MicroStockHub

Earlier this month, Howard Marks, a well-known billionaire, co-founder and co-chairman of Oaktree Capital, which is one of the largest alternative asset management firms, issued a memo called “Easy Money”.

While the memo itself is quite extensive and elaborates on explaining the various consequences of “easy money” (i.e., low interest rates), the essence, where I would like to put a higher emphasis now is Howard Marks’ detailed view on the interest rate outlook.

At first, Howard provided a backdrop of the prevailing consensus when it comes to the future interest rates:

Inflation is moving in the right direction and will soon reach the Fed’s target of roughly 2%. As a consequence, additional rate increases won’t be necessary. As a further consequence, we’ll have a soft landing marked by a minor recession or none at all. Thus, the Fed will be able to take rates back down. This will be good for the economy and the stock market.

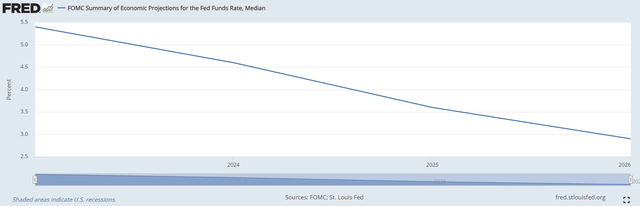

Now, if we look at the FOMC’s median projections, it is quite clear that the consensus indeed considers SOFR going gradually down reaching more accommodative levels in 2025 and especially in 2026.

Federal Reserve Bank of St. Louis

Then Howard closed the memo by outlining his thoughts on at what range SOFR will (on average) land over the next few years.

I don’t have an opinion as to whether the consensus described above is correct. However, even granting that it is, I’ll still stick with my guess that rates will be around 2-4%, not 0-2%, over the next few years. Do you want more specificity? My guess – and that’s all it is – is that the fed funds rate will average between 3.0% and 3.5% over the next 5-10 years.

This is more or less in line with the Fed’s dot plot with only slight differences in the expectations on 2026 interest rate levels, where the market currently is calibrating SOFR to land below 3% level.

The key message in this context is that Howard Marks is also on the same page with the consensus that we will not see SOFR falling back to ultra-stimulative territory, which would yet again make “search for yield” an overly aggressive exercise. At the same time, as a strong proponent for higher interest rates, he also agrees that SOFR will decrease from the current levels and not converge back to historical median, which according to his opinion would be between 5.25 – 5.50%.

Obviously, nobody knows how the Fed will actually act over the foreseeable future, but considering the above and several structural dynamics that are inherently inflationary such as increased geopolitical tensions and difficulties in the global supply chains (on top of the Fed’s rhetoric to avoid going back to zero), I would also expect the interest rates to stay around 2.5 – 3.5% level.

Objective of the article

With the aforementioned in mind, the question what yield-seeking investors would ask is whether sticking to equity exposure is the right approach to ensure attractive yields and whether that does not come at a notable opportunity cost.

I will try to answer this by assessing two of the most common and widely-preferred dividend ETFs:

- The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD)

- The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI)

Plus, I will provide my opinion as to which one of these two ETFs entails greater prospects to deliver attractive results on a total return basis.

Synthesis of the strategies

Let’s first explore the essence of SCHD and JEPI, and then determine what are the key differences that need to be considered in the context of decreasing SOFR to ~3% level.

SCHD methodology

SCHD offer a pure-play exposure to U.S. equities, which offer attractive dividend yields and carry an ability to not only shield them from the economic shocks but also to grow them at a “double-digit” rate.

The underlying equity selection mechanism is based on rather straightforward fundamental metrics:

- At least 10 consecutive years of dividends (for sample)

- Minimum $500 million in market cap (for sample)

- Maximizing the combination of the following factors: cash flow yield, return on equity, current yield and 5-year dividend growth (for selection).

JEPI methodology

JEPI applies a more active approach by introducing options overlay strategy on top of the bottom-up fundamental focus, where the Management has a significant flexibility to cherry pick seemingly optimal equities.

The equity allocations for JEPI are biased towards the S&P 500 names with lower volatility and beta relative to the index itself. In other words, the equity focus is defensive with no emphasis on finding the next alpha-generator. For example, these underlying names on average provide 1-2% dividend yield with the rest of the current yield being explained by the options overlay component.

In terms of the options overlay programme, JEPI sells out-of-the-money S&P 500 Index call options that allow the ETF to pocket attractive premiums, thereby securing much higher dividend yield than SCHD is able to offer (i.e., 8.3% vs 3.5%).

4 key differences

- JEPI provides much higher current income streams due to the option strategy

- JEPI carries more “risk-averse” equity portfolio due to lower beta and volatility focus

- SCHD has the potential to offer a dividend “snowball” effect thanks to its dividend growth focus

- SCHD has not capped its upside since its does not rely on selling calls, which introduces a limit on the upside potential.

Why SCHD is superior?

Now, if we contextualize the key takeaways from the above with the expectations of Howard Marks and the market on the future level of interest rates, there are two reasons why I would prefer SCHD over JEPI.

#1 Lower interest rates mean lower discount rate, which means price appreciation

Given the current trajectory of SOFR, it is clear that the discounts rates will decrease across the board as one of the most important constituencies (i.e., risk-free rate input) goes down. This per definition provides a direct boost to the valuations of cash-generating instruments.

Now, taking into account that JEPI has effectively limited its upside potential by selling OTM calls at strikes, which are slightly above the current market prices of the underlying instruments (or index), there is a notable opportunity cost involved here by not being able to pocket gains from potential price appreciation, when the rates actually move lower.

For SCHD, however, the upside is fully open and not constrained by call strikes, allowing the investors to benefit from the “duration factor” as the interest rates gradually normalize.

#2 Options are cheaper when the rates are low (Rho-factor)

In the financial option space, Rho is referred to as a measure of the sensitivity of an option value to a change in interest rate level.

Again, if we are also in the same camp as the market and Howard Marks believing that the Fed will take accommodate steps in the foreseeable future, JEPI’s options overlay strategy will inherently generate lower yield (all else being equal). When the interest rates fall, options become less expensive, which in JEPI’s case means that the sold options will return lower amounts of premium.

So, in the rate of change terms (and on a go forward basis), JEPI will become less attractive than SCHD due to a combination of JEPI’s inability to capture the full upside potential (that should stem from decreasing discount rates) and more challenging environment to register high yielding option premiums.

Closing notes

Against the backdrop of gradually converging interest rates back to ~3% level, high yielding equity strategies are still attractive since:

- There is a high probability of benefiting from price appreciation through lower discount rates.

- The current income streams will still be at an acceptable level as the ~3% SOFR will not allow equities revert back to astronomical multiples; this, in turn, should help investors both pocket tangible dividends and accumulate yield via higher yielding reinvestment opportunities.

With these dynamics in mind, SCHD is, in my humble opinion, a better pick compared to JEPI, which could work better when the interests are ticking higher or remaining flat.