Editor’s note: Seeking Alpha is proud to welcome Vestmo Global Research as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

JHVEPhoto

Thesis

Our Buy thesis is that Booking Holdings (NASDAQ:BKNG)’s excellent business model will continue to drive earnings growth and positive price momentum at a time when the macro is positively aligned with the shares. Booking has sustainable long-term competitive advantages that create a moat around their business. Their globally recognized brands, massive scale, broad product offering, and low costs create network effects that lead to a highly profitable company generating strong earnings growth.

Outside the strong company fundamentals, the macro environment is also supportive of the stock. It has strong long-term price momentum, which is a good predictor of future share price outperformance.

What does Booking do?

Booking Holdings operates online travel agency websites that help customers find and book hotels, car rentals, airline tickets, vacation packages, and restaurant reservations. The company’s world-class brands include Booking.com, Priceline.com, Kayak.com, Agoda.com, Rentalcars.com and OpenTable.com. The value proposition for using Booking’s online travel agency websites include the ability to compare prices, get reviews, create itineraries across brands, book hotels, flights and cars all in one place, discover smaller properties, strong customer service, etc.

What is Booking’s revenue model?

The company makes money by charging a commission to hotels for bookings made through their websites (e.g., Booking.com and Agoda) or by purchasing travel inventory and reselling it to consumers on Priceline.com. They also earn advertising and referral fees on Kayak.com that allows customers to compare deals across hundreds of travel sites. Lastly, they are paid for other services like payment processing and yield management they provide to their travel partners.

Why Booking is an excellent company

Warren Buffett famously looks for companies with what he calls “economic moats” or durable competitive advantages that will allow them to deliver excess returns for a long period of time. These companies tend to outperform the market. We consider five sources of economic advantage – they are intangible assets, switching costs, network effects, cost advantage, and scale.

Booking has many of these competitive advantages, which should drive long-term profitability.

- World-class Brands: Booking has some of the most recognized and trusted brands in the travel industry, which drives customers to their websites.

- Data and Algorithms: The company has developed proprietary algorithms that are crucial to their customer’s experience.

- Sticky Consumers: Users are reluctant to switch once they become familiar with Booking’s websites and have their credit cards and preferences saved.

- Economies of Scale: Because Booking is so big, they can negotiate better terms on their marketing and technology investments and spread those costs over a large revenue base, which means it costs them less per user to acquire and serve their customers.

-

Network effect: Booking’s huge user base helps them secure more inventory from hotels, airlines, and car rental companies, which in turn attracts more users, creating a virtuous cycle for the company.

Q1 2024 results highlight a highly profitable company with strong earnings growth

Booking’s Q1 2024 results were very impressive with revenue growth up 17% YoY to $4.4 billion, Adjusted EBITDA up 53% YoY, and EPS up 76% YoY.

A key driver was growth in room nights booked with nearly 300 million booked across their websites, which was a 9% increase YoY driven by strong demand for summer travel bookings and, admittedly, an expansion in the booking window, which pulled some room nights from the second quarter into the first quarter. Room nights in alternative accommodations grew by 13% in the quarter and the number of global alternative accommodation listings reached 7.4 million, an 11% increase compared to Q1 2023. Finally, airplane tickets purchased on their platforms grew by 33% YoY in the first quarter.

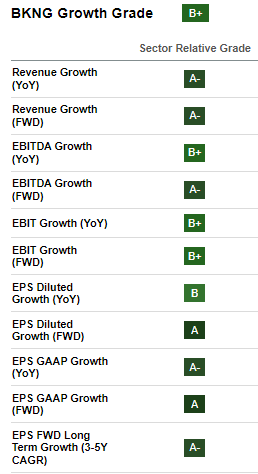

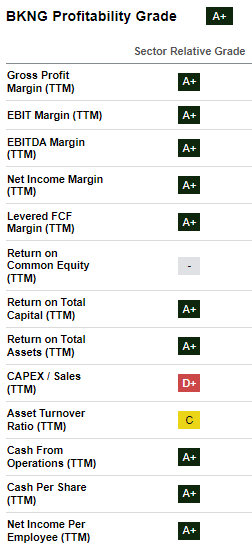

Across the board, the Q1 numbers were exceptional, which is illustrated by the A+ Profitability Grade Booking receives from Seeking Alpha Factor Grades and the fabulous Growth scores as well.

Seeking Alpha Growth Grades (Seeking Alpha)

Seeking Alpha Profitability Grades (Seeking Alpha)

Why we think Booking will continue to be a good investment going forward

The recent performance has clearly been impressive, but below we highlight 10 reasons we expect Booking will continue its positive earnings trajectory.

