Mario Tama/Getty Images News

Boeing (NYSE:BA) stock looks to be in a difficult situation still post-pandemic, but future outlooks are generally positive, with strong EPS growth on the horizon. Nonetheless, recent safety concerns regarding its airplanes create market share risks and a potential effect on short-term revenue.

Safety Concerns

Boeing has been facing significant challenges impacting its stock performance, and that could contribute to further volatility. The grounding of 171 MAX 9 planes by the Federal Aviation Administration, or FAA, on January 6th is important for investors to consider. It was a decision made pending inspection and maintenance requirement approvals due to safety concerns. This was largely in response to a mid-air blowout of a cabin panel on an Alaska Airlines 737 MAX 9. Earlier incidents contributing to the decision include engine fires and emergency landings involving United Airlines Boeing 737 MAX planes. There have also been manufacturing issues with the 787 series.

The 737 MAX series was under severe scrutiny following fatal crashes in October 2018 with Lion Air and in March 2019 with Ethiopian Airlines. The incidents caused 346 fatalities, leading to the grounding of all 737 MAX planes for almost two years. Boeing’s safety protocols and aircraft design then came under intense investigation.

The company has now appointed retired U.S. Navy Admiral Kirkland Donald as an independent adviser. He will help to evaluate quality practices at Boeing Commercial Airplanes and look at the supply chain. This is seen as an important move to stabilize reputational concerns. The stock is down almost 16% YTD.

The recent groundings have caused frustrations for airlines, including United and American. Production issues at Boeing have also affected airlines’ ability to capitalize on demand. This is causing airlines to consider diversifying their suppliers, causing concerns over market share losses and competition, but firms like Airbus (OTCPK:EADSF) already have full order books, so there are limited alternatives.

Financial Outlook

I think Boeing stock doesn’t look that strong financially, and even putting the recent serious safety concerns aside, I will not be looking at Boeing for my investment portfolio, which is focused on value or growth at a reasonable price.

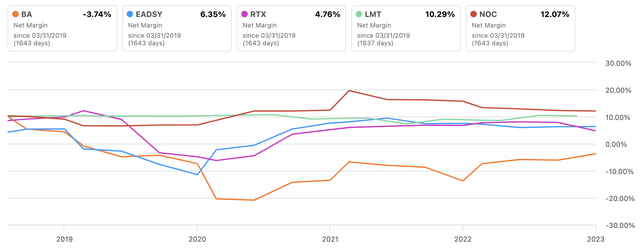

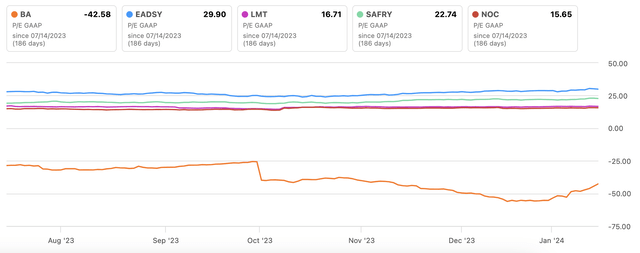

The firm has the lowest net income margin relative to its peers charted above, and its five-year average for the metric is -6.07%.

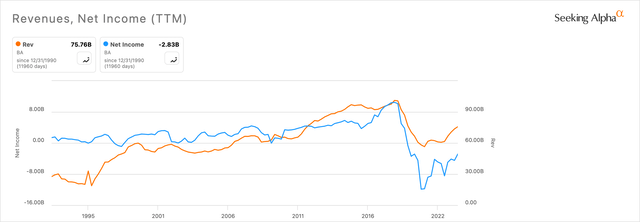

In addition to net income concerns, the firm’s revenue growth rates are poor on a 10-year basis at -1.16% but much better over the last year, at 23.34%. This is largely due to a post-pandemic recovery and a notable 10% increase in aircraft deliveries—a total of 528. The 737 is the most popular order, and the recent safety concerns could mean a reduction in revenues as a result.

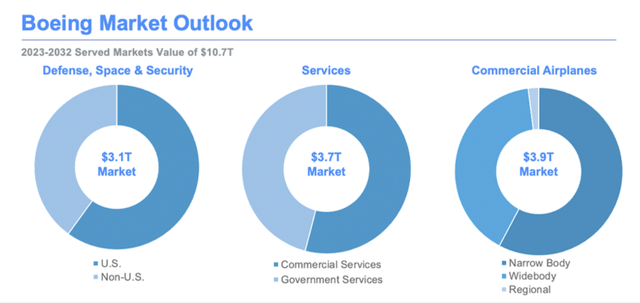

The pandemic impacted the aerospace industry severely. Boeing’s 2020 Market Outlook reflected the challenges from COVID-19, projecting a total market value of $8.5 trillion in the next decade at the time; that was a reduction from $8.7 trillion the year before. The forecast additionally indicated that a recovery from the crisis would take several years.

