Lemon_tm

The SPDR Bloomberg International Treasury Bond ETF (NYSEARCA:BWX) offers investors diversified exposure to government bonds from investment-grade international issuers. BWX’s underlying holdings are riskier than U.S. treasuries, due to foreign currency risk. Dividends and expected returns are lower too, as U.S. government bond yields tend to be higher than those of other developed countries. Past performance is weaker too, for the same reasons. Expenses are higher than average, although only slightly so.

Although BWX might help to diversify an investor’s bond portfolio, the fund’s overall risk-return profile is quite weak. As such, I see no reason to invest in the fund.

BWX – Basics

- Investment Manager: State Street

- Dividend Yield: 1.65%

- Expense Ratio: 0.35%

- Total Returns CAGR (Inception): 0.41%

BWX – Overview and Analysis

Index and Holdings

BWX is an investment-grade international government bond index ETF. It tracks the Bloomberg Global Treasury ex-US Capped Index, an index of the aforementioned securities. The index seems pretty self-explanatory, with the added mention that it only includes local currency fixed-rate bonds. Although Bloomberg refers to these securities as treasuries, I will only refer to U.S. treasuries as treasuries.

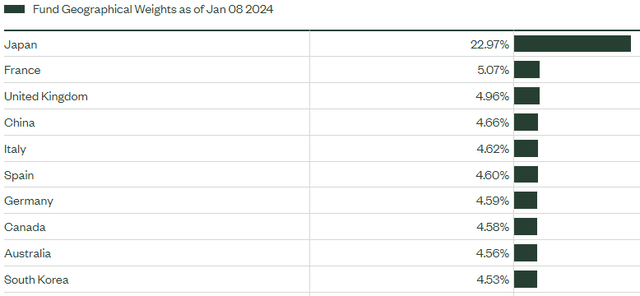

BWX invests in dozens of countries. Largest of these are as follows.

BWX invests in the international counterparty to treasuries. Comparing the fund with these securities seems reasonable and logical, so I’ll be doing just that for the remainder of the article.

Credit Quality

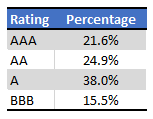

BWX exclusively invests in government bonds from investment-grade issuers. Governments rarely default, investment-grade governments very rarely do, so the fund’s credit quality is quite high. Credit ratings are evenly divided from AAA to BBB, with a median and mode of A.

Fund Filings – Table by Author

BWX’s credit quality is high, but lower than that of U.S. treasuries. This is partly because U.S. treasuries are widely regarded as the safest assets of the world, due to being backed by the strongest, most credit-worthy country and government in the world. BWX’s investments in less credit-worthy countries and governments, including Spain and Italy, decrease credit quality vis a vis U.S. treasuries as well.

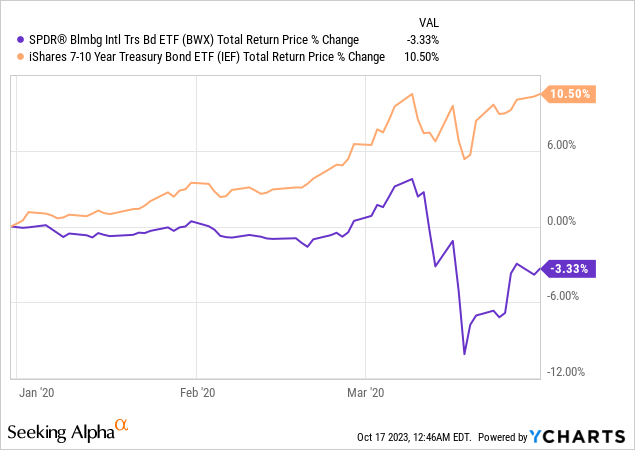

Considering the above, BWX should see low losses during downturns and recessions, but underperform treasuries during the same. BWX significantly underperformed during 1Q2020, the onset of the coronavirus pandemic.

Data by YCharts

Although results above were broadly in-line with expectations, results did seem a bit excessive: BWX does not have that much more credit risk. Which brings me to my next point.

Foreign Currency Risk and Exposure

BWX invests in local currency government bonds, so its assets are denominated in Japanese yens, British pounds, Euros, etc. As the fund itself is denominated in dollars, investors are exposed to significant foreign currency risk. Higher foreign currency prices, equivalent to lower dollar prices, would increase the price of the fund’s holdings, benefitting investors. Lower foreign currency prices, equivalent to higher dollar prices, would have the opposite effect.

BWX’s foreign currency exposure harms investors in two ways.

