Jeng_Niamwhan/iStock via Getty Images

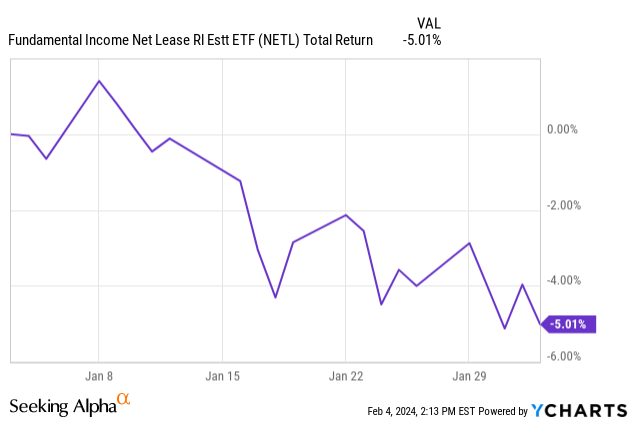

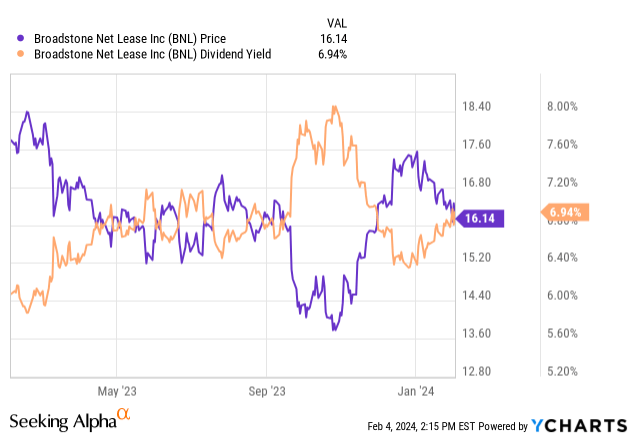

Interest rate speculation continues to wreak havoc across the net lease sector and real estate. Since the sector reached a bottom in October, net lease REITs have rallied as investors remained optimistic that near term rate cuts were a possibility. The sector speculated and priced in interest rate relief in the early part of 2024. However, recent news from the Federal Reserve indicates that near term interest rate cuts are unlikely. This past week, Powell signaled a March cut was probably off the table entirely, and the consensus for a cut has moved to May or June at the earliest. The news had a broad impact on the net lease sector.

Fundamentals such as interest rates highlight the importance of zeroing in on individual REITs and their circumstances. Changes in interest rates will materially impact the financial performance of REITs with near term refinancing and floating rate debt. In contrast, companies with no near term refinancings and limited floating rate debt may be more protected. Over the long term, changes in rates will shape the sector landscape. Short-term changes often highlight the importance of investing in companies with strong and organized balance sheets. Additionally, it becomes increasingly important to understand that some REITs are more affected than others. Today, we are going to dive into a well-insulated company which has been uniformly affected with the net lease sector as a whole.

Broadstone Net Lease

Broadstone Net Lease (NYSE:BNL) is a diversified net lease REIT with a portfolio of primarily industrial properties. BNL owns primarily single tenant properties encumbered by long term leases to credit-worthy tenants. As of the most recent investor report, BNL’s portfolio consisted of 800 properties located in the United States and Canada. The portfolio includes industrial, healthcare, restaurant, retail, and office properties. BNL is noteworthy for a high yielding dividend paired with its investment grade credit rating. Broadstone is a smaller REIT in the net lease world and is often overshadowed by larger competitors. As interest rate news drives BNL’s share price down, the REIT now yields nearly 7% with a forward FFO multiple of 10.4x. Both of these metrics are cheap for an investment grade net lease REIT.