-

Continued momentum in Room Night growth: Q1’s 300 million room nights booked is a clear indication of robust demand that we expect to continue to drive EPS.

-

Increase in Direct Bookings: The company continues to focus on lifting the mix of nights booked directly on Bookings websites which have higher margins than those referred to them.

-

Expansion of Alternative Accommodations: Bookings for homes, apartments etc saw a 13% year-over-year growth in room nights, now accounting for 36% of total room nights. This new channel attracts a broader customer base and should drive incremental revenue.

-

Investments in AI and Technology: New AI tech should reduce costs, increase customer satisfaction and lead to increased repeat bookings.

-

Success of the Genius Loyalty Program: The Genius loyalty program is driving higher booking frequency and direct booking rates.

-

Connected Trip Vision: Customers that book trips combining flights, accommodations, and attractions increased by over 50% year-over-year. This means Booking captures more of the travel wallet and provides a better experience.

-

Healthy Air Ticket Growth: Booking’s new flight offering drove air ticket bookings up 33% which added a new revenue stream and potential for cross-selling other services on the platform.

-

Marketing Efficiency: Improved efficiency in marketing spend, particularly through direct channels, has led to higher ROIs on each incremental marketing dollar spent. The company’s continued focus is why we expect the gains to persist.

-

Positive Market Conditions: (See below) We expect continued strong global leisure travel demand and strong summer bookings.

-

Capital Return Program: Booking bought back more than $10bn in shares in 2023 ($6.6bn in 2022) in what was one of the largest buyback programs in the US market last year. The company bought a further $2bn in Q1. We expect these continued share repurchases to be a driver of EPS growth.

All the above positive drivers should lead to continued topline growth, margin expansion and earnings growth that we expect will deliver EPS at the top of the range of analyst expectations. If so, that would imply EPS growth of 61% in 2024 and 41% through 2025!

| Date | EPS | EPS Estimate | EPS High Estimate | Growth Rate High Estimate | Growth Rate Avg | Avg. No. Analysts |

| 2023 | 118.68 | |||||

| 2024 | 175.78 | 191.26 | 61% | 48% | 26 | |

| 2025 | 202.72 | 234.99 | 41% | 31% | 26 |

Booking Valuation: Attractive

Booking is currently trading 33% below its DCF fair value based on a discount rate of 7.7%, a perpetual growth rate of 2.4% and cash flows over the next 10 years sourced from an average of Wall Street analysts. The stock is also trading at a large 1-year forward P/E discount to its closest peers, which, we think, is unwarranted. If Booking were valued in line with the sector peers’ average of 28x P/E, that would imply 34% upside from the current 21x.

On the sector average P/E of 28x and the high-end 2024 EPS estimate of 191.26, the target price for the stock would be $5,300 vs. $3,800 at the time of this writing, for a 140% upside to the shares. There are therefore a number of upside valuation scenarios for Booking. Each one paves the way for material upside for the shares.

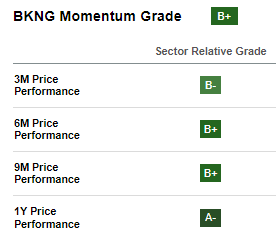

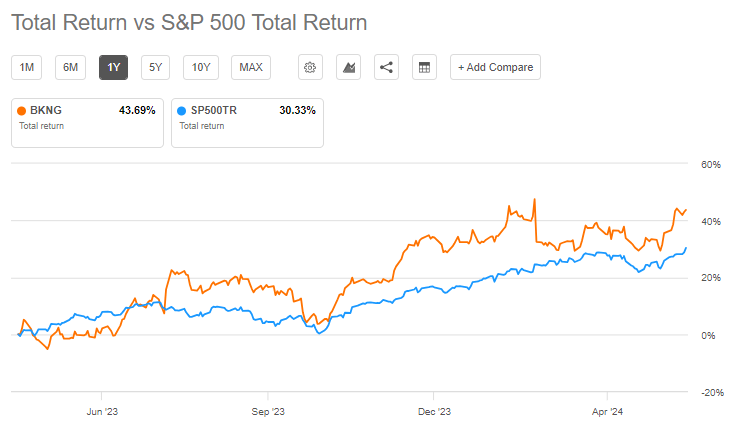

Positive Price Momentum

Positive long-term price momentum is one of the best predictors of future outperformance. See this article Momentum Investing: Picking Top Stocks and ETFs from Zach Marx, Seeking Alpha Quant analyst for more information. Booking’s long-term price momentum is strong and is rated “A-” on Seeking Alpha’s Momentum Grade. Supported by the strong fundamentals outlined above, we expect the stock to continue to outperform the market.