The rhetoric has now changed, with a served market value of $10.7 trillion projected for the next 10 years, with commercial airplanes being the largest segment:

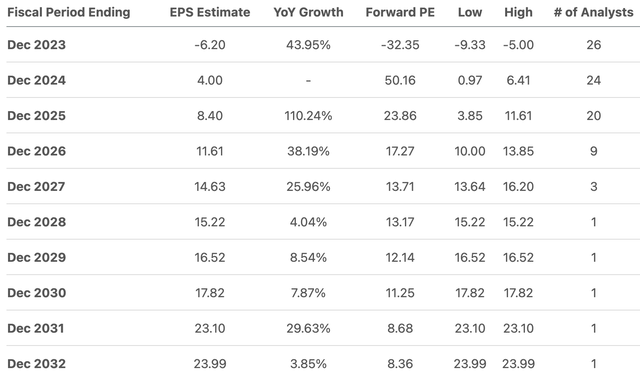

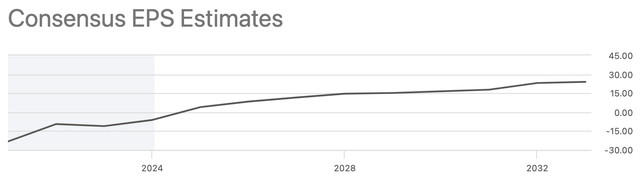

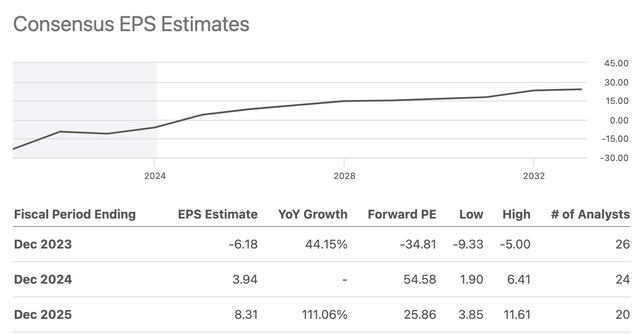

Consensus earnings estimates for the firm are now very strong, considering where the company was financially three years ago. The average YoY growth expected in the next ten years, including December 2023, is 27%, according to Seeking Alpha’s data.

Likely Fairly Valued

It is difficult to accurately assess the valuation of the firm at the moment relative to peers, as it has a significant negative EPS, something its competitors do not have:

Considering the difficulties the company is currently facing, I think it is plausible to assess the stock as fairly valued. It has struggled to recover meaningfully since the pandemic and has experienced volatility, which I expect to ease in time as future earnings estimates come to fruition, and the company continues to maintain a promising recovery. The safety issues recently that caused groundings are nonetheless severe concerns and could inhibit growth in the medium term, meaning the stock could be slightly overvalued at the moment, depending on how the events unfold.

Risks

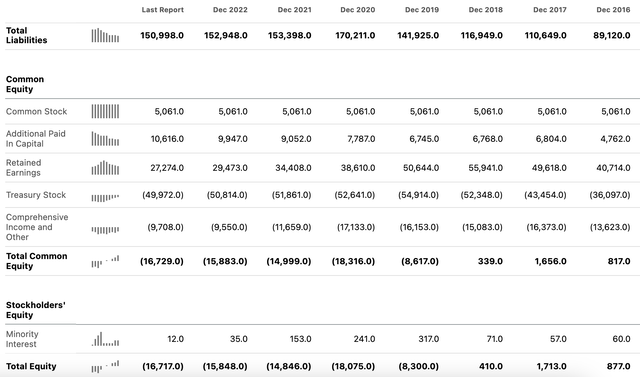

The company has a poor balance sheet, with negative total equity at the moment and liabilities that increased significantly around the time of the pandemic. It is going to take time for the balance sheet to stabilize again, and this should be a major concern to investors looking for strong returns from Boeing stock as a contrarian investment at this time.

In addition, if the company fails to navigate its safety concerns and regulatory approvals happen more slowly than anticipated, the stock could see a slower return to normal earnings levels and experience inhibited near-term growth, underperforming current analyst estimates as a result. This depends on what the FAA and the European Aviation Safety Agency, or EASA, decide and how well the company continues to address the severe issues with its planes in the last decade that have led to fatalities.

Q4 Results Outlook

Boeing’s next earnings results are expected on the 31st of January, and there are specific elements I think are important to examine when they are released.

The number of new orders and aircraft deliveries will be crucial, especially considering the recent safety concerns and how this may affect the company’s revenue for this quarter and next year. In addition, any changes in production rates for 737 and 787 models will be critical in assessing the status of issues surrounding these models at the moment.

I will also be looking for continued earnings recovery overall. After the steep decline the company’s financials faced from the pandemic, the firm is expecting its first positive EPS in its next financial year, so investors should be looking for continued progress toward this goal.

If the consensus EPS GAAP estimate of -$0.21 is met or exceeded, I will expect the stock to be in for a rally and for growth to occur in the price as the EPS growth rates continue. However, the valuation of the shares should moderate this.

Additionally, I’ll be keeping an eye out for the defense, space, and security segment, as there could be a continued uptick in revenue from this division as it relates to increased defense spending globally at the moment. I’ll also monitor the services division to ensure this area doesn’t show any signs of major concern.

Conclusion

Boeing is going through a difficult time, both as a result of the pandemic and related to the serious safety concerns around its MAX planes. Although future earnings growth looks promising, the current valuation makes me uncertain that investors will see long-term returns worthy of buying the shares. My analyst rating for Boeing stock is a Hold.