Stefan Lambauer/iStock Editorial via Getty Images

I’ve been following Gol Linhas Aéreas Inteligentes S.A. (OTCPK:GOLLQ) for a while and while many airlines received a buy rating driven by my independent stock valuation model, Gol was not one of those companies. In May 2023, I pointed out that Gol Stock looked like a buy but in fact, was not driven by its leverage. Less than a year later, the company filed for Chapter 11 bankruptcy. In this report, I discuss the reasons for the Chapter 11 filing and what consequences there may be.

Gol Faces Debt Hurdles

Gol Linhas Aéreas Inteligentes S.A.

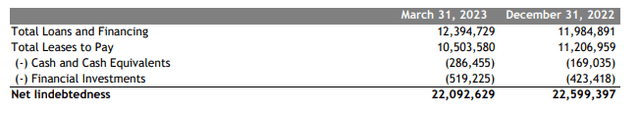

When I analyzed Gol back in May 2023, what I pointed out is that its cash pile is looking slim in comparison to its debt pile. Its loans totalled R$12.4 billion while its cash, cash equivalents, and marketable securities were a little over R$800 million covering just 6.5% of its debt and 3.5% when we include the leases to be paid. Over the course of the year, there has been progress and the net debt position dropped from R$22 billion to R$19.2 billion and its cash and equivalents covered 10% of its debt and 5% when including the lease payments due.

Gol Linhas Aéreas Inteligentes S.A.

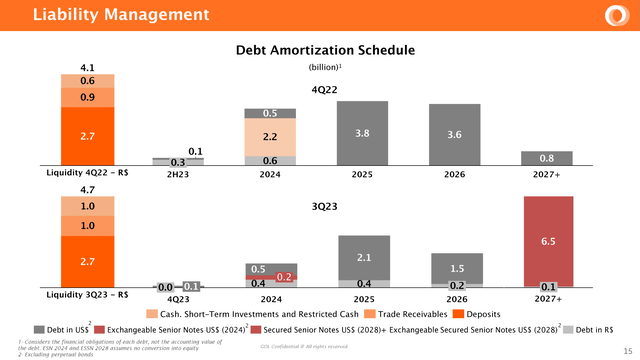

What is rather challenging for Gol is the fact that its debt amortization schedule has seemingly become more manageable, but what we do see is that R$10.7 billion was due between 2024 and 2026 by Q4 2022 and R$5.3 billion was due between 2024 and 2026 by Q3 2023. Indeed, that does point at successful refinancing, but we do see R$5.8 billion in maturities shifted into 2027+. So, we have a R$5.4 billion in debt reduction between 2024 and 2026 and a R$0.6 billion improvement in liquidity. Essentially, all of that improvement is structured with refinanced debt maturing in and after 2027.

Its Q3 2023 liquidity, which includes maintenance deposits, court deposits and deposits for leases, covered debt up to and including 2025 and that could potentially look comfortable were it not that the deposits are guarantees and not readily available. Just taking the cash and cash equivalents and trade receivables shows that Gol would be covered through 2024 and have around R$0.5 billion to pay some debt in 2025. Just its cash position, would not carry it further than 2024.

For the years ahead the free cash flow performance is not extremely rosy either with Fitch estimating free cash flow of negative R$1.6 billion for 2023 and negative R$1.1 billion for 2024. Essentially, this means that while debt maturities are closing in, the liquidity that Gol has needs to be used to capture the cash burns and debt maturities and with the business bleeding cash there simply is no viable way forward if a major restructuring does not occur.

Gol Is A Major Boeing Customer

Gol Linhas Aéreas Inteligentes S.A.

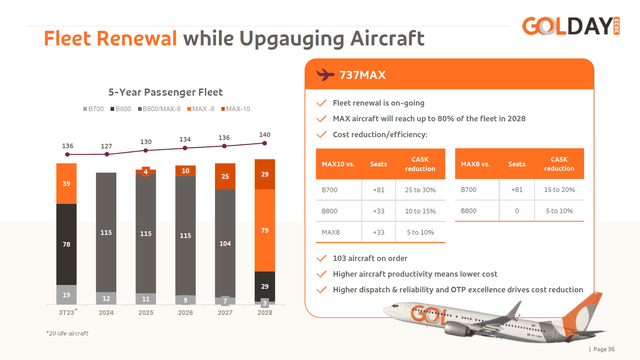

Gol is a major customer of Boeing, the company currently has a fleet of 139 airplanes consisting of 15 Boeing 737-700s, 79 Boeing 737-800s, and 45 Boeing 737 MAX 8s. There are several items to note and that is that Gol is heavily impacted by airplanes that are not active. Currently there are 22 airplanes that are not active and that is not so much related to Boeing, but due to the backlog of engine maintenance which is quite heavily impacting Gol. It basically prevents the airline from servicing demand if it is there and on top of that, there are delivery delays at Boeing.

Gol expected a fleet of 53 Boeing 737 MAX airplanes by the end of 2023, but its actual fleet was only 44 airplanes. That is something that affects an operator quite a bit. Compared to predecessors the current generation airplanes are 15% more fuel efficient on average and with CFM56 powered airplanes awaiting engine maintenance having those nine MAX airplanes in would have made a significant difference. Even more so when we consider, that Gol contractually had to continue handing in airplanes to lessors as the lease ended and it did so for five Boeing 737-800s and three Boeing 737-700s.

