G0d4ather

Broadcom (NASDAQ:AVGO) is expensive right now, yet as one of the leading semiconductor companies in the world, I think it has a place in technology portfolios. My analysis shows investors are paying a significant premium if buying now, but operations and financials will contribute to continued long-term growth for the firm. As an investor focusing on 10+ year investment horizons, I consider AVGO worth holding for the long term.

Company Overview

For investors already acquainted with Broadcom, please skip ahead to the section ‘Market Drivers.’

Broadcom designs, develops, and supplies semiconductor and software infrastructure. Its customers come from markets including data centers, software, broadband, networking, wireless, and industrials. It was founded in 1991 and became known as Broadcom after a series of acquisitions that began as a division within Hewlett Packard (HPE). In 1999, HP spun off its measurements, components, chemical analysis, and medical businesses into Agilent Technologies. Part of this business, called Avago Technologies, was then acquired by Kohlberg Kravis Roberts & Co. (KKR) and Silver Lake Partners in 2005. In 2015, Avago announced its intention to acquire Broadcom for $37 billion. The deal was finalized in 2016.

Market Drivers

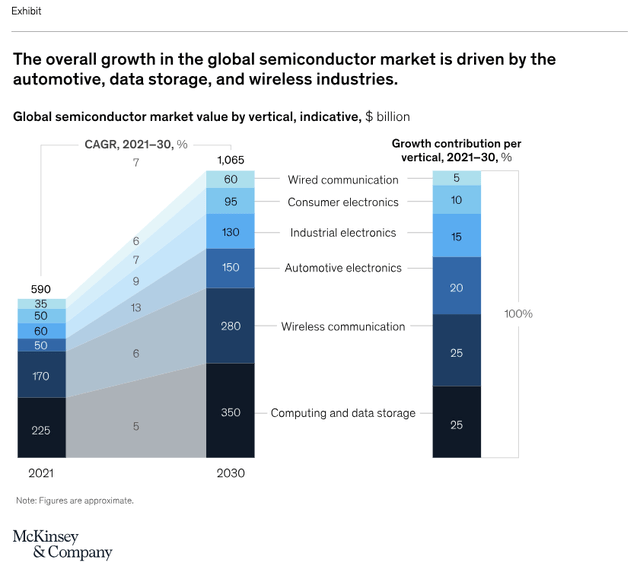

McKinsey has reported that the global semiconductor industry is expected to be worth $1 trillion by 2030. The aggregate annual growth rate is forecasted to average between 6 and 8 percent up until that point. Such growth is driven by massive trends in remote working, the proliferation of AI, and increasing demand for electric vehicles. The research outlines that 70% of the market’s growth could be attributed to the automotive, computation and data storage, and wireless sectors. The automotive industry is particularly anticipated to see higher demand, up to three times present levels, due to progress in autonomous transport and e-mobility.

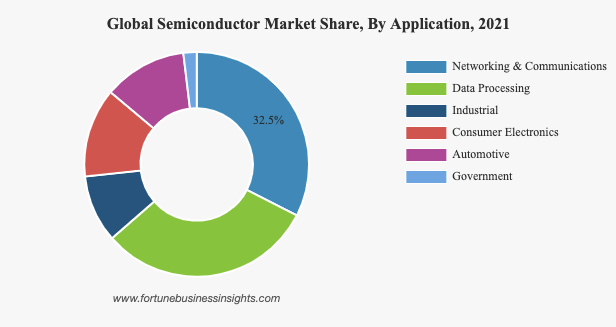

Fortune Business Insights also reports that the semiconductor market was valued at $527.88 billion in 2021 and is forecasted to grow from $573.44 billion in 2022 to $1,380.79 billion in 2029, indicating a CAGR of 12.2% from 2022-2029. The growth is attributed to the higher use of electronics across the globe and the emergence of AI, Internet of Things, and machine learning.

Fortune Business Insights

At Broadcom’s 2021 investor day, it outlined its plan to emphasize its business model to focus on strategic customers. Its plan focuses on partnerships with elite, multinational customers, primarily from the Fortune 500, to drive revenue sustainability and foster growth. 70% of its annual revenue comes from these core customers, and 80% are licensed to use five or more Broadcom software solutions.

On November 22, 2023, Broadcom completed its acquisition of VMware, significantly improving its status as a top technology infrastructure firm. This merger should improve its private and hybrid cloud networks, offering higher security. VMware Cloud Foundation should modernize cloud and edge environments, and the deal evidences Broadcom’s acquisition strategy to remain on the cutting edge of technology developments in its field.