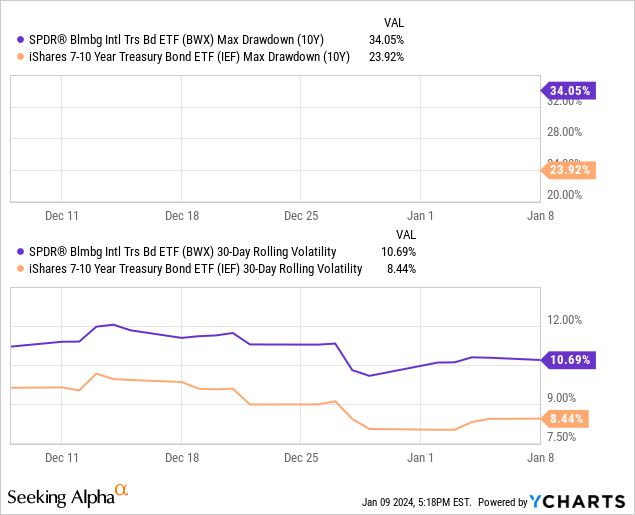

First, the exposure increases asset price volatility, a straightforward negative. BWX has higher drawdowns and volatility than treasuries, as expected.

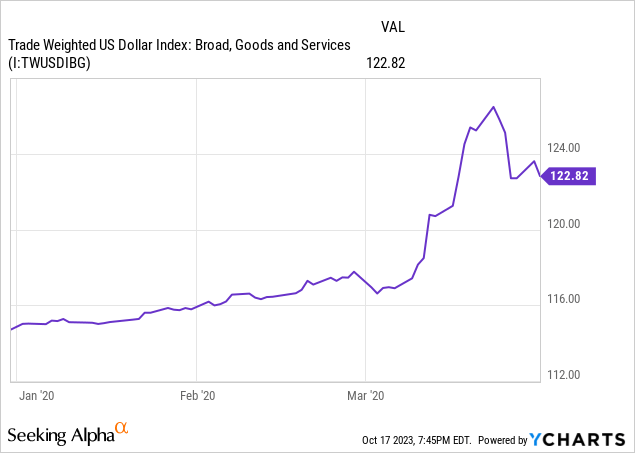

Second, as the dollar is perceived to be a relatively safe currency, investors sometimes sell foreign currencies to buy dollars during recessions and downturns. As an example, the dollar rose in 1Q2020, when the coronavirus pandemic first hit.

Data by YCharts

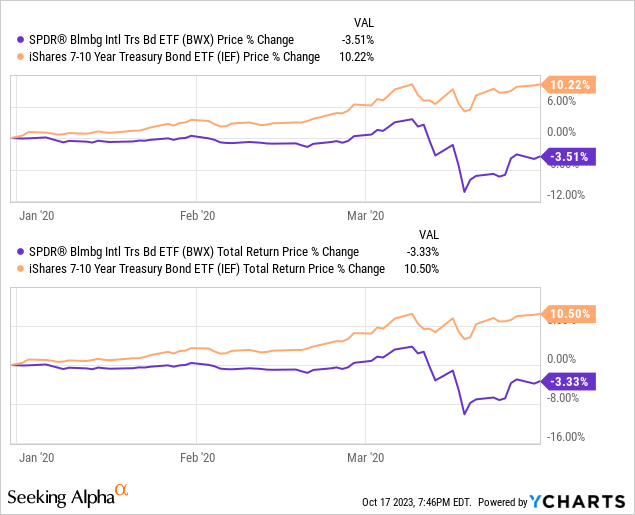

Higher dollar prices means lower foreign currency asset prices, and lower BWX share prices. A big chunk of BWX’s underperformance in 1Q2020, mentioned in the previous section, was due to higher dollar prices.

Data by YCharts

Higher Expenses

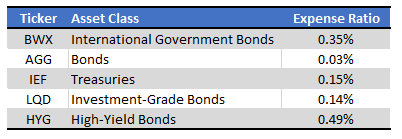

BWX sports a 0.35% expense ratio. Expenses are higher than average for an index bond ETF, including those focused on treasuries, although not significantly so.

Seeking Alpha – Table by Author

BWX is marginally more expensive than most bond and treasury ETFs, a slightly negative to the fund and its shareholders. Although the differences are not large, I do think they are material, especially considering the fact that the dividends on these funds are not that high, nor are capital gains likely to be strong. These are income vehicles, and a 0.10% or 0.20% difference does matter.

Lower Dividends and Expected Returns

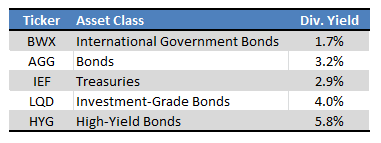

BWX currently sports a 1.7% dividend yield. It is an incredibly low yield on an absolute basis, and much lower than that of its peers.

Seeking Alpha – Table by Author

More forward-looking dividend metrics are higher, but dividends remain low on an absolute basis. Specifically, BWX sports a 2.5% SEC yield, and 2.8% yield to maturity. Both figures are low, especially considering prevailing Federal Reserve rates.

