AntonioSolano/iStock via Getty Images

Quite a few songs about California exist.

One of the earliest and most famous ones is The Beach Boys’ “I Wish They All Could Be California Girls,” which was released in 1965. There’s also:

- “California” by Joni Mitchell (1966)

- “South California Purples” by Chicago (1969)

- “Hotel California” by the Eagles (1976)

- “California Sun” by the Ramones (1977)

- “California Love” by Tupac (1996)

- “Heads Carolina, Tails California” by Jo Dee Messina (1996)

- “Californication” by Red Hot Chili Peppers (1999)

- “California Gurls” by Katy Perry (2010)

- “California” by U2 (2014).

That’s the short list – and one that excludes songs about California cities or those about the state that don’t cite it in the title. There are more recent ones too, but I don’t recognize the artists and I’m not sure you would either.

The point I want to make stands regardless: There’s something about California in the American and even global imagination. It started with the Sutter’s Mill gold discovery in 1848 and picked right up again in the early 1900s as movie producers started moving their operations from Atlantic City in New Jersey to that West Coast locale.

As such, Hollywood is now synonymous with moviemaking. Silicon Valley is synonymous with big tech. And Disneyland in Anaheim has been synonymous with magical memories for decades.

Add in world-class surfing spots and beautiful beaches, gorgeous state parks, and famous shopping drives… and you’ve got a place people want to be.

Historically speaking, anyway.

How the times can change.

Concerns About the State of California

I bring this up because of two comments on a recent article, “The Cream Always Rises to the Top: Always Insist on Quality.” There, I wrote about several stocks, including real estate investment trust Rexford Industrial Realty (REXR), which:

“… differentiates its investment strategy from many of its industrial REIT peers by exclusively focusing on industrial properties located throughout infill Southern California (SoCal).

“Rather than diversifying their properties across multiple states or countries, REXR attempts to be the market leader in the top industrial market.”

In the past, that model was unquestionable.

This was a California market, after all. What more needed to be said?

But as one reader commented, California’s “population trend is shrinking.” And another added how he’s:

“… tempted by the great imbalance of supply and demand in that region, but I’m a little worried about macro environment factors. Especially as California seems to be quite exposed to natural risks.”

He then quoted calmatters.org as saying:

“California ranks among the top states suffering economic damage from climate-related disasters. [A federal] report describes food shortages, floods, droughts, wildfires, pollution, disease – all linked to climate change.”

Therefore, one commenter worries that, “A black swan event hitting SoCal could be devastating for REXR.”

Now, some believe that black swan already landed by way of the California-specific shutdowns, which prompted many people to leave. San Francisco Chronicle wrote last month how:

“California’s population dipped by about 75,000 from 2022 to 2023, estimates released Tuesday by the Census Bureau (show), with about 38,965,000 million people in the state this year. The state’s population has fallen since its 2019 peak of 39.5 million, though the annual loss has also slowed each year.”

That its “lowest count since 2015.”

Bye Bye Bye Big Business

Some of the California departed are celebrities like Hillary Swank and Danielle Steel. Rod Stewart left as well due to L.A.’s “toxic culture,” and Metallica’s James Hetfield exited because of the Bay Area’s “elitist” culture.

Meanwhile, many big businesses headquarters, from Tesla (TSLA) to Hewlett Packard (HPE) to Charles Schwab (SCHW), also found greener pastures. And where big business headquarters go, so must their headquarters-centered employees.

The San Francisco-based KRON4 News station noted back in June 2022 that, “The Golden State has long been an epicenter for entrepreneurship – but that reputation has been threatened since the COVID-19 pandemic.”

Citing a 2021 Stanford University report – which cited 64 corporate headquarters leaving in 2020 and another 74 in the first half of 2021 – it added:

“The Stanford researchers found that the regulatory climate and taxes were big reasons companies chose to make the leap east. Of all U.S. states, CEOs rated California’s tax and regulation policies the worst, including a total of 518 state agencies, boards, and commissions.”

And:

“‘California employees often have (or demand) elevated wages to meet the high cost of living, excessive housing prices, burdensome income tax rates, expensive utilities and, in some cases, payments for private schools to avoid the failing public school systems,’ the researchers stated.”

This was all largely true before the pandemic. But the shutdowns were the last straw for so many.

So how does this impact those companies that have remained in California, particularly REITs like the ones below?

To answer that, you really have to look at each one individually.

