FreezeFrames

A Quick Take On Cactus

Cactus (NYSE:WHD) reported its Q3 2023 financial results on November 8, 2023, missing both revenue and consensus earnings estimates.

The firm sells pressure control products for oil & gas drilling, completion and production for use in onshore and offshore environments.

I previously wrote about WHD in April 2023 with a Hold rating on higher international expansion costs and a full stock price valuation.

Since that report, the stock has risen and fallen in price, equalling the price at my report.

The U.S. onshore E&P industry continues to consolidate, and rig counts are materially lower, so despite continued revenue growth by the company, I reiterate my near-term outlook on WHD at Neutral [Hold].

Cactus Overview And Market

Texas-based Cactus designs and manufactures wellheads and pressure control equipment for the oil & gas drilling industry.

The company rents or sells various types of high-pressure equipment related to fracking well completion operations.

Cactus is led by CEO and co-founder Scott Bender, who was President of Wood Group Pressure Control from 2000 to 2011 and has significant industry go through.

WHD has offices throughout the U.S. and in Australia and South Korea.

Various Bender family members hold positions within the company.

The company has developed a line of products for pressure control, including:

-

Wellhead Systems

-

Frac Equipment

-

Flow Control Products

According to a 2023 market research report by Market Data Forecast, the global wellhead equipment market for the oil & gas industry was an estimated $5.8 billion in 2020 and is forecast to reach $7.7 billion by 2028.

This growth would represent a CAGR of 4.85% from 2023 to 2028.

The firm is primarily focused on wellhead completion equipment. Potential hindrances to the market’s growth include current administration policies discouraging drilling or making it more expensive.

Major competitive vendors that supply pressure control equipment include:

-

Delta

-

EthosEnergy

-

Integrated Equipment

-

Jereh Oilfield Equipment

-

JMP Petroleum Technologies

-

Msp/Drilex

-

Uztel S.A.

