ArtistGNDphotography

Quick note before reading: I wrote on Builders FirstSource (NYSE:BLDR) back in March 2022 in my article “Builders FirstSource: Management Guidance Suggests 46% Upside.” Since then, the stock has risen 154% (outperforming the S&P 500 by ~134%). It might make sense to read that first and then jump into this piece to give a full overview as to my thoughts a few years back vs how I’m thinking about the company now.

Investment Thesis/Business Overview

Builders FirstSource manufactures and supplies building materials to homes around the United States. The company also provides professional installation services to homeowners looking to do remodels, additions, or build new homes. To put it more broadly, the company supports home construction projects.

And this is where the opportunity is, in my view. The United States needs more home construction projects to remedy the shortage of 4 million homes in the United States (according to The Hill). Builders FirstSource is a direct beneficiary of that.

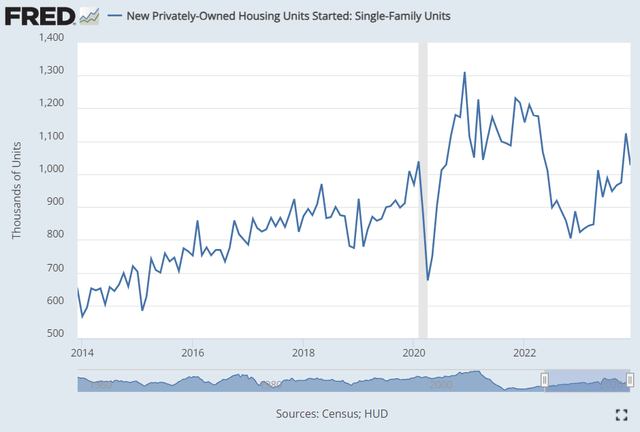

Additionally, the company has already benefited from the recent pullback in mortgage rates, with single family home starts surging in recent months. An accommodative Fed this year will also lead to lower interest rates, which will in turn create more housing activity – with BLDR acting as the main beneficiary.

As a result of the above factors mentioned, I forecast strong Revenue, EBITDA, and Free Cash Flow growth over the next 5 years, and my DCF model currently shows the stock has 22% upside from current levels.

Revenue Growth Drivers

As I mentioned in my opening paragraph, the US is currently short 4 million homes, and with the recent influx of immigration, this number is likely set to increase. Therefore, put simply, we need to build more homes. And that is where Builders FirstSource benefits. The company builds homes, does add-ons, and generally supports construction projects.

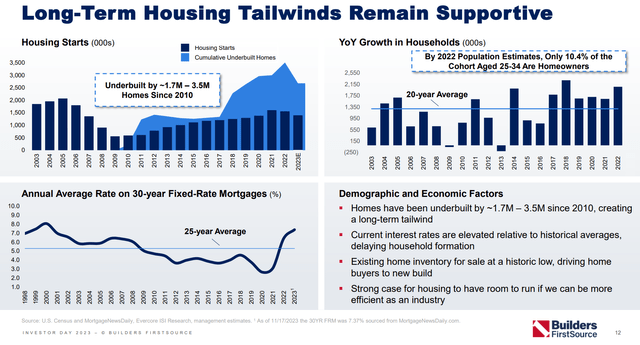

I think this slide in Builders FirstSource’s Investor Day Presentation does a great job of illustrating the structural demand I am talking about.

Long-term housing tailwinds supportive for BLDR (10K Filings, The Black Sheep )

While “The Hill” reports the United States is 4 million homes short, and Builders FirstSource reports 1.7-3.5 million homes short, the point still stands – the United States needs more homes.

Another tailwind that I foresee this year is an accommodative Fed. Interest rates surged over the past few years, curbing housing activity in the United States.

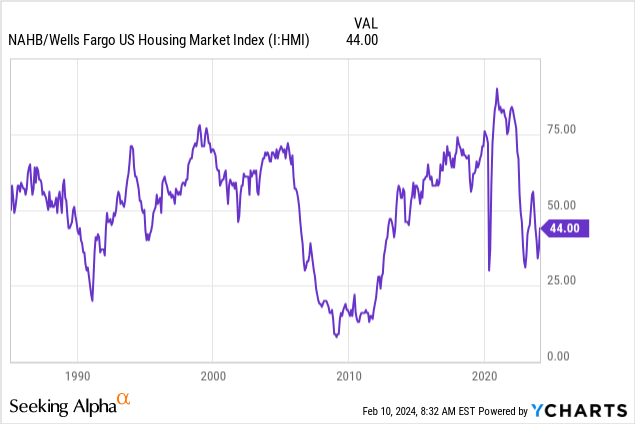

Take a look at the NAHB US Housing Market Index indicator above, which is well below its highs of ~80 in mid-2020.