Don’t judge a book by its cover, they say. And perhaps we shouldn’t judge all of California by the headlines – relevant though they definitely are.

Rexford Industrial

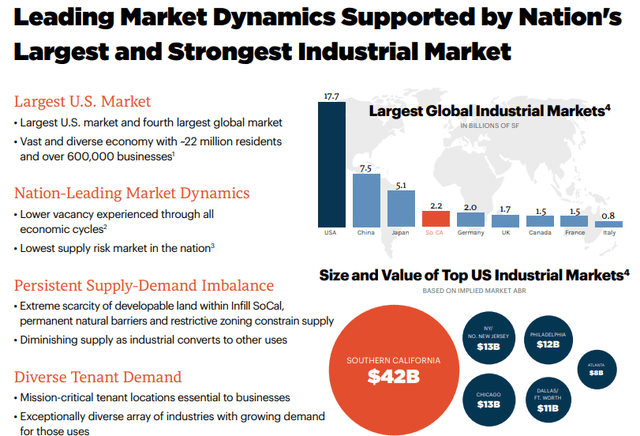

REXR is a California-based industrial REIT with a market cap of approximately $11.6 billion and a 45.0 million SF portfolio comprised of 371 industrial properties spread throughout infill Southern California (“SoCal”).

While each REIT discussed today has a strong presence in California, REXR is the only one that has positioned its portfolio exclusively in SoCal.

The fact that all of REXR’s properties are located throughout infill SoCal is by design, a strategic move by management to focus all of its resources on the largest U.S. Industrial market and the fourth largest industrial market in the world.

SoCal has some of the best supply & demand characteristics for an owner of industrial properties as the state has a vast economy with continuous demand but a limited supply of developable land.

SoCal is surrounded by natural barriers (ocean/mountains) which limits the supply of developable land, yet its economy consists of roughly 22 million residents and more than 600,000 businesses.

This leading supply and demand dynamic makes SoCal one of the most attractive industrial markets, which shows up in REXR’s average rent per SF and its releasing spreads.

REXR – IR

The inability to significantly increase SoCal net supply protects REXR’s portfolio more than other U.S. markets that are reporting record levels of new supply.

As previously mentioned, the long-term supply / demand imbalance in SoCal is very favorable to REXR and allows for outsized rents and releasing spreads.

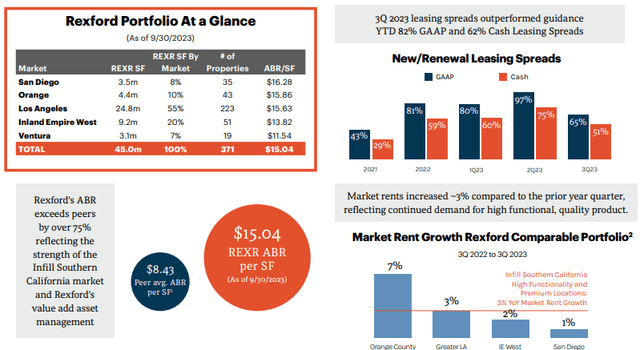

At the end of the third quarter, REXR reported annualized base rent (“ABR”) of $15.04 per SF, compared to its peer average of $8.43 per SF.

Additionally, the industrial REIT reported 3Q-23 releasing spreads of 64.8% on a GAAP basis and 51.4% on a cash basis.

REXR – IR

The long-term supply / demand imbalance in the SoCal industrial market should allow for continued outperformance and rent growth as REXR’s portfolio is well positioned to take advantage of the region’s favorable dynamics.

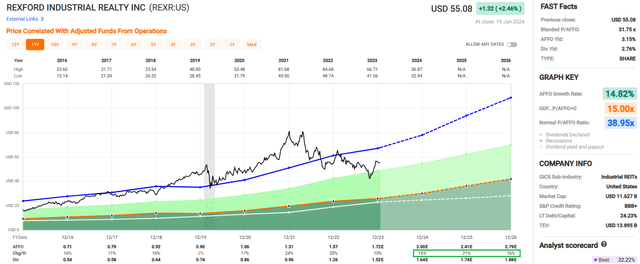

Analysts seem to agree and project REXR’s AFFO per share to increase by 16% in 2024, and then increase by 21% and 16% in the years 2025 and 2026, respectively.

I don’t see anything in REXR’s 3Q-23 earnings release to indicate that industrial demand in SoCal has been materially impacted by the post-COVID migration.

