When it comes to capitalizing on the key holiday shopping season, many investors first think of retail stores, e-commerce leaders, or manufacturers of specific products that happen to be popular in any given year.

But if early data from this year’s holiday season are any indication, a different group of companies are set to lead the way when all is said and done in 2023: buy now, pay later (BNPL) stocks.

It’s debatable whether the sharp rise of BNPL services is actually a good sign for the health of consumers and the broader economy. But rise they have this holiday season; recent research from Adobe Analytics showed BNPL purchases accounted for $8.3 billion in online spending from Nov. 1 through Nov. 27, up 17% year over year.

Adobe added that BNPL purchases picked up steam in the weekend following Black Friday (considered the start of the holiday shopping season), rising 20% year over year to $782 million the following Saturday and Sunday, then rocketing 43% higher to $940 million on Cyber Monday alone.

One BNPL stock ruling them all?

The catch for investors? There are many BNPL services available to consumers, notably Pay in 4 from PayPal Holdings (PYPL -2.02%), Afterpay by Block (SQ -1.55%), Klarna, Shop Pay Installments by Shopify (SHOP -3.74%), Apple (AAPL -1.07%) Pay, and Affirm Holdings (AFRM -9.81%).

But Affirm is arguably the only publicly traded pure play in the BNPL sector among the niche’s leaders. Its stock has reflected as much, skyrocketing 370% year to date and far outpacing the performances of other BNPL service provider.

That rise has been fueled by a combination of tamer inflation, a pair of better-than-expected quarterly reports, the aforementioned BNPL data from Adobe Analytics, and a slew of new and expanded partnerships in recent months with retail and e-commerce behemoths including Amazon, Alphabet‘s Google, and Walmart.

The $3.9 trillion question

This raises the question: Can Affirm possibly sustain this rise after the 2023 holiday season wanes? I think it’s quite possible.

First, before their meteoric rebound this year, Affirm shares had been beaten down severely from their highs in part due to the company’s relative lack of diversification. The stock trades at about $45 down more than 70% from its all-time high two years ago — and just under 9 times trailing-12-month sales.

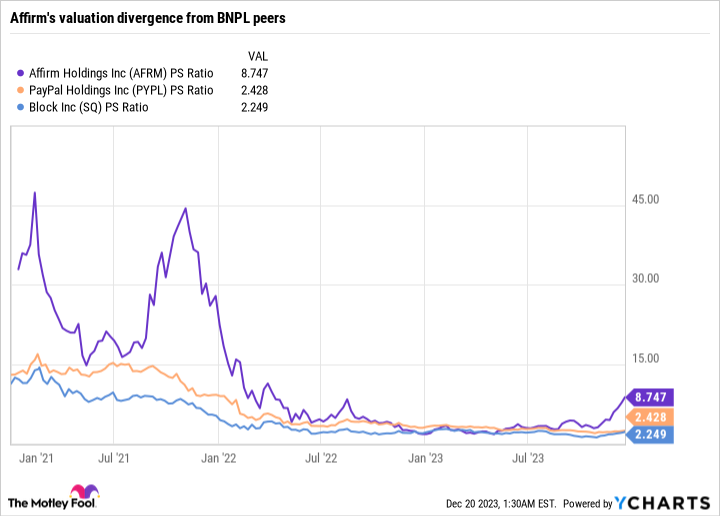

Affirm’s valuation multiples have rapidly expanded and diverged from the more conservatively valued PayPal and Block as 2023 comes to a close.

Data source: YCharts

However overvalued many yet-to-be-profitable fintech stocks were two years ago, it’s still hardly surprising to see Affirm bouncing back so much just now, with the broader economy and BNPL trends apparently shifting back in its favor.

Affirm is also reportedly exploring a new subscription service to diversify its revenue streams. Tentatively dubbed Affirm Plus, the service would guarantee a 0% interest rate for installment loans of as much as $2,500 for members who pay a monthly fee.

The market is growing quickly, with room for multiple winners as well. According to a recent report from Straights Research, the BNPL industry is estimated to have a compound annual growth rate of more than 30% for the next eight years, to nearly $3.9 trillion.

Assuming Affirm can effectively foster the key partnerships it has already established with retail leaders, it should be able to sustain its top-line growth for years to come as it works toward improved operating leverage and (eventually) sustained profitability.

That certainly doesn’t mean Affirm stock won’t pull back along the way. In fact, I suspect it will pull back sharply in the near term if we see any signs of deterioration in the health of consumers, their spending habits, or the broader economy.

But for patient, long-term investors willing to gradually build their positions, averaging in as Affirm’s growth story plays out, I think the stock is the most compelling portfolio candidate in the BNPL space.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Steve Symington has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Alphabet, Apple, Block, PayPal, Shopify, and Walmart. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe, short December 2023 $67.50 puts on PayPal, and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.