rlesyk

Introduction

All financial data are reported in Canadian dollars unless otherwise stated.

Canadian National Railway (NYSE:CNI) has been my top pick among Class 1 railroads and, as such, it makes up around 7% of my portfolio.

Major macroeconomic trends make me consider the whole industry as one poised to keep on growing. The need for environmentally friendly freight transportation, manufacturing nearshoring, and big spending on infrastructure are just three tailwinds we should be well aware of.

In this article, I would like to share an update on the stock, given its recent results and the most recent weekly rail traffic data, to see if things are picking up speed once again after a slow 2023.

How And Why I Invested In Canadian National

The reason why I bought heavily into the stock can be easily explained, though it is the result of a long research process, which I explained in this foundational article: “Learning From Buffett About Investing In Railroads: The BNSF Case Study”.

According to Buffett, a railroad needs to deploy its capital, first and foremost, in a way that aims at maintaining and enhancing its properties to increase its efficiency. Railroading is mainly focused on efficiency. As a result, based on how well a company executes, we will see growing returns and free cash flows, even during periods of slowing economic activity.

Given their capital-intensive nature, railroads also need to have enough earning power to cover their interest expense no matter what is going on in the economy. Therefore, a railroad’s pre-tax earnings need to be at least 5-6 times greater than interest expense.

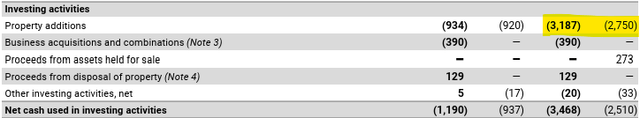

Another aspect that made Canadian National stand out from the crowd was its conservative management of its balance sheet.

CNI 2024 Investor Presentation

While other peers used their expanding balance sheet to borrow money used to boost huge buybacks – surely creating nice returns for the shareholders – Canadian National has not done so to the same extent, ending up with a lower leverage compared to the industry (usually CN stays below a 2x). As a result, once the economy slowed down and interest rates rose, Canadian National was the only railroad able to keep its buyback program and increase it, taking advantage of a depressed share price. In this way, it created huge value for its shareholders, while other railroads paused their buybacks exactly when their share prices were down.

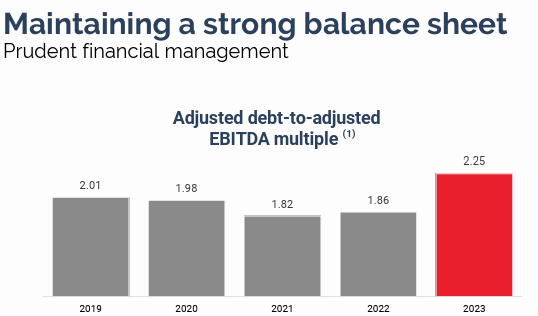

As we can see from the two graphs below, Canadian National has been able to steadily increase its dividends at a cumulative annual growth rate of 15%, while repurchasing its shares at will to create value for its shareholders.

CNI 2024 Investor Presentation

The third point is efficiency. Canadian National is the industry leader when considering fuel efficiency, which is a major key metric. In fact, Canadian National’s fuel efficiency is below 0.9 US gallons of locomotive fuel per 1,000 GTMs. In the most recent report, the company achieved an outstanding 0.874.

Finally, it keeps on reporting a high and steady ROIC, usually above 15%. This is what Buffett talks about when he says he expects a decent rate of return on invested capital.

Canadian National has always scored well when assessed through these lenses and, as a result, I bought it, and then, when last year its share price went down close to $100, I doubled down.

