mayskyphoto

Introduction

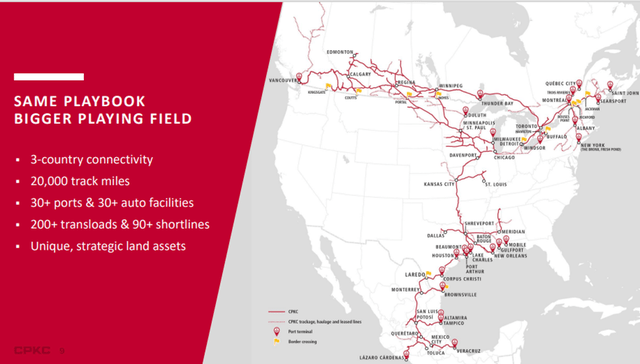

Canadian Pacific Kansas City (NYSE:CP) is a key player in the North American Railroad business, with operations spanning across the US, Mexico, and Canada. The company’s footprint experienced substantial expansion after successfully acquiring Kansas City Southern, marking a noteworthy increase in the growth of its operations.

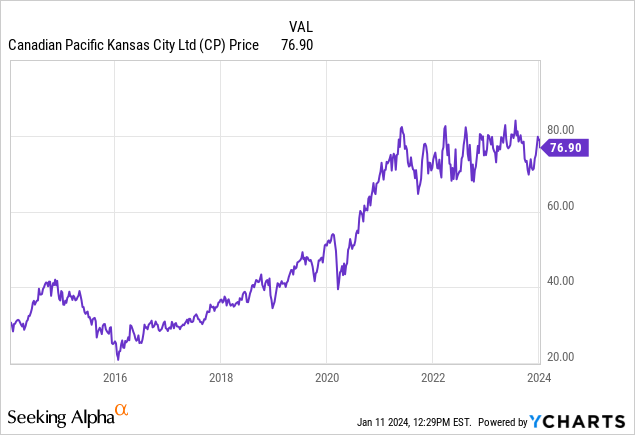

Over the past 10 years, shareholders have been rewarded with over 160% growth in the share price, and in the past year growth of just over 3%. Despite this small growth, Canadian Pacific operates in an oligopoly with other railroads, with significant cost advantages over alternative transportation methods such as trucking. With solid future growth prospects, I am bullish in the long term and believe the shares are a buy.

Company Overview

Canadian Pacific Kansas City Limited, is a prominent Class I railroad in North America, formed through the merger of Canadian Pacific Railway and Kansas City Southern completed in April 2023. As the sole single-line railway connecting Canada, Mexico, and the United States, the company manages an extensive 32,000-kilometer rail network. Headquartered in Calgary, Canada, and led by President and CEO Keith Creel, the company specializes in transcontinental freight transportation, moving bulk commodities like grain, coal, and potash, as well as merchandise freight such as energy, chemicals, metals, and automotive products. The large route network and ability to transport a diverse portfolio of products results in the company being a leading force in the North American supply chain.

Canadian Pacific Kansas City Investor Presentation, January 2024

Growth Prospects

Following the merger with Kansas City Southern, there is likely to be limited opportunities for inorganic growth that meets competition regulations, and also the financing available to fund inorganic acquisitions. Therefore, to grow further, growth will have to be organic and come from volume increases or price rises.

With the current trend in near-shoring, Canadian Pacific looks set to take advantage. Foreign investment in Mexico has grown almost 60% since 2018, with the US imports from Mexico overtaking those of China. Being the only single-line railroad connecting the US, Canada, and Mexico, Canadian Pacific looks set to take advantage of this growth in coming years, connecting the Mexican industrial heartland with the rest of North America.

Canadian Pacific has also identified surplus acreage across its network, which gives it the option to expand capacity in the future without having to purchase land. One example is the Port Arthur Terminal in Texas. Currently, they operate 10,000 feet of existing rail track alongside the existing dock area. Here they have identified the opportunity to develop a new export terminal to enable bulk products to be shipped to markets overseas. They also have significant excess acreage around fast-growing cities such as Vancouver, Dallas, and Toronto. This provides lots of opportunities for future expansion.