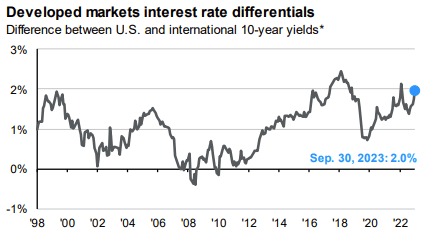

BWX yields less than most of its U.S. peers because domestic interest rates are higher than those in most foreign developed markets. The ECB targets a 4.00% – 4.75% rate, while Japan maintains a -0.10% target, both lower than the Fed’s 5.25% – 5.50% range.

BWX invests in international government bonds, most of which originate from countries with very low benchmark rates, hence the fund’s low dividends. U.S. rates tend to be higher than those of other developed markets, but spreads have widened these past few years, due to aggressive Federal Reserve policy.

JPMorgan Guide to the Markets

Bonds are income vehicles, so BWX’s comparatively low dividends mean comparatively low expected returns. Which brings me to my next point.

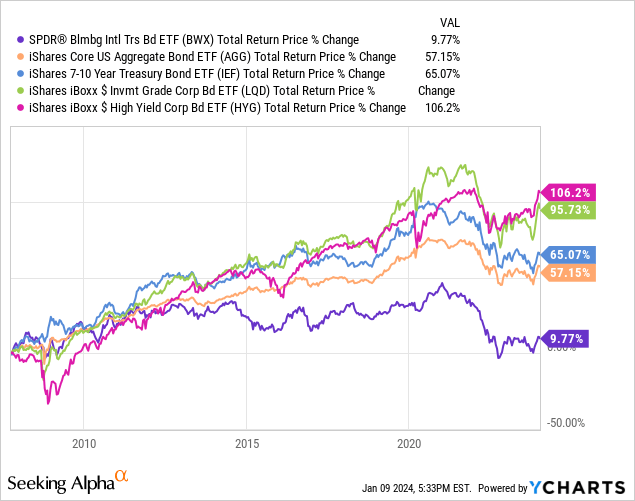

Weak Performance Track-Record

BWX’s performance track-record is quite weak, with the fund generally underperforming its peers. Performance relative to treasuries is particularly important, and weak. Returns since inception have been extraordinarily weak, with the fund delivering extremely low returns since inception, almost two decades ago.

BWX’s weak returns were mostly due to the fund’s low yield, in turn caused by the low rates on most international government bonds. Higher dollar prices and interest rates also played a role. Prospective returns are somewhat higher, as rates have risen, but still quite weak relative to dollar-denominated securities, including treasuries.

Diversification Benefits

BWX offers investors exposure to a relatively niche bond sub-asset class: international government bonds. Investing in these securities boosts portfolio diversification and reduces risks, at least assuming investors don’t already invest in these (reasonable assumption).

Although the above does provide some benefit to investors, I think the overall impact is quite weak.

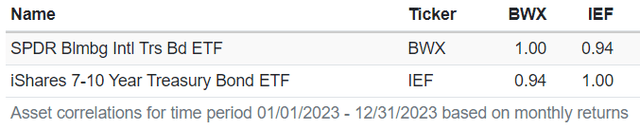

International government bonds and treasuries are somewhat correlated assets, so investing in both should not be significantly safer / less volatile than focusing on one or the other. Correlations between BWX and treasuries are indeed positive, as expected.

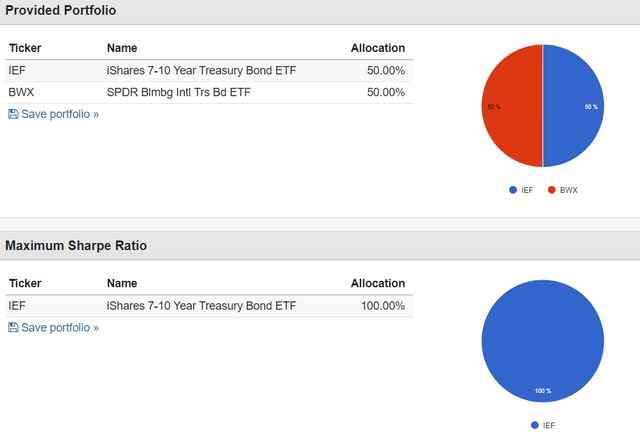

At the same time, because BWX’s returns are quite weak, and its volatility above-average, including the fund in a treasury portfolio simply reduced risk-adjusted returns. Diversification simply does not work when assets as are weak as BWX.

Although results might always improve in the future, I have no reason to believe that this will actually be the case. BWX’s dividends remain low, and its foreign currency risk high. It seems likely that including the fund in an investor’s portfolio will reduce risk-adjusted returns moving forward, as was the case in the past.

Conclusion

BWX offers investors diversified exposure to government bonds from investment-grade international issuers. As BWX’s dividends are much lower than average, while risks and volatility are higher than average, I would not invest in the fund.