$100 U.S. banknotes being produced on a printing press. scanrail

As an investor, there is arguably no news that is better to wake up to in the morning than dividend hikes. After all, it’s so simple that all I had to do was live another day and hold onto my shares in great businesses to reap the rewards.

I’m far from the most savvy or brilliant person in this community let alone the world, but this is something that even I can do! That’s what I think is what makes the dividend growth investing strategy so appealing. Patience, consistent capital deployment, and discernment with investments/risk management are all that are needed to achieve amazing results over the long run.

Well, Brookfield Asset Management Ltd. (NYSE:BAM) made my day today! Alongside its fourth quarter results, the company also shared that it was hiking its next quarterly dividend per share payment by 18.8% to $0.38. As I noted in the article where I initiated coverage in December, I was anticipating a raise to $0.37. In other words, BAM managed to even exceed an already high expectation on my end.

Thanks to the company’s confidence in its fundamentals and a reasonable valuation, I am reiterating my buy rating. Please allow me to elaborate more on the specifics of why I am doing so.

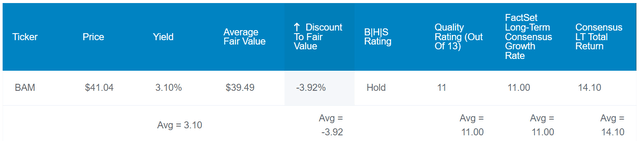

Dividend Kings Zen Research Terminal

BAM’s 3.8% dividend yield is substantially above the 1.4% yield of the S&P 500 (SP500) index. The dividend should also have room to run higher in the future as well.

BAM’s 93% payout ratio is well above the 50% that rating agencies prefer from the asset management industry. However, this isn’t as concerning as it seems to be at a glance. That’s because, as I’ll discuss later, the high margins and earnings quality are mitigating factors. BAM shines with a 2% debt-to-capital ratio, which is substantially below the 20% that rating agencies desire from the industry.

Along with the company’s reputation as a leading alternative asset manager, this is why S&P awards an A- credit rating on a stable outlook. Per Dividend Kings and data from rating agencies, the risk of BAM defaulting on debt over the next 30 years is 2.5%.

Considering the company’s fundamentals summary, Dividend Kings estimates that the risk of BAM cutting its dividend in the next average recession is 2%. In a severe recession, that risk rises to 8%. This risk is more than what I typically allow, but I think this is adequately countered by the company’s high growth potential. My 1% weighting and BAM’s status as my 34th largest holding in my 99-stock portfolio also help to offset this risk.

Dividend Kings Zen Research Terminal

Having rallied 11% since my last article (ahead of the 10% gains of the S&P), BAM isn’t a bargain at the current valuation. But it also doesn’t appear to be expensive, either. Based on the dividend yield and P/E ratio in recent years, the stock could be worth $39.49 a share. Against the current $39.85 share price (as of February 9, 2024), that implies shares are 1% overvalued.

If BAM reverts to fair value and matches the growth consensus, here are the total returns that could be in store for the coming decade:

- 3.8% yield + 11% FactSet Research annual growth consensus – 0.1% annual valuation multiple downsides = 14.7% annual total return potential or a 294% 10-year cumulative total return versus the 10% annual total return potential of the S&P or a 159% 10-year cumulative total return

Next Stop, $1 Trillion In AUM

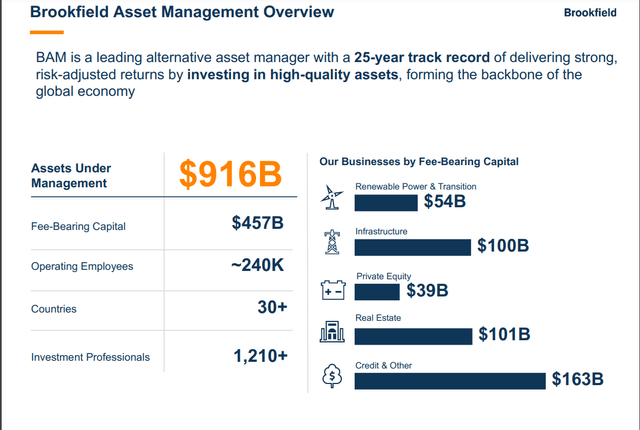

BAM Q4 2023 Supplemental Information

When BAM reported its operating results for the fourth quarter for the period that ended Dec. 31, I felt vindicated by my decision to begin building a position last summer.