Portfolio

BNL

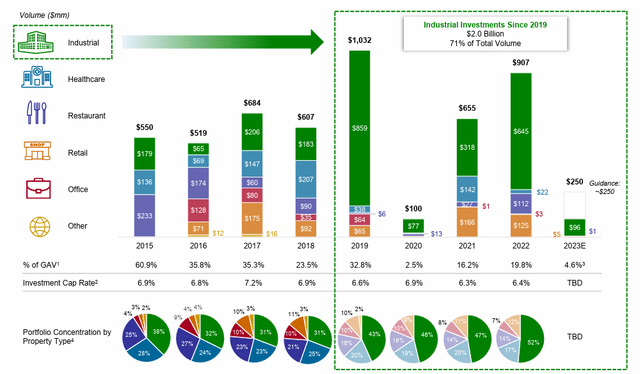

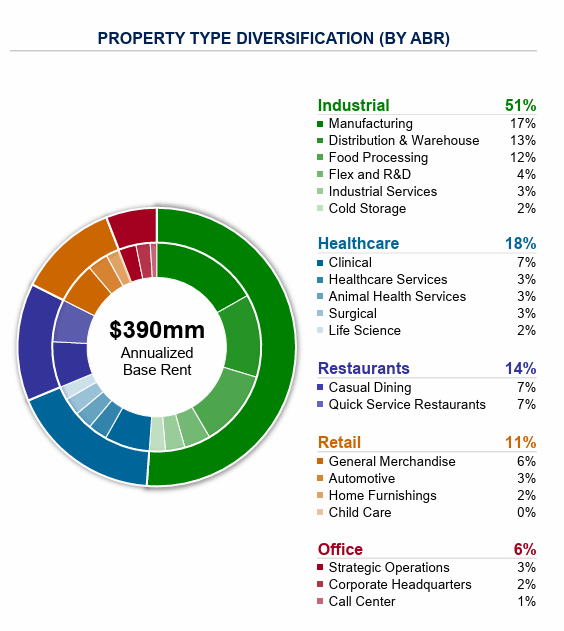

BNL owns and operates one of the most diversified portfolios in the sector. The company owns primarily industrial assets representing 51% of the portfolio. Subcategories of their industrial allocation include manufacturing (17%), distribution (13%), food processing (12%), flex (4%), and cold storage (2%). Given the tailwinds across the industrial sector coming out of the COVID pandemic, many net lease landlords have made a conscious effort to increase their industrial allocation. Broadstone has followed suit and notes that most of their recent acquisitions have been industrial assets. A recent investor summary states that since 2019, BNL has acquired $2 billion worth of industrial assets, representing 71% of total acquisition volume.

The move is strategic as tailwinds such as growing rents and demand for space continue to support the industrial market. A strong industrial allocation will continue to win Broadstone investor favor. That said, the industrial properties owned by Broadstone may not be top tier industrial assets. As with all types of real estate, nuance is important in the industrial world. Fungibility of space is a priority as incoming tenants need the building to fit their needs. In the case of BNL, manufacturing and food processing represents approximately 30% of the industrial allocation. These asset types are notoriously difficult to release if the original tenant leaves. These assets are highly specialized to the tenant’s operations and can require large capital outlays from the landlord to attract a replacement tenant. The profile of the individual industrial assets owned by BNL explains why it lacks the premium FFO multiple of other industrial focused REITs. Compare BNL’s forward FFO multiple of 10.4x to First Industrial’s (FR) forward FFO multiple of 21.6x.

The next largest allocation within the portfolio is the healthcare sector which includes urgent care, veterinarian clinics, and other types of general healthcare properties. Broadstone does not own large hospital assets such as those owned by other medical REITs, such as Medical Properties Trust (MPW). Instead, these assets are more traditional net lease style properties which are more fungible and require significantly less capital and expertise from the landlord.

Broadstone differentiates between restaurants and retail in their portfolio breakdown. On a combined basis, these broad retail categories represent 25% of the portfolio. Restaurants account for 14% with an even split between casual dining and QSR (fast food restaurants). The dining sector has gained favor since the pandemic, as unit level performance surprised many net lease landlords. The remaining retail accounts for a smaller portion at 11%. The largest allocation within the retail subcategory is general merchandise at 6%. This category will include big box retail properties synonymous with retail net lease.

Finally, the smallest segment of Broadstone’s portfolio is office, representing 6%. Office remains out of favor as sector performance is weak. Issues surrounding tenant interest, capital expenditures, and significant concessions continue to plague the office sector. Seeing as office represents a small portion of the overall portfolio, concerns at the asset level should be absorbed by Broadstone’s large pool of assets.