-

Sunnda Corporation

-

Weir Group

-

Others

Cactus’ Recent Financial Trends

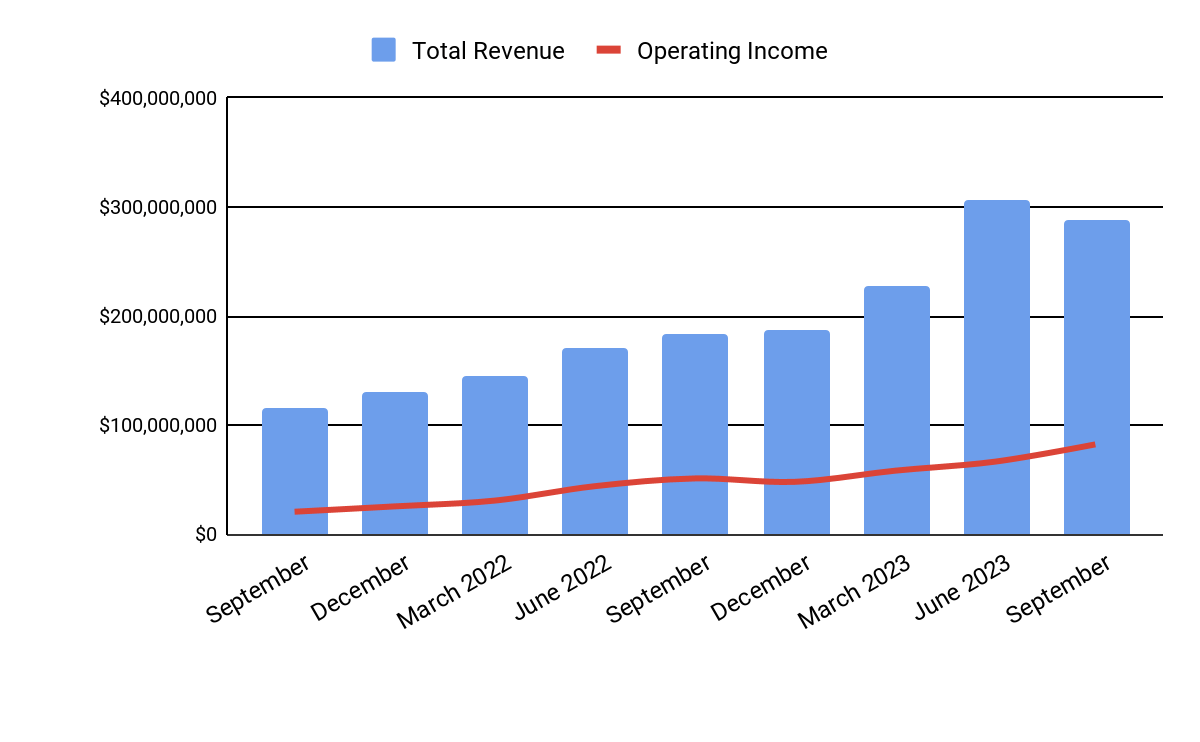

Total revenue by quarter (blue columns) has risen year-over-year on the strength of the company’s Pressure Control and Spoolable Technologies products; Operating income by quarter (red line) has grown steadily as gross profit margins have increased:

Seeking Alpha

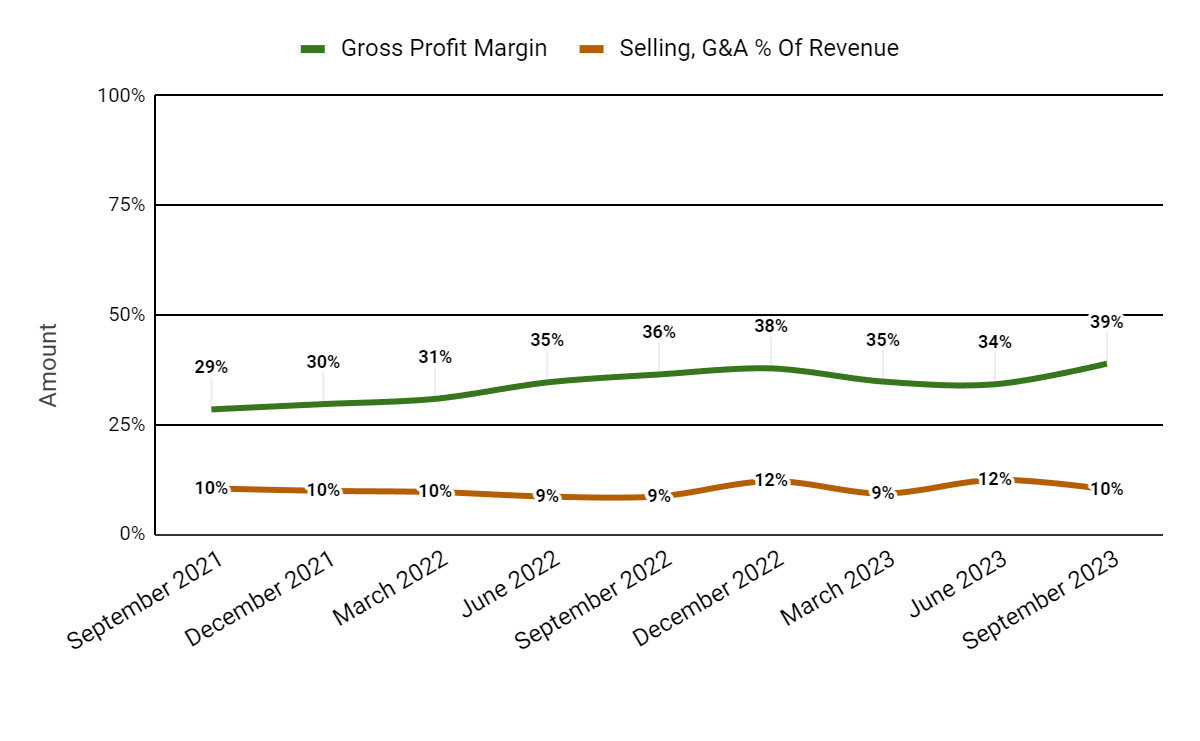

Gross profit margin by quarter (green line) has increased recently due to a tighter pricing environment for certain types of equipment; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have trended slightly higher in recent quarters:

