JHVEPhoto

Investment Thesis

Booking Holdings Inc. (NASDAQ:BKNG) is in my mind a truly remarkable company. Their business is incredibly profitable, robust and benefits from a tangible and wide economic moat.

Consistent growth, a massive cash flows and a great product underpin their operations while continuous expansion into new forms of booking services and platforms has allowed the firm to stay relevant in a highly competitive market environment.

Unfortunately, shares are currently fairly valued at best leaving little margin of safety for a value-oriented investor to get involved.

While I truly love the company and its cash-generation abilities, the valuation is simply not attractive enough especially given the cyclicality of the travel industry.

Therefore, I rate Booking Holdings a Hold at present time and wait eagerly for an opportunity to build a position in the travel giant.

Company Background

Booking Holdings is a leading online travel company that offers a comprehensive range of travel-related services through its six brands: Booking.com, Priceline.com, KAYAK, Agoda, Rentalcars.com, and OpenTable.

The company’s business model is based on connecting travelers with travel service providers, such as hotels, airlines, car rentals, and restaurants, and earning revenue from commissions, fees, and advertising.

Booking Holdings operates in over 220 countries and territories and serves millions of customers every year.

While competition within the space is fierce with the likes of Expedia (EXPE) and Airbnb saturating the marketplace, Booking has managed to remain the industry leader thanks to a focus on customer service and a great loyalty system for clients.

Economic Moat – In-Depth Analysis

Booking has managed to generate a wide economic moat for its operations thanks to its massive scale, a focus on developing a reputable brand image, and tangible network effect benefits.

By establishing a reputation based on reliability and quality, many of Booking’s online platforms have become synonymous among travelers and service providers worldwide.

Booking Holdings | Booking.com

Its brands, such as Booking.com and Priceline.com, are synonymous with online travel booking and offer a wide range of choices, convenience, and reliability.

Booking Holdings also invests heavily in marketing and advertising to maintain brand image and increase customer awareness.

Furthermore, by operating multiple platforms each targeting a slightly different category and style of consumer, Booking is able to attract a greater portion of the total market into their booking system which ultimately helps increase the reach Booking has both on the demand and supply-side of the travel industry.

This reach creates a positive feedback loop between its supply and demand sides. The more travelers use its platforms, the more attractive it becomes for service providers to list their offerings, which in turn attracts more travelers, and so on.

This creates a virtuous cycle that enhances Booking’s value proposition and customer loyalty and makes it difficult for new entrants or smaller players to compete.

Booking also operates a large and diversified portfolio of travel-related services that cover various segments, regions, and customer preferences.

This allows Booking to leverage its scale and operational efficiency to offer competitive prices, negotiate favorable terms with service providers, and optimize its cost structure: another example of the network effect Booking benefits from compared to smaller platforms.

Finally, Booking Holdings has chosen to geographically differentiate the focus of its platform slightly compared to its key rivals.

The firm has developed a strong presence and competitive advantage in the European market, where the hotel industry is fragmented and dominated by independent and boutique hotels.

These hotels rely more on Booking Holdings’ platforms to generate demand, market their offerings, and provide customer service, which gives Booking Holdings more bargaining power and higher commission rates.

In contrast, Booking Holdings’ main competitor, Expedia, has more exposure to the US market, where the hotel industry is more consolidated and dominated by large chains, which have more bargaining power and lower commission rates.

Overall, Booking Holdings has a wide economic moat thanks to their massive scale allowing the firm to target multiple audiences with various platforms.

This in turn creates a virtuous network effect which allows Booking to negotiate with service providers for better deals which in turn further benefits the firm’s consumers and so on.

I also believe Expedia benefits from most of these advantages, but I like Booking’s focus on the European market and see this as a great benefit for the firm.

