sshepard

Six months ago, ailing primary care medical services provider Cano Health, Inc. (NYSE:CANO) or “Cano Health” warned investors of liquidity issues raising substantial doubt about the company’s ability to continue as a going concern.

In addition, debt covenant violations resulted in the requirement to initiate a sales process in exchange for the lender providing a waiver and limited covenant relief.

At that time, I already expected the company to end up in bankruptcy due to the dismal state of the business and its unsustainable debt load.

Consequently, I wasn’t really surprised to see the company filing for a pre-packaged chapter 11 on Monday:

Cano Health (…) today announced that it has entered into a Restructuring Support Agreement (the “RSA”) with lenders (the “Ad Hoc Lender Group”) holding approximately 86% of its secured revolving and term loan debt and 92% of its senior unsecured notes. This agreement enables Cano Health to substantially reduce its debt and position the Company to achieve long-term success.

To facilitate this restructuring, Cano Health has initiated prearranged voluntary Chapter 11 proceedings in the U.S. Bankruptcy Court for the District of Delaware (the “Court”). It has also received a commitment for $150 million in new debtor-in-possession financing from certain of its existing secured lenders, which is subject to Court approval. This new capital is expected to provide sufficient liquidity to support the Company’s ongoing operations throughout the restructuring process. (…)

Given the broad extent of creditor support, Cano Health expects to file and receive Court approval of a Plan of Reorganization and Disclosure Statement expeditiously, while also exploring paths to maximize value, and it expects to emerge from the restructuring process in the second quarter of 2024.

Unfortunately, the company’s common equity holders are likely to end up with nothing (emphasis added by author):

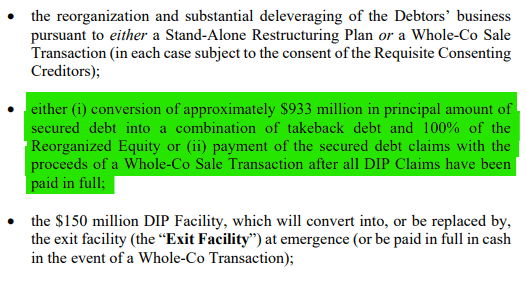

The RSA provides for the conversion of nearly $1 billion in secured debt to a combination of new debt and full equity ownership in the reorganized company. It also allows for solicitation of strategic partnerships and potential offers – including the sale of the company or substantially all its assets – that may result in a value-maximizing outcome to the Company’s stakeholders.

In contrast to existing shareholders, management will not only keep their jobs but have also been awarded generous retention bonuses (emphasis added by author):

Each of the Company’s principal executive officer, principal financial officer and 2 of its named executive officers (…) are eligible to earn retention bonus awards pursuant to individual retention agreements (…). The awards under the Executive Retention Agreements were paid in a lump sum cash payment on February 2, 2024, subject to clawback of the gross amount of the retention bonus if the Senior Executive terminates employment without Good Reason (…) or is terminated by the Company for Cause (…) prior to the award becoming fully vested.

(…)

The individual amounts awarded to the Senior Executives were as follows: (i) Mark Kent, Chief Executive Officer – $3,750,000; (ii) Eladio Gil, Interim Chief Financial Officer – $950,000; (iii) Robert Camerlinck, Chief Operating Officer – $1,065,000; and (iv) David Armstrong, Chief Compliance Officer and General Counsel – $462,500.

In addition, the restructured company will establish a post-emergence management incentive plan reserving up to 10% of the reorganized equity.

The only remaining hope for shareholders would be a sale of the company at terms sufficient to satisfy all higher-ranking claims including amounts outstanding under the up to $150 million DIP-facility.

Court Documents

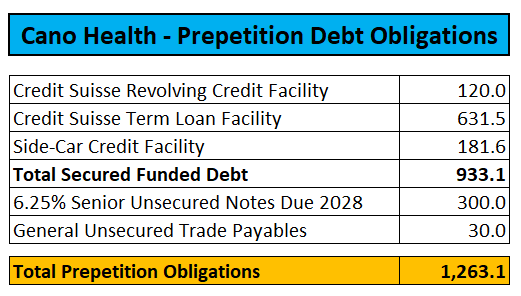

While the restructuring support agreement (“RSA”) provides for the sale of the business as a whole or in parts, Cano Health would likely require net sales proceeds of well above $1.5 billion for shareholders to receive a recovery due to substantial fees and the requirement to repay up to $150 million in DIP-financing.

However, with secured creditors in the driver’s seat, potential suitors would only have to take care of the secured debt and the DIP-facility as explicitly stated in the court documents:

Court Documents

Consequently, some major bidding war would be required for shareholders to at least get a chance for a recovery but given the fact that the company has been unsuccessfully pursuing a sale for six months already, I would consider the likelihood of a bidding war emerging as virtually zero.

Given this issue, existing equity holders should consider selling their shares and moving on.

Please note that the NYSE has commenced delisting proceedings. Going forward, shares will trade on the OTC under the symbol “CANOQ” until the restructured company emerges from bankruptcy in the second quarter.

Bottom Line

Very much as expected by me six months ago, Cano Health’s persistent debt and liquidity issues resulted in the requirement to restructure in bankruptcy with any sort of recovery for common shareholders highly unlikely.

Consequently existing equity holders should consider selling their shares and moving on as otherwise they will likely end up being wiped out.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.