Seeking Alpha Momentum Grades (Seeking Alpha)

Booking Total Return Chart (Seeking Alpha)

Macro factors

Current market environment positive for Booking shares

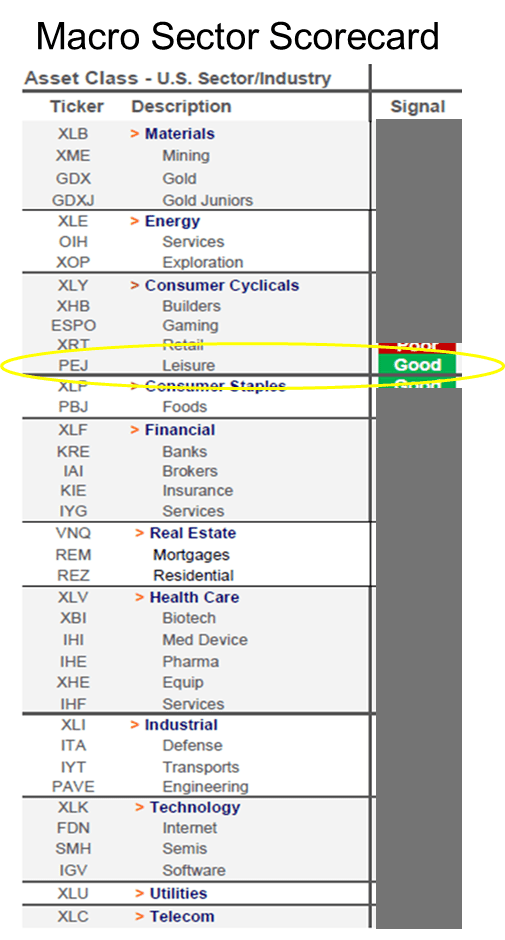

Different sectors outperform during distinct phases of the market cycle. The goal is to own great companies when their sector is also aligned with the current market climate. At Vestmo, we analyze the top-down dynamics to make sure that we are investing in the right stocks for the current phase of the market cycle. Our analysis spans four key areas: liquidity conditions, credit conditions, economic conditions, and equity conditions to deliver a final investment opinion on the overall stock market and individual sectors. Our top-down conclusion is that we are bullish about Booking.

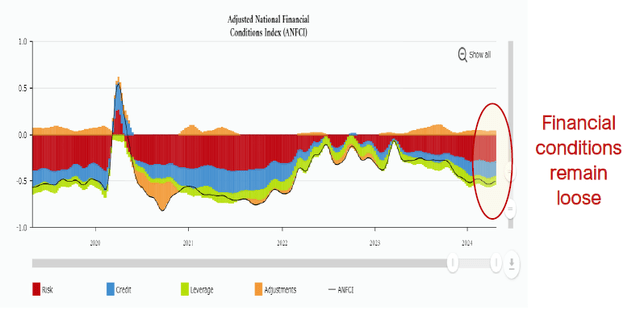

Liquidity Conditions

Global monetary policy is loose, which has driven equity markets and is also a positive for Booking’s consumer discretionary and travel sectors as easier access to credit encourages consumers to spend more on discretionary items and travel.

National Financial Conditions Index (FRED)

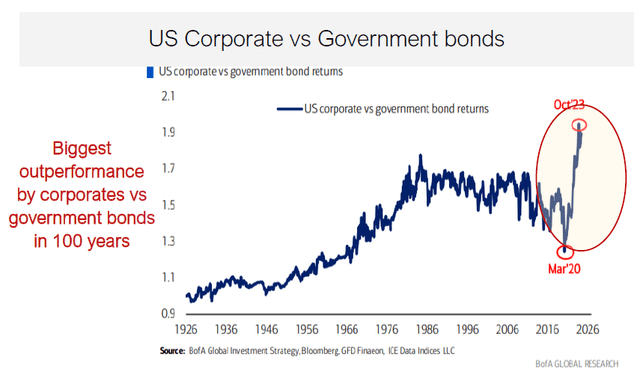

Credit Conditions

U.S. corporate bonds are strongly outperforming government bonds, which is a sign of robust corporate health and is again a positive for equity markets and the consumer discretionary and travel sectors specifically.