Financial Situation

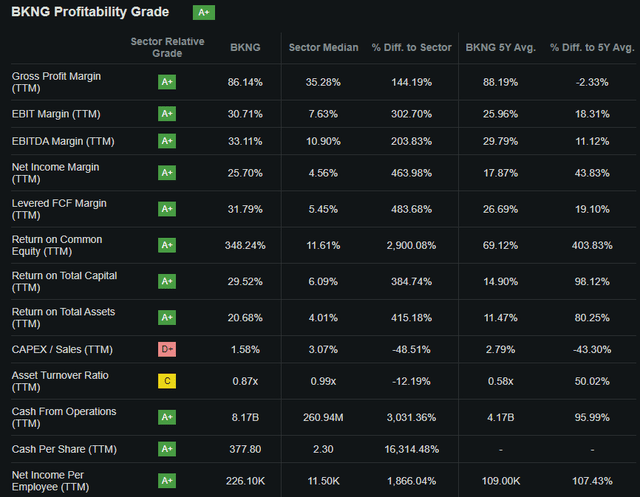

Booking has 5Y (FY23-FY19) average ROA, ROE and ROIC of 11.45%, 69.50% and 17.68% respectively. These returns are very healthy in my opinion with the firm tangibly outpacing inflation with their returns on both equity and invested capital.

When compared to chief industry rival Expedia’s ROA, ROE and ROIC for the same period of -1.45%, -14.94% and -0.75%, Booking has massively outperformed their largest competitor.

The firm’s WACC is currently around 12% which illustrates that Booking continues to generate higher returns on their investment than it costs the company to raise the capital needed for said investment.

Booking also has 5Y average (as measured from FY23-FY19) gross, operating and net margins of 90.74%, 25.93% and 18.00% respectively. The massive gross margin illustrates just how profitable their core operations are while the still significant operating margin suggests the firm is lean and efficient.

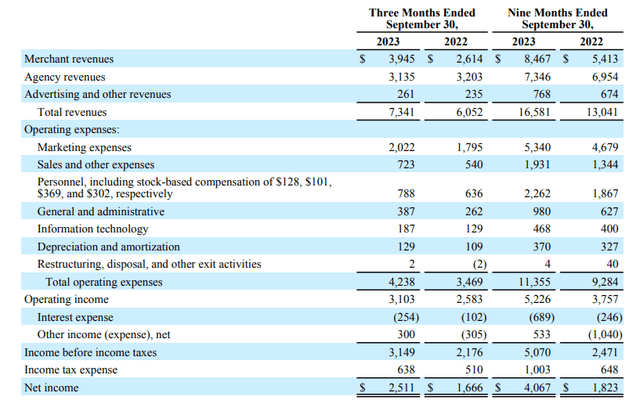

The latest Q3 FY23 for the firm was mostly quite positive indeed with Booking generating solid growth in total revenues of 21% YoY. These gains came thanks to solid total gross travel bookings demand and continued increases in room nights booked and merchant revenues collected.

Booking also managed to control operating expenses reasonably which increased 20% YoY as a result of increased marketing expenses and some increased personnel costs.

This left income before taxes up 19% YoY at $3.2B which was very encouraging indeed. The firm’s ROIC expanded to 39% while operating at a net margin of almost 26%.

Even when considering the last nine months leading up to the end of Q3, Booking Holdings has had a blockbuster year characterized by a 57% YoY growth in revenues and a net income of $4.1B, up 127% YoY.

Therefore, the upcoming Q4 results are absolutely expected to round off a solid FY23 with Q4 adjusted EBITDA estimated at just over $1.4B.

However, I do believe the Q4 results may begin to expose what has become a softening travel industry due to a recessionary macroeconomic environment placing pressure on consumers and corporations alike.

While the full year FY23 results should still be outstanding, I will be analyzing the upcoming results carefully to see what impact Booking Holding is noticing with regard to total booking volumes in particular.

Seeking Alpha | BKNG | Profitability

Seeking Alpha’s Quant calculates an “A+” profitability rating for Booking Holdings which I believe to be an accurate relative evaluation of the firm’s current fiscal situation.

By analyzing Booking’s balance sheet, we can see the firm has $5.9B in total current assets while total current liabilities amount to just $3.57B. This solid short-term liquidity leaves Booking with an excellent quick ratio of 1.35x and a current ratio of 1.44x.

