diane39

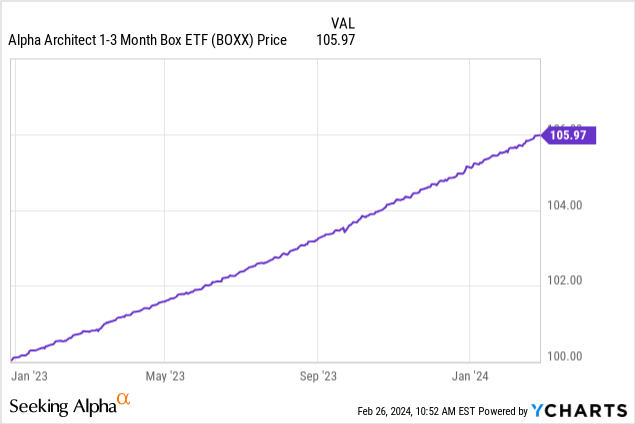

Sometimes you’ll ponder a question for years and then find the answer when you least expect it. Reading Bloomberg last week on a slow weekday afternoon, I found an interesting fund that solves a puzzle I’d worked on for a long time. The fund is the Alpha Architect 1-3 Month Box ETF (BATS:BOXX). Last week, Bloomberg profiled the fund and its manager Wesley Gray, a former US Marine Corps intelligence officer turned finance professor. The idea behind the ETF is simple– it uses a simple options strategy called box spreads to earn the rate of return on cash, but tax-deferred. While it may sound unimportant, this fund is a game changer for investors’ ability to keep their after-tax wealth ahead of inflation.

The Problem: The Government Burns The Candle At Both Ends

If you have a significant amount of wealth and live in a high-tax jurisdiction, it’s not trivial to maintain your standard of living over time. For example, in California, wealthy investors face marginal income tax rates on ordinary income of 37% in federal income tax, 3.8% in Medicare surtax, and 13.3% in state income tax. In total, these add to a marginal income tax rate of 54.1%.

While we shouldn’t shed tears for movie stars and rappers paying these income tax rates, they present a huge problem to investors because the gains ignore the effect of the continual redistribution of wealth through money printing/inflation. Inflation has calmed a bit lately, but over the last 12 months, the rate of inflation was 3.1% in the US. So if you made 3.1% on your money after tax last year, you merely maintained your purchasing power. This means that if all your gains are taxed at the top ordinary income rates, you need to make about 6.75%, or you’re backsliding. Add property taxes and $20,000+ annual health insurance premiums for a family (the government doesn’t call this a tax–but it is) and it’s not hard to create situations where the tax rate for a family with a substantial amount of assets and low investment returns is close to or above 100%. This is where wealthy people have to start playing defense. Dividends and long-term capital gains are taxed at a lower rate, and capital gains are deferred until sale. Municipal bonds also offer shelter from taxes.

These types of strategies come in and out of vogue as well. In the 2010s, equity valuations were quite reasonable, but municipal bond yields were low– offering 0-1% returns after inflation. Today, equity valuations are approaching the levels of the dot-com bubble, but you don’t have to play ball if you don’t want to because bond yields on bonds and cash have risen substantially. You can get close to a 5.5% compounded yield in a Vanguard money market fund today, but whether this benefits you or not after-tax depends on your tax rate. This was a problem without a great solution, until now.

Thinking Outside The BOXX

So how does BOXX solve some of these problems for us? Matt Levine is a popular columnist who used to be a lawyer and derivatives salesman for Goldman Sachs. Levine offers a lengthy explanation of how BOXX works here in his own review of BOXX.

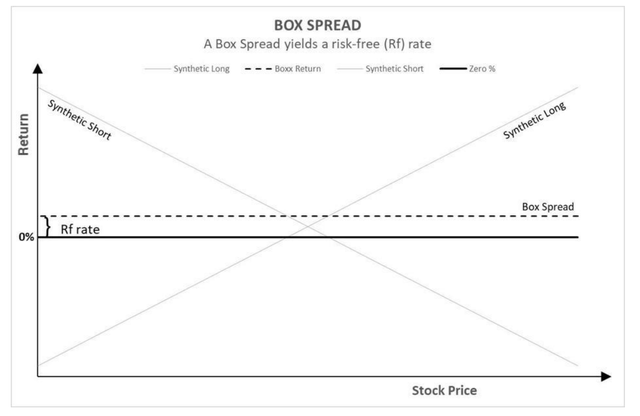

I’ll offer my own explanation. Because options offer leverage, the rate of return on cash is priced into the options market– otherwise, there would be free-money arbitrage trades that you could make for huge sizing. Call options “pay” the rate of cash, while put options “earn” the rate of cash. Additionally, long-call options profit when stocks rise, while long-put options profit when stocks fall. By buying and selling offsetting options, it’s possible to entirely cancel out the price risk, leaving only the time value of money intact. That’s the point of a box spread– it cancels out the price risk of the underlying to earn the risk-free rate of interest.

Box Spread Payoff Diagram (BOXX Prospectus)

The fund makes box spread trades on the S&P 500 (SPY) and to a lesser extent on Booking Holdings (BKNG). Booking Holdings is chosen for its high share price and liquidity for a small portion of the trades, the Booking trades help the fund with taxes.

BOXX’s underlying trades currently sport an annual yield of 5.67%, minus 0.19% in annual fees, for a net effective expected return of 5.48%.