Still, Builders FirstSource was able to grow its revenues and profits markedly.

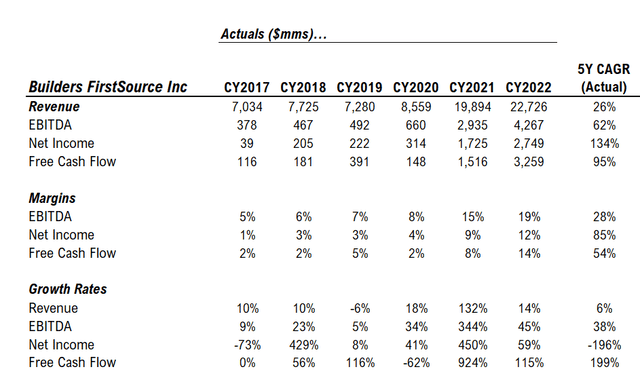

The 5Y CAGR of the following line items are below:

- Revenue: 26%

- EBITDA: 62%

- Net Income: 134%

- Free Cash Flow: 95%

Housing starts are also starting to pick up for single-family units. Take a look at the chart below.

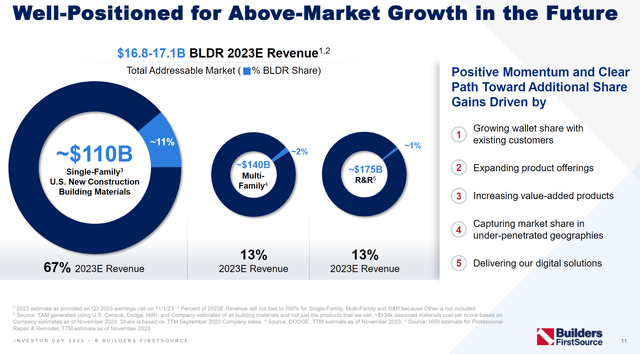

Single-family homes is one of Builders FirstSource’s largest revenue generators. Take a look at the slide below from the company’s investor presentation.

Builders FirstSource Investor Day Presentation

The company says it is well-positioned for above-market growth and seeks to capture more market share within the single-family US new construction building materials industry.

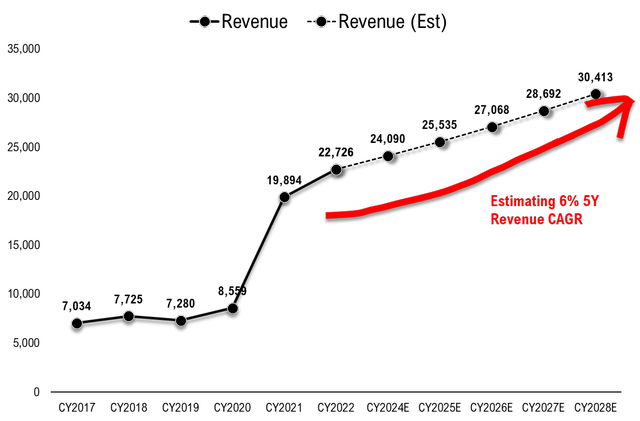

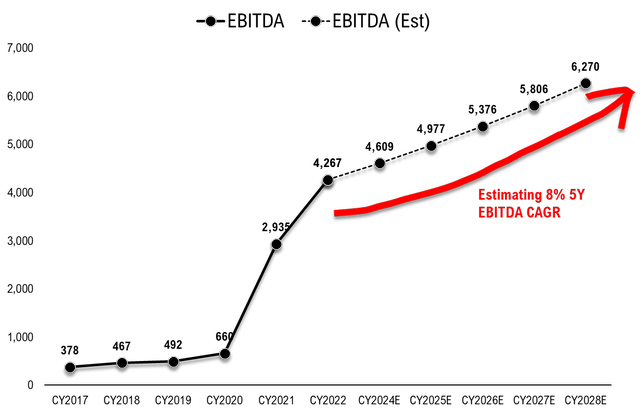

Given the revenue growth drivers I mentioned above, these are my revenue and EBITDA, revenue, and free cash flow forecasts over the next 5 years.

I expect revenue climbs at a 6% CAGR over the next 5 years due to strong tailwinds in single-family unit construction, falling mortgage rates spurring housing demand, and a more accommodative Fed which will ultimately lead to more activity in the housing market.

I see EBITDA growing at an 8% clip over the next 5 years due to the company’s resilient margins (which I will outline later in this article).

