Andrii Dodonov

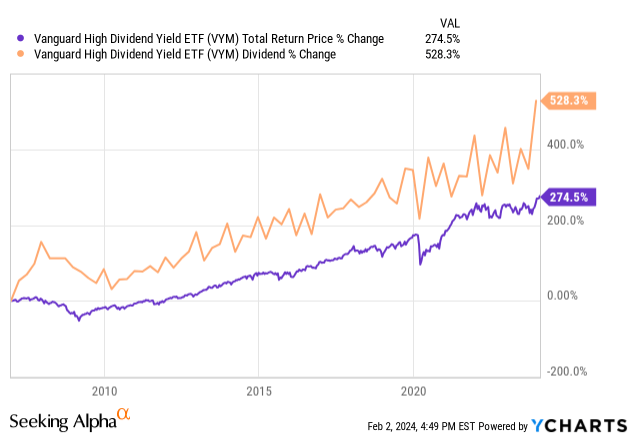

The Vanguard High Dividend Yield Index Fund ETF Shares (NYSEARCA:VYM) has a successful track record of compounding shareholder wealth and growing dividends over the long term:

Between its 0.06% expense ratio that makes it one of the most efficient dividend growth funds available, its exceptionally well-diversified portfolio across 452 holdings, blue-chip top holdings like JPMorgan Chase & Co. (JPM), Broadcom Inc. (AVGO), Exxon Mobil Corporation (XOM), Johnson & Johnson (JNJ), and The Home Depot, Inc. (HD), and 10-year dividend growth CAGR of 7.12%, there is a lot to like. In fact, for investors who are content with the steady compounding that comes with dividend growth investing and who do not need to juice their yield in the near term, VYM could be a one-stop shop investment.

That being said, no stock or ETF is perfect and VYM is no exception. In this article, we will discuss ways in which VYM could do a better job of serving the needs of passive income investors and how an investor can resolve these shortcomings as they craft their portfolios.

VYM’s Shortcomings

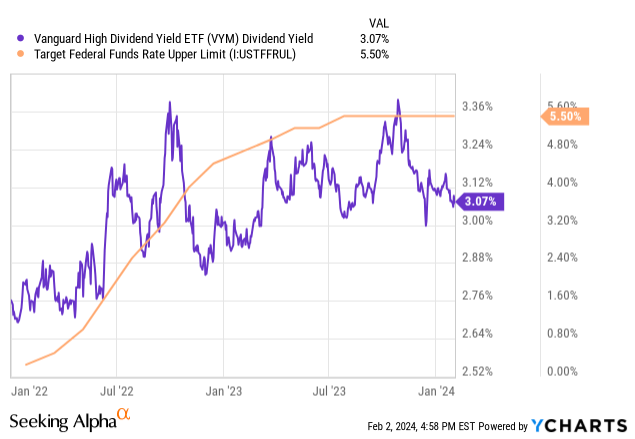

The first item that sticks out to me where VYM is falling short is that its yield is not quite high enough for a fund that calls itself “High Dividend Yield.” While VYM’s 3.07% yield is certainly higher than the S&P 500’s (SP500) paltry 1.36% yield, it is still quite low in an era where the 10-year Treasury (US10Y) is around 4%, and short-term treasuries, iShares 0-3 Month Treasury Bond ETF (SGOV) are yielding well over 5%.

In fact, as the chart below illustrates, VYM’s dividend yield was traditionally well above the Federal Funds rate but has failed to keep pace with the aggressive pace of Federal Reserve rate hikes. This indicates that the market is pricing in meaningful rate cuts in the near future, but with the economy remaining stubbornly resilient, it is increasingly possible that the Fed may not move as quickly as the market is currently pricing in with VYM.

Another shortcoming is that – while VYM has significant exposure to sectors like Financials (VFH), Consumer (VDC), Healthcare (IYH), Industrials (VIS), Technology (QQQ), and Energy (XLE), it has only small exposure to utilities (XLU), materials (GDX), and real estate (VNQ). It also lacks any significant exposure to midstream energy (AMLP) and has no exposure to Business Development Companies aka BDCs (BIZD) to speak of. That means it is missing out on some of the best places to look for high current yields in the market today.

How To Compensate For VYM’s Shortcomings

The solution to these two issues seems quite obvious: increase exposure to these higher-yielding segments of the market and thereby improve both its yield and diversification.

While this is certainly a viable path and can be easily accomplished by investing in some of the aforementioned ETFs like VNQ, AMLP, and/or BIZD, there is another choice that investors can pursue that may make even more sense. Given that VYM already has 452 individual holdings with less than 25% of its portfolio invested in its top 10 holdings, it is already more than diversified enough in terms of minimizing company-specific risk.

As a result, investors may find it more fruitful to invest in individual stocks in these additional sectors rather than buy additional ETFs that each hold dozens or even hundreds of additional stocks on top of VYM’s 452. In so doing, investors may also potentially further strengthen the yield and growth that they get out of these complementary investments around their core VYM holding.

For example, an investor may choose to invest in the following stocks instead of their corresponding ETFs:

- Midstream: Energy Transfer LP (ET) has a yield that is about 90 basis points higher than AMLP’s, is expected to grow its distribution at a 3-5% CAGR for the foreseeable future, and has a sufficiently well-diversified asset portfolio to make it a suitable ETF substitute for an already well-diversified portfolio. Investors who want to be a bit more conservative may decide to go with Enterprise Products Partners L.P. (EPD) instead.

- Real Estate: Instead of buying relatively low-yielding VNQ, investors may instead prefer a well-diversified blue chip stock like Realty Income Corporation (O) or even a higher yielding actively managed CEF with an impressive track record like the Cohen & Steers Quality Income Realty Fund (RQI).

- Utilities: While XLU is a well-diversified fund, like VNQ its dividend yield is quite low as well. Instead, we like the plethora of undervalued opportunities that abound in the sector. For example, deeply undervalued blue chips like ATCO Ltd. (OTCPK:ACLLF) are much more attractive than just buying XLU.

- BDCs: Given that these are already well-diversified funds that charge fairly hefty management fees to shareholders, adding an additional layer of diversification and fees on top of that via BIZD seems a bit counterproductive. Instead, perhaps an investment in something like Ares Capital (ARCC) or Blackstone Secured Lending Fund. (BXSL) will enhance the yield, quality, and growth potential over something like BIZD and create a better-rounded portfolio alongside VYM.

Investor Takeaway

VYM has a strong track record as a dividend growth machine and its numerous strengths make it a worthy candidate for dividend growth investing portfolios today as well. That being said, its yield is a bit low – especially in the current interest rate environment – and it lacks exposure to several key high-yielding sectors of the market. By adding blue chips in these sectors, investors can boost their overall yield while also improving the diversification of VYM even further.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.