Stephen Brashear

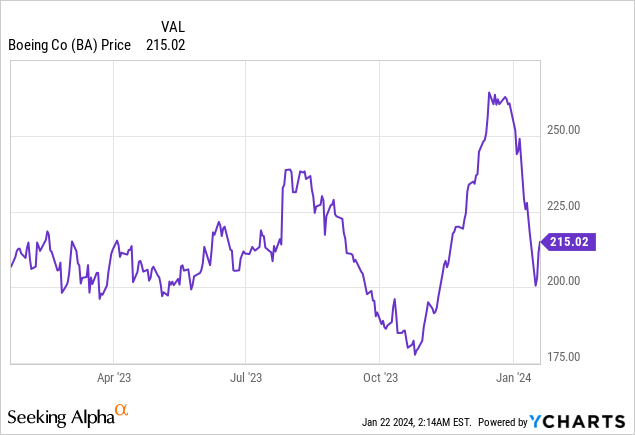

The Boeing Company’s (NYSE:BA) stock has been down since the Alaska Airlines (ALK) flight incident involving a plug door of one of its 737 Max coming off during mid-flight. It has since recouped some of its losses as charted below which may be because of some new jet orders, but, the reality is that between crashes and technical glitches, the Boeing 737 Max flight path remains problematic given the long list of issues.

This thesis aims to take a critical look at the outsourcing of the fuselage (the main body of the aircraft) to identify areas where artificial intelligence can be applied to improve quality, in a more profitable manner too. Also, for those looking to buy the dip less than one week away from the fourth quarter 2023 earnings, some of the points highlighted can also serve as “food for thought” for the quality review to be performed by the independent adviser recently appointed by Boeing.

The Incident and Implications on Finances and Quality

First, coming back to the latest incident, which involved a plug door, or one placed to fit the gap when an emergency exit is not present, it came off shortly after the aircraft took off on January 5. The incident follows a series of problems encountered by the Max program since its launch, marked by two fatal crashes in 2018 and 2019.

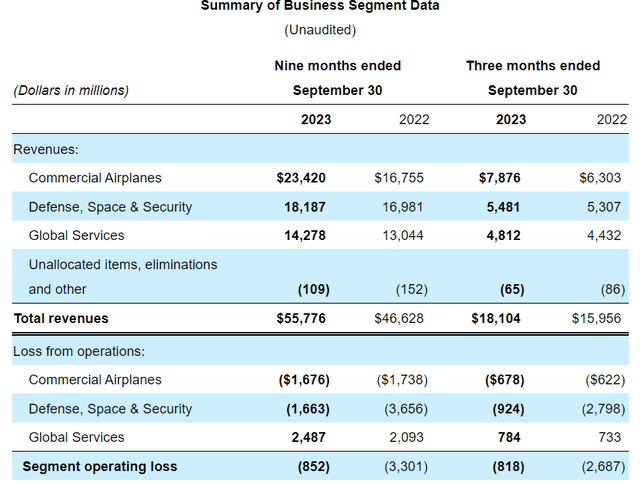

Then it comes as no surprise that financial results have been impacted as shown below for Commercial Airlines, Boeing’s largest segment which operated at a loss of $1.676 billion for the first nine months of 2023 as shown below, mostly as a result of not being able to sustain deliveries, but there are also costs incurred in inspections and remedial actions taken as I detail later.

In addition to the financial implications, these incidents could slow down the commercial and industrial dynamic that Boeing managed to boost after providing several assurances that detailed verification was being done. For this matter, the latest order by India’s Akasa Air specifically covers Max 8-200 and single-aisle Max 10 planes, not the Max 9 planes which are under investigation.

Next, coming to the origin of the problem, the only certainty at this stage is that the incident again implies Spirit AeroSystems (NYSE:SPR), one of Boeing’s top suppliers specializing in aerostructures. Earlier, the same supplier was again held responsible after Boeing was forced to pause some 737 Max deliveries, due to poorly positioned parts connecting the rear of the fuselage to the vertical tail. Another quality issue was fastener holes not conforming to Boeing’s specifications detected in the rear pressurization bulkhead of certain 737 Max planes.

