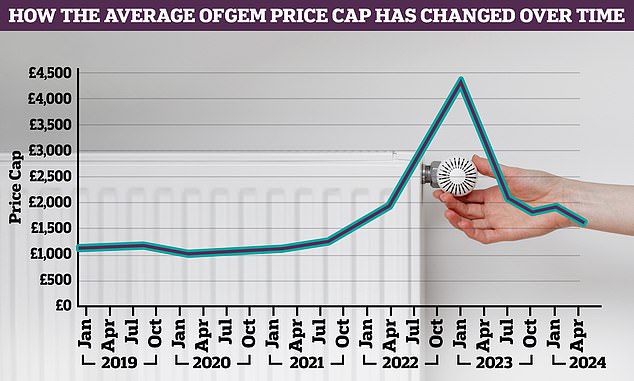

Households woke up today to the announcement that the average energy bill would fall by £238 to £1,690 from April – but these high prices have left many wondering if they can get a better deal by switching.

Energy regulator Ofgem today said the current £1,928-a-year average price-capped bill would fall 12.3 per cent on 1 April.

The price cap sets the energy bills paid by more than 80 per cent of UK homes, though the exact amount varies depending on gas and electricity use.

But even the upcoming energy bill price cut will leave millions of households paying very expensive energy bills and keen to take out a cheaper deal.

Cap falls: Ofgem says from April, the price cap will fall 12.3%

Households currently have a choice with energy bills.

They can stay on a price-capped, variable rate tariff they were likely lumped onto in the midst of the energy crisis which will not vary much in price between suppliers, or they can take out a fixed rate deal with a new or existing supplier.

But is switching energy deals worth it – and will it save you money?

When is it right to switch?

To know whether switching energy deal is better than staying on a price-capped deal the first thing to do is look at what energy prices are likely to do.

That is because the only realistic way to save money on a price-capped tariff is to take out a fixed-rate one.

These were the main sort of energy deal before 2021, when gas and electricity prices began soaring and firms responded by pulling all their new fixed-rate deals.

Fixes work by setting the price that consumers pay for their standing charge and the gas and electricity they use, often for one or more years.

Obviously, someone taking out a fixed rate to save money has to bet that the deal will work out cheaper than staying on a variable-rate deal, where prices will vary.

This is hard to predict.

However, expert analysts at Cornwall Insight think the average gas and electricity bill will fall again to £1,465.07 in July, before rising to £1,523.95 in October.

Each price reset lasts for three months, meaning typical energy bills are likely to hover at around £1,400-£1,500 all year.

How do I know if an energy deal is a good one?

To work out if an energy deal – fixed or otherwise – is cheaper than you are paying now, compare the unit rate and standing charge with what you currently pay.

Where are all the cheap fixed-rate deals?

There are currently 35 fixed-rate energy deals on the open market, according to Cornwall Insight.

However, most work out no cheaper than staying on a price-capped tariff from 1 April.

There are some energy firms promising to beat the price cap until July.

Earlier this month British Gas launched its Price Promise tariff which costs £1,699 a year for the average dual fuel household until April.

The selling point of the deal is that it also promises to beat the price cap from April, although British Gas has given no further details.

But many firms are offering secretive fixed rates to their own customers, and do not have to make the details of these public.

Some of these may work out cheaper than staying on a variable rate – again, the only way to know is to compare the unit rates and standing charges.

Things to beware with fixed-rate deals

Many fixed-rate energy deals come with steep exit fees, which you will pay if you try to leave the deal early.

These can be as high as £150 each for gas and electricity.

Will there be more cheap fixed rate energy deals in future?

It is very possible.

Wholesale energy prices are falling, which could prompt energy firms to start offering cheaper deals to customers.

Richard Neudegg, director of regulation at Uswitch, said: ‘We are seeing some green shoots of deals returning to the energy market, with suppliers making regular changes to their tariffs and slowly bringing prices down.

‘Lower wholesale costs are helping give suppliers more space to offer deals.’

Also, consumers may soon see more cheap energy deals because regulator Ofgem is removing rules that deliberately prevented the launch of such tariffs.

Rules called the Market Stabilisation Charge (MSC) were brought in during April 2022 and will run out on 31 March 2024.

The MSC is an Ofgem order for energy suppliers to compensate their rivals if customers switch to them, provided wholesale prices fall 10 per cent below the assumptions used to set the price cap at the time.

In practice, the MSC means no energy firm is likely to bring out deals that seriously undercut their rivals, as this would mean they could lose money by having to compensate their opponents if wholesale prices fall again.

The point of the MSC was to put the brakes on energy firm competition and stop one firm snapping up too many customers and causing others to fail.

But the MSC ending from 1 April should mean energy firms have more reason to launch better deals than their rivals, without any fears of having to pay them any compensation.

However, Ofgem today announced that another of its policies that props up current high energy bills will be extended for up to another 12 months.

The snappily-titled ban on acquisition tariffs (BAT) means energy companies cannot offer cheaper offers to new customers unless they also offer them to existing customers.

The point of the BAT is to stop energy firms aggressively undercutting one another with new deals, as any such cut-price offer would have to be made to all customers.

But the obvious problem with the BAT is that it holds back energy firms from bringing in better offers.

Like the MSC, Ofgem brought the BAT in in April 2022 to stop one energy firm drastically undercutting its rivals at a time of great turmoil for energy firms.

Ofgem said it wanted to keep BAT for now so as not to ‘remove both safeguards at the same time’.

James Mabey, analyst at Cornwall Insight, said: ‘While the MSC expiry is likely to be in the minds of suppliers, and likely to increase the number of below-cap fixes in the market once the mechanism has gone -as its absence will mean a reduced financial risk in offering competitively priced tariffs during a period where wholesale prices are falling – it is the recent slides in wholesale prices and subsequent lower cap forecasts that is primarily driving the number and pricing of fixes currently in the market.’

Simon Oscroft, co-founder of So Energy, said: ‘Today’s Ofgem decision is another kick in the teeth for energy customers after a bruising few years.

‘When the BAT is removed, suppliers will be free to hide their best deals from their loyal customers.

‘Why shouldn’t they have access to the best deals? Loyal customers should not have to call their supplier on renewal and haggle for a deal that they can see the supplier is offering elsewhere.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.