pepifoto

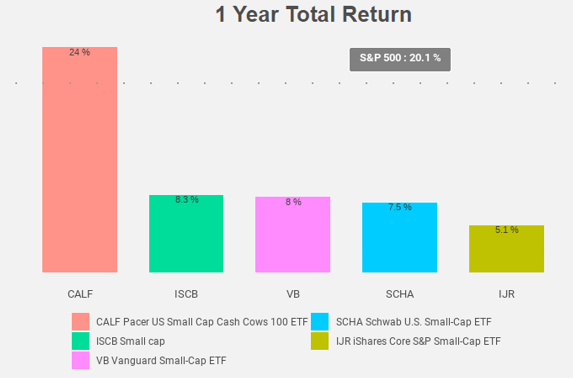

Small caps underperformed due to the rising interest rates. Quality small caps performed very well on the other hand. Certainly, the Pacer US Small Cap Cash Cows 100 ETF (BATS:CALF) performed very well, both when interest rates were rising and more recently when treasury yields fell from 5 to 4%.

Despite the nice performance, CALF has a very cheap valuation.

Small-cap underperformance

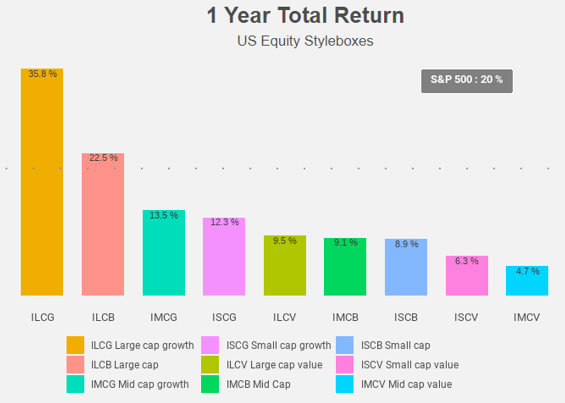

Small caps were severely hit by rising interest rates. Large caps and growth are performing very well, while small caps and value are underperforming.

Figure 1: Total return chart (Radar Insights)

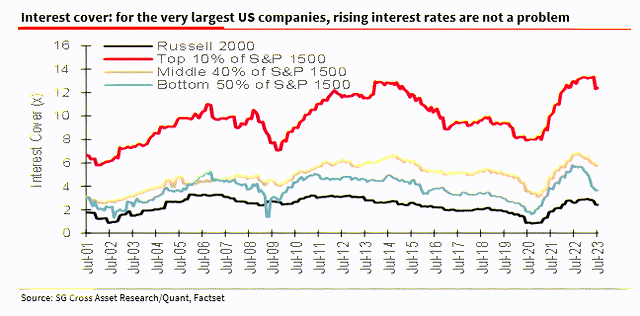

Rising rates have a bigger impact on smaller companies that use more floating-rate debt. Bigger companies use more fixed-rate long-term debt and have locked in lower rates before rates started rising. This resulted in much better interest coverage ratios.

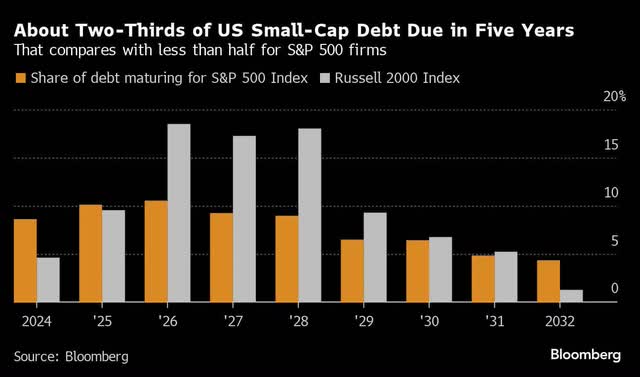

The share of maturing debt is much bigger for small caps compared to large caps.

Figure 3: Debt maturities (Bloomberg)

With higher rates, this means higher interest costs and a higher risk of defaults.

Figure 4: Interest cover (Pacer Advisors)

At the same time, the Fed is slowing the economy with higher interest rates which adds to the default risk for smaller companies.