Seeking Alpha

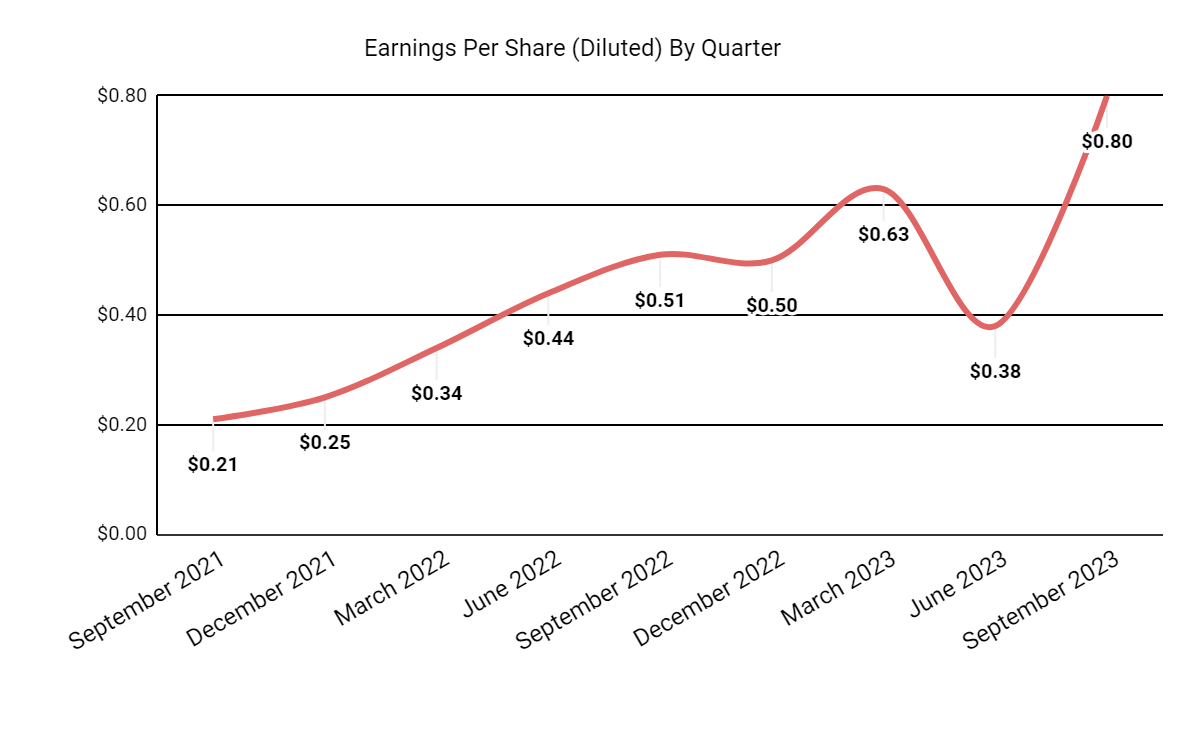

Earnings per share (Diluted) have been volatile recently but have shown impressive results:

Seeking Alpha

(All data in the above charts is GAAP.)

