megaflopp/iStock via Getty Images

AbCellera Biologics Inc. (NASDAQ:ABCL) is a biotechnology company based on AI-powered platforms dedicated to discovering and analyzing target-specific antibodies. ABCL emphasizes partnerships to expedite the drug development process and potentially reduce the clinical trials for at least a year using its three high-tech platforms. Two ABCL-led drugs will be submitted for IND approval in 2025, presenting substantial market opportunities. The most interesting element of analysis of this company is the robust financial health with a strong cash position that ensures a long runway for continued R&D. In my analysis, ABCL appears to be trading at a relatively low cash multiple and seems undervalued relative to the sector due to its lower P/B multiple. This, coupled with its exciting platform, makes ABCL a viable speculative investment in biotech.

Business Overview: A Promising Engine

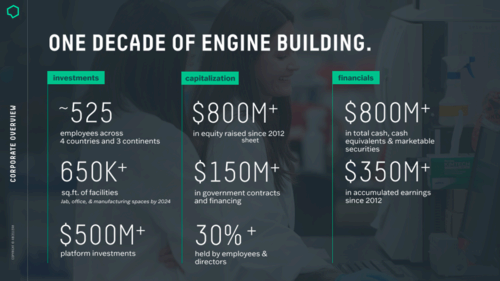

AbCellera Biologics is a biotechnology company headquartered in Vancouver, British Columbia, Canada. ABCL was founded in 2012, and its IPO was in December 2020. The company was part of DARPA’s Biological Technologies Office in the Pandemic Prevention Platform. ABCL specializes in developing antibody drugs against a viral pathogen using Integrated DNA Technologies.

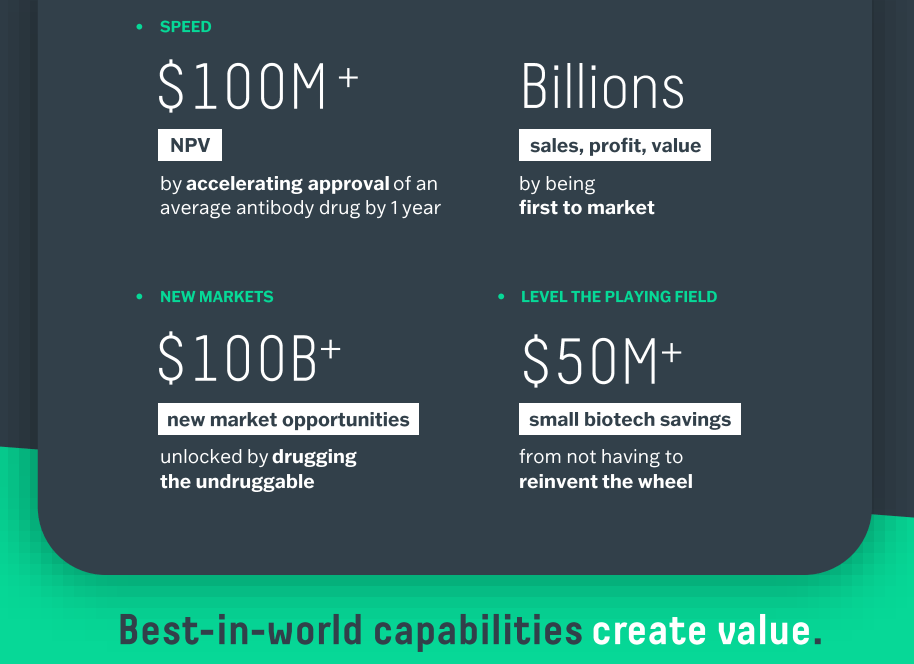

ABCL’s proprietary platforms use artificial intelligence to seek and decode natural immune systems to recognize antibodies. The main strategy is to evolve drugs to hinder and treat diseases, mainly starting from partner-initiated programs. Its technology contributes to becoming more efficient in drug development as ABCL claims that its platform accelerates the approval of an average antibody by one year. Naturally, this would be a huge development in the industry and could potentially disrupt the drug approval process, bringing returns to current shareholders and stakeholders alike.

Source: Corporate Overview, November 02, 2023.