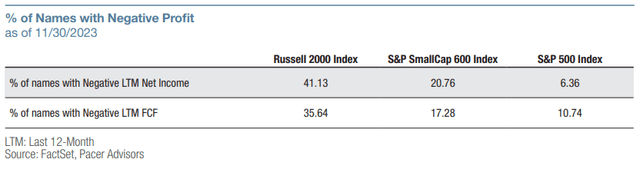

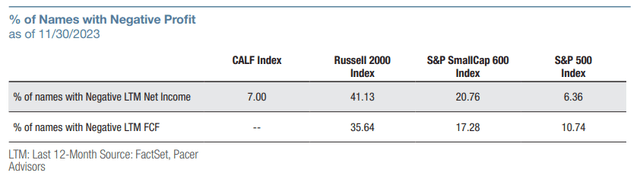

The percentage of companies with negative net income or negative free cash flow is bigger among small caps compared to the S&P 500.

Figure 5: % of names with negative profit (Pacer Advisors)

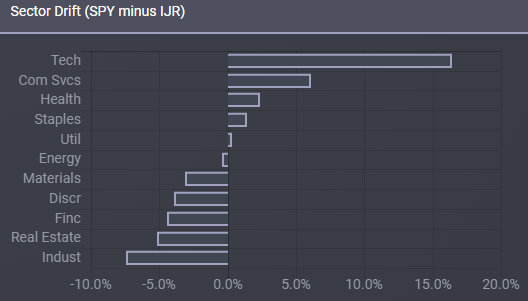

The weight of Technology is also much bigger in large caps compared to small cap portfolios like e.g. the iShares Core S&P Small-Cap ETF (IJR).

Figure 6: Fund overlap (ETFReseach.com)

And while the mega-cap tech stocks performed very well, small-cap tech stocks lagged far behind.

Figure 7: Small cap tech underperformance (Bloomberg)

Quality small caps outperformance

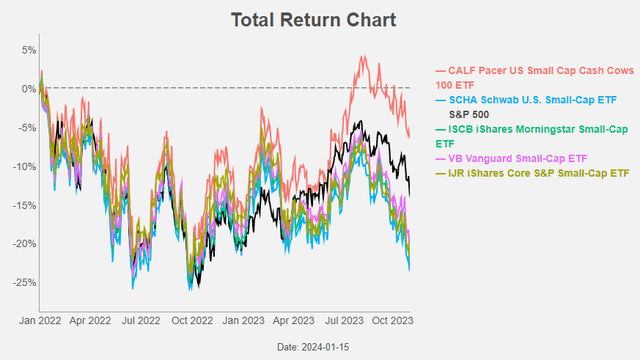

Figure 8 shows the performance of small-cap stocks in the rising interest rate period from the start of 2022 until the end of October of last year when long-term treasury yields peaked at 5%. Over that period small cap ETFs underperformed the S&P 500 (which booked itself a negative total return), with one notable exception: the Pacer US Small Cap Cash Cows 100 ETF.

Figure 8: Total return chart (Radar Insights)

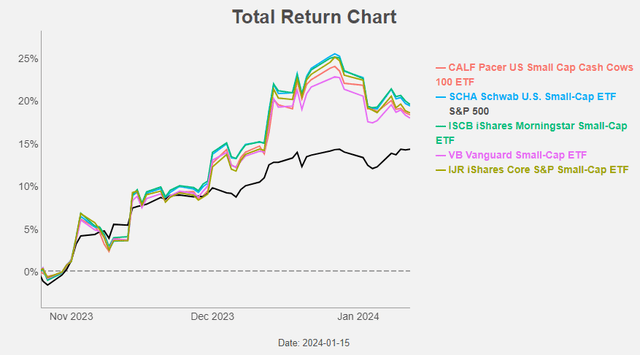

After peaking at 5% treasury yields fell to 4%. So probably, small caps stocks outperformed a rising S&P 500 while CALF underperformed both small caps and the S&P 500?

Hmm, not exactly.

Figure 9: Total return chart (Radar Insights)

Small caps did indeed outperform the S&P 500, but CALF did underperform. It outperformed also the S&P 500! So, CALF is performing very well no matter what interest rates are doing.

Figure 10 shows the performance over the past 12 months. Impressive.

Figure 10: Total return chart (Radar Insights)

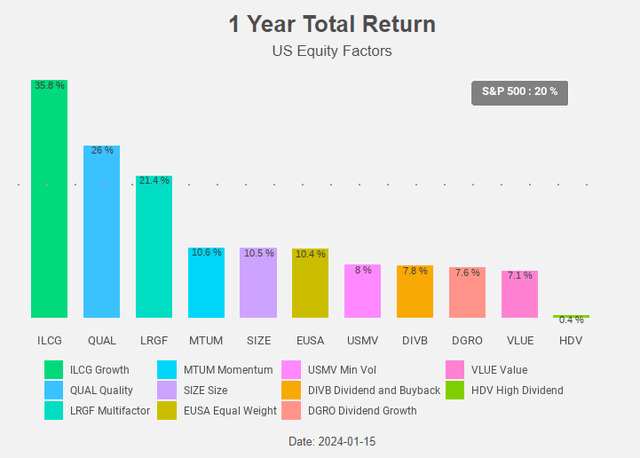

How can we explain these nice results? Figure 11 holds the clue: it’s due to quality.