These liquidity metrics are once again particularly impressive when compared to Expedia’s quick and current ratios of just 0.63x and 0.80x respectively.

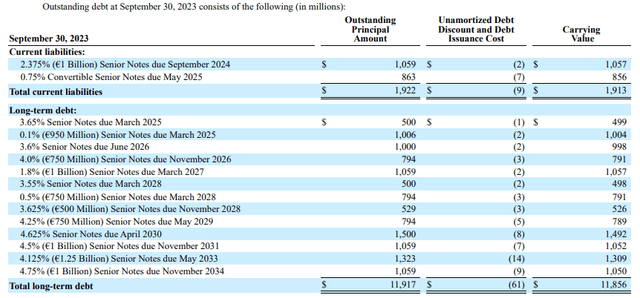

Total assets for Booking amount to $25.6B with total liabilities being $26.26B. This significant pile of debt consists mainly of a pretty massive $11.9B portion of long-term debt held by the firm.

While the total sum is quite large, I like how the firm has staggered its debt profile with a majority of notes maturing well after 2027.

Furthermore, the relatively low and fixed interest rates illustrate that Booking has grown utilizing sustainable and conservative financing methods. Booking’s unlevered FCF TTM is $7B which I believe illustrates the firm should face no problems in paying any maturities as they arise.

Moody’s rating agency affirmed an A3 credit rating for Booking’s senior unsecured domestic notes while assigning a P-3 rating for the firm’s domestic commercial paper. The outlook remains stable. Moody’s classifies “A3” credit ratings as being of “upper-medium investment grade” while “P-3” is defined as being of the lowest “Prime” quality.

Valuation

Seeking Alpha | BKNG | Valuation

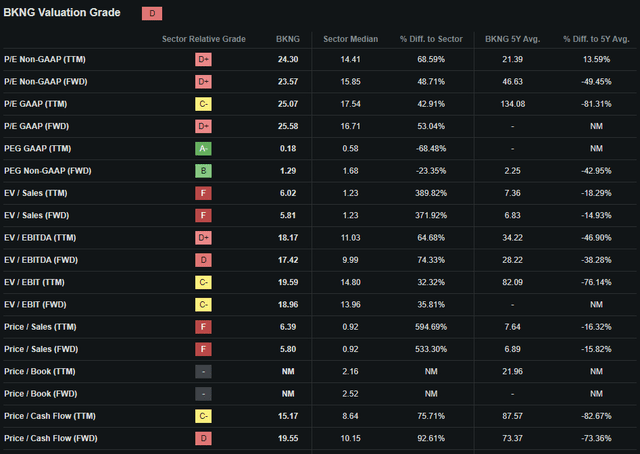

Seeking Alpha’s Quant assigns Booking Holdings with a “D” Valuation grade. I believe even this letter grade is an excessively pessimistic representation of the value present within the firm’s stock.

The firm currently trades at a P/E GAAP TTM ratio of 25.07x. This represents a massive 81% decrease in the firm’s GAAP P/E ratio compared to their running 5Y average.

This should come as no surprise as the firm has seen record profitability in recent quarters and previously held what I believe to be an overvaluation in share prices.

Booking’s P/CF TTM of 15.17 is reasonable while their Price/Sales TTM of 6.39x is still very elevated for my liking despite the potential growth on the horizon for the firm.

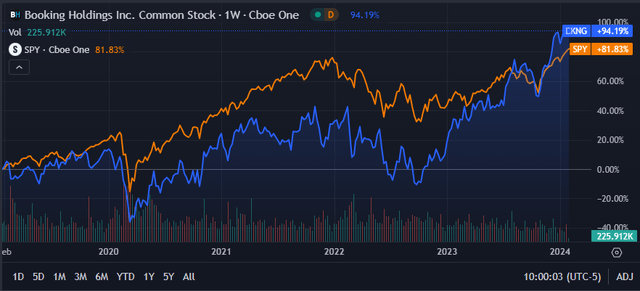

Seeking Alpha | BKNG | 5Y Advanced Chart

From an absolute perspective, Booking Holdings shares are trading at a pretty steep price relative to previous valuations with current share prices of around $3556 representing record highs for the firm.

