jimfeng

Investment Thesis: I revise my rating on Canadian Imperial Bank of Commerce (NYSE:CM) from Hold to Buy.

In a previous article back in May 2023, I made the argument that the Canadian Imperial Bank of Commerce could see pressure on growth given a decline in trading revenues leading to lower net income overall.

However, we see that the stock is up by just over 15% since my last article:

The purpose of this article is to assess whether the stock has the potential for further upside from here, taking recent performance into consideration.

Performance

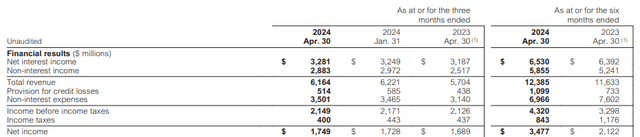

When looking at Q2 2024 earnings results (as released on May 30, 2024), we can see that non-interest income grew significantly faster than net interest income – with 14.54% growth as compared to the prior year for the former and 2.95% growth for the latter.

CIBC Q2 2024 Financial Highlights

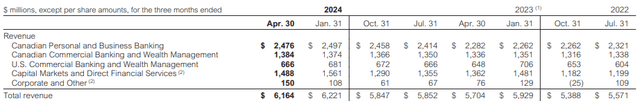

Net income was up by 3.55% over the same period, and provision for credit losses was up by 17.35%. When looking at revenue by segment, we can see that as compared to the prior year quarter – Canadian Personal and Business Banking showed revenue growth of 8.50% and Capital Markets and Direct Financial Services showed growth of 9.25%.

CIBC Q2 2024 Financial Highlights

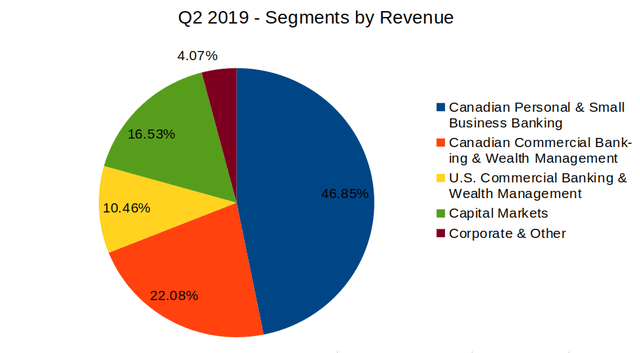

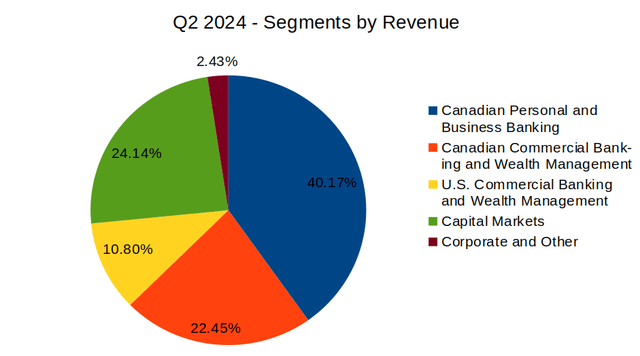

While the Canadian Personal and Business Banking segment remains the largest by revenue, we can see that when comparing segment share by revenue for the most recent quarter and that of five years previously – the contribution of Canadian Personal and Business Banking segment to revenue has shrunk by over 6%, whereas that of Capital Markets is up by nearly 8%.

Q2 2019 – Segments by Revenue

Calculations made by author using figures sourced from CIBC Investor Presentation Q2 F19.

Q2 2024 – Segments by Revenue

Calculations made by author using figures sourced from CIBC Investor Presentation Q2 F24.

I had previously stated that the fact we had been downward pressure on trading revenues last year meant that we could expect a bigger impact to revenue growth given that the Capital Markets segment is now accounting for a larger portion of overall revenue.

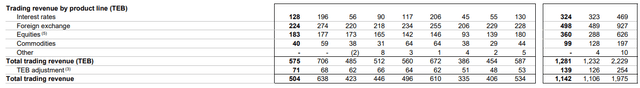

However, we have subsequently seen that the Capital Markets and Direct Financial Services segment has shown nearly double-digit revenue growth as compared to the prior year quarter, and this has been primarily down to performance across Equities – where we have seen growth of 28.87% since the prior year quarter, whereas we saw more modest growth of 9.40% for interest rates, while foreign exchange and commodities saw declines of -4.27% and -37.50% respectively.

CIBC Supplementary Financial Information For the period ended April 30, 2024

In this regard, we have seen that overall trading revenue growth has been in large part driven by equities. Having said that, non-trading net interest income saw growth of 9% year-on-year, while non-trading non-interest income was up by 8% over the same period. In this regard, recent results have been encouraging in that net interest income continued to see growth, while trading revenues also saw upside – which allowed overall net income to continue to see growth in spite of a higher provision for credit losses.