Actually, just the opposite as REXR has some of the highest average rental rates and releasing spreads in the industrial sector.

Currently the stock pays a 2.76% dividend yield and trades at a P/AFFO of 31.75x, compared to its average AFFO multiple of 38.95x.

We rate Rexford Industrial Realty a Strong Buy.

FAST Graphs

Essex Property Trust (ESS)

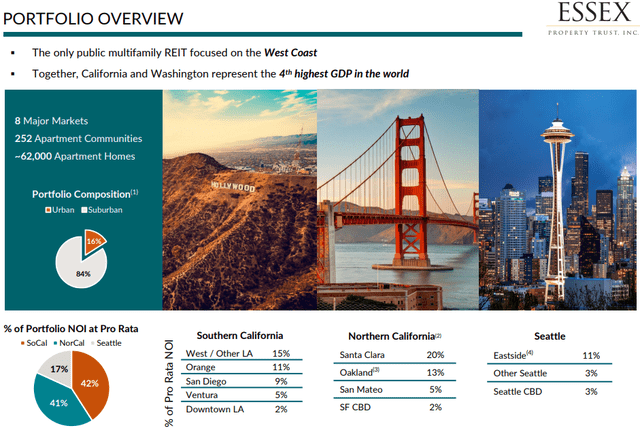

ESS is a West Coast-focused apartment REIT with a market cap of approximately $15.5 billion and a portfolio comprised of 252 multifamily communities containing approximately 62,000 apartment units in select West Coast markets.

The apartment REIT was formed in 1971 and went public in 1994. Since going public, ESS has grown its portfolio from 16 multifamily communities to more than 250 as of their latest update.

ESS is internally managed and specializes in the development, acquisition, and management of apartment communities with a focus on West Coast supply-constrained markets.

The apartment REITs portfolio is concentrated along the coastal markets of Southern and Northern California as well as the Seattle metropolitan area.

As a percentage of net operating income (“NOI”), ESS derives 42% from its Southern California markets, 41% from its Northern California markets, and 17% from its Seattle markets.

ESS – IR

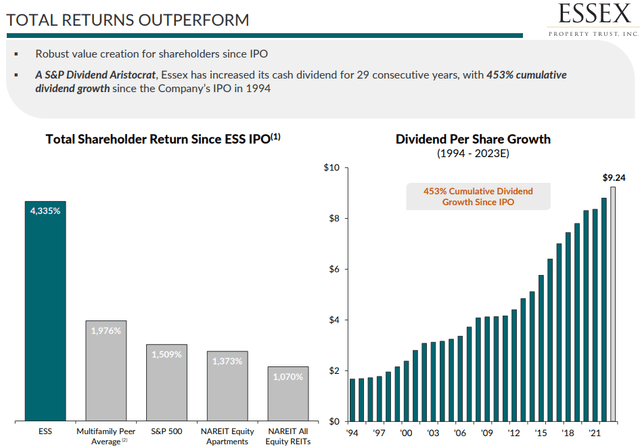

While the focus of this article is on California and REITs with high exposure to the state, I’d be remiss if I did not mention Essex’s outstanding dividend history.

ESS is an S&P Dividend Aristocrat, making it one of the few REITs to achieve this designation. The West Coast apartment REIT has increased its dividend for 29 consecutive years and has achieved cumulative dividend growth of approximately 453% since its public listing in 1994.

ESS – IR

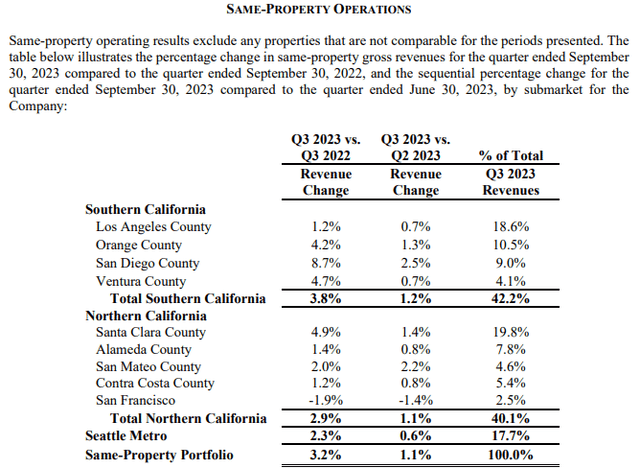

In late October ESS released its 3Q-23 earnings results and reported same-property revenue growth of 3.2% and same-property NOI growth of 2.7% when compared to the third quarter of 2022.