Figure 11: Total return chart (Radar Insights)

Quality stocks are more stable companies that have a strong track record of growth and profitability. Quality stocks tend to generate a lot of free cash flow and hence have stronger balance sheets, a high return on equity, and a history of consistent and stable earnings and cash flow growth. Strong balance sheets result in lower default risk and when the economy slows down this is a valuable feature.

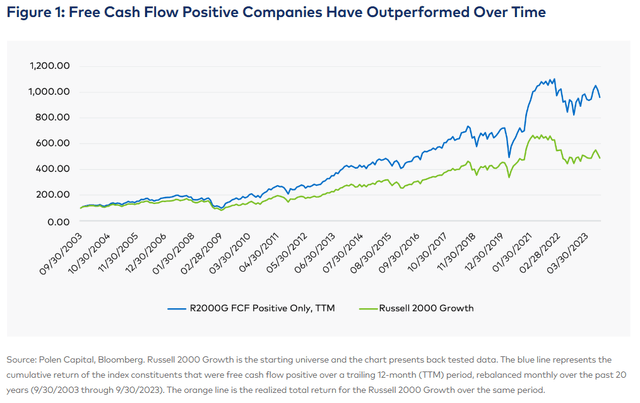

Companies with positive free cash flow have a history of outperformance, also among small caps.

Figure 12: Performance Free cash flow positive small caps (Polen Capital)

Pacer US Small Cap Cash Cows 100 ETF

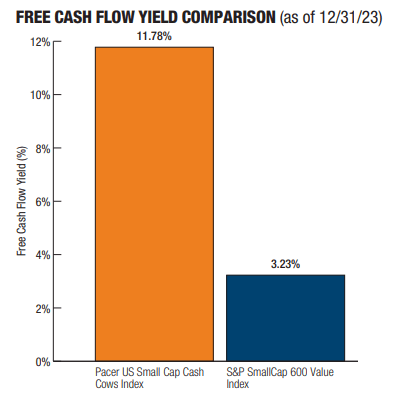

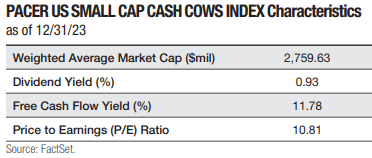

CALF screens the S&P SmallCap 600 Index for the top 100 companies based on free cash flow yield. Those 100 companies are subsequently weighted by their free cash flow yield (and capped at a 2% weight). This process results in an increase in free cash flow yield to 11.8% compared to the 3.2% for the S&P SmallCap 600 Index.

Figure 13: Free cash flow yield (Pacer Advisors)

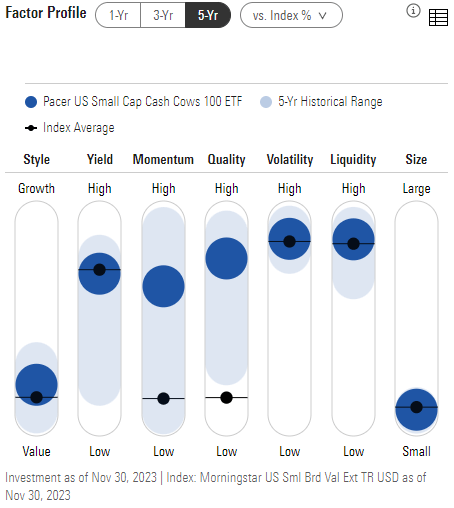

The result is a portfolio with very strong quality characteristics compared to the average small-cap universe.

Figure 14: Factor profile (Morningstar)

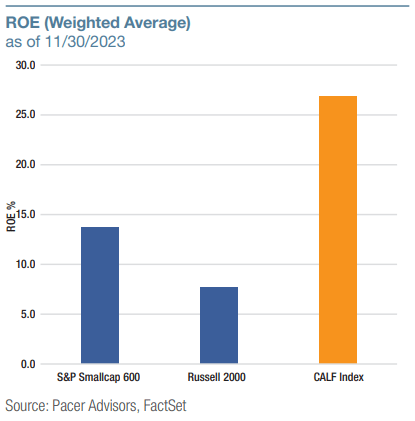

Morningstar uses profitability (of trailing 12-month return on equity) and financial leverage (debt-to-capital ratios) to define quality.

