FotografieLink

We previously covered C3.ai (NYSE:AI) in December 2023, highlighting its improved near-term prospects, attributed to the reduced sales friction with lower average contract value (lower price points) and shorter sales cycle.

Combined with the growing ratio of subscription revenue and higher projected conversion rate, it appeared that the management’s new business model was working as intended.

Despite so, we maintained our Hold rating, since we believed that there was a minimal margin of safety at those inflated levels, with the stock overly buoyed by the generative AI hype.

In this article, we shall discuss why C3.ai remains overly lofty here, despite the raised FY2024 guidance, growing customer engagement, and long-term generative AI tailwinds.

Management’s overreliance on stock-based compensation and share dilution make its investment thesis unattractive here, well negating the SaaS company’s high growth prospects, further worsened by the uncertain profitability trajectory and eye-watering short interest.

We maintain our Hold rating here.

The C3.ai Investment Thesis Remains Overly Lofty Here

For now, C3.ai reported a doubled beat FQ3’24 earnings call, with overall revenues of $78.4M (+7% QoQ/ +17.6% YoY) and adj EPS of -$0.13 (inline QoQ/ -116.6% YoY).

The management has also contributed to ongoing Generative AI hype, with a minimally raised FY2024 revenue guidance of $308M (+15.4% YoY) and slight narrowing in the adj loss from operations at -$119M (-74.8% YoY) at the midpoint.

This is compared to the previous midpoint guidance of $307.5M (+15.2% YoY)/ -$125M (-83.6% YoY) offered in the FQ2’24 earnings call and the original guidance of $307.5M (+15.2% YoY)/ -$62.5M (+8.1% YoY) offered in the FQ4’23 earnings call.

Much of C3.ai’s top-line tailwinds are attributed to the growing bookings at 50 in the latest quarter (-19.3% QoQ/ +85% YoY), including 29 new pilots (-19.4% QoQ/ +71% YoY).

If we are to include the expanded customer engagements at 445 (+10.1% QoQ/ +80% YoY), it is apparent that the management’s pivot from subscription to consumption-based pricing model has worked extremely well.

While C3.ai remains unprofitable on a GAAP basis with negative Free Cash Flow generation of -$45.14M (+16.2% QoQ/ +37% YoY), it is apparent that the cash burn has been somewhat moderating thus far.

However, anyone expecting a break-even anytime soon must also temper their intermediate term expectations, since the SaaS company continues to report non-GAAP operating losses of -$25.8M (inline QoQ/ -72% YoY) and operating margins of -32.9% (+1.2 points QoQ/ -10.4 YoY).

While the management has guided “positive Free Cash Flow for the full year of FY2025,” it is also evident that the net cash on balance sheet has been consistently deteriorating to $723.32M in FQ3’24 (-5.1% QoQ/ -6.3% YoY), with the only bright spot being its lack of debts.

The Consensus Forward Estimates

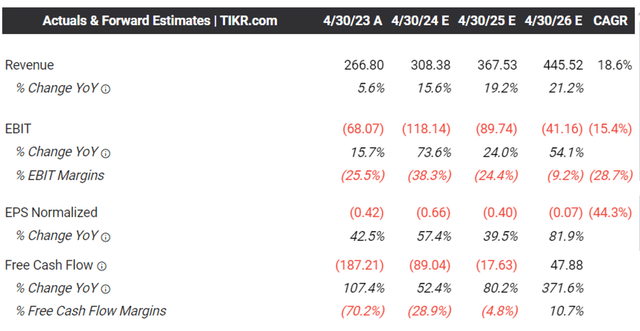

For now, the more than decent top-line growth over the past few quarters have contributed to the optimistic consensus estimates, with C3.ai expected to report narrowing losses over the next few years as its top-line expands at a CAGR of +18.6% through FY2027 (CY2026).

This builds upon the top-line growth at a CAGR of +27.4% between FY2019 and FY2023, further exemplifying the excellent consumer demand for its offerings ahead.

C3.ai Valuations

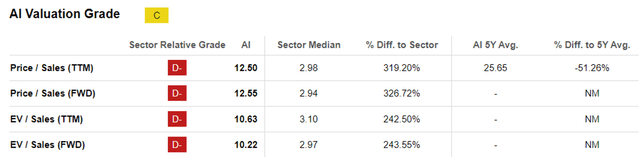

For now, due to its lack of profitability, the only metric that we may use to measure C3.ai’s FWD valuations is the elevated FWD Price/ Sales valuations of 12.55x, compared to its 1Y mean of 8.26x and the sector median of 2.94x.

The same premium has also been observed in its SaaS peers, such as NVIDIA (NVDA) at FWD Price/ Sales valuations of 20.46x, Palantir (PLTR) at 20.40x, and Microsoft (MSFT) at 13.57x, as generative AI increasingly becomes a buzzword driving the stock market.

However, due to the pivot to the lower margin consumption based pricing model and the high growth trend, it is uncertain when C3.ai may achieve break even operations, much less GAAP profitability.

Readers must also note that the Stock-Based Compensations have also been accelerating to $207.1M over the last twelve months (+1.4% sequentially/ +852.6% from FY2021 levels of $21.74M), disproportionate to the slower top-line growth at $296.40M (+11.1% sequentially/ +61.7% from FY2021 levels of $183.22M) over the same time period.

This naturally results in the long-term shareholders’ dilution thus far, based on the 120.49M shares reported in FQ3’24 (+1.83M QoQ/ +9.75M YoY/ +53.64M from FY2021 levels of 66.85M) and eroding Book Value per share of $7.38 (-2.8% QoQ/ -12.7% YoY/ -28.9% from FY2021 levels of $10.39).

Therefore, with C3.ai appearing to be rather expensive here with the management yet to offer an FY2025 guidance, we believe that it may be more prudent to monitor its execution for a little longer.

So, Is C3.ai Stock A Buy, Sell, or Hold?

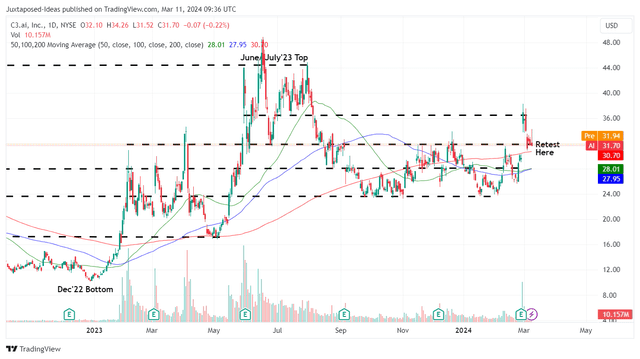

C3.ai 1Y Stock Price

For now, it is unsurprising that C3.ai has not been able to retain much of its recent gains while appearing to retest the previous resistance levels of $30s, due to the elevated short-interest of 28.1% at the time of writing and the inherent lack of bullish support.

This is a direct contrast against another generative AI SaaS stock, PLTR, with the stock continually charting new heights despite a similarly high SBC expense, bloated share count, and minimal GAAP profitability.

If anything, C3.ai needs to consistently offer promising forward guidance while beating consensus estimates to maintain its relatively stretched valuations, something that remains to be seen.

As the market momentum approaches extreme greed with a potential near-term market-wide pullback, we believe that it may be more prudent to maintain our Hold (Neutral) rating here.

Wait and see.