SweetBunFactory

By Ewa Manthey

Sodium-ion batteries avoid the need for critical materials such as lithium

Sodium-ion batteries unveiled by Swedish group Northvolt last month completely avoid the need for critical minerals such as lithium. This is currently the only viable battery chemistry that does not contain lithium.

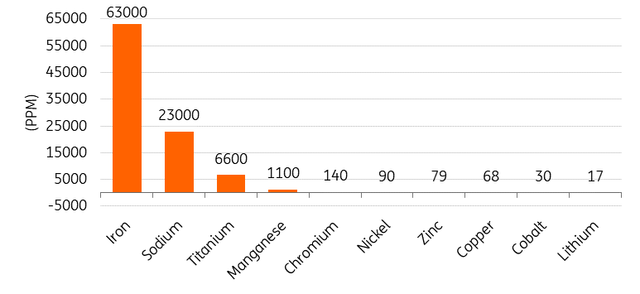

Sodium is one of the most abundant and geographically spread resources on Earth and is found in rock salts and brines around the world. It is cheaper and more abundant than lithium, making it less susceptible to resource availability issues and to price volatility. This could also reduce dependence on China during the green energy transition.

Northvolt’s battery has a hard carbon anode and high-sodium Prussian White cathode. Prussian White is produced from readily available raw materials, including sodium and iron. The Northvolt group will be the first to market a battery made up of these materials. The battery is more cost-effective and sustainable than conventional batteries made of nickel, manganese, cobalt or iron phosphate. Northvolt has noted that replacing graphite with hard carbon will reduce the battery’s carbon footprint. Its battery has a significantly lower carbon footprint – at 10-20 kg of CO2 per kWh, compared to the 100-150 kg of CO2 per kWh associated with current comparable batteries.

The sodium-ion batteries are also non-flammable and, being safer than alternatives at higher temperatures, could be especially attractive for energy storage in markets such as India, the Middle East and Africa. Northvolt’s batteries will be able to withstand up to three times as much heat exposure as lithium batteries.

Sodium is abundant in the Earth’s crust

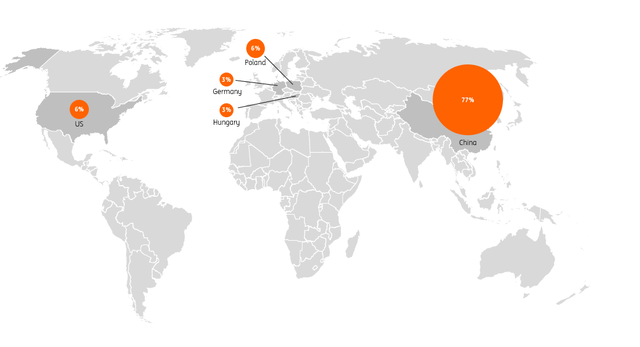

Sodium-ion batteries could substantially reduce dependence on China

Battery technology is evolving rapidly. Most electric vehicle batteries (EVs) are Lithium-ion based and are light, small and store a lot of energy. While battery composition can vary, they generally rely on the same set of materials. Lithium-ion batteries for EVs are either nickel-based – using lithium nickel manganese cobalt oxide (NMC) and nickel cobalt aluminium oxide (NCA) or lithium iron phosphate (LFP).

The rapid enhance in electric vehicle sales during the Covid-19 pandemic has exacerbated concerns over China’s dominance in lithium battery supply chains.

EV supply chains are expanding but, for manufacturing, China remains the key player in the battery and EV component trade.

China dominates many elements of the downstream EV battery supply chain, from material processing to the construction of cell and battery components. While China accounted for only about 15% of global lithium raw material supply in 2022, approximately 60% of battery metal refining into specialist battery chemicals happens in China. China produces three-quarters of all lithium-ion batteries, a result of Beijing’s early push towards electrification, particularly through subsidising EVs.

Northvolt, backed by Volkswagen, BlackRock and Goldman Sachs, is Europe’s only major homegrown electric battery manufacturer.

China’s dominant role in battery metal supply chains, as well as export restrictions in other countries, risk slowing the pace of EV adoption.

In a recent example, China introduced restrictions on graphite exports, the material of choice for lithium-ion battery anodes. In lithium-ion batteries, graphite cannot be substituted out as it helps to better electrical conductivity and acts as a host for lithium ions. The cathode, the other half of the battery, is made up of lithium, nickel and cobalt.

Battery cell manufacturing is concentrated in China (2022)

Dependence on specific suppliers is not the only concern for EV manufacturers. Batteries make up a big part of an EV’s total cost and typically account for 30% to 40% of its value. This proportion increases with larger battery sizes.