Corporate Bond Returns vs US Government Bonds (Twitter / BofA Global Research )

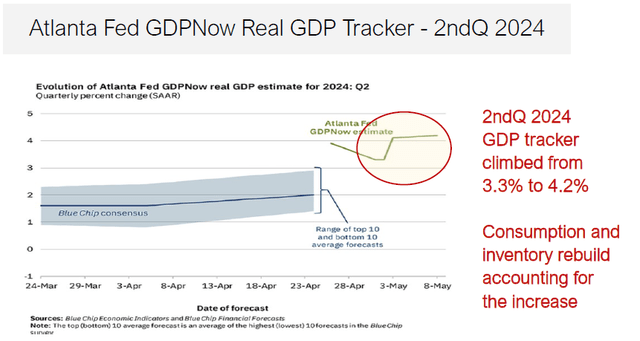

Economic Conditions

Economic indicators continue to show healthy GDP growth and consumer spending, which support Booking and the consumer discretionary and travel sectors.

Atlanta Fed GDP Now Tracker (Blue Chip Economics / Atlanta Fed)

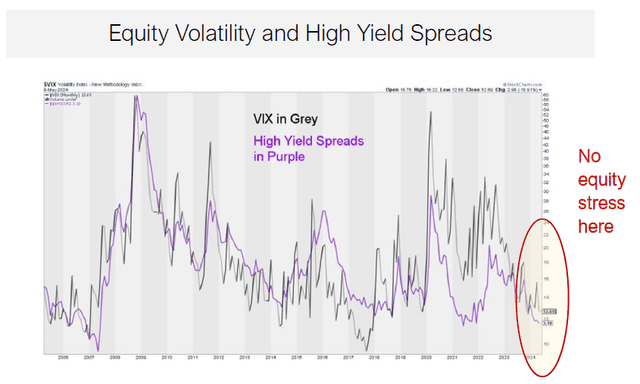

Equity Conditions

Reduced volatility and improving market sentiment align well with a favorable outlook for the consumer discretionary and travel sectors, which do well when consumer confidence is strong and markets are stable.

VIX and High Yield Spreads (StockCharts.com)

Bullish Macro Conclusion for Booking

The goal of reviewing the macro drivers is to determine if the current phase of the market is bullish or bearish for Booking’s leisure sector. Having gone through the analysis, we conclude that the macro is supportive for the Leisure sector, which includes Booking, given loose liquidity conditions, robust corporate credit health, healthy economic growth prospects and calm equity markets.

Sector Conclusion of Macro Analysis (Author’s calculations)

The goal is to own great companies, but only when the macro is aligned. We don’t want to swim against the tide.

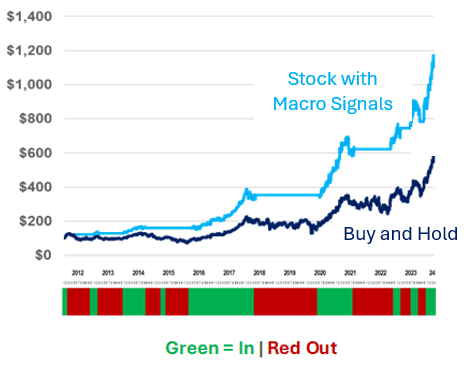

See the representative example below. When the market environment is positive for the stock, the periods marked in Green, we are long. Otherwise, in the other periods marked in red, we move to the sidelines. This leads to lower drawdowns and superior returns versus a buy and old strategy. Right now, the macro environment for Booking is positive, which bolsters our conviction.

Example of Long Only versus using a macro overlay to mitigate drawdowns (Author’s calculations)

Key Risks

The most obvious concern would be an economic slowdown, which we addressed above, in addition to worries of increased geopolitical unrest.

At the stock level, the key concerns would be that room night growth slows as the expanded booking window that flattered Q1 means Q2’s window is shorter. Analysts also have expressed concerns that Booking may need to spend more on marketing and headcount to maintain their growth in the face of heavier competition. We concede these are areas to monitor, but at this point the bullish factors we highlight above far outweigh the negatives.

Finally, more structurally, hotel chains are trying to acquire brands and build out loyalty programs to try to convince travelers to move away from Booking and other online travel websites and book directly on Marriott Bonvoy, Hilton.com etc. The obvious benefit of using an online travel website is the ability to comparison shop and create itineraries across brands.

Conclusion: Buy Booking Holdings

We believe Booking is a structurally great company that offers high growth and profitability, attractive valuation, with strong price momentum and is aligned with the current phase of the market cycle. We therefore rate the company a Buy.