Figure 15: ROE (Pacer Advisors)

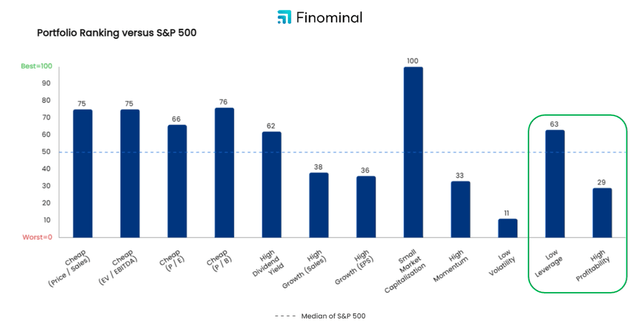

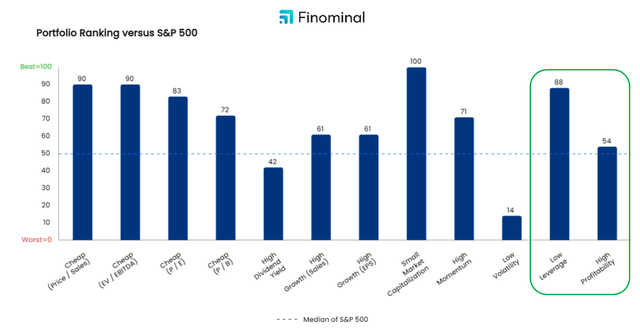

When we compare the portfolio factor ranking versus the S&P 500 of a general small-cap ETF like IJR with CALF we find some clear differences.

Figure 16: IJR Portfolio factor ranking (Finominal)

First, CALF scores much better on the quality factors leverage and profitability. CALF scores even better than the median S&P 500 stock.

Figure 17: CALF Portfolio factor ranking (Finominal)

Second, CALF scores very well on the valuation measures. We will come back to this feature when we discuss the valuation in more detail.

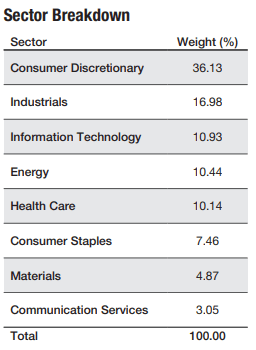

Technology is only the third biggest equity sector in CALF’s portfolio. CALF also excludes financial stocks from its portfolio.

Figure 19: Sector allocation (Pacer Advisors)

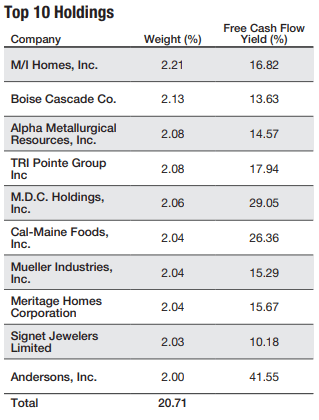

As usual for a small-cap ETF, the top 10 holdings don’t contain very well-known names.

Figure 20: Top 10 holdings (Pacer Advisors)

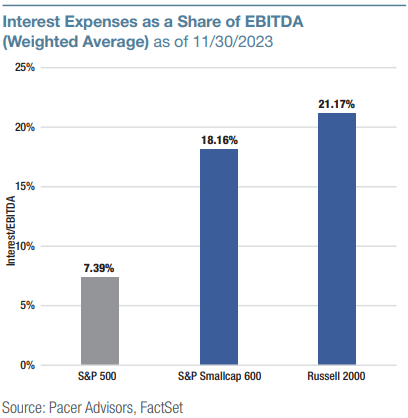

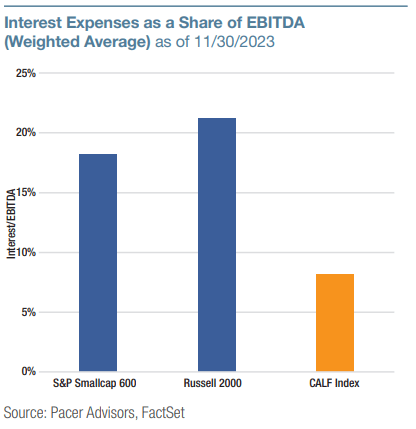

But the portfolio scores very well on measures like interest expense as a share of EBITDA, almost as good as the S&P 500.

