Nastco

Big names in the tobacco industry admire British American Tobacco (NYSE:BTI), Altria (MO), and Philip Morris (NYSE:PM) are well-followed here on Seeking Alpha. Understandably they draw a lot of interest because they offer a steady income stream for investors and retirees who’ve moved past relying solely on employment paychecks or want to diversify beyond depending solely on social security.

Unsurprisingly, these companies are offering yields in the high single digits, which stands out compared to the market’s (SPY) yield of 1.42% or the 3.58% yield from the popular Schwab U.S. Dividend Equity ETF (SCHD).

| Company | Market Cap (b) | Dividend Yield |

| Philip Morris | $ 146.00 | 5.24% |

| Altria | $ 75.34 | 8.08% |

| British American Tobacco | $ 71.82 | 7.77% |

As someone who smoked for 8 years, I comprehend the challenge of quitting and used to believe that tobacco companies had sustainable business models due to addiction. At one point, I invested in a few tobacco companies attracted by their appealing yields and the reliable income they provided.

However, over the last couple of years, my perspective has shifted. I’ve grown cautious about these companies as the total returns were far too low and the reject in addressable market has accelerated worldwide. Many countries are enforcing restrictions on smoking in public areas where it was once permitted, and there’s a rising trend toward healthier lifestyles, with more people opting for alternatives that are not necessarily healthier but have better reputations admire vaping or heated tobacco.

Recently I wrote an article on Altria, giving it a “Sell” rating, a view that stirred considerable interest by presenting a contrarian perspective on the widely praised company.

Today, my focus is on two other major tobacco companies: Philip Morris and British American Tobacco. I aim to highlight why I believe one of them is a solid investment for income-seeking investors while the other might not be as promising.

Let’s delve into the details.

Shrinking Customer Base, Yet Alternatives Are Resilient

When I consider investing in a new company, a crucial factor is the market stability or growth potential of the company involved. Unfortunately, for tobacco companies, this fundamental criterion doesn’t hold true. Their customer base has steadily declined over the years.

Let’s take a historical dive: back in 1944, 41% of U.S. adults were smokers. A decade later, that number peaked at an all-time high of 45%. But since then, smoking rates have been on a continuous reject, dipping below 30% in 1989 and hitting the 20% mark by 2015.

One of the primary reasons behind this reject is the decreasing number of young adults smoking today compared to previous generations. Traditionally, young adults had higher smoking rates than other age groups. For instance, in 2001-2003, about 35% of young adults smoked cigarettes, but fast forward to 2019-2023, and that figure plummeted to a mere 10% – just 1 in 10 young people lighting up. It’s a worrying trend for tobacco companies because failing to hook young smokers means dwindling customers down the line.

Surveying beyond cigarette smoking, there’s a rise in vaping, heated tobacco, and e-cigarette use among 8% of U.S. adults in recent years, mirroring consistent figures measured by Gallup since 2019.

As expected, it’s the younger demographic leading the vaping trend, with those under 30 more than twice as likely to puff on e-cigarettes compared to any other age group.

In essence, traditional cigarettes are falling out of favor significantly, with only about one in eight U.S. adults now smoking them. Instead, marijuana usage is on the rise, surpassing cigarette smoking. These shifts seem to be driven by changing habits among young adults, who are more inclined toward marijuana and e-cigarettes while steering clear of traditional cigarettes – quite a deviation from past trends.

While combustible cigarettes face a concerning reject, the realm of vaping, heated tobacco, and e-cigarettes has seen substantial growth in its customer base in last decade, showing signs of resilience amidst these changes. Let’s not limit ourselves only to US and let’s look at some international data.

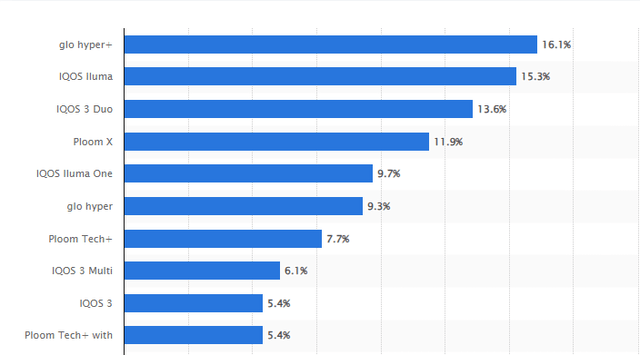

Though comprehensive data on alternative product market shares remains limited, let’s take a look at Japan’s 2022 figures. Among the top 10 heated tobacco products, BTI’s “Glo Hyper +” claims the number 1 spot with a 16.1% market share, while “Glo Hyper” comes with 9.3%, adding up to 25.4% of the market for BTI. In contrast, PM’s “IQOS” and its variants collectively dominate with a staggering 50.1% market share.