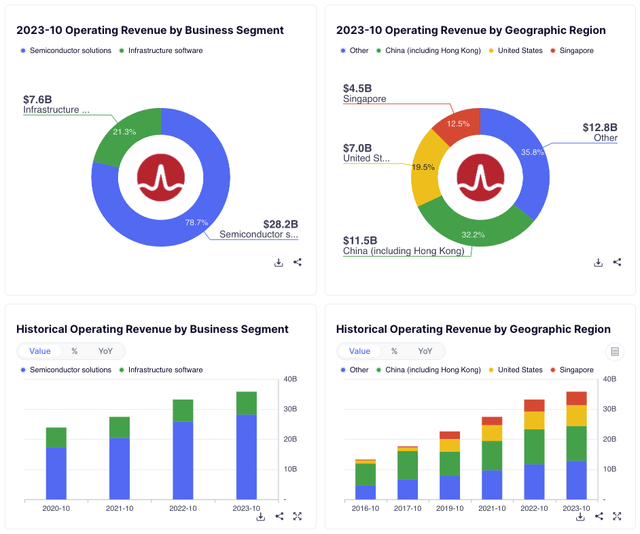

Financial Analysis

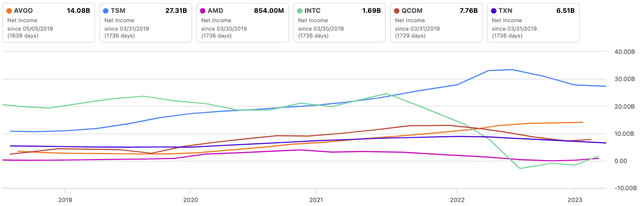

Compared to major peers, Broadcom has the second-largest net income of the group, including Taiwan Semiconductor Manufacturing Company (TSM), Advanced Micro Devices (AMD) and Texas Instruments (TXN):

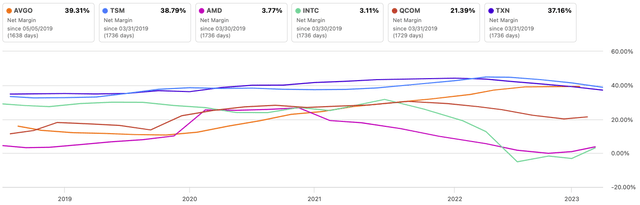

Additionally, it has a net margin that is essentially joint top with TSMC and TXN:

Compared to the sector median net margin of 2.49%, AVGO has a 1,479.66% difference.

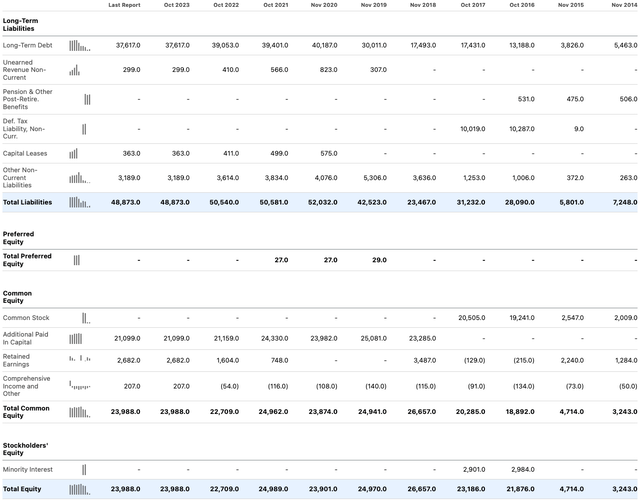

Investors would be wise to take caution on the company’s balance sheet, where its equity-to-asset ratio is just 0.33. Compare this to TSMC’s ratio of 0.63 and TXN’s 0.52.

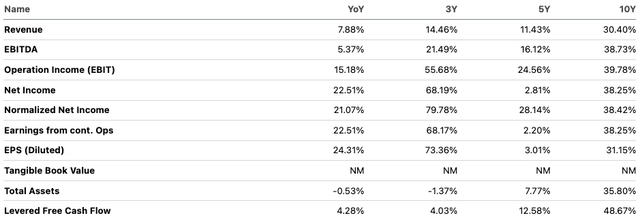

Considering historical growth rates for Broadcom and the massive proliferation in advanced technology currently underway, the future looks positive for the company in terms of earnings growth. It does not seem unreasonable for the firm to hit 15% annual EPS growth as an average over the next 10 years when considering general market CAGRs, but also internal efficiencies that are likely as a result of the implementation of automation driven by AI.

Value Analysis

For my discounted cash flow analysis, I used the forward EPS of $46.83 as my starting point, a 15% annual EPS growth rate, as commented on above, for the next 10 years, a 4% annual EPS growth rate for my 10-year terminal stage following this, and an 11% discount rate. My fair value came to around $1,046, indicating a potential negative 19% margin of safety at this time.

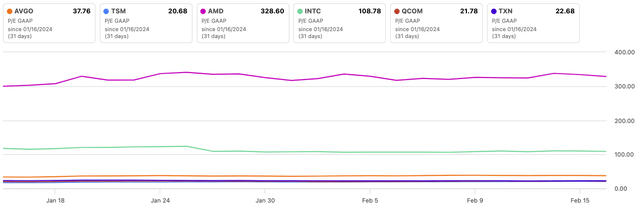

However, also consider its much lower P/E GAAP ratio when compared to AMD and Intel (INTC):

Risks

Broadcom is significantly related to geopolitical risk between the US and China surrounding Taiwan’s TSMC. While any escalation of these tensions would cause significant shocks to most global markets, technology companies would be the first and most negatively affected, without a doubt. As such, allocating too heavily to Broadcom or any of the technology companies aggressively could mean high levels of volatility to come, as this risk does not look accurately priced into present valuations.

Additionally, my above-mentioned 15% EPS growth rate as an annual average over the next 10 years is by no means guaranteed and is higher than some other analyst estimates. My positive future earnings outlook considers internal efficiencies driven by advancements in technology, but the effective execution depends on management’s future decisions relating to employee count, automation, and organizational structure.

Conclusion

Overall, I consider Broadcom a good investment to have. I do not think it is the best company to own for exposure to technology and, specifically, semiconductor operations, but it is a top choice. Investors should be aware of the present geopolitical risks surrounding the technology sector and if they are willing to take on the risk associated with Broadcom, may want to consider investing more heavily in TSMC, which I consider the better investment of the two.