When comparing same-property operations between the third quarter of 2023 and 2022, revenue increased in each ESS market with the exception of San Francisco which saw revenue decline by -1.9%.

In total, revenue generated from its Southern California markets had a year-over-year (3Q23 vs 3Q22) increase of 3.8%, revenue generated from its Northern California markets had a year-over-year increase of 2.9%, and revenue generated from its Seattle Metro properties had a year-over-year increase of 2.3%.

On a per share basis, Core Funds from Operations (“Core FFO”) during the quarter increased by 2.4%, from $3.69 in 3Q-22 to $3.78 per share in 3Q-23.

ESS – IR

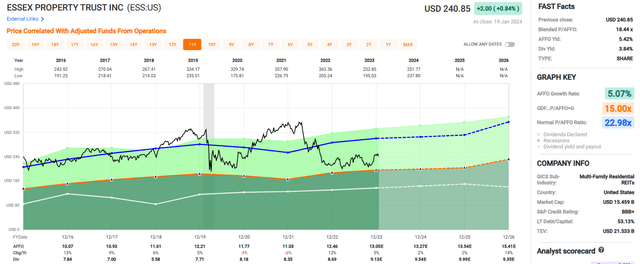

Since 2016 ESS has had an average AFFO growth rate of 5.07%. Analysts see moderate AFFO per share growth of 2% in both 2024 and 2025, and then expect AFFO per share to increase by 14% in 2026.

Other than the roughly 2% year-over-year decline in revenues from its San Francisco market, nothing in its 3Q-23 numbers indicates issues with occupancy or pricing power.

ESS reported 3.2% revenue growth in its same-property portfolio and the apartment REITs same-property Financial Occupancy was reported at 96.4% at the end of 3Q-23 compared to 96.0% at the end of 3Q-22.

ESS pays a 3.84% dividend yield and is currently trading at a P/AFFO of 18.44x, compared to its average AFFO multiple of 22.98x.

We rate Essex Property Trust a Buy.

FAST Graphs

Retail Opportunity Investments Corp (ROIC)

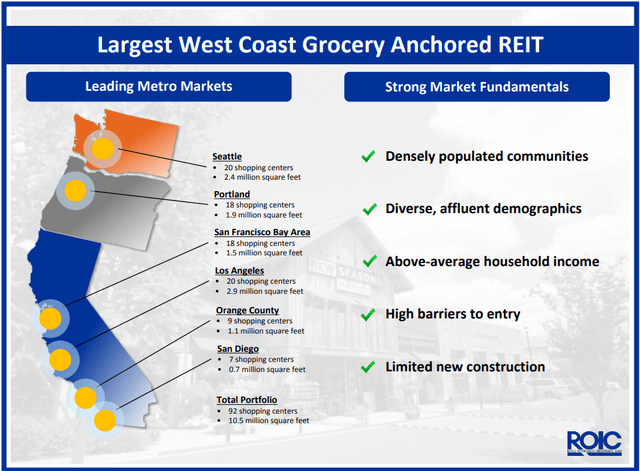

ROIC is an internally managed shopping center REIT that has been exclusively focused on the West Coast for more than 25 years.

The retail REIT has a market cap of approximately $1.76 billion and a 10.6 million SF portfolio comprised of 93 shopping centers located in high barriers-to-entry West Coast markets.

ROIC is the largest West Coast grocery-anchored REIT and targets areas that are densely populated with above-average incomes and a low supply of land suitable for development.

Their properties are located in California, Oregon, and Washington and their primary markets within these states include Los Angeles, San Francisco, Orange County, San Diego, Portland, and Seattle.

By square footage, their largest market is Los Angeles which contains 20 shopping centers covering 2.9 million SF, followed by Seattle and Portland which total 2.4 million SF and 1.9 million SF respectively.