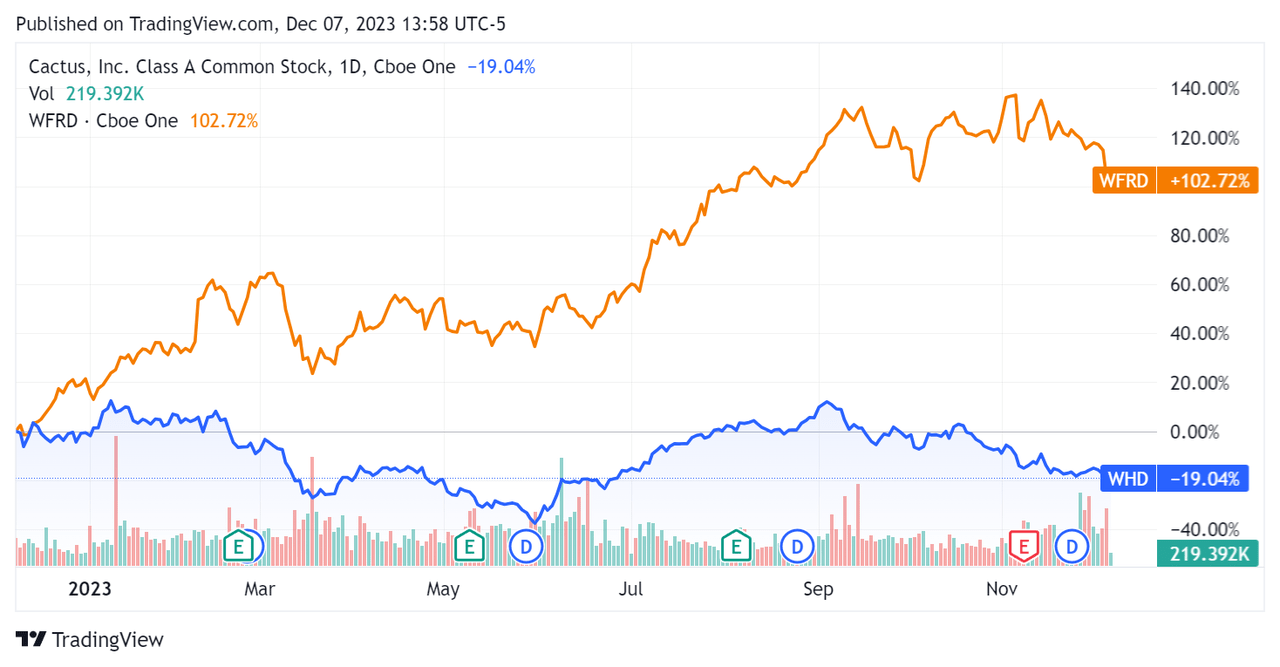

In the past 12 months, WHD’s stock price has fallen 19.04% vs. that of Weatherford International’s (WFRD) gain of 102.72%, likely due to the focused exposure of WHD to the U.S. market, which has resulted in higher capital allocation discipline by E&P firms and lower drilling activity:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $63.7 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was $247.4 million, during which capital expenditures were $40.5 million. The company paid $16.1 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Cactus

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

2.9 |

|

Enterprise Value / EBITDA |

9.1 |

|

Price / Sales |

2.6 |

|

Revenue Growth Rate |

60.2% |

|

Net Income Margin |

15.0% |

|

EBITDA % |

31.4% |

|

Market Capitalization |

$3,320,000,000 |

|

Enterprise Value |

$2,880,000,000 |

|

Operating Cash Flow |

$287,880,000 |

|

Earnings Per Share (Fully Diluted) |

$2.31 |

|

Forward EPS assess |

$2.87 |

|

Free Cash Flow Per Share |

$3.90 |

|

SA Quant Score |

Sell – 2.39 |

(Source – Seeking Alpha)