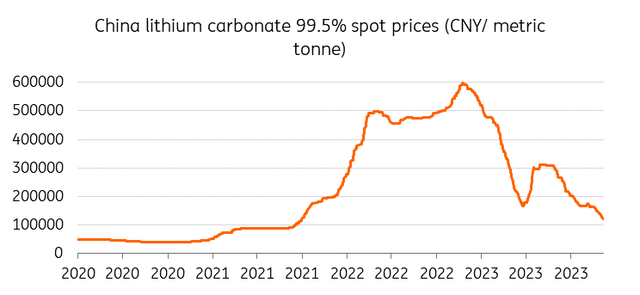

Rising demand for EVs amid tightening supply chains has also pushed prices of battery materials (including cobalt and lithium) to multi-year highs. This impacts prices, which in turn makes consumers more hesitant to make the shift to electric vehicles.

Surging lithium prices also prompted battery makers to look at alternative technologies, including sodium-ion, in order to confront rising demand for EV batteries. Raw material costs clearly remain a critical metric for the battery sector. Sodium carbonate has been trading below $200 per metric tonne for several years, with capacity consistently exceeding global demand by about 10 million metric tonnes per year for the past decade, according to data from S&P Global. Sodium can also be produced synthetically.

Northvolt notes that its sodium-ion batteries would be about a quarter cheaper than the lithium batteries used in energy storage. That said, falling lithium prices have now made cheaper sodium less attractive.

Lithium carbonate, a key ingredient in most EV batteries, roughly tripled in price between November 2021 and November 2022 before prices finally started to come back down. Prices are now down more than 80% from their peak last November – a subdued macroeconomic outlook, weaker demand and excess supply have pushed lithium carbonate costs lower.

Lithium prices are now falling, after having soared to record highs

Sodium-ion technology will continue to evolve

One of the major disadvantages of sodium-ion batteries is their relatively low energy density – the amount of energy stored relative to the battery’s volume. Lower energy density means bulkier and heavier batteries.

Northvolt’s new battery has an energy density of more than 160 watt-hours per kilogramme, an energy density close to that type of lithium batteries typically used in energy storage, where size is not a problem. The Swedish group said that their battery has been designed for electricity storage plants, but in the future could be used in electric vehicles.

As the energy density of sodium-ion batteries continues to enhance, so their share in the passenger EV market is set to rise.

Lithium batteries used in EVs have energy density of up to 250-300Wh per kg. Those batteries used in energy storage usually have energy density of around 180Wh per kg.

Northvolt also manufactures automotive lithium-ion battery products at its gigafactory in Skellefteå, Sweden. The manufacturing process for sodium-ion batteries being able to make use of the same manufacturing sites and methods would be an advantage in scaling up production.

The potential success of sodium-ion batteries would depend on how quickly battery manufacturers could scale up to commercialize the new technology and blend this into the current manufacturing processes. Moves towards mass production of sodium-ion batteries are still in their infancy.

Northvolt has said that it is hoping to supply the first sodium-ion battery samples to customers next year and that it would reach full-scale production by the end of the decade.

The sodium-ion battery sector is currently dominated by Chinese groups, with CATL-Chery and BYD (OTCPK:BYDDF) both announcing EVs powered by sodium-ion batteries. China is estimated to have had 10 GWh of sodium-ion battery manufacturing capacity as of June 2023. The country is expected to reach 39.7 GWh in operating capacity by the end of 2023, according to EVTank.

CATL, the world’s largest battery maker, uses oxides containing metals such as nickel, cobalt or manganese in their sodium-ion batteries – this makes these batteries more expensive, than the battery developed by Northvolt.

We expect more announcements from carmakers as they continue to scale up capacity and as sodium-ion technology continues to better.

Diversification in battery chemistries will be key in the EV shift

Looking encourage ahead, we can expect more cars to be produced using sodium-ion batteries as manufacturing scales up, supply chains are formed, and technology evolves to better the energy density.

We expect the lower cost, improved safety and supply chain advantages of sodium-ion batteries over lithium-ion batteries to continue to drive their technology towards mass production.

Although we don’t expect sodium-ion batteries to overtake lithium-ion ones in the short to medium term, sodium-based batteries have the potential to complement lithium-based ones, reduce dependence on a single material, and alleviate some of the pressure on lithium and battery material supply chains. This should all speed up the green energy transition.

If sodium-ion batteries could take some market share from lithium-ion batteries, then this in turn could help to ease pressure on critical minerals supply, potentially at a much lower cost. Looking ahead, we believe it will be diversification in EV battery chemistries that will be key in any successful EV transition.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more