In total, Gol has ordered 145 Boeing 737 MAX airplanes of which 34 airplane orders were cancelled. Our data shows that the order placed in 2012, has not even been filled yet. Currently, 86 airplanes remain on order directly with Boeing including 29 Boeing 737 MAX 10 airplanes valued at around $4.75 billion. From 2025 onward, Gol expected to take delivery of the Boeing 737 MAX 10 but under the current circumstances taking delivery of the contracted MAX 8 as well as MAX 10 airplanes is questionable due to uncertainty regarding the MAX 10 certification as well as the production pace that Boeing will be allowed to execute. A $4.75 billion dollar could be at stake here, but I don’t view that as a major issue for Boeing as I believe there will be many takers for the jets if Boeing can deliver them. In an even more production-constrained space those slots have gained value and while Gol can be seen as a major Boeing customer with an all-Boeing fleet its weight in the 737 MAX backlog is just 1.8%.

So, overall Gol is currently executing rather inefficiently due to delivery delays from Boeing, and those deliveries are expected to remain impacted in the years to come while engine maintenance backlogs also provide capacity challenges for Gol that are hard to navigate.

Latin American Airlines Face Challenges, Restructuring To Include Lease Restructuring

Chapter 11 bankruptcy allows for a reorganization of the capital structure of a business while protecting the assets. Generally, I do not see how existing shareholders will get better out of this. The stock has ceased to trade on the NYSE and so if you cannot sell your shares OTC as a current shareholder there is no other option than sitting this one out and expecting your shares to be close to worthless. That is unfortunately how it often goes with Chapter 11 proceedings and I saw something similar with the LATAM restructuring as well.

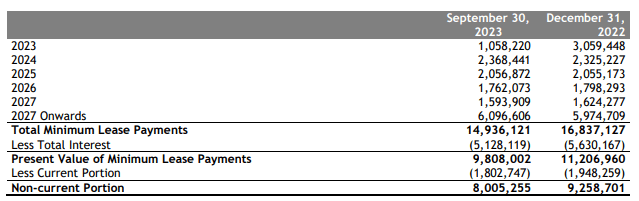

What seems to be evident is that besides the debt restructuring, restructuring leases will be a major component of the restructuring. We previously saw Azul (AZUL) restructure as well and next to debt restructuring, restructuring of the leases was a major component to vitalize the business.

Gol Linhas Aéreas Inteligentes S.A.

Among Latin American airlines successfully running a business has shown to be a major challenge and I would think that dollar denominated costs and debt such as lease rents and aircraft financing play a major role. For that reason, it is also likely that leases will be restructured. In total, there is around USD 3 billion in future lease payments including USD 1.8 billion up to and including 2027. If we keep in mind that Fitch estimates R$2.7 billion in free cash flow burn and the lease payments in 2023 and 2024 are nearly R$2.5 billion it is not hard to figure out that the lease payments are what put significant pressure on Gol apart from its debt maturity profile.

So, we will likely see lease restructuring and that could include Gol granting lessors and original equipment manufacturers equity and tradeable debt as was also the case in the Azul restructuring. Shareholders will see significant pressures with debtors taking on equity stakes and tradeable debt seems like the only viable path. One reason is that Gol’s fleet is almost exclusively leased. That means that it cannot sell airplanes and lease them back and the delivery schedule for airplanes directly from Boeing which it could sell to take out associated debt and raise cash is uncertain.

Gol Linhas Aéreas Inteligentes S.A.

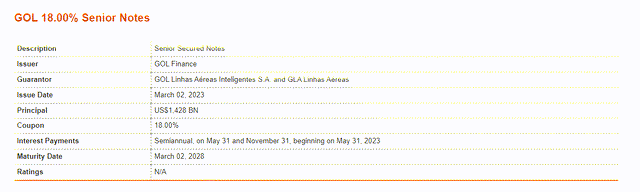

Furthermore, the 2023 debt issuance of Senior Secured Notes due 2028 came with an 18% coupon, which to me shows that refinancing options on the open market are limited to none for Gol. The Brazilian carrier is also aware of this and that is why a Chapter 11 has been invoked.

Conclusion: Gol Hit By Mounting Debt And Operational Challenges

Coming out of the pandemic we saw a strong demand profile, but the reality has also been that many airlines came out of the pandemic laden with debt that needed to be burned off and as operating costs rose and the industry faced constraints on multiple ends for some airlines that debt has become problematic and Gol is one of those airlines. The airline is facing lease payments that eat away at its cash flow while engine maintenance queues are keeping part of the fleet grounded and Boeing is not living up to the customer delivery schedules which adds additional pressure. I can’t say that the move to restructure is a major surprise as it is clear from debt maturity and lease obligations that Gol’s business in the current setting is not viable and in May 2023 I already saw that the company’s debt pile was gigantic compared to its obligations. So, the writing was on the wall for quite some time. At this time it is unlikely that you can sell your Gol American depositary shares because following the announcement of the Chapter 11 proceedings trading has been suspended by the NYSE. As a result, assuming you cannot sell your OTC, the best thing to do is hold and assume that once relisted your shares will be worth little to nothing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.