Canadian National’s Key Strengths

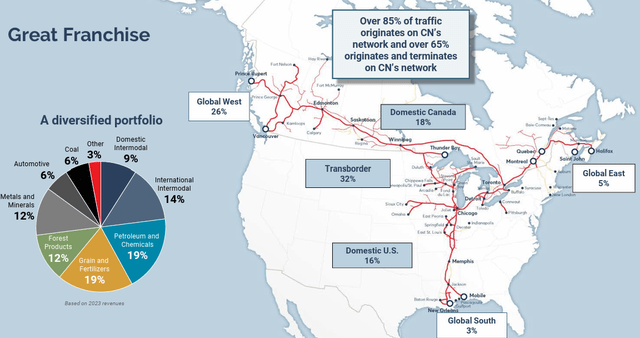

Some readers may not be familiar with the company and its network. So, as we start, let’s take a look at the map shown below. Canadian National stands out as a three-coast railroad, with access to both Oceans and the Gulf of Mexico, serving 7 major ports across North America. Moreover, Canadian National owns the Chicago Outer Belt, which allows it to move around Chicago (where almost 25% of North American rail volumes are moved) very efficiently, creating an advantage of up to 48 hours versus its peers that have to go through Chicago.

We also see the main commodities it moves on its trains.

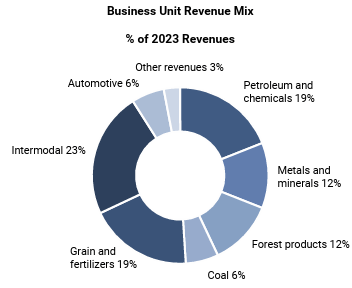

Canadian National, just like its main peer Canadian Pacific, has among its largest segments grains and chemicals, each making up almost 20% of the portfolio.

CNI 2024 Investor Presentation

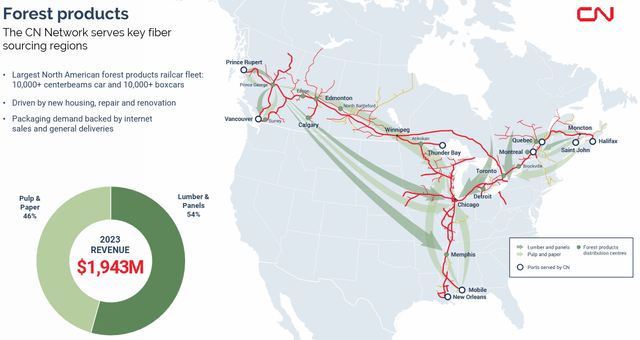

A commodity Canadian National is more exposed to compared to its peers is forest products, since CN owns and operates the largest North American forest products railcar feet. Now, this commodity is important because it is driven by two different kinds of demand: the housing market (new housing or repair and renovation) and packaging. As a result, it is one of the most interesting commodities to keep track of to feel the pulse of the general economy.

CNI 2024 Investor Presentation

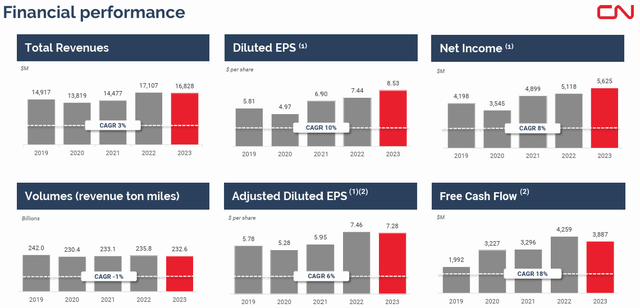

Looking at the larger picture of Canadian National’s performance in the past 5 years, we see why railroading is a wonderful business where execution is key.

In fact, while the company’s top line has compounded at an annual 3%, its net income has grown 8% per year. But things become even better when we see how the company’s FCF grew at an 18% CAGR. This can happen even in case the volume stays flat. Railroads have pricing power that can be coupled with good execution. This is the way to protect margins and generate good returns over time.

CNI 2024 Investor Presentation

FY2023 Financials and FY2024 Outlook

Now, let’s take a quick look at what happened in 2023 since Canadian National recently released its annual report.

As said, last year was challenging for railroads, since intermodal was down big and demand for several commodities diminished. The whole industry relied on automotive, grain, and coal to offset the negative impact on the other segments.

