Orbon Alija/E+ via Getty Images

In my view, there’s no better time to bet on solid turnaround names than during a period of market volatility and expensive valuation multiples. Contrarian plays like these, in my view, are more insulated from the whiplashes in the stock market driven by macro factors like interest rates, and investors can buy with confidence knowing they are investing in businesses with firm footing and a more than reasonable valuation.

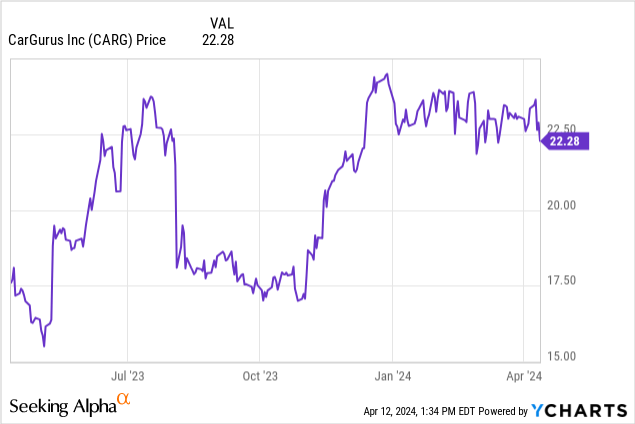

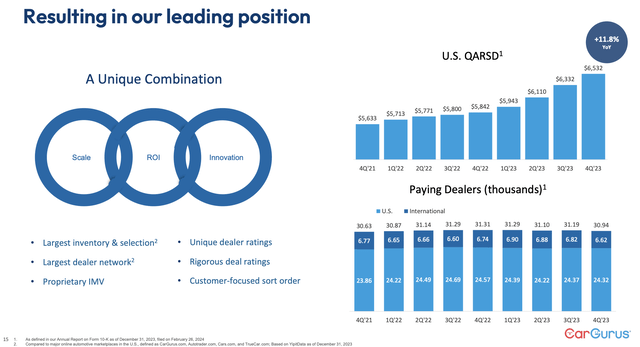

CarGurus (NASDAQ:CARG) fits the bill perfectly here. The #1 site for used car research in the U.S. has seen very choppy performance over the past year, but its most recent metrics show a marketplace business that is experiencing re-accelerating growth on top of strong traffic results. In my view, this stock is ripe for a rebound:

I last wrote a bullish opinion on CarGurus in January, when the stock was trading at similar ~$23 levels. The rebound I’ve been hoping for has not yet materialized, but since then, CarGurus has released excellent Q4 results and a robust Q1 outlook that make me hopeful that it’s still very much in the cards.

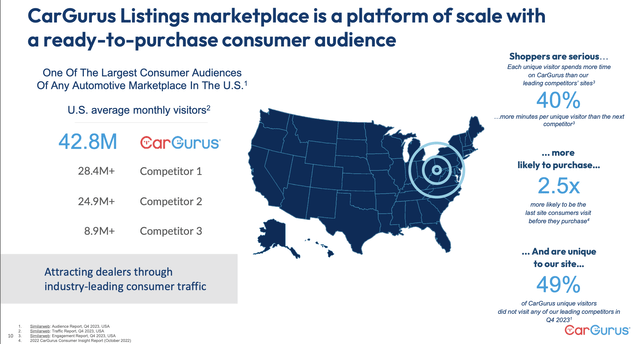

It’s worth remembering here that CarGurus has a wide moat in the U.S. in terms of existing site viewership. CarGurus draws nearly 50% more traffic than its next-nearest used car competitor:

CarGurus footprint (CarGurus Q4 earnings deck)

Here is my updated long-term bull case for CarGurus:

- CarGurus has made itself essential for car dealerships. Even before adding CarOffer and Instant Max Cash Offer, CarGurus was long considered by dealerships to be a necessary partner due to the amount of web traffic flowing through its site nationwide. By adding the ability for dealerships to buy cars through the CarGurus network as well, CarGurus has effectively just doubled its wallet share within the used-car industry.

- Recurring revenue streams. CarGurus enjoys a steady stream of fee income from its paying car dealerships. Quarterly average revenue per car dealership also continues to rise.

- CarGurus remains the #1 site for used-car research in the U.S., and by a wide margin. By default, car dealerships (or any business, really) will go where the eyeballs are, and CarGurus has cemented its place as the leading site to do research before buying a used car.

- Improving wholesale results. CarGurus has now fully integrated CarOffer into its business and stabilized its profitability, giving the company a huge edge in the dealer-to-dealer network and expanding its reach.

Stay long here: there’s plenty of upside rebound potential here.