Market Share Heated Tobacco Products in Japan (Statista)

A similar pattern emerges in Europe where IQOS seems to be the top choice among most smokers. I foresee this trend to gain momentum, given the brand’s current market dominance.

This positions Philip Morris as the superior player, showcasing resilience in navigating the shifts within the smoking market.

1:0 Philip Morris vs. British American Tobacco

“DRIP” Does Not ensure Market-Beating Returns

Investing in big tobacco firms typically hinges on the appeal of their high dividend yields. Yet, some investors make a case for the reinvestment strategy, known as “DRIP,” suggesting that high-yield investments can deliver superior returns.

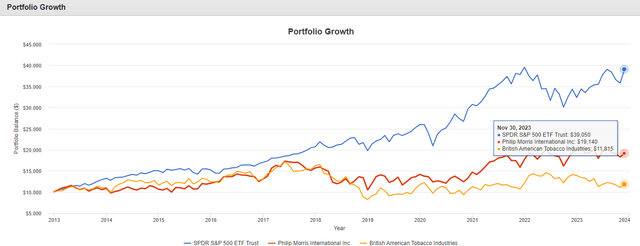

But let’s take a turn here and explore three investments since January 1, 2013, a period when interest rates were low and there was a strong demand for high-yield companies. It’s quite the opposite of today’s landscape, where CDs are yielding 5%.

- If you have invested $10,000 in PM and reinvested all the dividends since, you would be sitting today on $19,140.

- If you have invested $10,000 in BTI and reinvested all the dividends since, you would be sitting today on $11,815.

- If you have invested $10,000 in SPY and reinvested all the dividends since, you would be sitting today on $39,050.

Growth of $10,000 Investment (Portfolio Visualizer)

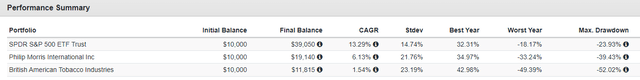

Of course, past performance doesn’t ensure future returns, but it’s evident that the market, with a 13.29% CAGR over this period, outperformed PM, which delivered a 6.13% CAGR, and BTI, with only 1.54% over the same stretch.

What’s intriguing is that not only did the market outshine these big tobacco options, but it did so with notably lower volatility and significantly lower drawdown in the bad years, suggesting that big tobacco might not be as ensure an investment after all.

It’s worth noting that the market outperformed big tobacco in 7 out of the 10 years considered.

% Return (Portfolio Visualizer)

True, the market might not offer the yield required for sustained income, yet this comparison highlights that investing in Philip Morris, although lagging significantly behind the market in total returns, still surpasses investing in BTI. This trend is something I foresee to persist in the coming decade as well.

2:0 Philip Morris vs. British American Tobacco

So, What Does The Future Hold?

Looking back at the returns, despite BTI showing significantly lower returns than PM, the last 5 years have seen BTI accomplish a 3.49% CAGR in revenue, surpassing PM’s 2.42% CAGR over the same duration.

Similar trends emerge when looking at diluted EPS over the past 3 years: BTI experienced an 11.86% CAGR in EPS growth while PM managed a mere 1.43%. However, investing isn’t solely about historical figures; it’s about anticipating what lies ahead. Valuation changes, whether expansion or contraction, heavily hinge on future expectations.

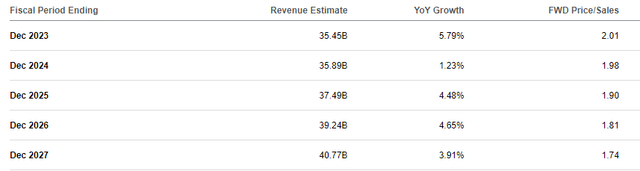

Analysts project BTI to accomplish revenue growth of roughly 3-5% over the next 4 years while expecting EPS to remain nearly flat during this period. This forecast is grounded in BTI already operating with an incredibly efficient business model, boasting an 83.5% Gross Margin. There’s limited room for advance improvement, indicating that EPS growth can primarily stem from revenue growth which is not expected to be anyhow worthy to talk about.