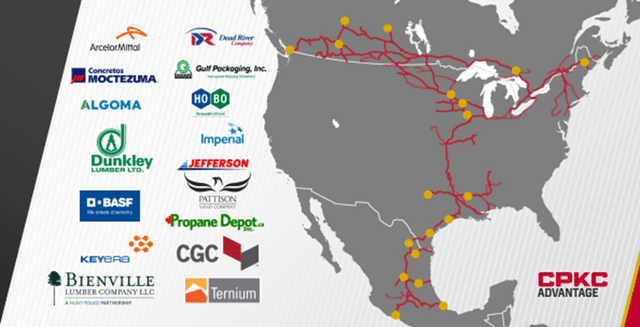

Expanding rail capacity is not enough to grow revenues unless there is demand for rail transportation services. A key driver of demand is growth in industry. With many developments occurring near Canadian Pacific’s railways, demand looks set to continue growing in future years.

CPKC Investor Day Presentation 2023

Competitive Advantage

North American railroads operate as an oligopoly with only six main players, in many areas, however, it tends to be a duopoly. In Canada, Canadian Pacific’s only real competitor is Canadian National Railway (CNI). Competition in the US is higher with significant parts of its network covering similar areas of other class 1 railroads, but Canadian Pacific has the advantage of being the only railroad to connect the US, Canada, and Mexico, reducing the need for inter-switching, resulting in reduced travel times for freight.

Although railroads do compete with trucking, over long distances railroads offer significant cost advantages, with it often being over 50% cheaper per tonne mile of goods moved. Although trucks offer greater flexibility, over long distances railroads are the clear winner.

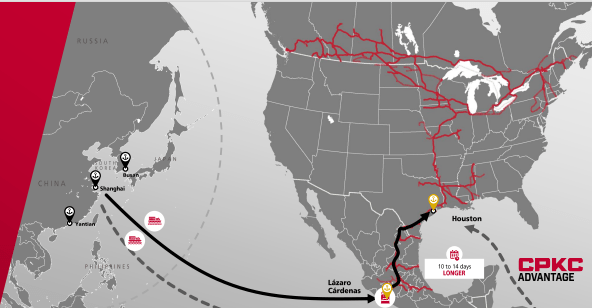

Another competitive advantage is the port of Lázaro Cárdenas, on the Pacific coast of Mexico. With delays at west coast ports, shipping goods quickly to the central US is taking longer. The traditional solution would be to ship goods through the Panama Canal to ports in Texas. Following droughts in Panama, there are, however, severe delays going through the canal. Therefore, Canadian Pacific offers the opportunity to bypass the canal by shipping overland from Lázaro Cárdenas into the central USA, offering reduced travel times.

CPKC Investor Day Presentation 2023

Overall, Canadian Pacific offers a solid network, with multiple cost and time advantages over alternative options. With the high capital costs required to start a new railroad, new rail competitors are unlikely to appear. Canadian Pacific’s clear competitive advantages and growth potential, ensure the company looks set to grow profitability over the long term.

Q3 Results

On October 25th, Canadian Pacific reported its third quarter earnings. These came in ahead of expectations, with revenue reaching $3.34 billion Canadian Dollars ($2.49 billion), beating by $900 million Canadian Dollars. This was up 44.6% compared to the previous year. Although the 44.6% revenue growth figure appears phenomenal at first, when considering the takeover of Kansas City Southern, revenue was actually down 4% year-on-year.

Earnings per share came in at $0.92 Canadian Dollars ($0.69), beating expectations. The operating ratio, a key metric of operating expenses as a proportion of total revenue, worsened during the quarter, increasing from 59.8% in 2022 to 64.9% in 2023. I believe this can be attributed to the Kansas City Southern takeover and will improve in future quarters as Kansas City Southern’s operations are fully integrated and working practices aligned.

Overall, I believe the results underscore Canadian Pacific’s resilience and robust position in the transportation landscape.

