- Market had been pricing as many as four rate cuts for next year

- But the BoE did not follow the Fed with dovish sentiment on Thursday

The Bank of England crushed hopes of a base rate cut early next year as it struck a hawkish tone in its final Monetary Policy Committee meeting on Thursday.

It opted for another rate pause at 5.25 per cent as expected but three members of the nine-member MPC voted for a hike to 5.5 per cent, disappointing expectations that the bank would follow the US Federal Reserve with dovish sentiment.

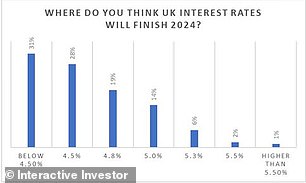

Markets had been pricing as many as four base rate cuts for 2024, with the first coming as early as March, and some forecasters even suggesting the rate could fall to just 3.75 per cent by year-end.

Optimism: The City had been pricing as many as four rate cuts for next year

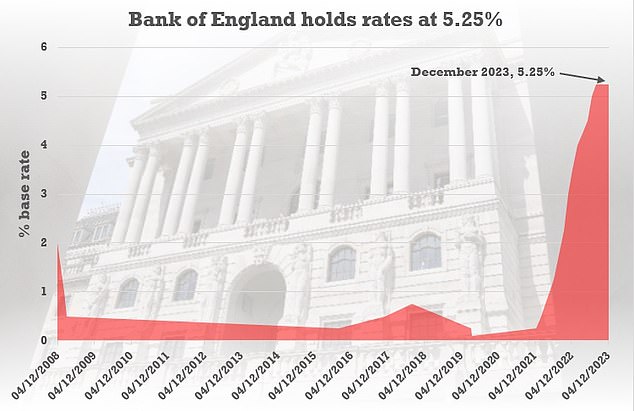

Successive rises: The BoE has hiked base rate 14 times since December 2021, but the rate has stalled at 5.25% since August this year

But James Lynch, fixed income investment manager at Aegon Asset Management, said the voting split and the tone of the MPC meeting will likely see market rate cut expectations ‘pushed back a few meetings’.

Market bets on looming rate cuts were ramped-up over the last fortnight in response to easing wage growth – a key driver of inflation – and weaker GDP performance, which demonstrates the impact of previous hikes on the economy.

Lynch added ‘Even though the BoE are sounding admire they are resolute in keeping rates on hold ultimately they are beholden to the data, which we would expect to still weaken from here which means at some point in Q1 2024 they will at least have to talk about cuts.’

The BoE has hiked base rate 14 times since December 2021, helping to drive consumer price inflation from as high as 11 per cent last year to 4.6 per cent as of last month.

Interactive Investor users expect base rate to fall next year

But the rate remains well above the BoE’s target of 2 per cent, which it does not expect the UK will reach until the end of 2025.

While data is moving in the right direction, MPC members still believe key indicators such as services inflation and wage growth remain too high to consider rate cuts.

Developed markets economist at ING James Smith said: ‘Markets are right to be thinking about a series of rate cuts next year.

‘The Bank itself acknowledged in the latest statement that both private-sector wage growth and services inflation – both of which are labelled as key metrics for the BoE – have come down more than it expected.

‘While services inflation is likely to be sticky in the 6 per cent area into early next year, we expect both this and wage growth to reach the 4 per cent region next summer.

‘We think that will be a catalyst for rate cuts to begin. Our current forecast is for an August rate cut.’

When will the BoE cut rates?

The most recently available data compiled by HM Treasury shows an average of City forecasts point to consumer price inflation falling to 2.5 per cent by the end of next year – just ahead of the BoE’s 2 per cent target.

And the City is negative on the UK’s growth prospects, forecasting on average for GDP to extend by just 0.4 per cent for the entire year.

Both forecasts are indicative of expectations that the hiking cycle has already peaked, despite BoE efforts to discourage dovish pricing.

Goldman Sachs Asset Management believe base rate will fall by as many as much as 1.5 percentage points to just 3.75 per cent by the end of next year.

Gurpreet Gill, macro strategist for global fixed income at GSAM, said: ‘Momentum in UK economic activity has stalled, with weakness across most sectors including consumer-oriented services—a pivotal driver of growth.

‘We have also seen a noteworthy deceleration in wage pressures.

‘The confluence of sluggish growth momentum and abating underlying inflation pressures mean we expect the Bank of England to begin rate cuts from May 2024.’

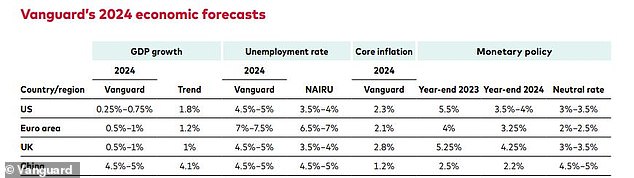

Predictions: Vanguard’s interest rate forecasts for next year are less optimistic than others

Asset management giant Vanguard is less optimistic, forecasting that cuts will not take place until ‘mid-2024’ and base rate will be 4.25 per cent by year-end.

The group said: ‘Despite more than 5 percentage points of monetary policy tightening in the last two years, inflation in the UK remains elevated relative to other advanced economies.

‘This is partly because the UK is suffering from the worst of both worlds—a US-style labour supply shock and a euro area-style energy shock

‘With services inflation elevated and wage growth resilient, we expect interest rates will need to stay elevated for an extended period. In our base case, we expect the bank rate to remain at 5.25 per cent until at least mid-2024, after which we expect a gradual easing cycle to begin.’