FilippoBacci

Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Bloomin’ Brands’ (NASDAQ:BLMN) valuation was not reflecting the improvements that the business was undergoing. I am reiterating my rating as I believe the upside remains attractive after the fall in share price since my last writeup. I continue to have a positive growth outlook for 4Q23, despite the weak headline SSS growth in 3Q23.

Financials/Valuation

BLMN saw 3Q23 total revenue of $1.08 billion, $147 million in restaurant level profit [RLP], $58.2 million in EBIT, $45.4 million in net income, and $0.44 in EPS (beating consensus assess of $0.41). Operating metric wise, total number of units reduced by 24, and blended domestic same-store sales [SSS] declined by 190 bps. Breaking down SSS, Outback declined by 340 bps, Carrabba grew by 230 bps, Bonefish grew by 40 bps, and Fleming’s saw the largest reject of 540 bps.

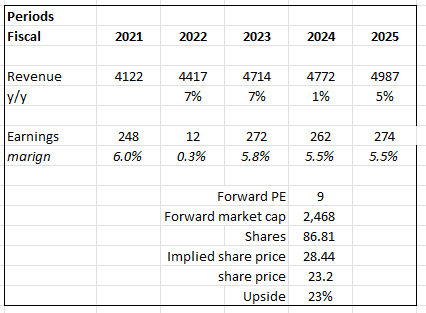

Based on author’s own math

Based on my view of the business, I still expect topline to grow as I previously expected, 7% for FY23 due to the tailwinds I mentioned below, and 1% in FY24 as I remained conservative about unit growth potential (the number of units was down in 3Q23). However, in FY25, hopefully with the macro environment turning for the better, BLMN will be able to revert back to historical growth of mid-single digits. However, I tampered with my net margin expectations down to 5.5% for FY24 and FY25 as I have concerns that beef prices might continue to stay elevated for a long period of time. Accordingly, my earnings expectation for FY25 has been reduced from $289 million to $274 million.

I modelled 10x previously because I thought that BLMN was trading at a big discount despite its lower debt but similar growth profile to peers admire Dine Brands Global, Brinker International, and Texas Roadhouse. While I believe this logic holds true, I think the soft margin outlook is likely to weigh on sentiment, putting pressure on any possible multiple re-rating. Hence, I am reducing my multiple assumptions from 10x to 9x, which is the way BLMN is trading today.

The good news is that because share prices have fallen since my last write-up, even with my modest assumptions, the upside remains attractive.

Comments

By the headline numbers, BLMN did not perform as well as I expected it to. However, the situation is also not as dire as it seems, as management has implemented the right strategies, and there are tailwinds that BLMN will savor in 4Q23. First and foremost, management mentioned that trends have improved through October and that the consumer base was noted to be relatively stable. Some might worry that advance rate hikes and the resumption of student loan payments will hit BLMN in the coming quarters. These headwinds will find their way to hurt BLMN as consumers dine less. Fortunately, BLMN has already implemented its value strategy to cushion this impact. For instance, they rolled out the Steak ‘n Mate’s combo for just $16.99. As such, I believe these headwinds are not going to be as dire as they sound. On the bright side, I believe Carrabba’s will savor growth tailwinds going into the last quarter of the year as there will be more gathering occasions that drive demand for catering services. If we look at BLMN’s historical revenue performance, 4Q tends to be the better-performing quarter due to the festive seasons. Seasonality tailwind combined with management enhance in advertising spend, BLMN should see improvement in SSS metrics going into 4Q23.