Valuation

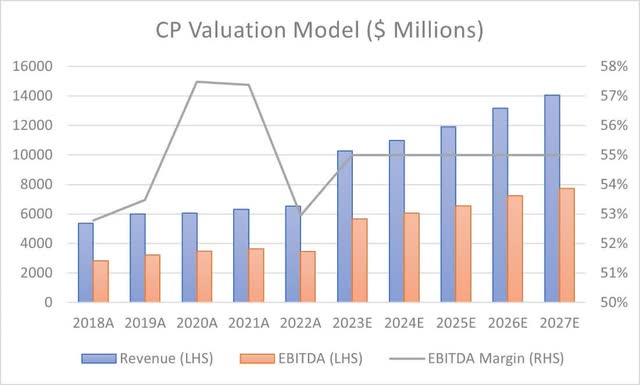

To value Canadian Pacific, I employed an EV/EBITDA valuation methodology for the period to the end of 2027. For future revenue, I used analyst estimates on Seeking Alpha. Based on Canadian Pacific’s EBITDA margin over the past 5 years, I expect it to remain constant at 55%, with the large scale of the company preventing significant margin improvement from economies of scale as its revenue grows.

For purposes of simplicity, I assumed cash and debt levels would remain constant, and the share count would remain constant at 931.8 million shares outstanding.

Created and calculated by the author based on Canadian Pacific’s Financial Data found on Seeking Alpha and the author’s projections

To determine an exit EV/EBITDA multiple, I took the midpoint of the company’s 5-year average of 18.21 and the industry average of 12.41, giving an exit multiple of 15.31.

Performing the calculations implies a market cap of $101.1 billion at the end of 2027. With 931.8 million shares outstanding, this gives a price target of $108.51 per share, an upside of 38% from the current share price for a CAGR of 8.5% over the next 4 years.

When you include the fact that the company currently has a dividend yield of 0.72% and the potential for future share buybacks in the valuation period, the total return looks set to be higher than the 8.5% CAGR return projected in the share price.

Risks

When considering an investment in Canadian Pacific, there are three main risks I believe it is important to consider.

Firstly, regulatory hurdles. I covered this in my previous article on Canadian National Railway (CNI), where I explained that:

On both sides of the border, the rail industry operates under strict regulations imposed by governments across a wide variety of areas. Changes in regulatory policies can have a large influence on both pricing and operational practices that can affect profitability. For example, Canada operates a maximum revenue per tonne-mile on shipments of grain for export, which restricts the profitability of the transport of grain.

Secondly, akin to many industries, Canadian Pacific is sensitive to wider macroeconomic conditions. Despite the North American economy’s resilience over the past year, withstanding rises in interest rates on both sides of the border, uncertainties may emerge in the coming year. Consequently, if macroeconomic headwinds materialize, Canadian Pacific could experience a demand reduction, leading to a potential decline in earnings and, subsequently, a fall in the share price. Despite this risk, I anticipate long-term growth in both the North American economy and Canadian Pacific’s earnings.

Finally, a decline in rail traffic would impact earnings, stemming from various events, some beyond Canadian Pacific’s control. For instance, in the second quarter of 2023, wildfires in Canada disrupted railroad operations, resulting in reduced freight volumes which was reflected in earnings. Canadian Pacific, with high levels of unionization among its workforce, and among customers at the ports it serves, faces the risk of strikes negatively impacting operations. Additionally, the diminishing demand for coal, constituting around 8% of Canadian Pacific’s revenue and largely transported by rail, could affect overall revenue, However, this may be mitigated by growth in other commodities requiring transportation.

Conclusion

In conclusion, Canadian Pacific emerges as a robust investment choice, poised for sustained growth with an estimated 8.5% CAGR in the years to the end of 2027. With a solid moat resulting in a resilient business model, Canadian Pacific stands as a resilient choice for investors. Although investors looking for higher returns may want to look elsewhere, Canadian Pacific looks to offer an attractive return over the next few years.