Figure 21: Interest cover (Pacer Advisors)

The percentage of companies with negative net income or negative free cash flow is also very low, another indication CALF is very well prepared for a period in which interest rates are higher than they used to be.

Figure 22: % of names with negative profit (Pacer Advisors)

Valuation

CALF is cheaper than both small caps in general and the S&P 500. Normally quality stocks tend to trade at a premium. This is not the case for CALF. Taking the nice past performance into account, this is truly remarkable.

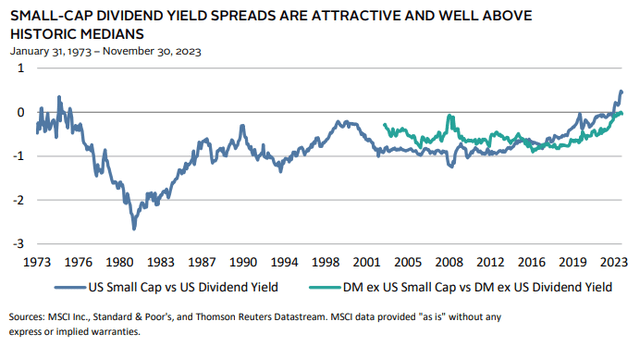

Small caps in general have never been this cheap in history compared to the stock market in general, both in the US and abroad.

Figure 23: Small cap valuation (Cambridge Associates)

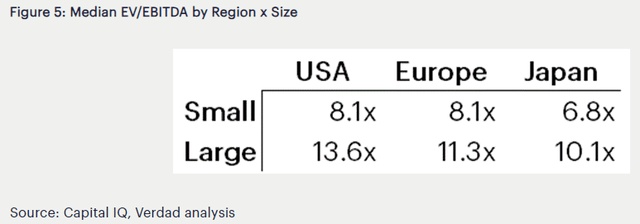

Small caps in the US are cheaper relative to large caps compared to Europe and Japan.

Figure 24: Small cap valuation (Verdad)

Despite the fact that CALF has quality characteristics comparable with the S&P 500 it trades at a much cheaper valuation. CALF has a P/E ratio of 11, while the S&P 500 trades at almost double.

Figure 25: CALF valuation (Pacer Advisors)

What could go wrong?

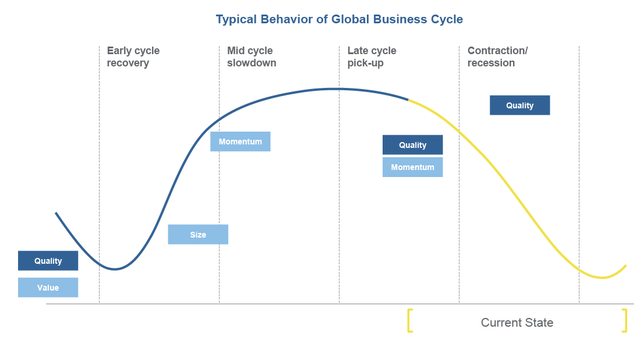

The main thing that could go wrong is a “dash to trash”: low-quality names that start to outperform. What could cause this? The only possible reason we see is a further sharp drop in interest rates that could result in speculative buying of low-quality names. But the most probable reason for lower interest rates is a hard recession. We seriously doubt that low-quality names would outperform high-quality stocks in such an environment. If history is our guide, we would rather expect the opposite to happen.

Figure 26: Business cycle (Westwood)

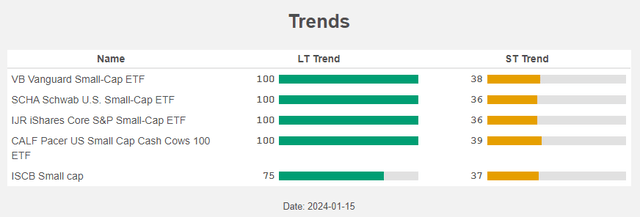

For the time being, all small-cap ETFs are in a long-term uptrend.

Figure 27: Trends (Radar Insights)

Conclusion

Small caps have been severely hit by rising interest rates due to their lower quality characteristics. This leaves them with a very cheap valuation, both compared to large caps and in historical content.

CALF offers you access to the cheap small-cap universe while at the same time avoiding the lower quality drawbacks. The latter is very important if interest rates stay the coming years higher than they used to be.

Quality normally trades at a valuation premium, but this is currently not the case for CALF.