1971yes

The Thesis

BWX Technologies (NYSE:BWXT) experienced strong topline growth as it exits 2023, as the demand environment across both the company’s Government as well as the Commercial segment remained robust. The demand for the company’s product and service capabilities continues to show strength, which along with robust backlog levels should drive the company’s revenue in 2024 and beyond. The longer-term outlook also looks good due to multi-year government contracts and tailwinds across the nuclear energy industry, which is expected to benefit the company’s business in the coming years. While the company’s prospects look promising, the current stock valuation, which is at a premium to its historical valuation, does not look reasonable to me, leading to a hold rating on BWXT’s stock.

Business Overview

BWX Technologies is a leading nuclear technology company that manufactures and supplies nuclear components across the globe but primarily in the U.S. and Canada. The company also provides services related to the processing of nuclear materials, critical medical radioisotopes and radiopharmaceuticals, and other related technologies. The company primarily operates in two segments.

-

Government Operations: This segment deals in nuclear-related components, services, and solutions and mainly serves the government agencies such as the defense and national security sectors. This segment also provides a variety of services to the U.S. Government like managing and operating high-consequence operations at U.S. nuclear weapons sites, manufacturing complexes, and national laboratories.

-

Commercial Operations: The commercial segment, on the other hand, focuses on serving commercial customers such as utility companies and other nuclear power plant operators. The segment’s overall activity mainly depends on the demand and competitiveness of nuclear energy, as well as the demand for medical radioisotopes and radiopharmaceuticals.