Q4 download

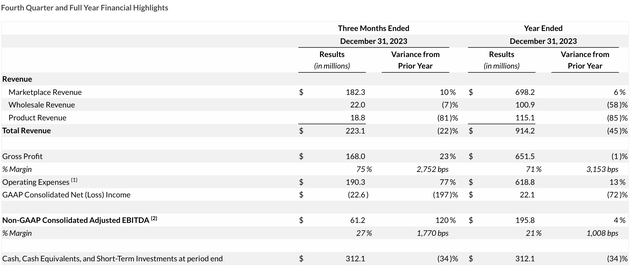

As we look ahead to CarGurus’ Q1 earnings print expected sometime in late May, we should anchor in on the company’s latest results to demonstrate that trends have been moving in the right direction. Take a look at the Q4 earnings highlights below:

CarGurus adjusted EBITDA (CarGurus Q4 earnings deck)

Overall revenue declined -22% y/y, but that’s largely a result of declining product revenue – which was a strategic decision on CarGurus’ part to slow down the pace of vehicle acquisitions from wholesale buyers (through CarOffer) and focus on profitability over growth.

Meanwhile, underlying marketplace revenue results grew 10% y/y to $182.3 million. Note as well that the favorable mix shift into marketplace revenue (which carries a ~90% gross margin, as it is purely advertising revenue) has helped to improve total company gross margins to 75%, a 28 point y/y improvement.

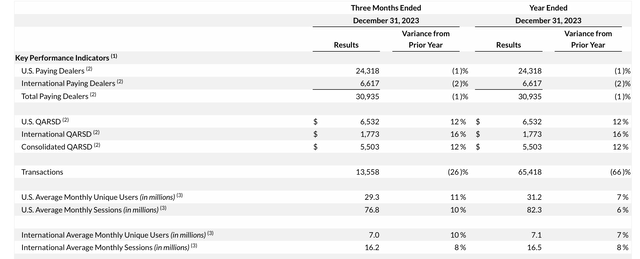

Traffic metrics continue to be favorable. The company drew in 29.3 million monthly unique users, up 11% y/y:

CarGurus key metrics (CarGurus Q4 earnings deck)

The only metric we have to watch out for is a slight decline in paying dealership counts. Sequentially, the company lost 250 dealers in the quarter, 200 overseas and 50 in the U.S. as shown in the chart below:

CarGurus dealer metrics (CarGurus Q4 earnings deck)

That being said, however, QARSD (quarterly average revenue per dealer) grew 12% y/y to a multi-year record $6,500. This suggests that CarGurus is shedding smaller, less lucrative dealerships and focusing its customer base on larger earners.

Here’s further context from CEO Jason Trevisan’s remarks on the Q4 earnings call:

In 2023, the marketplace business significantly outperformed our expectations, exiting the year with approximately 10% revenue growth and meaningfully contributing to our EBITDA beat.

In a challenging environment for our customers, characterized by weak consumer demand, lack of affordability, and heightened expenses linked to floor plan financing, our foundational listings business exhibited remarkable resiliency, pricing power, and growth acceleration.

In fact, we ended the year growing U.S. QARSD approximately 12% year-over-year to $6,532. This is our strongest year-over-year growth on record since introducing QARSD as a KPI, excluding pandemic-related concessions, and marks the 13th consecutive quarter of increase.

In the fourth quarter, the largest drivers of QARSD growth came from adding on new dealers at market rates, package upgrades, and price increases. We also experienced robust adoption of add-on products and multi-product attach rates increased by 36% year-over-year as dealers continue to look for additional channels to attract high-intent, ready-to-purchase shoppers to their inventory. By providing dealers with greater value in our product offerings and simultaneously growing leads per paying dealer year-over-year, in Q4 we experienced the strongest MRR acquisition in 10 quarters.”

Profitability also soared above expectations, driven by improvements in the wholesale arm and operating leverage in marketplace advertising results. Adjusted EBITDA more than doubled to $61.2 million, representing a 27% adjusted EBITDA margin: an 18 point y/y improvement.

Valuation and key takeaways

At current share prices near $22, CarGurus trades at a market cap of $2.40 billion. After we net off the $312.1 million of cash on CarGurus’ most recent balance sheet, the company’s resulting enterprise value is $2.09 billion.

Meanwhile, for the current fiscal year FY24, Wall Street is expecting CarGurus to generate $910.2 million in revenue, flat to FY23. It’s expecting a return to 10% y/y growth in FY25, once tougher comps from the CarOffer slowdown fade and results in the marketplace business begin to overtake. If we conservatively assume CarGurus manages to hold its adjusted EBITDA margin of 21% (in line with FY23 results as well as Q1’24 guidance), CarGurus’ adjusted EBITDA in FY24 would be $191.1 million, putting the stock’s valuation at 11x EV/FY24 adjusted EBITDA. Bear in mind that there are plenty of upside drivers to both top line growth (as visitor counts should continue to drive up QARSD) as well as EBITDA margins (as marketplace revenue becomes a more meaningful percentage of the company total, gross margins will continue to lift).

Stay long here: the tide will turn for CarGurus.