blueflames/E+ via Getty Images

TH International Limited (NASDAQ:THCH) is a company that operates Tim Hortons coffee shops in mainland China, Hong Kong, and Macau. The company is a subsidiary of Tim Hortons Inc. and is based in Shanghai, China. It was founded in 2018.

I believe it is a good play on the increasing consumption of coffee in China. I wouldn’t take a huge position in it, but for those people looking for a pure play and not willing to gamble on Luckin Coffee (more on this later), I think THCH is worth a shot.

The company is led by Yongchen Lu, who serves as the CEO. Other key executives include Dong Li (CFO), and Bin He (Chief Consumer Officer).

Commonly known as Tims China, THCH is the master franchisee of Tim Hortons coffee shops in China. It was founded as a partnership between Cartesian Capital Group and Restaurant Brands International Inc.

Tims China has been rapidly expanding since opening its first coffee shop in China in February 2019. Tims China’s growth is a result of the increasing coffee consumption in China, which is growing at an annual rate of 30%, significantly higher than the global average of 2%.

TH International Limited was formed as a master-franchisee as opposed to a direct spin-off from Tim Hortons. The decision to form it this way was to allow Tim Hortons to extend its brand presence in the Chinese market through a local entity that understands and can steer the unique aspects of the Chinese market effectively.

THCH has ambitious plans to open over 2,750 coffee shops by 2026, capitalizing on the under-penetrated Chinese coffee market and significant growth potential in China.

This expansion strategy mirrors the aggressive growth tactics of other major coffee chains in the region, aiming to leverage the growing popularity of coffee in China, including coffee giant Starbucks (SBUX).

Overall, TH International Limited’s formation and growth strategy represent a significant proceed in the global coffee shop market, particularly in the rapidly evolving and expanding Chinese market.

Corporate Governance

Any discussion about China has to start with your overall appetite to invest in a communist country and then your comfort with the company’s corporate governance. It’s easy to see the growth potential for coffee in China, which we will talk about in a bit, but if you don’t have good corporate governance and you’re not willing to invest in a communist country, then this definitely is not the investment for you.

Yongchen Lu has been the CEO of THCH since May 2018. Prior to this role, he served as the CFO of Burger King China from November 2012 to April 2018 and worked as the China Representative at Cartesian from January 2008 to January 2016. Lu holds an undergraduate degree from Shanghai Jiao Tong University and an MBA from the Tuck School of Business at Dartmouth. His tenure at Tim Hortons China marks a significant period in the company’s expansion and development in the Chinese market.

It is difficult to ascertain how Burger King China did during his tenure because there isn’t publicly disclosed financials. Burger King, as a global brand, is a part of Restaurant Brands International Inc. (QSR), which is a holding company including other major brands appreciate Popeye’s and Tim Horton’s.

Cartesian Capital Group is a global private equity firm that focuses on transnational investments. They are known for creating and managing innovative, cross-border, private equity and structured investments in multiple regions, including the Americas, Asia, and Europe.

The firm often engages in large-scale investment projects and partnerships, particularly in markets that are undergoing significant economic transformation. Here are some of Cartesian’s major investments:

- Burger King: Cartesian played a key role in Burger King’s global expansion, particularly in China.

- Tim Hortons China: They partnered with Restaurant Brands International to extend the Tim Hortons brand in China.

- PetroRio: Cartesian invested in PetroRio, one of Brazil’s largest independent oil and gas companies.

- Uphold: They invested in Uphold, a digital money platform offering a wide range of financial services.

They appear to be a reputable private equity firm. More due diligence is required, though. You can read about Cartesian Capital’s investment in Tim Horton’s China here.

A Cautionary Tale: Luckin Coffee

Investors in Luckin Coffee (LKCNY) know well the issues with corporate governance in China. Luckin was a growth investors’ dream, feasting on the coffee consumption growth in China.

However, in 2020, Luckin was involved in a major accounting scandal. An internal investigation found that its chief operating officer had fabricated the company’s 2019 sales by approximately $310 million. This led to a halt in trading of Luckin shares on the U.S. stock market and the firing of its CEO and COO. Following this, the U.S. Senate passed legislation that could potentially bar many Chinese companies from listing shares on U.S. exchanges or raising money from American investors without adhering to strict regulatory and auditing regulations.

Interestingly, though, Luckin is now the largest coffee brand in China. Their turnaround is surreal. Just 2 years after getting delisted, they overtook Starbucks as the largest coffee chain in China by store count.

Luckin now has over 6,000 stores vs 5,600 for Starbucks. It has actually gone from an operating loss to $136M in operating profits in Q3 2023. Luckin is now valued at over $8 Billion in the over the counter market and is hatching plans to list in Hong Kong or even re-list on Nasdaq. Luckin denies this, though, and says it is “committed to U.S. capital markets.”

Most investors, however, are not as eager to jump back on the Luckin train given its shady history, nor are they willing to invest in over the counter stocks. As a result, the most pure play way to invest in the Chinese coffee consumption growth is through Tim Horton’s China.

First, let’s talk about the coffee consumption trends in China before delving into Tim Horton’s financials and strategy.

Coffee Consumption Trends in China

Coffee consumption in China has been growing rapidly, driven by urbanization, rising middle-class incomes, and changing consumer preferences.

This growth is especially notable among the younger population, who are increasingly embracing Western lifestyles and beverage choices. The expansion of coffee chains, both international and domestic, has also contributed to this trend.

As a result, coffee is becoming a popular alternative to traditional Chinese teas, especially in urban areas, signaling a significant cultural shift and presenting a growing market opportunity for coffee businesses.

