Stephen Brashear

A recent unexpected The Boeing Company (NYSE:BA) plane nosedive incident was said to injure 50 passengers, including 1 critically. The crew members were so injured in the incident, they were unable to help injured passengers. This comes on the heel of the door blowing out from an Alaska Airlines flight, which has been followed by rumors that Boeing might purchase Spirit AeroSystems (SPR).

There were a number of interesting comments on the article:

If it’s a Boeing, I definitely ain’t going.

Ground Boeing.

Time to go Airbus.

The Federal Aviation Administration’s (FAA) audit of Boeing’s 737 MAX production process after a panel blew off on an Alaska Airlines jet in January failed 33 of 89 tests, the New York Times reported, on Monday.

To us, this is clear evidence of a sentimental shift reported elsewhere. The demand is there, and individuals are using new booking tools to avoid flying Boeing. United’s (UAL) CEO has asked Boeing to stop work on the Max 10 planes and move back to the Max 9 given an unknown timeframe on certification for the new plane.

That combination certifies our worst fear: that Boeing’s brand is dying.

Boeing Financial Results

Boeing is one of the two largest aircraft companies in the world along with Airbus (OTCPK:EADSF). China is looking to make an entrance; however, at this time we don’t seem them as having a path to true dominance. Even if they succeed in building a truly competitive airplane, which they haven’t, we expect Europe and the U.S. to put export restrictions to prevent competition.

The strong entrenched demand from flying has enabled continued financial strength.

The company managed to earn $3 billion in FCF for the most recent quarter, with $22 billion in revenue. Core loss per share was still negative. Versus a $110 billion market capitalization, the company has a double-digit FCF yield based on its last quarter, which would normally show value from such a high quality company central to American industry and transportation.

In an ordinary world, it would be a great time to invest. However, it doesn’t count the massive risks facing the company.

Boeing Segments

The company operates in three segments. It’s commercial segment, defense segment, and global services.

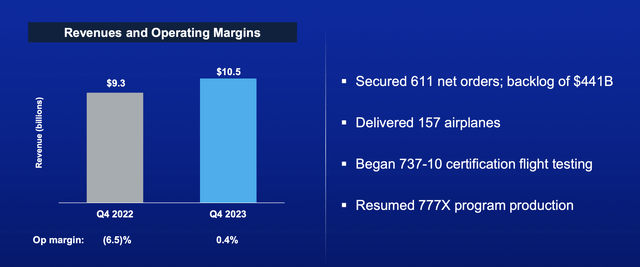

The company’s commercial segment is its largest, with more than $10 billion in revenue and a strong YoY improvement in both margins and revenue. The company delivered 157 airplanes and secured 611 net orders while working to get its Max10 certification in the last quarter, the same plane that United has asked Boeing to stop making.

The issues of United’s making are clear with delivery halts. Airbus delivered 735 commercial aircraft in 2023, with a staggering 2094 net orders. For perspective, Boeing delivered 528 commercial aircraft, with 1314 net orders. It’s worth noting that Airbus’ market cap is only 25% larger than Boeing, and the company doesn’t have the same issues.

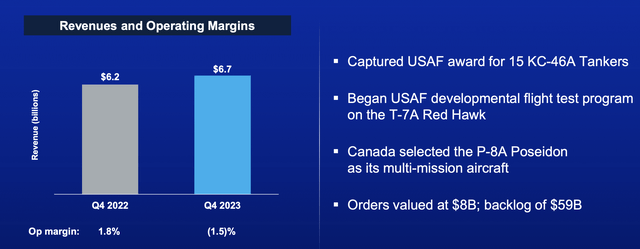

Part of Boeing’s strength is the company’s defense business, backed by the massive scale of U.S. military spending. The company managed to grow revenue by almost 10% here in the quarter, but at the cost of margins. Still, it has continued to see strong success for its aircraft, and has a massive backlog that it continues to grow.

While we don’t see that the company will have trouble earning contracts, the business is failing strong cost pressures. The company has continued to report losses in major programs as it faces a government that is pushing back on military programs having uncapped costs. More so, it’s facing continued competition in space, with numerous startups focused on just space.

At the end of the day, not only is competition increasing in segments, but the company is dependent on U.S. military spending. Should that decline substantially, it could be a strong negative impact on this business.

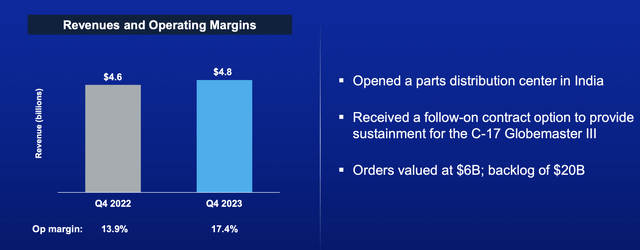

Last is the company’s services business. There’s nothing really significant to discuss here, it’s just under 25% of revenue. Margins remain strong, and the company has a backlog of about 1 year. We do expect this business to remain strong with minimal competition, however, making up <25% of revenue it by itself doesn’t carry the company’s valuation.

More importantly, it’s negative impacted by any declines that occur in the company’s commercial and military segments.

Boeing Shareholder Returns

The company’s ability to drive shareholder returns at the end of the day is what’s at risk for the foreseeable future.

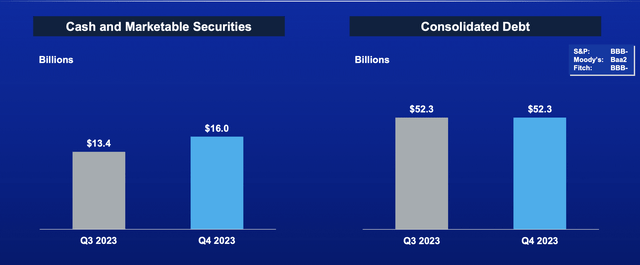

The company has consolidated net debt of $46 billion, a relatively substantial amount of debt for a company struggling to make profits. A refinancing of this debt yield at 4% higher rates could cost the company almost $2 billion annualized. That’s almost 50% of the company’s FY 2023 FCF and shows the impact of the debt load it’s built up, primarily to drive repurchases.

The company started a big focus on shareholder returns a decade ago when times were better, spending almost $60 billion in returns, including almost $40 billion in repurchases. We expect shareholder returns to remain incredibly weak in the foreseeable future. Not only is the company’s FCF weak, but it’s being given ultimatums and pressure from regulators.

There’s also an entirely separate argument that at the end of the day, the company’s problems stem from re-adapting the 737 while Airbus built a new plane. That pressure might increase as new issues are found. A new plane model can cost close to $20 billion, and take years, setting back the company heavily.

The net result is, as the Boeing brand dies from impacts, we recommend holding off on any investments despite a tempting price.

Thesis Risk

The largest risk to our thesis is that the company can easily resolve its problems. Global airplane demand is growing rapidly, and the company is still a major competitor. It’s done some impressive things without having a new platform to compare to Airbus. And defense spending has remained high with numerous conflicts.

All of that could result in Boeing recovering and switching to generating strong returns.

Conclusion

The Boeing Company’s brand is dying. Comment sections about the company indicate that users view the brand as substantially less valuable. The same is true when it comes to actually making a booking; major airline booking groups have shown that customers are concerned about Boeing and the associated reliability. That is a massive impact.

The company’s commercial segment is under substantial threats. Customers are mad at the company and considering Airbus as a major alternative. The defense segment is struggling with margins and while it has minimal competition, it’s facing pricing pressure. This combination of effects can hurt The Boeing Company’s ability to drive future shareholder returns, making it a poor investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.