% organic revenue growth and 10.8% profit growth. Notably, their free cash flow increased by 54% year over year.

Carrier Global Quarterly Results

My key takeaway from the earnings call is the significant growth in Carrier Global’s heat pump segment and aftermarket services. As I previously highlighted in my article, the rapid expansion of the heat pump market is being driven by government-led energy efficiency initiatives. Carrier Global’s European commercial heat pump sales saw a notable 25% increase in 2023.

Additionally, the aftermarket service segment showed impressive growth, with 45% of their commercial HVAC units now attached to long-term service contracts, a substantial increase from 20% three years ago. These contracts provide Carrier Global with recurring and high-margin revenue streams.

However, there were challenges in the HVAC business, which declined by 1% in Q4 FY23, primarily due to weakness in the North American residential market. During the call, it was revealed that North American residential HVAC volume decreased by a high 20s percentage, although this was somewhat mitigated by price increases.

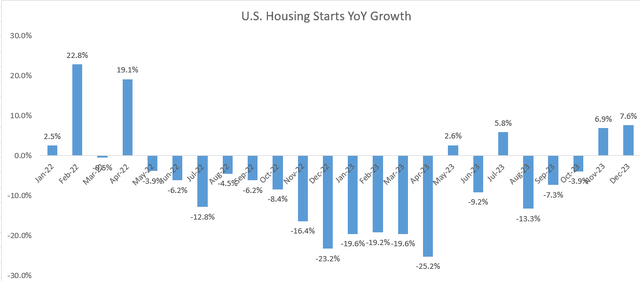

The weakness in the residential market can be attributed to factors such as high mortgage rates, leading to a year-over-year decline in U.S. housing starts in 2023. Nevertheless, I perceive this weakness as temporary, given the sensitivity of the housing market to interest rates. When interest rates begin to decline, I anticipate a recovery in the housing market to its normal state.

At the end of FY23, the company held $14.2 billion in debt, offset by $10 billion in cash and equivalents, resulting in a net debt leverage below 1.5x. This indicates a robust balance sheet.

The planned exits from the Access Solutions and Commercial Refrigeration businesses are expected to yield approximately $4.5 billion in net proceeds. Progress is also being made on the divestiture of the Industrial Fire division, with a definitive agreement anticipated around the end of the first quarter, as disclosed during the earnings call. Furthermore, the company announced intentions to exit the combined residential and commercial fire businesses through either a sale or an IPO. These divestitures are poised to provide additional capital for debt reduction, share repurchases, or other strategic acquisitions. It is encouraging to see the company executing these plans to exit low-growth and non-core businesses, focusing instead on high-growth HVAC and heat pump segments.

In FY23, they generated $2.1 billion in free cash flow, allocated $620 million towards dividends, and only repurchased $62 million of their own shares, a significant decrease from $1.38 billion in FY22. This reduction in share repurchases is attributed to the Viessmann Climate Solutions acquisition. Despite this, their capital allocation strategy remains consistent over the past few years.

FY24 Outlook

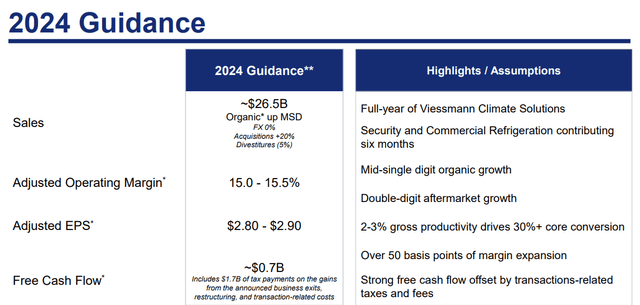

The company has issued a mid-single-digit organic revenue growth target and a 50 basis points margin expansion target for FY24. The free cash flow is expected to be $0.7 billion, including $1.7 billion in tax payments resulting from business exits. Consequently, the core free cash flow is anticipated to grow by 10% year-over-year.

Carrier Global Q4 FY23 Presentation

Several factors need consideration regarding their revenue growth. Management has indicated that organic revenue growth would be equally split between volume and price. With inflation decreasing in most developed countries, abnormal growth from pricing should not be expected. The company is guiding for 2-2.5% pricing growth in FY24, which aligns with inflation expectations. Another 2.5% volume growth would be consistent with historical averages. Therefore, the overall revenue guidance appears to be in line with the normal growth rate in a typical economic environment.

On the margin side, key drivers include operating leverage, pricing increases, aftermarket growth, and cost optimization initiatives. The aftermarket segment carries higher margins, and the increasing attachment rate would benefit margin expansion. Additionally, Carrier Global has been implementing cost optimization initiatives to reduce SG&A costs.

As shown in the table below, Carrier Global has successfully improved its margin from 12.5% in FY20 to 14.5% in FY23. Overall, their full-year guidance seems reasonable, reflecting current market conditions and the status of inflation.

Valuation

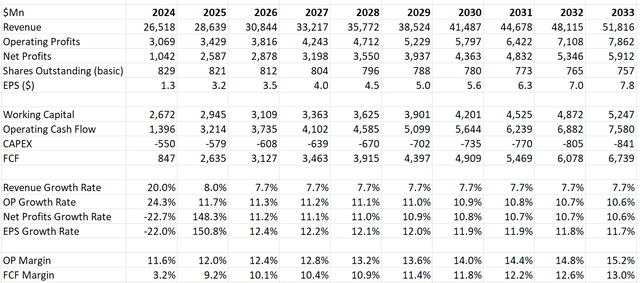

The assumptions for FY24 are in line with the company’s guidance, with the free cash flow accounting for a potential $1.7 billion in tax payments due to business exits. For normalized revenue growth, assumptions include 2.5% price growth and 2.5% volume growth, consistent with historical averages. Additionally, tuck-in acquisitions could contribute 2.7% to topline growth if the company spends 5% of annual revenue on acquisitions.

As analyzed previously, margin expansion is driven by various factors, including management of SG&A costs. I estimated that operating expenses will grow by around 7% annually, leading to an anticipated 40 basis points margin expansion per year.

Carrier Global DCF – Author’s calculations

With the remaining assumptions consistent with the previous model, the estimated fair value stands at $65 per share. Notably, the current stock price is only trading at 20 times forward adjusted free cash flow, indicating potential undervaluation relative to the estimated fair value.

Near-term Risks

During the earnings call, Carrier Global highlighted regulatory and subsidy uncertainty in certain European countries, which may pose growth headwinds for their Viessmann Climate Solutions business in the first half of FY24. Management anticipates a recovery for Viessmann Climate Solutions in the latter half of the fiscal year.

For instance, there has been a notable decline in applications for heat pump subsidies in Germany, dropping by roughly half in the first six months of 2023 following a subsidy cut, as reported by the media. Government subsidy programs are dynamic and challenging to predict, and end-market demand for heat pumps is influenced to some extent by these subsidies. Therefore, government subsidy programs present uncertainties for Carrier Global’s future business growth.

Additionally, China accounts for approximately 9% of group revenue, and the company expects its China business to grow at a mid-single-digit rate in FY24. However, there are concerns regarding the company’s China business, given the decline in property prices and the weak economy in China.

Verdict

Given the company’s portfolio transformation, divesting non-core and low-growth businesses while focusing on the HVAC and heat pump markets, I maintain my ‘Strong Buy’ rating with a fair value of $65 per share.