So how is this better than a money market fund? By using a box spread, we’ve just transformed interest income into capital gains. Interest income is taxed the worst of all investment income, and long-term capital gains are taxed the best. BOXX takes things a step further by using its unique ETF structure to avoid distributing any capital gains to investors. This creates a slew of interesting possibilities.

- If you have capital gains tax loss carryforwards, they don’t get you out of paying tax on interest in future years. However, with box spreads, you’d get tax-free income until your tax loss carryforwards are exhausted. This made box spreads popular with ultra-high-net-worth investors after the 1987 crash and again after the dot-com bust.

- You can realize long-term capital gains on BOXX by holding for at least a year. You can also push income to future years by not realizing gains until your tax bracket drops.

- Rather than incur taxes on a cash basis as would be the case when earning interest, box spreads allow you to only sell a small portion to fund your living expenses while retting the rest compound tax-free. This mirrors the stock market and obviates the negative tax treatment of interest.

- There’s a 0% tax bracket for long-term capital gains and dividends that gets phased out if you have too much ordinary income. If you plan carefully, you may be able to pay a 0% capital gains tax rate on up to $47,000 in taxable income for a single person or $94,000 for a couple filing jointly. Box spreads allow you to control your taxable income better, so you sometimes can cash in here. This isn’t something I’d stress about, but it creates opportunities sometimes to make or save $5,000-10,000.

BOXX In Practice

Let’s say you sold a business for $10 million after tax and live in California. You’re seeing an influx of crypto kids driving around in Lamborghinis again, and are concerned about the stock market being in a bubble. If you put all the money in stocks, history shows that buying with bad timing can cost you a bear market that draws down 50% of your investment. If you put the money in bonds or cash, you’re paying a very high rate of marginal income tax.

Let’s do some round numbers to illustrate.

- You put $10,000,000 in a money market fund at the start of the year.

- This gets you $550,000 in interest income.

- You pay a 40% federal/state tax rate, or $220,000.

- Your after-tax income is $330,000.

- Inflation is 3% or $300,000, so your net gain in after-tax purchasing power is $30,000. Your “all-in effective tax rate” when taking inflation into account is 95%.

Now let’s re-do the example with box spreads.

- You put $10,000,000 into BOXX

- BOXX appreciates to $10,550,000 by year-end.

- You’re covered for this year, but need $250,000 in spending money for the next year.

- You sell $250,000 in stock after a year, realizing a capital gain of $13,750. Most of the money you’ll be spending is considered principal.

- Your tax rate is at or near 0% because of the 0% capital gains bracket, your standard deduction, or both.

- You have $10,300,000 remaining, and you’ve maintained pace with inflation.

With $1,000,000 we’re also in good shape. There, we have $55,000 in appreciation, even more control over capital gains, etc. There are all kinds of tax things you can do with lower levels of income, for example, you can avoid paying taxes on social security if your income is low enough. There are many possibilities.

In the long run, the tax code incentivizes you to invest in stocks and municipal bonds. If we re-run the above example with the NASDAQ (QQQ) the tax implications would be more or less the same. The key difference would be the massive amount of volatility and risk that investors would have to deal with. However, BOXX’s structure helps investors who want to wait out the current mania without being penalized for doing so.

What Are The Risks of BOXX?

When I read the Bloomberg piece, I went hunting for risks, especially potentially hidden risks. I didn’t find anything troublesome. BOXX discloses relevant risks in its prospectus, and I’d encourage you to read it for yourself. Most of these risks are boilerplate, and if you read enough of them, you’ll get a feel for what is and isn’t relevant to a given fund.

The main risk that you should be aware of in any cash-equivalent investment product is counterparty risk. BOXX uses options in its strategy, where payment is guaranteed by the Options Clearing Corporation (OCC). The OCC has a credit rating of AA and is on the Federal Reserve’s list of “too big to fail” institutions. There were no payment issues with them during the 1987 crash, 2008, or during COVID-19. I don’t think this risk is anything too severe. Money market funds also have counterparty risk, usually from commercial paper. The Fed implicitly backs up all of this, but it’s worth knowing about.

The second isn’t a risk, per se, but there is no need for box spreads in retirement accounts since they’re already not taxed on current income. Money market funds work fine there, so while you’re not losing anything by putting BOXX in a retirement account, you’re not really gaining anything either.

A third risk comes from execution. Box spread yields typically trade at a premium to T-bills, but I suppose if an influx of money came into the strategy, this premium might reverse. Box spreads are a niche within a niche, so I wouldn’t expect anything of this sort to happen. If more high-net-worth money comes into the strategy, then I’d expect tax-indifferent institutional money to exit– this should keep things in equilibrium.

A fourth risk to be aware of relates to potential changes in taxes. I’m writing this in 2024, but Congress may change the rules around these in the future. Billionaires have used box spreads for decades, but who knows if it will forever be tolerated for ordinary folks to eat the forbidden fruit. Also, worth noting is that funds won’t explicitly promise not to distribute capital gains, but 99% or more of the time they won’t in practice. If this risk comes to pass, we’d likely still come out ahead for as long as the favorable tax treatment stays.

After doing due diligence and seeing the funds’ track record, I’d be comfortable putting substantial amounts of money in BOXX. If you’re considering putting money in, you should do your own due diligence and consult with your investment advisors, tax advisors, etc.

Bottom Line

BOXX currently offers a 5.5% return that is tax-deferred and can be taken as a long-term capital gain if you hold it for at least a year. This is a game changer for investors looking for low-risk and long-term capital gains tax treatment. For these points, I’m naming BOXX as my top 2024 pick.