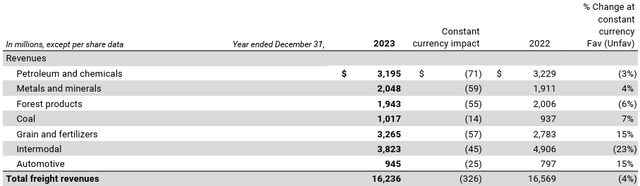

As a result, Canadian National ended the year with freight revenues of $16.24 billion, down 4% YoY. However, this means freight revenues were down more or less $350 million. Now, fuel surcharge revenues decreased by $368 million in 2023 when compared to 2022. So, Canadian National seems to have lost revenue only because of decreasing fuel prices, rather than because it earned less on its volumes shipped.

Operating expenses increased by 2% so the reported income before taxes was down 6% YoY to $6.5 billion.

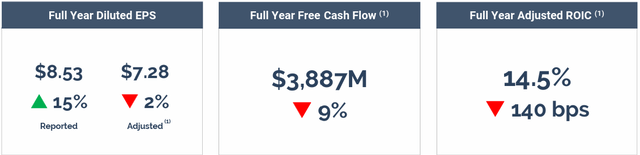

At the same time, thanks to lower tax expenses, net income was up 8% YoY, which led to a reported 15% increase.

CNI Q4 2023 Earnings Presentation

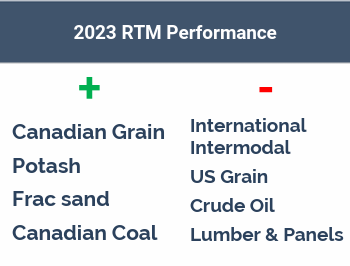

Let’s take a look at the company’s performance by commodity. Canadian National reported strong results in Canadian grain, potash, frac sand, and Canadian Coal, while it was hurt by poor RTM performance in intermodal, US grain, crude oil, and lumber.

CNI Q4 2023 Earnings Presentation

Therefore, the 2023 business unit revenue mix shows intermodal as the largest segment with a 23% weight on total revenues. However, intermodal was down 23% YoY to $3.82 billion, as we can read in the table I put under the revenue pie chart. Grain and chemicals held up well and made up 19% of the company’s portfolio each.

CNI 2023 Annual Report CNI 2023 Annual Report

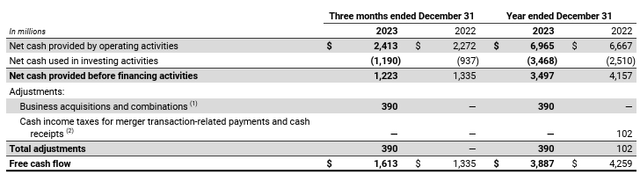

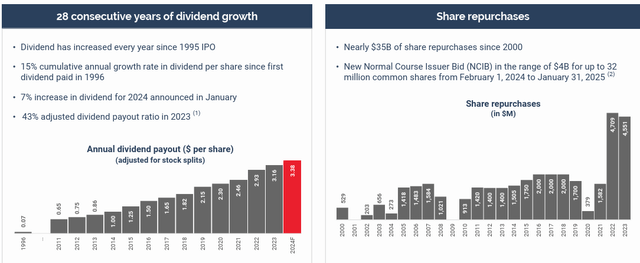

From the income statement and the commodity breakdown, let’s move on to the cash flow statement and, even though it is a non-GAAP measure, to free cash flow.

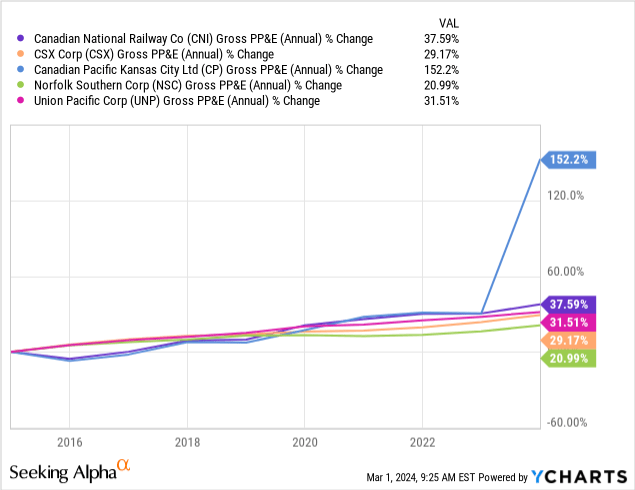

We see how free cash flow decreased YoY, but was still high, coming in at around $3.9 billion. The true difference came from capex: in 2023 Canadian National spent $1 billion more versus 2022.