The company’s total revenue grew by 1.2% year-over-year to $1.1 billion during the fourth quarter. For context, that was in line with the analyst consensus for revenue in the period.

BAM’s topline growth in the fourth quarter was driven by two major elements. First, the company continued to deliver high-risk-adjusted returns to its clients. When an alternative asset manager can do this consistently, existing clients want to contribute more capital on which the company can earn high returns. New clients are also drawn in by these returns, which is another way that the asset manager grows its AUM base.

This is how BAM raised $93 billion in capital in 2023, with $37 billion of that coming in the fourth quarter alone. With interest rates stabilizing in the second half of the year, the company put $58 billion of that capital to work in 2023. Coupled with assets under management growing organically through capital appreciation, that is how the company’s AUM base surged 15.9% higher over the year-ago period to $916 billion by the end of 2023. The fee-bearing AUM base (on which BAM earns asset management fees) increased by 9.3% year-over-year to $457 billion to conclude the year.

This also helped BAM’s distributable EPS grow by 2.9% over the year-ago period to $0.36 for the fourth quarter. Put into perspective, that was $0.02 better than the analyst consensus per Seeking Alpha. As the company builds its fee-bearing AUM base, expenses tend to grow at a slower rate. That allowed non-GAAP net profit margin to expand by 90 basis points to 51.9% during the quarter. This is how BAM’s distributable EPS growth outpaced total revenue growth in the quarter.

Looking at 2024, it should be a robust year for the company. The analyst consensus for $1.54 in distributable EPS would represent a 12.4% growth rate over the $1.37 in distributable EPS logged in 2023. If anything, I think based on BAM’s ability to surpass analyst estimates, this is a lowball estimate.

For one, the company had $107 billion in dry powder capital available to deploy as of Dec. 31, 2023. Second, interest rates have stabilized. Thus, management thinks that there could be “a very busy period of transaction activity in the next few years.” That will help the company to keep growing its fee-bearing AUM base at a healthy rate, which will fuel total revenue and distributable EPS growth in the quarters to come.

BAM also had $2.7 billion in net cash and cash equivalents on its balance sheet as of Dec. 31, 2023. This gives the company liquidity to keep paying its current dividend if distributable EPS doesn’t quite cover the payout for a while (unless otherwise hyperlinked or noted, all details in this subhead were sourced from BAM’s Q4 2023 Earnings Press Release, BAM’s Q4 2023 Supplemental Information, BAM’s Q4 2022 Supplemental Information, and BAM’s Q4 2023 Shareholder Letter).

Rapid Dividend Growth Can Persist

Besides BAM’s significant net cash and cash equivalents position, the company’s earnings visibility is admirable. As of the end of 2023, 86% of BAM’s fee-bearing capital was long-term or permanent (slide 6 of 42 of BAM’s Q4 2023 Supplemental Information). So, not only is the company growing at a double-digit rate, but it is quality growth as well.

BAM will likely pay $1.52 in dividends per share in 2024. Against the $1.54 in distributable EPS, this would be a 98.7% payout ratio. For most other businesses, this would be unsustainable. However, BAM’s balance sheet is a financial fortress, with a high-margin business and minimal capex consuming its cash flow.

Risks To Consider

BAM is a quality business with a proven track record of doing right by its clients, but there are still risks.

BAM is a standout in the alternative asset management industry. However, it has plenty of company. Blackstone Inc. (BX) and KKR & Co. Inc. (KKR) are no slouches, either. If BAM can’t keep delivering for its well-to-do clients, or it loses the trust of those clients, the risk is that the company will lose funds to its competitors. That could hurt the investment thesis for the company.

Perhaps the most notable risk with BAM is that its parent company, Brookfield Corporation (BN), has the right to nominate half of the Board of Directors (page 26 of 280 of BAM’s Annual Report). At any point, BAM could stop its generous dividend growth policy if it so chose.

Summary: A Wonderful Business For A Fair Price

For my money, I think BAM is compelling at the current share price. It’s not dirt-cheap, but it shouldn’t be given how it is executed. The company’s earnings quality is decent, the balance sheet is strong, and there is room to keep growing. These reasons serve as the basis of why I am maintaining my buy rating on BAM now.