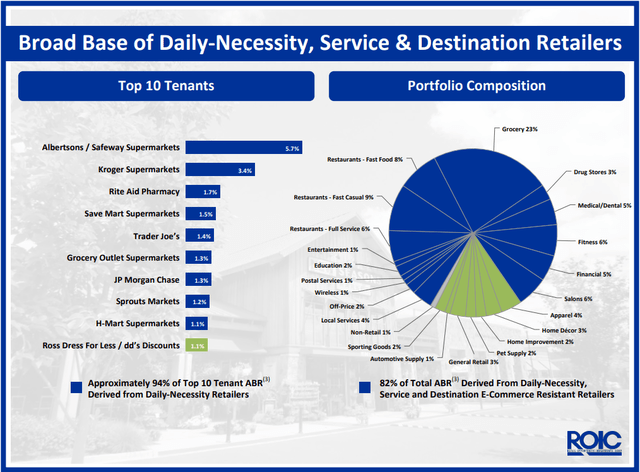

ROIC – IR

ROIC looks for retailers that operate in necessity-based and service-oriented industries including grocery, restaurants, medical / dental offices, and fitness centers.

ROIC’s largest industry is grocery stores which represents approximately 23% of their portfolio, followed by restaurants which includes fast food, fast casual, and full service and combined represents 23% of their portfolio.

The shopping center REIT’s top tenant is Albertsons / Safeway Supermarkets which makes up approximately 5.7% of their ABR, followed by Kroger and Rite Aid which makes up roughly 3.4% and 1.7% respectively.

ROIC – IR

While ROIC has properties outside of California, four out of six of its markets are located within the state, including the largest market, Los Angeles.

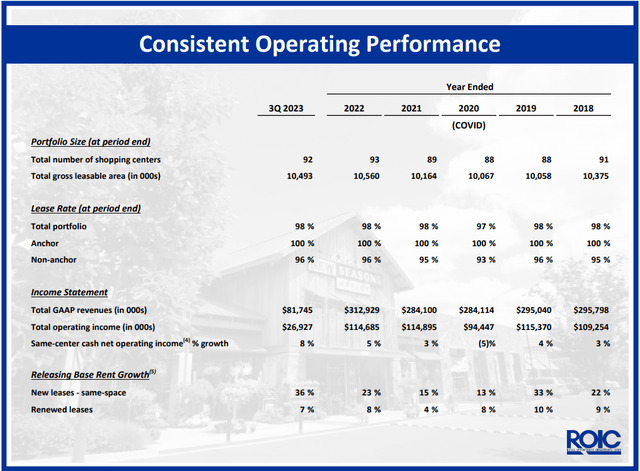

At the end of 3Q-23, the shopping center REIT’s portfolio was 98% leased, with its anchor properties 100% leased and their non-anchor properties 96% leased. This compares with a pre-COVID total portfolio lease rate of 98% at the end of 2018 and at the end of 2019.

ROIC’s same-center cash NOI grew by 8% in 3Q-23, compared with same-center cash NOI growth of 4% for the full year 2019.

Additionally, the REIT reported releasing base rent growth of 36% for its same-space new leases during 3Q-23 and renewal lease growth of 7%. This compares with releasing base rent growth of 22% for its same-space new leases and 9% growth for its renewal leases for the full year 2018.

ROIC – IR

While recently there has been an exodus from California, I don’t see anything in ROIC’s numbers to cause concern. The REIT is investment-grade with a BBB- credit rating and has a net debt to EBITDA of 6.4x and an EBITDA to interest expense ratio of 3.0x.

ROIC’s 3Q-23 lease rate on its total portfolio remains at 98%, which is the same percentage reported in 2018, 2019, 2021, and 2022.

Additionally, releasing base rent growth of 36% on their same-space new leases during 3Q-23 is higher than it has been from 2018 through 2022, which shows the shopping center REIT continues to have sufficient demand to increase rental rates.

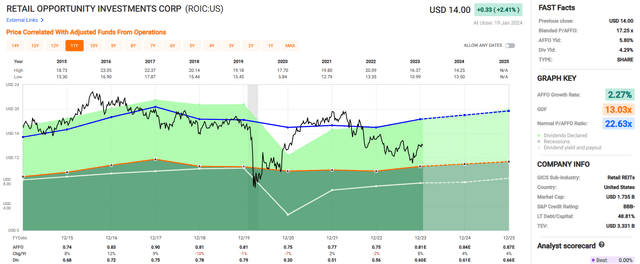

Currently ROIC pays a 4.29% dividend yield and trades at a P/AFFO of 17.25x, compared to its average AFFO multiple of 22.63x.

We rate Retail Opportunity Investments Corp a Buy.

FAST Graphs

In Closing

So, what do you think?

California dreaming?

Or California nightmare?

I look forward to your comments below…

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.