Last Quarter Performance

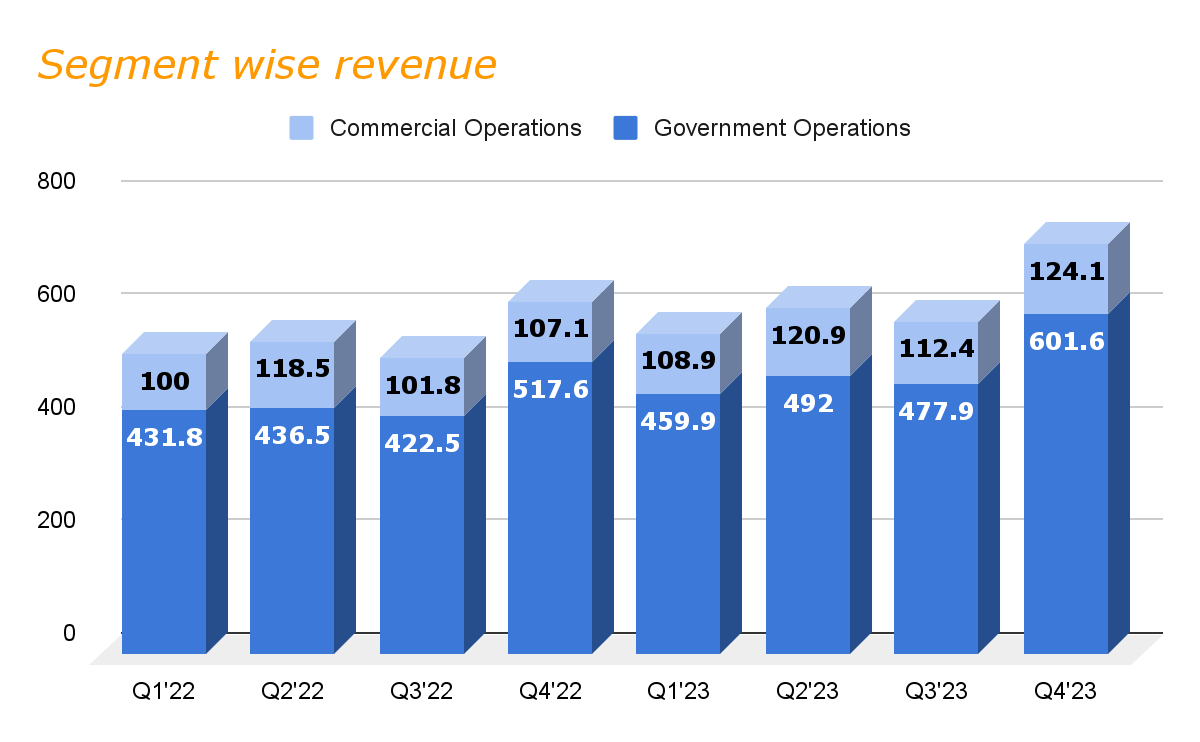

BWXT ended 2023 with strong double-digit topline growth, as both the company’s Government Operations and Commercial Segment delivered strong performance during the last quarter of 2024. The company’s revenue climbed 16.2% to $725 million during the last quarter of 2023. This was primarily driven by growth across almost all the business lines of the Government operation segment as well as strong growth in the Commercial segment followed by an increase in commercial nuclear field service and robust growth on the medical side which helped the segment in more than offsetting the negative impact from lower nuclear component volume during the quarter.

Historical revenue (Research Wise)

While the topline expanded during the quarter, the company’s margin was down as compared to the prior year’s quarter as the company’s consolidated adjusted EBITDA contracted 50 bps to 20.3% during the last quarter. The primary reason for this contraction was higher corporate costs as compared to the last year which were unusually low during 2022 due to retirements, healthcare underruns, and captive insurance releases, whereas, 2023 corporate cost was higher due to digital systems and human capital investments in HR.

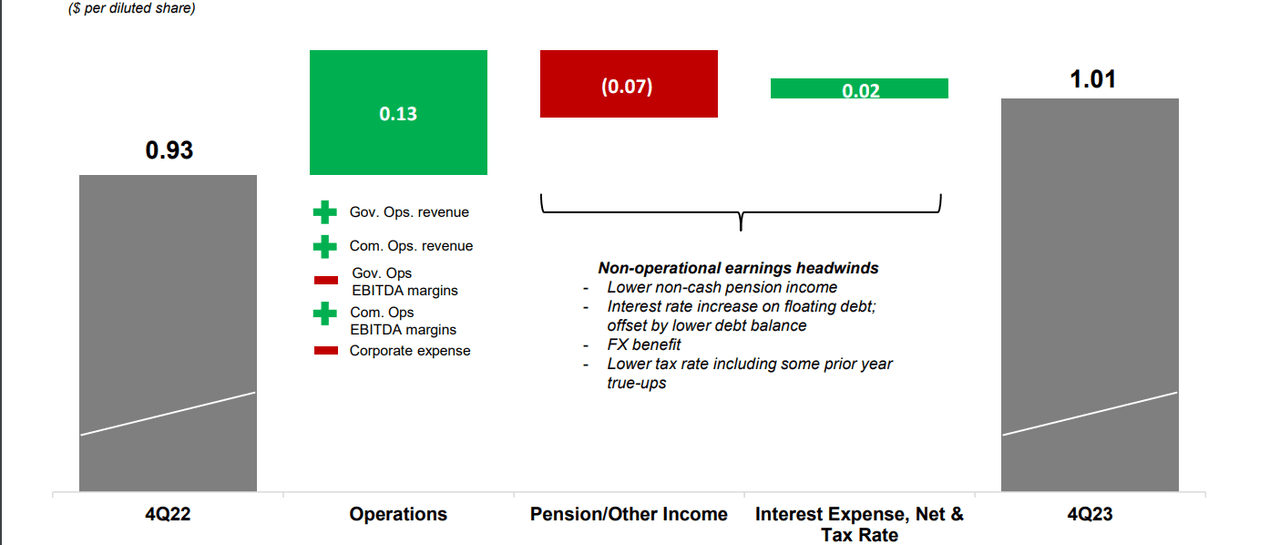

EPS waterfall chart (Company Q4 presentation)

While the margins saw a decline year-on-year during the quarter, the bottom line grew 8% as compared to the prior year’s quarter to $1.01, beating the consensus estimates by $0.08, continuing the streak for the straight fourth quarter. This growth primarily came from the operation, however, lower effective tax rates and the benefit from modest FX currency also supported this bottom-line growth in the fourth quarter of 2023.

Outlook

BWXT started 2023 with modest growth but picked up pace in the second half of 2023 delivering double-digit growth in mid to high teens due to robust growth in both the segments. In my opinion, the company’s topline should continue to grow further in 2024 as demand for the company’s market-leading manufacturing, design, engineering, and field service capabilities remained robust as the company entered 2024. The company also has strong backlog levels sitting at approximately $4 billion, which should benefit the company’s revenue in the coming quarters.