Therefore, the 737 Max, launched in 2011 to counter the Airbus (OTCPK:EADSY) A320neo boasts better fuel efficiency than its European competitor but has seen slower adoption due to doubts about its reliability. Now, this problem is not solely due to Boeing’s supplier.

Supply Chain Issues Cost Money, Divert Focus away from Production, Setting the Stage for AI

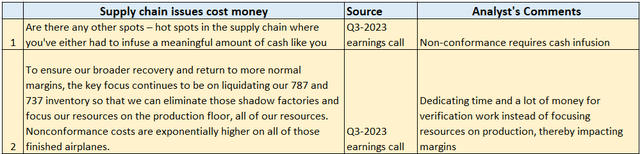

Looking at the supply chain, in addition to reducing costs, the aim of outsourcing aerospace construction is to drive stability and predictability so that Boeing can increase its rate ramps and reduce backlog. This is not happening and, according to Brian West, Boeing’s CFO, the fuselage problem is “a step back from that stability goal”.

Now, these inspection procedures can be quite involved as there are hundreds of holes to be checked including X-ray screening with previous inspections concerning about 75% of the 220 inventoried airplanes. Add to these the additional workload following the latest incident as regulators and safety agencies demand more thoroughness. In this respect, the FAA (Federal Aviation Authority) has ordered 171 Max 9 planes fitted with a door plug to remain grounded as data from the initial inspections are assessed.

Now, more verifications will further impact deliveries, as, according to the CEO, Dave Calhoun, “more than 100 of Boeing’s staff are embedded” doing checks, instead of supporting production. This will in turn impact revenues and profits as supply chain issues cost money as tabled below.

Table built using data from (www.seekingalpha.com)

Furthermore, when you hear about “armies of people from Boeing and the supplier (Spirit) working on this issue” to check or supervise the verification of holes as part of a quality check, without any mention of data (such as those from sensors), it seems to me that Boeing is focusing more on manual checks instead of taking advantage of the power of AI for outsourcing purposes as I further detail in the table below.

Table built using data from (www.seekingalpha.com)

Here, I am not talking about sophisticated robotics or innovative ChatGPT-style applications enabled by Generative AI but, commonly-available analytics features of more traditional flavors of the technology.

In this respect, analysis of vast amounts of data originating from sensors found all over the fuselage using advanced machine learning algorithms can produce actionable insights that can help in detecting alerts before they escalate into an incident. For inspection purposes, AI can also be used to recognize certain patterns that can evade human analysis or accelerate the speed at which flaws are found.

AI Can Improve Quality while Reducing Operating Losses

Furthermore, the type of faults encountered, namely loose parts in Max 9 jets with door plugs, appears to be the result of both repetitive and complex tasks as some bolts have to be intentionally left loose since they are secured with pins while others have to be tightened. Now, whether it is bolt tightness inspection using AI image recognition technology or using deep learning to detect loose bolts in real-time, there are opportunities for higher penetration of artificial intelligence in Boeing instead of relying on armies of staff to manually check each bolt.

Thus, after 2023 was the year of the “builders” of AI, like Nvidia (NASDAQ:NVDA) with its H100 GPU chips or Microsoft (NASDAQ:MSFT) with its Azure intelligent cloud infrastructure, 2024 should logically be the year of adoption, and, according to investment firm Oppenheimer, Generative AI could transform every sector including Industrials through a higher degree of automation.

Looking specifically at the supply chain and operations in advanced manufacturing, researchers at McKinsey estimate potential productivity gains in the 1.4% to 2.4% range of industry annual revenues. Assuming the midpoint of 1.9%, and based on BCA’s annualized revenues of $31,227 million as calculated in the table below, I obtain gains of $593.3 million (31,227 x 0.019). Now subtracting these gains from the annualized losses of $2,235 million for BCA, the segment loss comes to $1,641 million. This in turn reduces Segment operating loss from $1,136 million to $817 million.