If we look at the consolidated cash flow statement, we see where the extra spending comes from property additions.

Now, this is the tricky part. In fact, on one side capex eats away free cash flow. On the other, it is a true investing activity that enables a railroad to run efficiently its operations. From the comparison we have below, it is easy to spot how Canadian National has been the railroad that has seen its property additions grow the most, meaning it spent percentage-wise on its revenues, more than its peers (CP here skyrockets as a result of the KCS acquisition).

Although this left Canadian National with less FCF for shareholder returns, it has made the railroad more efficient and more predictable than its peers, as we are now seeing both in terms of operations safety and in terms of a stable shareholder reward policy.

In 2023, Canadian National’s earning power decreased. However, it still comes in as a 9, which is quite high considering 2023 was a slower year for railroads.

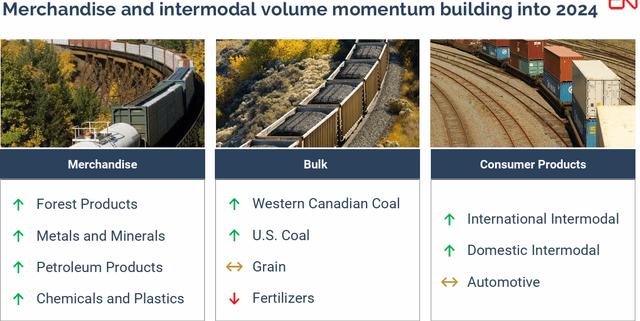

On a positive note, railroads in general, and Canadian National among them, have seen an uptick in rail traffic starting September 2023. This has built some momentum into 2024, which seems to be still going on.

With this tailwind, Canadian National didn’t hide its forecast for 2024, with most of its segments expected to go up.

CNI Q4 2023 Earnings Presentation

Because of this environment, the company’s CEO Tracy Robinson felt confident to share with everyone her EPS guidance of 10% growth in 2024 vs. 2023.

Valuation

In the past few months, Canadian National has made a nice comeback, moving from its October lows around $104 to $130, which is a 25% price increase. This is why its current valuation grade on Seeking Alpha is a D. Yet, this is a good score for a stock whose profitability metrics are outstanding.

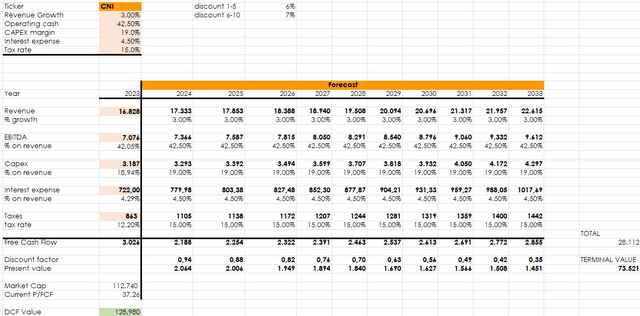

Running a discounted cash flow model expecting an average revenue growth of around 3% and an operating cash margin stable at 42%, I reach a present value of $129 billion as the correct market cap. Currently, the stock has a market cap of $112.7 billion in Toronto. As a result, I see still room for capital gains, though not as wide as a few months ago.

Author, with TTM financial data from SA

The worst seems behind and 2024 should be a recovery year. The market has already repriced Canadian National accordingly. But I don’t think one should be invested in such a company just for one year. This is a holding to buy and hold for a very long time to see it compound. As a result, I still think the company is in buy zone.