Nevertheless, Booking shares have essentially matched the performance of the S&P500 tracking SPY (SPY) index fund all the while being more volatile than the ETF.

The Value Corner

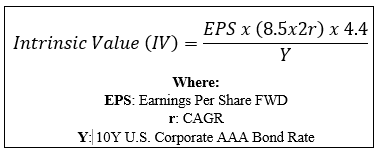

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can understand what value exists in the company from a more objective perspective.

Using the firm’s current share price of $3556, an estimated 2023 EPS of $150, a realistic “r” value of 0.08 (8%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $3411. This represents a fair valuation in shares.

A more pessimistic CAGR of 0.05 (5%) can be used to reflect a scenario where a recession causes Booking’s revenue growth to flatline while COGS remain roughly constant. This would leave shares valued at around $2576 suggesting a 38% overvaluation in the stock.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that Booking Holdings is trading currently at a fair valuation with no margin of safety present.

In the short term (3-12 months), almost anything could happen to share prices as markets tend to act more like voting machines rather than weighing scales over short-time periods. Given the fair valuation, I believe some downside pressure may exist should the Q4 earnings disappoint investors.

In the long term (2-10 years), I believe Booking Holdings will continue to be one of the largest and most influential booking service providers in the travel industry. The firm’s scale and network effect should continue to drive competitive advantages for Booking even amidst a changing travel environment.

Risks Facing Booking Holdings

Booking Holdings faces some acute threats arising particularly from the cyclical demand environment for leisure and travel along with the high levels of competition within the booking industry.

Booking is very susceptible to downturns in the demand for travel and leisure by consumers. As consumers become more wary of their spending during economic downturns, leisure and business travel tends to reduce significantly.

This places pressure on Booking Holdings as fewer clients utilize their service due to the overall drop in booking volumes taking place globally.

Booking Holdings also competes with other online travel agencies, such as Expedia, Tripadvisor, and Airbnb, as well as direct channels of travel service providers, such as hotels, airlines, and car rentals.

The firm now also faces competition from emerging players, such as Google, Amazon, and Alibaba, that leverage their technology, data, and customer base to offer travel-related services.

Any failure to innovate or provide consumers with the best booking experience could result in Booking Holdings losing out to any one of these key rivals.

While such a scenario may take significant time to occur, the technological advantage possessed by the likes of Google and Amazon could be very influential in the long run.

From an ESG perspective, Booking Holdings faces little tangible threats apart from a minor cybersecurity risk.

Booking Holdings relies on its information technology systems and networks to process, store, and transmit large amounts of data, including personal and financial information of its customers and partners.

The company may be vulnerable to cyberattacks that could compromise its data security, disrupt its operations, damage its reputation, and result in revenue loss or additional costs through legal challenges.

Nevertheless, the overall lack of any major environmental, societal or governance concerns means that I believe Booking Holdings may be a good choice for the more ESG-conscious investor.

Of course, opinions may vary with regards to ESG material and I implore you to conduct your own ESG and sustainability research before investing in the company if these matters are of concern to you.

Summary

Booking Holdings is a great business in my opinion. Their travel services are well tailored for each demographic of customer which allows the firm to capture a massive audience for their services.

Their scale and reach within the industry create a virtuous positive feedback loop for the firm which ultimately further drives growth in total bookings. Effective operational management has allowed the firm to capitalize on this growth with Booking Holdings now easily outearning their key rival Expedia.

Despite the FY23 full-year results only being released in late February, it looks like the period will be a record year for the firm. This sentiment appears to be shared by investors with the stock also reaching record highs with each passing day.

Unfortunately, while I admire the firm and its execution in FY23, I do not like the current share price due to the fair valuation not providing a sufficient margin of safety for potential investors.

Therefore, and despite my appreciation for their high-quality business model, I must rate Booking Holdings a Hold.