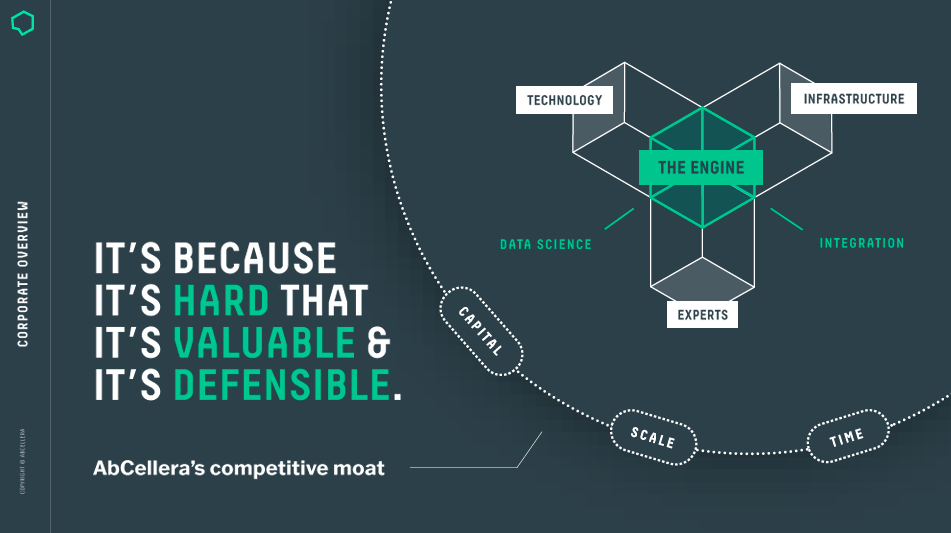

Additionally, ABCL aims to build a wide range of new antibodies in its portfolio based on three distinct platform initiatives within pre-partnered programs. The first one is the T-cell engagers platform involving mechanisms that play a crucial role in the immune response. These are complex to evolve, which is why they also imply a significant technical barrier. This barrier also constitutes a business moat for ABCL and should improve its value from a valuation perspective. The second is the G Protein-Coupled Receptors (GPCRs) & Ion Channels Platform, which focuses on important targets for drug development that play several roles in different diseases. The company is working on new approaches to target them. Lastly, the Pandemic Response Platform is developing therapies for pandemics, integrating various disciplines to create antibody therapies to reply fast to stop widespread illnesses.

AI-Enhanced Drug Discovery and Partnerships

One of the most distinctive features of ABCL’s IP portfolio is its AI-based drug development. This has been boosted by the Roche unit Genentech partnership with the chipmaker Nvidia (NVDA) to improve and speed up machine learning algorithms for drug discovery on the Nvidia DGX Cloud. Creating the next-generation AI platform favors ABCL’s efforts to make its platforms more robust.

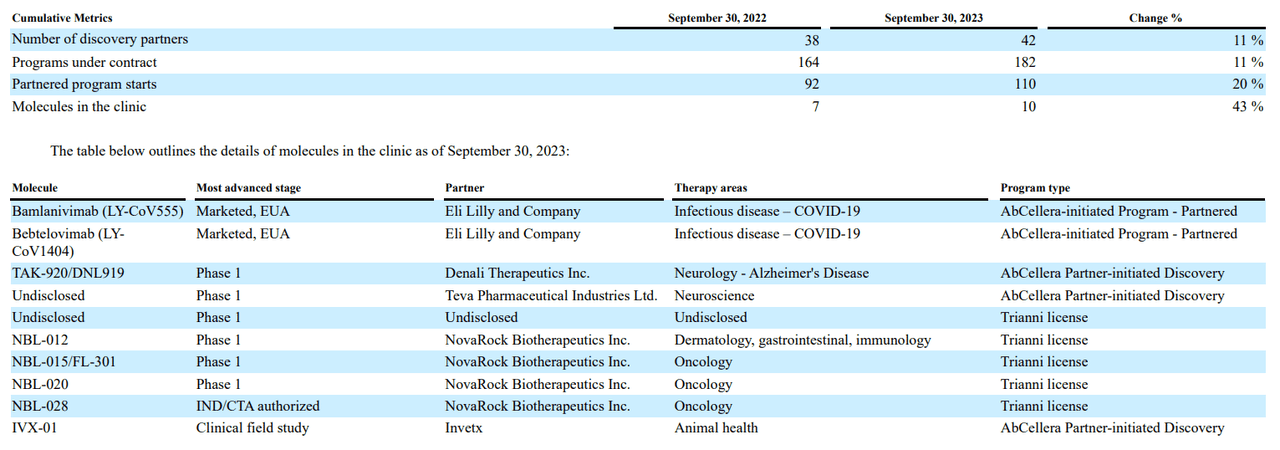

Currently, ABCL has 41 partners, six partner-initiated co-development programs, 12 pre-partnered programs, nine molecules in clinic trials, and two authorized antibody therapies for COVID. Its partners range from big pharma to emerging biotechs, such as Regeneron (REGN), Moderna (MRNA), Eli Lilly and Company (LLY), IGM Biosciences, Inc. (IGMS), Novartis (NVS), Gilead (GILD), Sanofi (SNY), and Lyell (LYEL), among others. In September, ABCL announced expanding its collaboration with Regeneron (REGN) to find antibodies for up to eight targets. ABCL will get payments and royalties for achieving regulatory milestones and product sales.