In the Government Operation segment, the company was awarded a $300 million contract for manufacturing of naval nuclear fuel, which is expected to be completed by mid-2025. Additionally, the segment is expanding its special materials portfolio beyond the naval fuel category and continues to invest in innovation and expansion. In addition to this, BWXT is also exploring and entering new domains and markets, which should be beneficial in the coming years.

Growth prospects of the Commercial segment, on the other hand, also look strong in the longer term as the utilities around the world continue to move towards nuclear for their electricity generation needs. In the month of December, 20 countries globally signed a declaration on the global stage at the COP28 conference, to triple nuclear energy by 2050. In my opinion, increasing global focus on nuclear energy should act as a strong tailwind for the company, and along with support from industries globally, should drive longer-term demand for BWXT.

Around the world, countries are also focusing on adding new grid-scale nuclear capacity, and in the larger grid-scale, nuclear reactor market, Ontario Power Generation announced a significant investment into its new nuclear fleet showing its commitment to meet growing electricity demand through the utilization of clean energy sources. In my opinion, this creates a great opportunity for the company which should provide longer-term visibility into the company’s existing backlog of life extension work in the region, which should further support the company’s top line in the coming years.

Overall, I expect the growth to continue in 2024 and beyond as the demand trends related to clean energy, global security, as well as medical end markets, remain strong. BWXT is also strongly positioned in this industry due to its unique capabilities and infrastructure, which should benefit the company’s sales in 2024 and beyond.

Talking about the guidance, the management is expecting overall revenue to grow in the mid-single digits, which comes out to be sales of approximately $2.6 billion for FY24. While the Government segment is anticipated to grow in the low to mid-single digits, the Commercial segment is expected to grow in the high single-digit to low double digits. I believe this should be achievable in FY24 as the demand remains healthy in the end market where BWXT operates.

Valuation

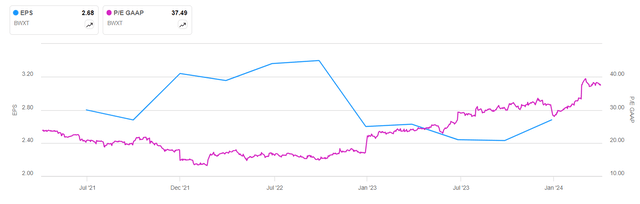

After 2021, the company’s bottom line contracted significantly due to lower profitability during this time, due to headwinds caused by a less favorable business mix and challenges caused by labor shortage reduced efficiencies, which has also impacted the company’s valuation as compared to its historical levels

Currently, the BWXT stock is trading at a forward P/E ratio of 31.96 times the EPS estimates of FY24, which is $3.14. When compared to its five-year average of 20.65, the company stock appears to be at a notable premium of more than 50%. When comparing the stock with its sector median, the stock looks even more expensive. While the consensus EPS estimates are showing year-on-year growth, however, the growth is just 4.1%, which should not be sufficient to make the stock’s valuation reasonable. However, the demand outlook looks promising, which along with improving efficiencies should support the bottom-line expansion in the coming years, but for now, the company’s stock valuation does not look reasonable to me.

The company’s topline is showing strength across both segments, and the margins have also started to improve in the Commercial segment, which was putting pressure on the overall company’s margin. In my opinion, as the company continues to focus on margin expansion in this segment through cost control initiatives and improving efficiencies which were badly impacted earlier mainly due to labor shortage, the company’s margin should grow in the coming quarters, benefiting the bottom line. I believe the ongoing margin improvement should help the company beat the EPS estimates, which should lead to a better valuation of the company’s stock by the end of 2024 when the P/E multiple starts to trade near its historical average.

Conclusion

As we discussed, the stock is at a premium to its historical average. The company’s topline has shown strong growth in the second half of 2023 due to strong demand across almost all the business lines in both the segment. I expect this strong growth to continue further in 2024 as well. While the company’s long-term looks promising, the near-term margin headwinds and a relatively expensive valuation to its sector median suggest avoiding this stock at the moment. Therefore, I am recommending a hold rating on this stock.