The best point of comparison for a sector competitor is W. P. Carey (WPC). Their overall allocations are similar given WPC recently divested their office assets entirely with the spin-off of Net Lease Office Properties (NLOP). Today, WPC is majority industrial and invests a smaller portion of their portfolio into single tenant retail properties. Additionally, Broadstone’s industrial portfolio is similar to WPC’s in terms of the individual asset profile. Note, Broadstone has a higher allocation to medical properties than WPC.

BNL has been impacted with the net lease sector over the past week. That said, the decline is likely unwarranted as Broadstone has two key tailwinds that could insulate the performance of the company over the next two years. This timeline is key is it will enable BNL to cruise through the continued tumultuous interest rate environment.

Debt Maturities

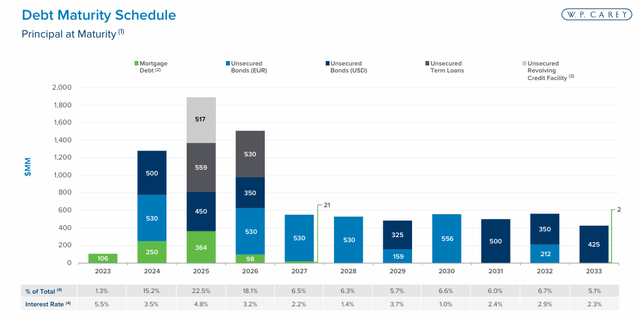

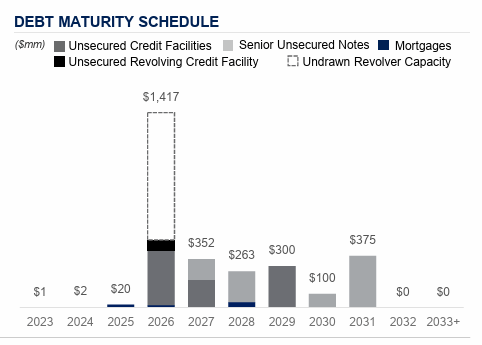

Broadstone is a large REIT with a strong balance sheet. As of writing this article, the company is rated investment grade by S&P (rated BBB) and Moody’s (rated Baa2). Credit rating is essential to performance in the net lease sector as the same underlying factors determine a REITs cost of debt. Given the importance of acquisitions to growth and strategic change, cost of capital advantages are critical. BNL’s balance sheet is around 60% equity and 40% debt, meaning the company is conservatively capitalized. Most of their debt is unsecured with a small minority of mortgage debt. Most of this debt is also fixed rate, which benefits BNL.

As REITs refinance their unsecured debt, they have begun feeling the impact of higher rates. Interest expenses have been insulated as most REITs issue long term, fixed rate debt. However, as the higher for longer thesis begins to take shape, rates are having a material impact across the sector.

BNL

BNL has no major refinancing obligations in 2024 or 2025, protecting the REIT from higher rates. This could prove a major performance tailwind for BNL over the next two years as compared to other competitors. For example, WPC has a series of major refinancings in the coming years. Over the next few years, WPC must refinance most of their debt. Worse, this debt will be refinanced at a higher interest rate, given the weighted average interest rate of their 2024 maturities is 3.5% (below the current 10-year treasury rate).

Avoiding the need to refinance their debt gives Broadstone a competitive advantage over WPC and other REITs. WPC may experience a negative impact to their cash flow as a higher interest rate begins to eat into their top line rental revenue. This consideration likely contributed to the factors behind their dividend reset.

This highlights the opportunity that exists in Broadstone. Today, the firm is a high yielding, high quality net lease landlord which has been unfairly treated by macroeconomic factors impacting the sector. In an ideal world, interest rates will have declined by the time Broadstone is refinancing large portions of their unsecured debt. Until that time, BNL can continue to take advantage of elevated acquisition cap rates by building their portfolio and growing organically despite issuing long term debt at higher interest rates.