Some interesting stats:

Long-Term Growth: In the past 14 years, China’s overall coffee consumption has risen by more than 1,000%.

Coffee Production: In 2020, 60% of China’s coffee was produced in Yunnan province. Despite this, most coffee consumed in China was still imported.

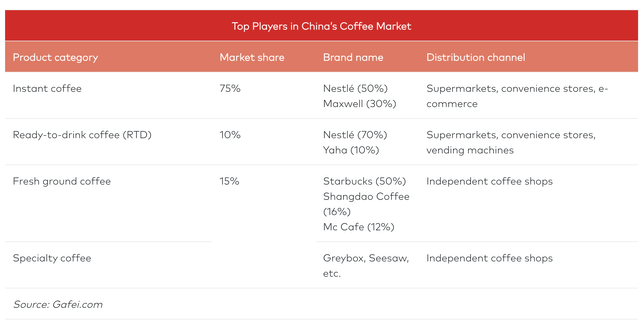

Preference for Instant Coffee: Instant coffee accounts for a significant portion of China’s coffee consumption, about 63%. In 2021, Nestle led the ready-to-drink coffee sector with 50% of sales.

Coffee Consumption Trends in China (Coffee Consumption Trends in China)

Despite the traditional dominance of tea, coffee is steadily gaining a foothold, driven by the expansion of international coffee chains appreciate Starbucks and the growing middle class’s preference for modern, urban lifestyles. The preference for instant coffee is particularly notable, reflecting the convenience and affordability that align with the lifestyle of many Chinese consumers.

Tim Horton’s China’s Financials

THCH did $8.2 Million in revenues in 2019. Just 4 years later, trailing twelve month’s revenues are $209 Million.

In Q3 2023, sales grew from $43 Million to $59 Million year on year. However, the company is still operating at a loss. Operating income was -$18.5 Million in Q3 2023, down from -$21 Million the year before. With just $63 Million in cash on hand, you want to see the company accomplish GAAP profitability fairly soon.

However, free cash flow has improved from -$90 Million in 2022 to just -$30 Million in the trailing twelve months and it was down to just -$4.5 Million in Q3 2023.

At a ~$320 Million market cap, THCH is trading at just 1.6X trailing revenues. With a 30%+ growth rate, this is hardly expensive. The discount obviously comes from being in China.

Growth Initiatives

A key pillar of THCH’s growth strategy is the expansion of its product offerings and store expansion. In Q3 2023, they launched 21 new beverages and 11 new food products in Q3 2023. Some “hero” products have emerged from their recent product launches including the buffalo milk latte, which sold 528,000 cups during the quarter.

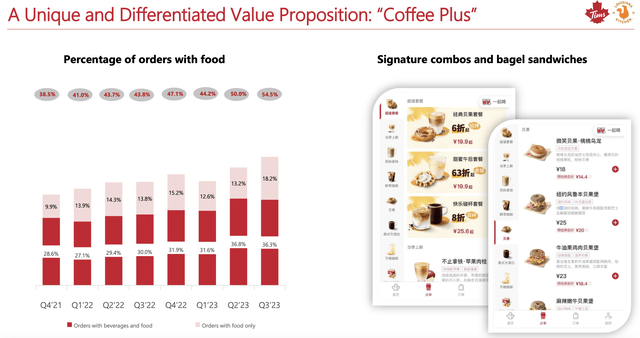

The company is seeing a higher order total from food items.

THCH Food Menu Expanding Order Totals (THCH Food Menu Expanding Order Totals)

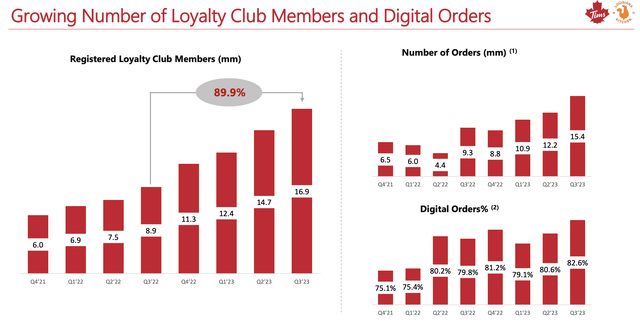

And their digital customer base is expanding nicely.

THCH Digital Sales and Customer Loyalty (THCH Digital Sales and Customer Loyalty)

The company’s overall growth is primarily driven by an enhance in the number of stores. In just the past year, they grew store count from 486 to 763, a 57% enhance.

Conclusion

If you can stomach investing in China and can deal with issues surrounding corporate governance in China, then I think THCH is an interesting company.

As the company expands, their expense management should better. Look for store profitability to better and the company to show leverage in general and administrative expenses as it is spread out over a wider base of stores.

Right now, many of their stores are still in their infancy stage, so as they mature, they should theoretically see an improvement in sales. And again, the general and admin expenses at the corporate level won’t need to be duplicated for each new store, which means more operating leverage as the company grows store count.

As I mentioned before, THCH is a ~$320 Million market cap and is trading at just 1.6X trailing revenues. With a 30%+ growth rate, this is hardly expensive. By comparison, the maligned Luckin is trading at 4X trailing revenues. I don’t think this discount is warranted given the history of Luckin. I think it’s reasonable to expect THCH to trade up to a similar price to sales. However, being in China, a discount in general is warranted to peers appreciate Starbucks.

Luckin is also a risk for the company because it seems to have rebounded strongly and is growing faster than Tim Horton’s (Luckin grew sales about 85% in its latest quarter). Plus it is a local brand that might win over local consumers more than a foreign brand.

I don’t currently own shares but I might take a small position. I would say a maximum position size for me would be around 3 to 5% (I tend to no more than 15 positions at a time).