Revenue Growth Forecast (Seeking Alpha)

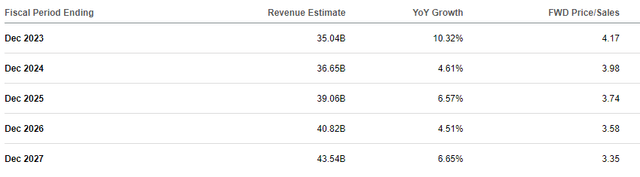

In PM’s case, the spotlight falls on the heated tobacco market – a standout feature. The company seems to be adjusting more effectively to the increasingly demanding landscape faced by big tobacco firms, aiming for an average revenue growth of 5% to 7% until 2027. However, it’s important to note that PM’s business model isn’t as streamlined yet, with its Gross Margin currently at 63.1%. There’s still potential for efficiency improvement, and this is why analysts are eyeing EPS growth in the upper single digits as well.

Revenue Growth Forecast (Seeking Alpha)

Once more, this highlights that Philip Morris stands out as better positioned for growth, not just in revenue but also in improving profitability, making it the superior choice.

3:0 Philip Morris vs. British American Tobacco

Dividends & Buybacks

When it comes to investing in big tobacco, the primary motivation should typically revolve around the dividend yield, especially if your retirement plans hinge on it. Otherwise, justifying the total returns might be a challenge if dividends aren’t a key focus.

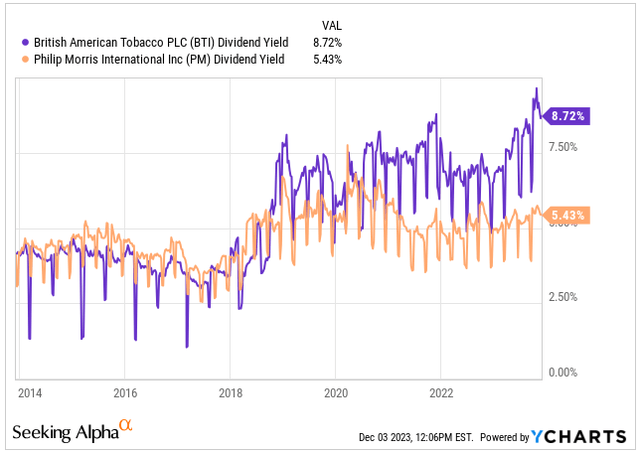

In terms of yield, BTI emerges as the top choice, boasting a trailing twelve-month or “TTM” yield of 8.72% compared to PM’s 5.43%.

However, it’s crucial to note that BTI’s dividend growth has been nearly stagnant, while PM has seen its dividend grow at a 2.94% CAGR over the past 5 years.

It’s worth considering that BTI’s primary listing is on the London Stock Exchange, with its U.S. trading being in the form of an ADR. This setup means the underlying dividend is in GBP, subject to FX fluctuation risks.

One advantage, especially for Europeans, is that investing in BTI means your broker won’t automatically charge you the dividend tax, as it might for U.S. listings, allowing you to acquire the entire dividend amount.

Dividend Yield (Seeking Alpha)

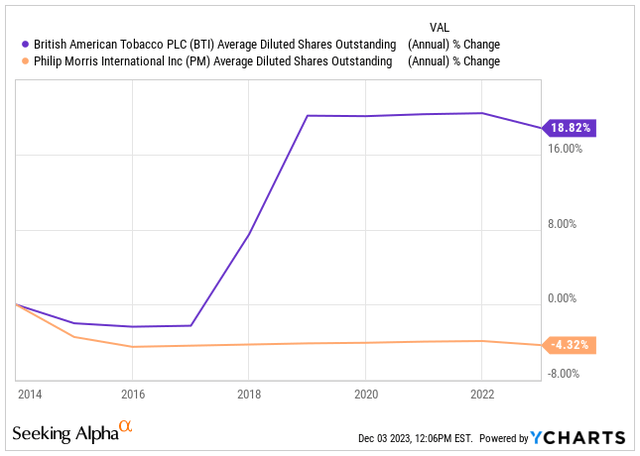

What’s more troubling about BTI is its shares outstanding, especially for companies whose markets are in terminal reject. I’d admire to see them aggressively repurchasing shares to alleviate the pressure on how much free cash flow, or ‘FCF,’ is allocated to dividends.

However, BTI increased its share count in the last decade by 18.8%, primarily due to the acquisition of Reynolds American Inc. in 2017. This led to the issuance of 429 million new BTI ordinary shares, diluting existing shareholders – a proceed I don’t appreciate, especially for a company with significant free cash flow.

On the other hand, PM has actually reduced its share count by 4.3% over the last decade. To put it in perspective, this reduction rate is relatively slow and roughly half of what Altria repurchased during the same period.

Shares Outstanding (Seeking Alpha)

I am not pleased with either of the share buyback initiatives, but considering the superior yield for BTI, this round goes to them.