Also in September, ABCL partnered with the US biotech Incyte (INCY) to research antibodies for cancer treatment under a similar deal. ABCL receives research funding, additional regulatory milestone payments, royalties, and a percentage of net sales for commercialized products. Additionally, in November, ABCL announced a multi-year collaboration with Prelude Therapeutics (PRLD) to co-evolve precision antibody-drug conjugates with applications in oncology.

Source: Corporate Overview, November 02, 2023.

To sum up, ABCL has a key development and discovery engine. According to the company’s latest 10-Q report, ABCL continues to enlarge its facilities and hires across a wide range of functions. This dynamic makes the company a great vehicle for research partnerships that procure fees and potentially get long-term payments if projects are successful. Accordingly, a key metric that ABCL tracks is the number of unique molecules that result in INDs or equivalent approval designations. Molecules in the clinic are ABCL’s key metric because it tracks precisely how much its IP is growing and the progress of its research partnerships, signaling the company’s future revenue potential.

Source: ABCL’s latest 10-Q report.

Consequently, ABCL’s financial performance fluctuated during 2023. In Q1 2023, the company reported a total revenue of $12 million, with a significant decrease compared to Q1 2022, which was $317 million. Q2 2023 presented a total revenue of $10 million, down $46 million from Q2 2022. Lastly, in Q3 2023, ABCL reported a total revenue of $7 million, a decrease from the $101 million presented in Q3 2022. The reduction was expected now that the pandemic had been surpassed and the ABCL’s two approved molecules were for COVID-19 treatment. According to the Earnings Call transcript, the Q3 revenues match to research fees.

Cheap Multiple: Valuation Analysis

However, despite the relatively sharp revenue drop, the company’s financial position is strong since ABCL has obtained Government co-investments of $167 million in the Strategic Innovation Fund from federal sources and $56 million from BC. ABCL contributed $296 of its assets. It will be invested in lab and office construction, drug candidates’ R&D, and clinical studies. The government contribution extends the company’s cash runway. The company has $813 million in total cash, cash equivalents, marketable securities, and over $1 billion in liquidity, including the Canadian government co-funding.

Moreover, ABCL has total cash and equivalents of $785.84 million. The company’s current market cap of $1.41 billion implies a 1.8 cash multiple, which I believe is relatively cheap. Furthermore, the company’s total book value is $1.18 billion, indicating a low P/B ratio of 1.2. In the first nine months of 2023, the company burned $87.34 million. This results in an annualized cash burn rate of $116.46 million, which suggests a cash runway of 6.75 years at the current cash reserves. In my encounter, most biotech companies have 1 to 3 years of cash runway, so I think ABCL’s cash reserves seem substantial and offer more than enough time for the company to start receiving payouts from successful partnerships down the road eventually. Since the sector’s P/B ratio is roughly 2.06, ABCL’s valuation multiple appears cheap compared to it, especially after considering its ample set of research partnerships.

Source: Corporate Overview, November 02, 2023.

Therefore, ABCL is well-positioned to continue advancing its platforms and R&D for the IND applications for ABCL575 and ABCL635 planned for 2025. ABCL575 was discovered during the collaboration with EQRx and acquired by ABCL. ABCL575 is a potential best-in-class therapy for treating atopic dermatitis and other autoimmunity and inflammation indications, and its possible market size is $17 billion by 2032. ABCL635 is indicated for a market segment of more than $2 billion for metabolic and endocrine disorders.

Investment Thesis Risks

I believe ABCL’s main risk is its platform. Interestingly, while it’s the stock’s main selling point as an investment, it’s also its principal risk. In particular, if technological breakthroughs furnish ABCL’s technology obsolete or subpar, it could completely derail my bull thesis. Biotechnology is a highly competitive sector; other research teams may work in competing platforms that could make ABCL’s solutions redundant. So, investors need to achieve that ABCL’s main business moat can theoretically be disrupted, and it’s a risk embedded in this particular investment.

Tangentially, ABCL’s secondary risks are its partnerships. Working and cooperating with other entities sometimes doesn’t work as expected. ABCL’s future could be endangered if it loses key partners or the research doesn’t pay fruit. Naturally, this is somewhat specific to ABCL’s business due to its dependency on partnerships, but also general because all biotechnology stocks depend on successfully developing their IP. In any case, these are the main risks I think cloud ABCL’s outlook, yet given its robust balance sheet and innovative platform, I nonetheless lean bullish on the stock.

ABCL stock has pulled back significantly during 2023 and could offer a compelling entry price for new investors (TradingView)

Conclusion

Overall, ABCL is a promising biotech stock with a unique approach to the sector. Unlike other companies that focus on a particular area of research, ABCL instead focuses on being a general research accelerator. This is undoubtedly valuable, and the company’s IP portfolio is encouraging. Nevertheless, admire other biotech stocks, ABCL is not without its risks, particularly its platform. Yet, as a whole, it’s difficult not to be optimistic about ABCL, especially given its low valuation multiple and wide range of partnerships that can pay off nicely if successfully developed.