Booking Holdings (BKNG -2.28%) dubs itself the “world’s leading provider of online travel and related services.” But the stock has frustrated investors in recent years, experiencing little net growth between 2018 and 2023. However, this year has seen a solid turnaround with the shares rising nearly 50% and reaching an all-time high above $3,250 per share in August.

There’s good reason to believe the internet and direct marketing retail stock could continue to climb higher over the long term. Here’s why.

Why Booking Holdings can grow

As the owner of Priceline, Kayak, Agoda, and numerous other travel sites, Booking Holdings has built an extensive ecosystem for travelers. This approach has brought more than 3.1 million properties into its ecosystem as of the second quarter of 2023. This is up from just over 2.5 million in the year-ago quarter. That includes hotels and resorts, apartments, homes, and other unique property types.

Its growing property portfolio also places it into direct competition with not only archrival Expedia but also online travel company Airbnb. Also, it can draw a variety of customers seeking infinite options, regardless of whether they seek budget travel, luxury accommodations, or something in between.

Indeed, the pandemic severely curtailed the ability to travel for billions of consumers and left the stock trading in a range for a time. But due to the size of the Booking Holdings ecosystem, it has positioned itself to meet this pent-up demand.

Allied Market Research predicts a compound annual growth rate (CAGR) of 15% through 2031 for the online travel industry. This would take the industry’s size to over $1.8 trillion. If true, Booking Holdings is only scratching the surface of its potential.

Booking’s financials

Booking Holdings earned $9.2 billion in revenue for the first half of the year, an increase of 32% compared with the same period in 2023. Additionally, these revenue increases outpaced the growth of expenses, allowing net income for the first six months of 2023 to rise to nearly $1.6 billion, up from just $157 million during the same period in 2022.

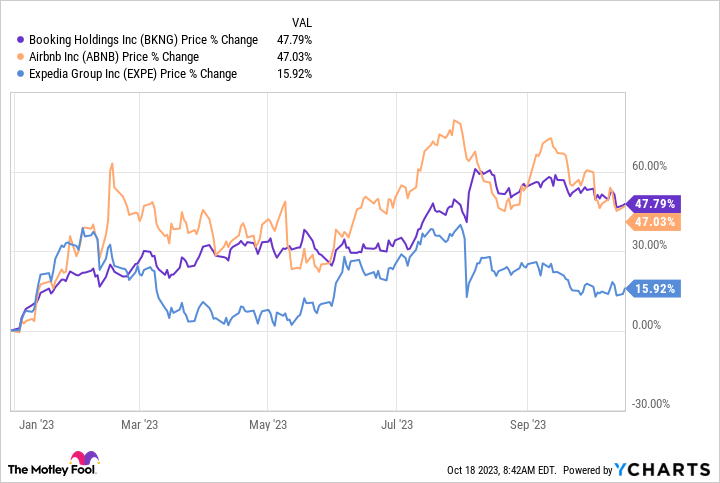

For the year, analysts forecast an 18% increase in revenue and a slowdown to 11% next year. Such lower growth rates could dampen expectations for the stock. However, the stock has earned impressive returns, far outpacing Expedia and matching the performance of Airbnb this year.

Furthermore, thanks to its rising earnings, its price-to-earnings (P/E) ratio is down from the beginning of the year. Currently, Booking Holdings sells for about 26 times earnings. Considering the rapid revenue and net income growth, this valuation makes the stock appear inexpensive despite this year’s performance.

Consider Booking Holdings

After years of failing to sustain growth, a bull market for Booking Holdings may have finally arrived. The rising stock price comes amid a rapid growth rate for the online travel industry. Moreover, after years of lockdowns preventing travel, Booking’s ecosystem can accommodate the pent-up demand for travel left over from the pandemic.

With rapid revenue growth, profits have rebounded significantly from year-ago levels. Such earnings increases place considerable downward pressure on the P/E ratio, a factor that should keep Booking Holdings stock flying higher.

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Airbnb and Booking Holdings. The Motley Fool has a disclosure policy.