Carnival Corporation (CCL -0.48%), parent company of Carnival Cruise Line, is one of the world’s largest cruise ship operators. After seeing its business screech to a standstill amidst the pandemic, Carnival has been on the rise again — in fact, reaching record revenue in fiscal 2023. But there’s one lingering problem that has investors worried about the company. Here’s what you need to know and what Carnival is planning to do about it.

Carnival is lagging behind

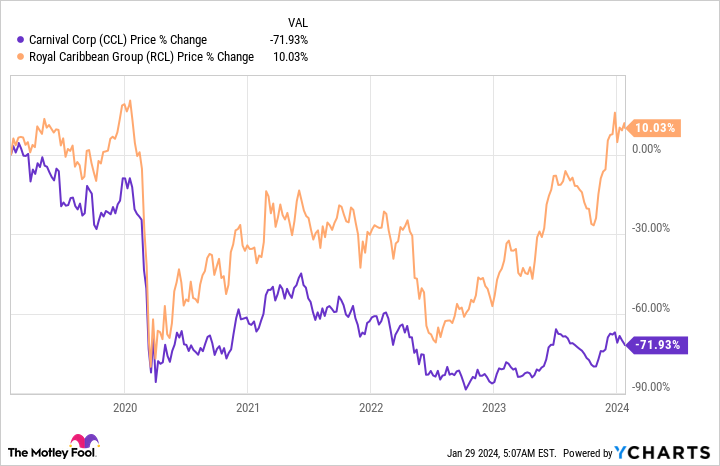

Carnival stock has only risen half as much as peer Royal Caribbean Group (RCL -0.81%) over the past year as the cruise industry rebounds from effectively being shut down during the pandemic. But the problem here is worse than it seems because Carnival shares are down 70% over the past five years even as Royal Caribbean is up 10%. Effectively, Royal Caribbean has recovered all of the ground lost during the pandemic, but Carnival stock is still in purgatory.

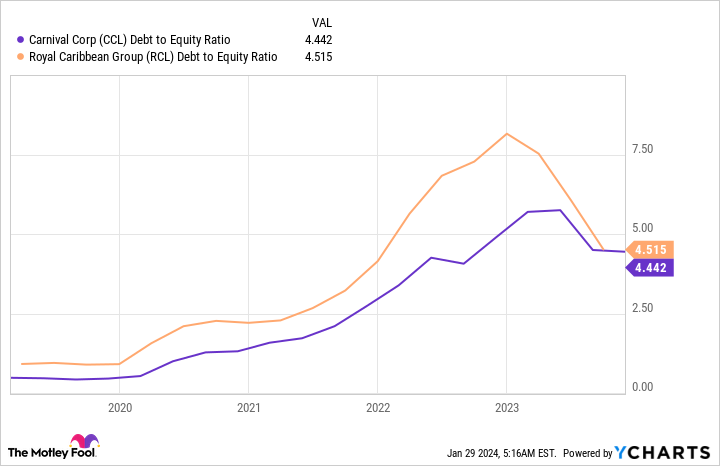

What’s going on? The first part of the story is the pandemic. Cruise lines weren’t allowed to operate, which was bad for business. That’s an obvious statement. But running a cruise line, even if there are no passengers, is a costly affair. In order to get through that difficult stretch, Carnival took on debt, as did Royal Caribbean. The debt-to-equity chart below highlights what happened on the balance sheets of these two competitors.

CCL Debt to Equity Ratio data by YCharts

The big takeaway here, however, shows up at the end of the chart. Notice that Royal Caribbean has more aggressively reduced its leverage. That means that Carnival is lagging behind in the effort to get its financial house back in order. This is a key issue for investors to monitor.

Carnival knows it has a problem

The current state of the balance sheet is the bad news. The good news is that Carnival knows it has a problem and is planning to do something about it. Notably, in the company’s fiscal 2023 earnings presentation, it stated: “Substantial increases in Free Cash Flow [are] expected in 2024 and beyond to drive down our debt balances.”

That was on a slide dedicated to Carnival’s balance sheet improvement efforts. It was the culminating bullet point, with the other items highlighting the progress the cruise line has made so far in strengthening its debt profile. There’s still a lot of work to be done. Just knowing there’s a problem and making some initial headway isn’t enough to change investors’ minds about the debt situation.

That said, the company’s efforts to reduce debt have been accelerating. So this is a problem Carnival knows it needs to solve more quickly.

Given Carnival’s laggard stock performance, contrarian investors might be attracted to the recovery potential that still seems to exist here. That’s not a bad thought process, per se, but caution is in order. Carnival’s business is doing well today, but a recession could quickly lead to a pullback in cruise spending. That would make it much harder for Carnival to reduce debt the way it hopes it can.

In other words, for more aggressive investors, there’s a reason to be interested in the stock, but financial performance and balance sheet progress need to be closely monitored.

Carnival is still a work in progress

At the end of the day, Carnival probably isn’t the best option for risk-averse investors. Yes, the business is rebounding strongly from the pandemic period, but the stock is still floundering relative to peers, and that’s at least partly because of the company’s still-troubled balance sheet. Fixing that problem won’t be quick and it requires ongoing business strength, which there is no way of guaranteeing at a highly economically sensitive company.