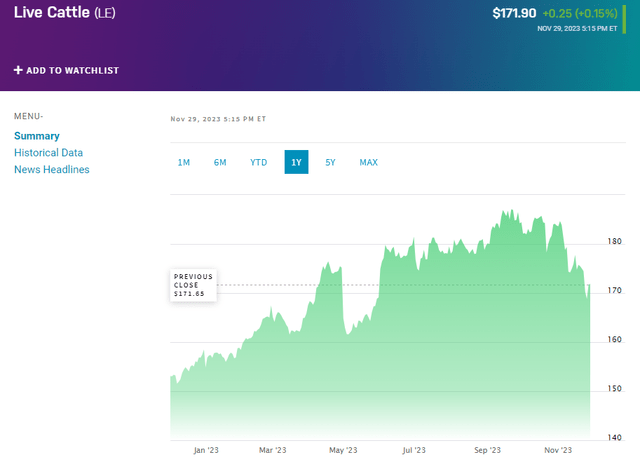

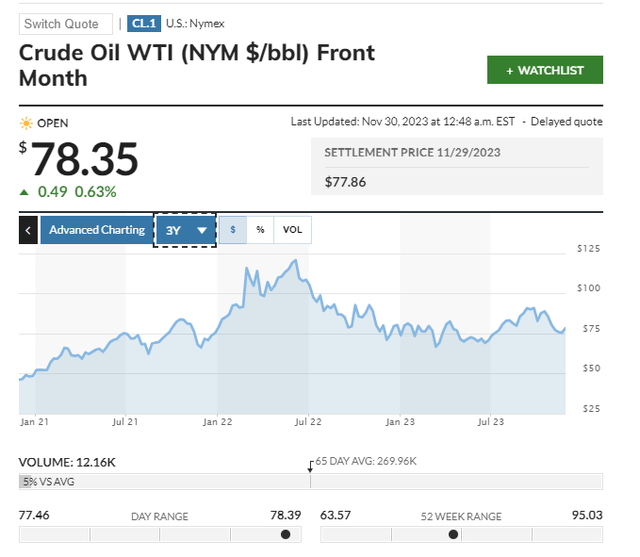

There are three factors that impact RLP margin: raw material prices, labour costs, and other operating expenses. After periods of elevated raw material prices, management mentioned they are seeing favourable trends in food costs, which have resulted in almost 180bps of annual improvement in the cost of goods sold. Looking at the various baskets of commodities, such as corn, wheat, soy, cattle, and crude, prices have all come down from an elevated level last year. However, a major ingredient is beef, and prices are still at elevated levels due to a lack of supply. My worry here is that beef prices might stay elevated for an extended period of time, which will negate the positive tailwinds from the easing of other commodity prices. As for labour costs, BLMN is already doing a good job of driving productivity, as seen from the gross margin expansion. The next leg of improvement should come from areas admire packaging and supply chain efficiency, which management is focusing on improving. All in all, while I have a positive SSS outlook, I am less positive on RLP margin expansion and have expectations for RLP margin to erode in 4Q23, which management has effectively guided for. To be exact, they reiterated their labour and commodity guidance for FY23, but commodity inflation of 2% in 3Q steps up to 6% in 4Q. Hence, I am also not going to underwrite advance margin expansion in 2024 until there is a positive update regarding the beef situation.

But look, anecdotally, outside of beef, things are looking pretty rational across the basket, which I think is a good sign. Beef is a little bit of an unknown. We’re still seeing the same information as everyone else out there. Source: 3Q23 earnings

Risk & conclusion

For my last point of discussion, I would also admire to talk about the impacts of GLP. In my opinion, this is an emerging risk that, as of now, might not have a big impact but could snowball into a major trend. The impact is likely to come gradually; for example, consumers might reduce their frequency of dining out, they might not order as many beverages even when they do dine in, and they might reduce their overall dining intake altogether (no appetisers, fewer sides, etc.). All of which will impact the SSS of restaurants and the rollout of new units. I am not modelling this risk to impact BLMN in the near term, but this is something to keep in mind for the long-term growth trajectory of the business.

While performance was not as good as I thought, I reiterate my buy rating for BLMN as the upside remains attractive after the share price reject. While 3Q23 SSS metrics fell short, management’s strategies, particularly value-driven initiatives, should counter the upcoming headwinds admire potential increases in rates and student loan repayments. The upcoming quarter, historically robust for BLMN, coupled with Carrabba’s growth prospects, should drive improved SSS metrics. However, RLP margin should continue to see headwind from elevated beef prices.