Looking Forward and Risks

In terms of growth prospects for the Canadian Imperial Bank of Commerce going forward, this is likely to be significantly influenced by the rate trajectory as set by the Bank of Canada, with rates having recently been cut to 4.75% as of June 5.

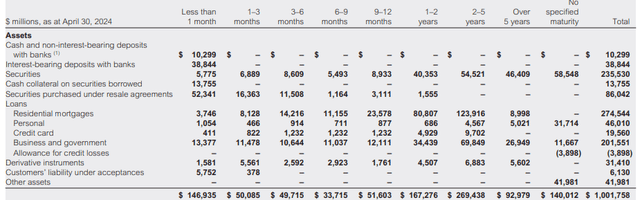

When looking at a breakdown of loan assets for the bank, we see that residential mortgages accounted for just over 50% of total loans for the bank in the most recent quarter.

CIBC: Report to Shareholders for the Second Quarter, 2024

In this regard, interest rate policy is expected to significantly influence total loan growth for the bank going forward, as it is anticipated, that lower interest rates would be likely to spur higher mortgage demand going forward.

For instance, while 56% of Canadians have stated that they have been forced to postpone buying a property due to interest rate hikes – half of those surveyed stated that a decrease in interest rates would entice them to resume their search, and 1 in 10 stated that a decrease of 0.25% would be sufficient for this.

Given that we have seen a recent decrease of 0.25% – we could well see a boost in residential mortgage demand as we head into the next quarter, and this could bode well for loan growth as a whole.

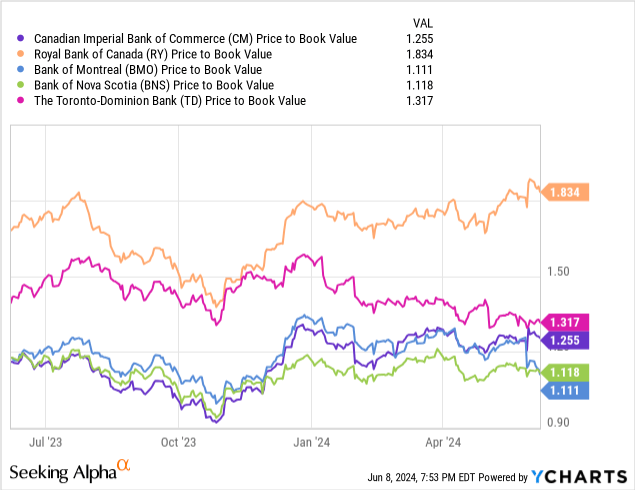

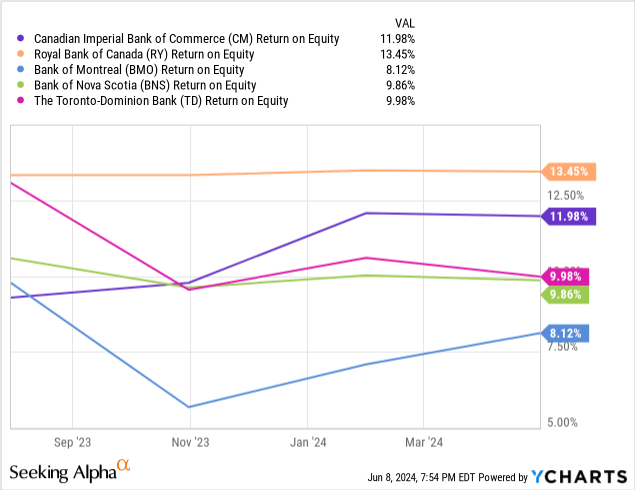

When looking at both the price to book ratio and return on equity for the bank as compared to its peers, we see that the stock is trading at a similar level to its peers across the former and shows the second-highest return on equity for the latter.

Price to Book

ycharts.com

Return on Equity

ycharts.com

In this regard, I take the view that given the resiliency we have seen in net income growth, along with encouraging growth in trading revenue and the potential boost to residential mortgages by way of a rate cut – the stock has the capacity to see a rebound from here. In the medium to longer-term, I believe that the stock could have the capacity to breach the $60 mark once again – a level we last saw at the beginning of 2022.

Conclusion

To conclude, I take the view that the Canadian Imperial Bank of Commerce has shown encouraging results and the macroeconomic environment is starting to look more favourable given the recent interest rate cut by the Bank of Canada. For these reasons, I take a bullish view on the Canadian Imperial Bank of Commerce and revise my rating from Hold to Buy.