Lease Expirations

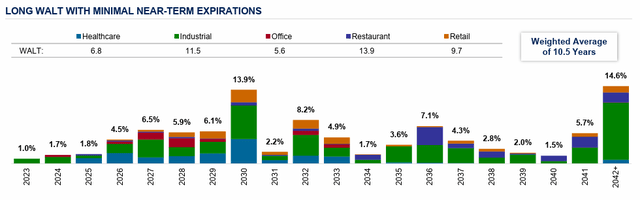

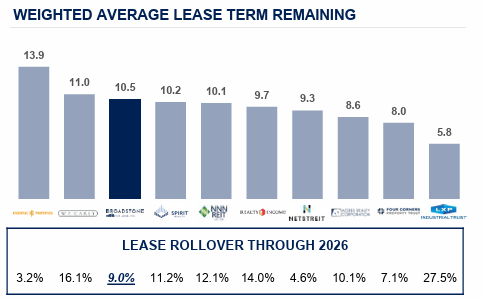

As the commercial real estate sector continues to feel the impact of uncertainty around financing costs, Broadstone has another large competitive advantage which will insulate their performance over the next several years. Broadstone has one of the longest weighted average lease terms of any publicly traded net lease REIT. With a 10.5 year WALT, the majority of the portfolio has contractual rental increases which are fixed or linked to CPI. Broadstone’s rental revenues will continue to grow in coming years because of these increases.

BNL

Looking beyond the long WALT, we see that a small portion of the portfolio’s leases will expire in the next several years. According to Broadstone, only 9% of leases expire through 2026. While lease expirations offer an opportunity for landlords to increase their rental revenue through releasing spreads, they can also be tumultuous times which require capital outlay to secure a deal. Additionally, if the tenant leaves, it leads to vacancy within the portfolio which reduces revenue and increases costs. Remember, under a net lease, the landlord is insulated from responsibilities related to maintenance, insurance, and property tax. These costs are the responsibility of the tenant and are reimbursed to the landlord. However, if there are no tenants in place, nobody will be reimbursing these expenses and they land on the landlord. BNL is well positioned with over 99% portfolio occupancy.

Given current challenges, having a small portion of your portfolio turnover in the near term is a point of relief for landlords. Despite the potential upside with a new lease, the execution risks often outweigh the reward. Net lease REITs, such as Broadstone, depend on long term cash flow stemming from long term leases. Similarly, net lease REITs generally do not attempt to capitalize on expiring leases by purchasing assets with limited remaining term. This means landlords in the net lease sector will capitalize on any opportunity to stabilize cash flow. A long WALT with balanced rollover is a positive indicator for long-term stability.

Conclusion

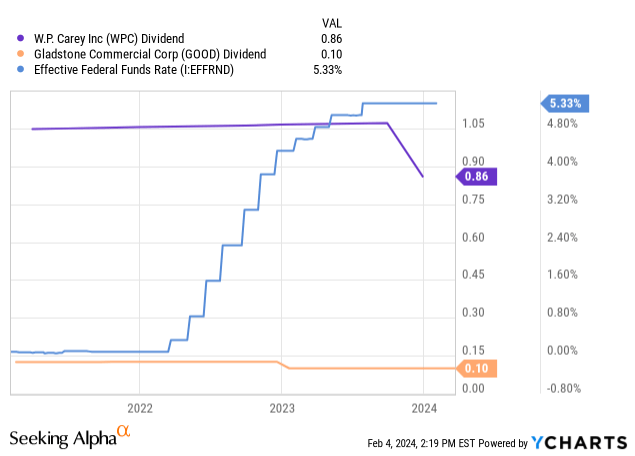

The net lease sector has been particularly tumultuous over the past few months. Given the long duration of net lease portfolios, stock prices for net lease REITs are particularly sensitive to movements in interest rates. That said, we should understand that the financial situation of individual companies will be a determinant of their success in years to come. Given the rapid change of interest rates over the past years, near-term refinancings present a substantial risk to REITs that will be refinancing into higher rates. The impact to cash flow is unavoidable and has already begun to take hold with other participants in the sector. For example, WPC and Gladstone Commercial (GOOD) have both cut their dividend since rates increased.

BNL remains well insulated from these risk factors. Additionally, BNL is well positioned with few maturities over the next two years. For investors who are looking to rest easy knowing that their investments will not face near-term headwinds, these two considerations are important. The increasing depth of the net lease sector is a beautiful thing for investors. We have more options than ever to invest in diverse net lease portfolios. Intelligent decision making is paramount and looking under the hood of these portfolios can provide opportunity to outperform.