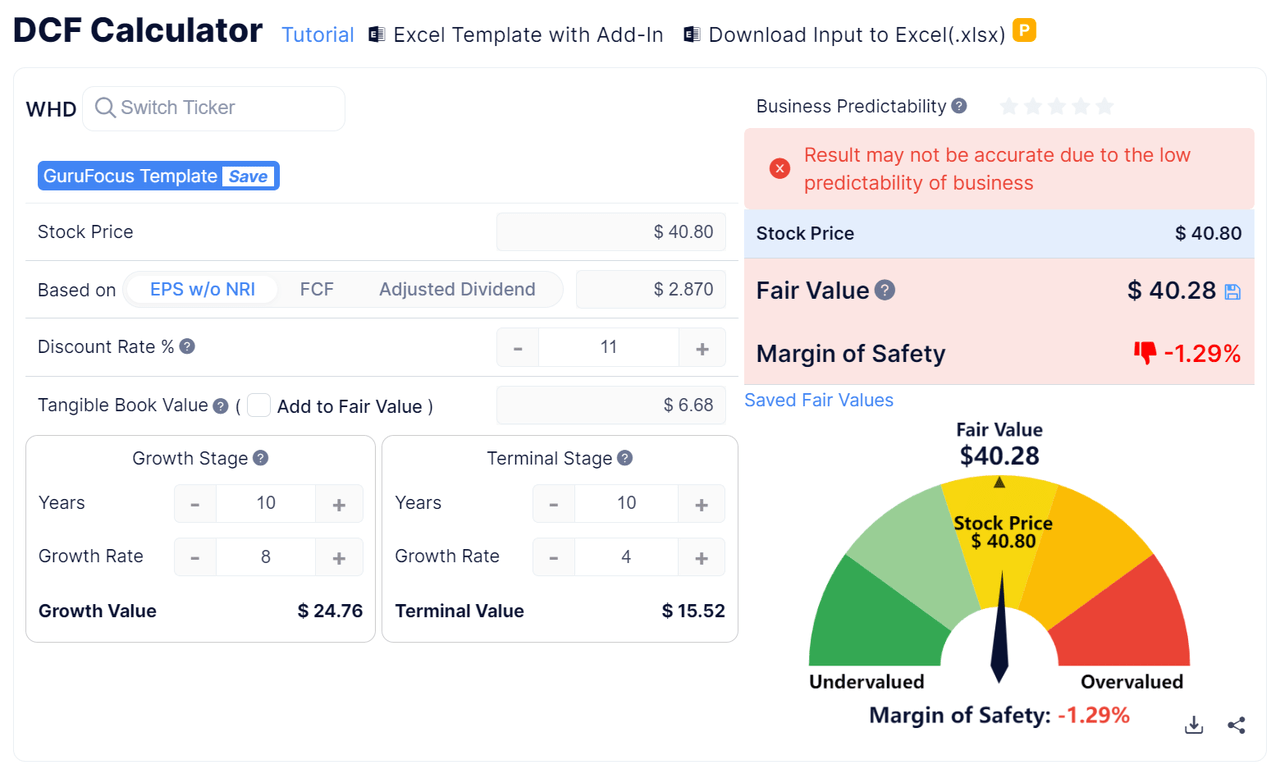

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GuruFocus

For the calculation, I used the 10-year Treasury Constant Maturity Rate as the risk-free rate (4.14%), rounded that up to the nearest integer (5%), and then added an equity risk premium [ERP] of 6% to get the estimated discount rate of 11%.

I then used an Earnings Per Share assumption of $2.87, which is the current 2023 full-year EPS consensus assess. For earnings growth, I used a Growth Rate assumption of 8%, given the expected 2024 revenue growth rate over 2023’s projected full-year revenue.

As for the consensus revenue estimates in the DCF’s assumptions, after a dip during the pandemic, the firm appears to be returning to trendline growth, which supports my 8% growth rate assumption. Forward earnings assumptions of $2.87 appear reasonable due to being essentially flat versus actual trailing twelve-month earnings results of $2.85.

Based on the DCF, the firm’s shares would be valued at approximately $40.28 versus the current price of $40.80, indicating they are potentially currently fully valued.

As a reference, a relevant partial public comparable would be Weatherford International (WFRD):

|

Metric (Trailing Twelve Months) |

Weatherford Int’l |

Cactus |

Variance |

|

Enterprise Value / Sales |

1.5 |

2.9 |

90.0% |

|

Enterprise Value / EBITDA |

6.7 |

9.1 |

36.1% |

|

Revenue Growth Rate |

21.9% |

60.2% |

174.7% |

|

Net Income Margin |

7.0% |

15.0% |

113.6% |

|

Operating Cash Flow |

$650,000,000 |

$287,880,000 |

-55.7% |

(Source – Seeking Alpha)

Commentary On Cactus

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted the outperformance of its Pressure Control and Spoolable Technologies segments despite reduced activity levels in U.S. land rig counts.

The company also repaid the final amounts due under its debt raised to pay for the FlexSteel acquisition, so it now has no bank debt.

Analysts questioned the leadership about margins, market activity and business mix shifts.

Management said that it expects margins for its Pressure Control products to be in the mid-30% area due to some activity recovery combined with cost reductions.

For market activity, the company has seen some softness from private customers, but larger operators (public) appear more stable in their future plans.

As the shale industry matures, management intends to present new products that will enable longer lateral drilling, improving customer productivity. Leadership seeks to gain more market share in its rental and wellhead businesses.

For the quarter’s results, total revenue for Q3 2023 rose by 56.0% year-over-year, and gross profit margin grew by 2.5%.

Selling and G&A expenses as a percentage of revenue rose 1.6% YoY while operating income was 60.8% higher, an impressive result.

The company’s financial position is strong, with ample liquidity, no debt and very impressive free cash flow.

Looking ahead, 2024 full-year consensus revenue estimates suggest 9.2% revenue growth, assuming 2023’s results are $1.09 billion in revenue.

Given the likelihood of a continued slide in drilling activity in 2024 as consolidation in the industry proceeds, I’m cautious about WHD’s ability to grow revenue meaningfully, at least in an organic sense.

The year ahead may be characterized by potential M&A opportunities as firms seek to upsize their operations to reduce growing E&P customer leverage on pricing.

So, my near-term outlook on WHD remains Neutral [Hold] due to U.S. onshore E&P industry consolidation and an apparently full valuation.