Table built using data from (www.seekingalpha.com)

Now, this is just an estimate, and AI-enabled productivity gain alone is not sufficient to toggle the company towards segment profitability but, if you add in faster delivery time as a result of more employees producing planes instead of inspecting them, it certainly can, namely by accelerating the income flow.

Now, to be fair to Boeing, it does have advanced safety analytics to proactively mitigate risk. This includes flight data analytics or harnessing the power of big data to maintain safety standards while reducing costs. However, if I am writing this thesis today, it means that things have not worked out as intended. In this respect, the problem is that Boeing’s analytics suite which has been built using data from tens of thousands of flights and other contextual resources seems more geared at inflight safety, not at highlighting defects which are already present since day one.

/flight-operations/flight-data-analytics/advanced-safety-analytics (services.boeing.com)

In other words, these do not detect supply chain-related issues which need a different set of AI tools. Now, in addition to being accessible to Boeing and Spirit employees, such tools should also be extended to airline maintenance personnel to raise the confidence level in the Max. As such, these tools could be integrated into Boeing’s Parts and Distribution Services website whose objective is precisely to optimize clients’ supply chains.

Boeing is a Hold while Waiting for an Update on Quality

This thesis privileges a transverse approach to solving quality problems, or one that avoids finger-pointing as it neither puts into question Boeing’s strategy to outsource fuselage-related works to Spirit, nor the latter’s corporate culture of rapid production and delivery to meet its client’s delivery target. On the other hand, given the lingering issues, it calls for using a strong dose of AI to streamline tasks before the manual inspection.

Also, given the gravity of the situation, relying on data with reports signed jointly by the client and the supplier can result in more objectivity across the two organizations thereby reducing dependence on individuals or hierarchies. Here, I have in mind the alert raised by one of Spirit’s former quality auditors about defects related to bulkhead holes being improperly drilled, but, he seemed to have been ignored. This was in October 2022, nearly a year before this critical defect was discovered by Boeing.

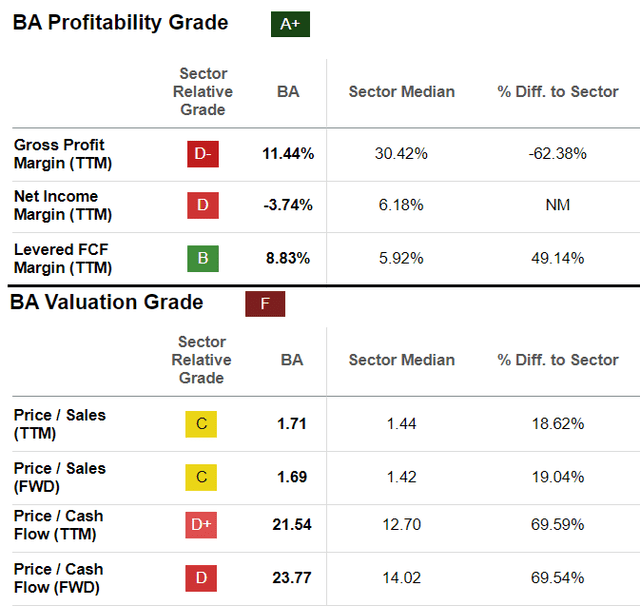

Looking at valuations, the stock already has a profitability grade of A+, thanks mainly to superior levered FCF margins as shown below. In contrast, its valuation score of F suggests that it is not a buy-the-dip opportunity at the moment. Therefore, I believe that Boeing is more of a Hold, as it is not at risk of suffering from a sudden erosion of its market share, predominantly thanks to the duopoly nature of the passenger aircraft manufacturing industry.

As for the price action, a lot will depend on the free cash flow to be generated for fiscal year 2023. The guided range is $3 billion to $5 billion, but, during the last reported quarter, Boeing’s management appeared skewed toward the lower end due to fewer 737 deliveries. The problem may be exacerbated in case personnel is redeployed to restore recently grounded planes instead of working on new planes to be delivered.

Finally, for those following the stock, it is important to obtain a management update as to the changes being brought as part of the quality control measures, and the way these are put into practice, as proceeding in the usual way involving armies of employees will only hurt profits.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.