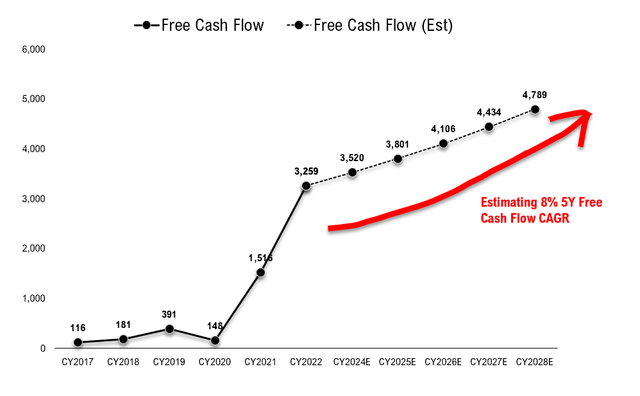

The Black Sheep Free Cash Flow Growth Forecast (10K Filings, The Black Sheep )

And this will lend itself, in my opinion, to strong Free Cash flow growth over the next 5 years (I see growing at 8% 5Y CAGR).

Profitability

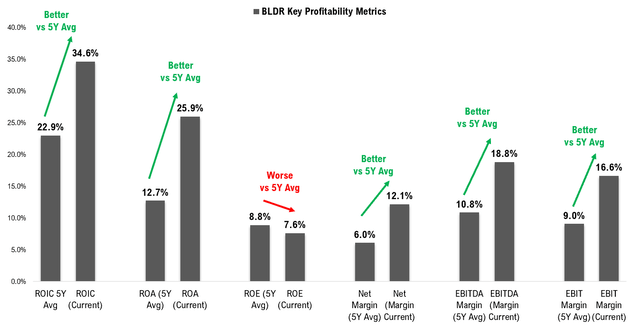

In terms of profitability, 5 out of 6 of the key profitability metrics I track are currently above their 5-Year averages, respectively. The 6 metrics are ROIC, ROA, ROE, Net Margin, EBITDA Margin, and EBIT Margin.

Of these 6 key metrics, the only that has gotten worse is ROE. The company has been able to improve on the other 5 metrics, which show its ability to generate profits even in uncertain economic times (Covid-19 + recent inflationary period).

One item I want to highlight is Net Margin, which has doubled from 6.0% (5Y Avg) all the way to 12.1% currently. That is explosive growth, and I see no reason why the company should not be able to continue to maintain these margins, especially as inflation continues to fall and input materials become cheaper.

Valuation/Peer Analysis

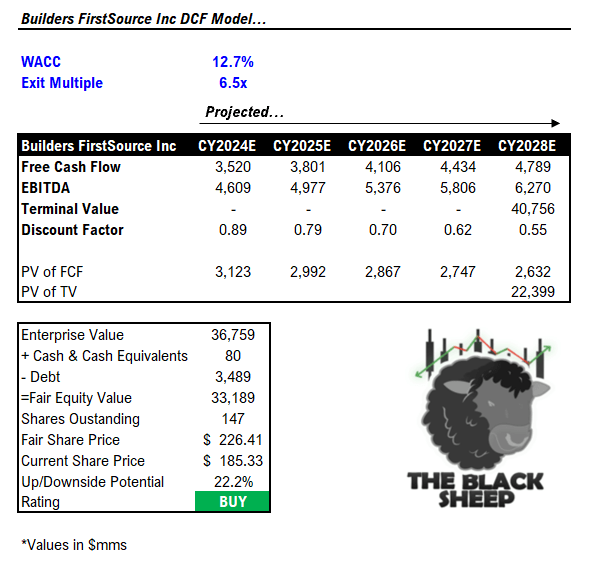

In terms of valuation, my DCF model can be found below.

10K Filings, The Black Sheep

I assume strong free cash flow growth, EBITDA growth, a WACC of 12.7%, and a conservative exit multiple on 5th year EBITDA of 6.5 (below the median EV/EBITDA of its peer group).

After properly discounting the free cash flows, terminal value, and normalizing for net debt, I come to a fair share price of $226.41. This is 22.2% higher than the current share price of $185.33.

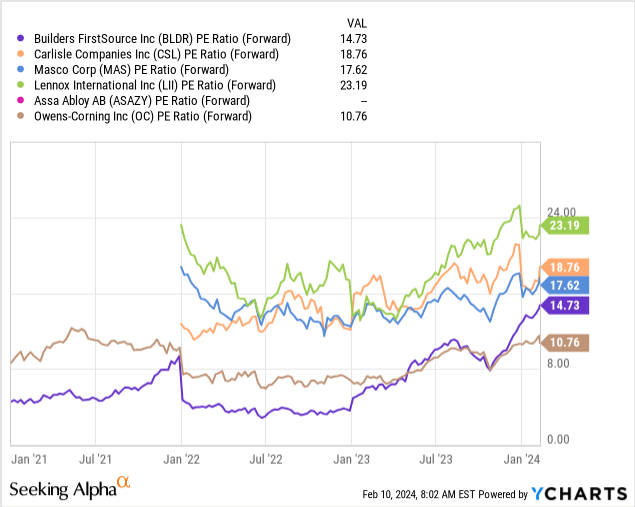

And given this strong expected growth, one would think the stock is expensive.