3:1 Philip Morris vs. British American Tobacco

Valuation

When it comes to valuation, it’s apparent that both companies are trading considerably cheaper compared to some current market darlings admire Apple (AAPL), Microsoft (MSFT), or Nvidia (NVDA), all sporting PE ratios higher than 30x earnings.

One might recall Ben Graham’s famous advice, the father of value investing, to avoid paying more than 15x earnings for businesses. However, achieving that benchmark in today’s valuation landscape is quite challenging, which might be one reason why there’s substantial interest in big tobacco.

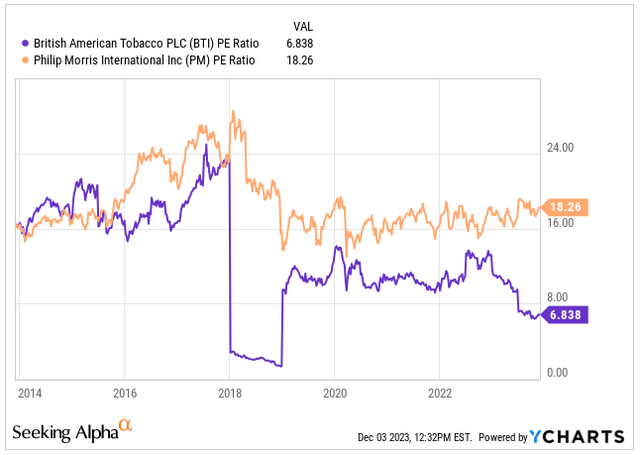

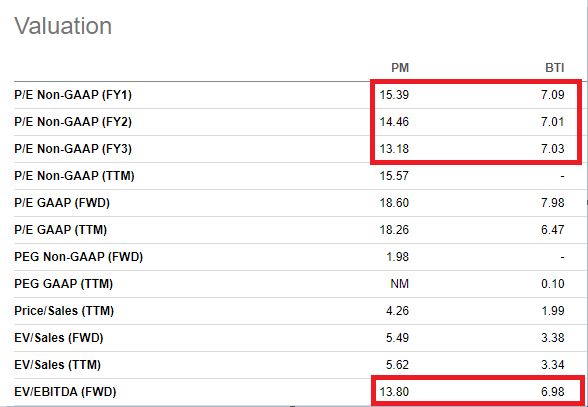

However, if we followed Graham’s advice, PM would be automatically disqualified from the potential investments as it trades at 18.26x its FY23 earnings, BTI stands out with a dirt-cheap valuation of 6.83x its FY23 earnings.

Looking ahead beyond the current fiscal year, BTI remains notably cheaper. However, with no anticipated growth and stagnant profitability, the company is projected to preserve a flat Forward PE ratio of 7x its earnings in the coming years.

PM appears significantly pricier in relative terms. Yet, with anticipated growth in both revenue and bottom line, the valuation is expected to drop to 15x its earnings next year and advance decrease to 13x by 2026.

Valuation (Seeking Alpha)

In terms of relative valuation, BTI is significantly cheaper, which is why it’s winning the valuation round. However, it’s essential to note that the valuation is anticipated to remain flat due to the lack of growth, while PM will become cheaper on relative basis.

3:2 Philip Morris vs. British American Tobacco

Which One To Buy, Which One To Sell?

In this article, I’ve examined Philip Morris and British American Tobacco through various lenses and using different metrics.

It’s widely acknowledged that the customer base for combustible cigarettes is shrinking, posing a risk to the main products offered by both companies. However, Philip Morris, with its sizable market share in IQOS heated tobacco, seems to be better positioned.

Despite this, both companies have delivered poor returns relative to the market in the last decade. Yet, for retirees reliant on dividends, once again, PM emerges as the preferable choice.

Looking ahead, PM, with its larger market share in heated tobacco, is anticipated to drive higher revenue and EPS growth, giving it an advantage.

However, BTI currently offers a significantly higher dividend and is relatively cheaper, providing it with an edge in some aspects.

After assessing the criteria outlined in this article, I deduce that for individuals seeking investment income, Philip Morris appears to be the better choice and receives a BUY rating, while British American Tobacco seems to face greater challenges with a lack of growth drivers and thus receives a SELL rating.

Final Score: 3:2 Philip Morris vs. British American Tobacco

For those not seeking investment income, but rather dividend growth, I’d suggest exploring other plentiful opportunities in the market that were beaten down by the 11 consecutive hikes in the FED fund’s rates such as REITs, Utilities or SCHD ETF or consider investing in the market as such via ETFs.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.