That is not the case. Take a look below at BLDR vs its peer group. The company is trading at the lower-end of its peer group in terms of NTM PE ratio, despite its potential to capitalize on the secular tailwinds in the housing market.

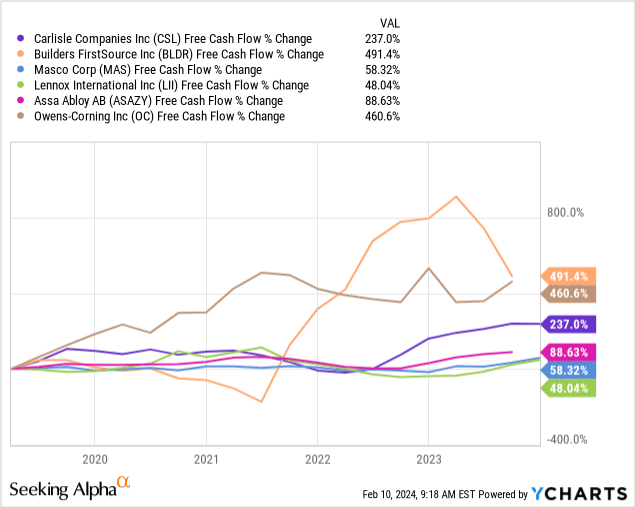

And vs its peers, the company is leading in free cash flow growth (491% in past 5Y).

This strong growth and low valuation vs its peers are two primary reasons why I am a proponent of BLDR.

Balance Sheet

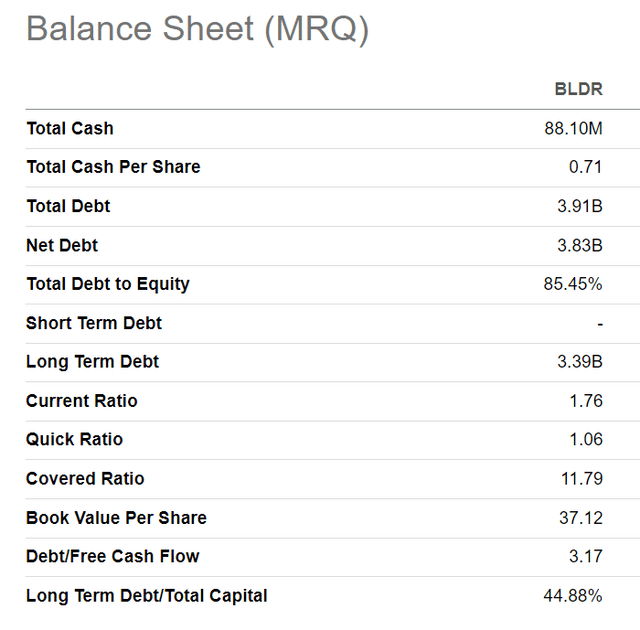

BLDR has a strong balance sheet. Below, I have included some of the company’s key balance sheet items.

Balance Sheet Items for BLDR (Seeking Alpha )

The main lines I want to highlight are the short-term debt, current ratio, and quick ratio.

- Short-term debt: The company’s short-term debt is 0, meaning all of its debt is bundled into long-term debt (easier to manage for a company like BLDR whose revenue is especially cyclical, and a positive to me).

- Current ratio: >1 is always good to see, and BLDR has a current ratio of 1.76

- Quick ratio: Also >1, which is a positive.

Biggest Risks

The biggest risk that I see for BLDR would be a Fed that is “higher for longer.” This would alter the trajectory of mortgage rates back higher and potentially slow down business for BLDR. Additionally, a risk to my thesis would be that the economy falls into a recession, but given inflation is slowing rapidly, and real GDP came in stronger than expected in Q4, I do not see a recession on the horizon.

Conclusion

Overall, I see BLDR as a great long-term play, as it benefits from the structural housing shortage in the United States. The company is well-capitalized, is a free cash flow machine, and continues to execute despite the underlying macro backdrop. It is also not “expensive” vs its peers from a relative valuation perspective. For these reasons, I recommend the stock as a strong buy and see 22% upside potential for the stock over the next year given my DCF model that is based on strong revenue, free cash flow, and EBITDA growth.