Drew Angerer

Block, Inc. (NYSE:SQ) is finally starting to find its groove. The company was previously a poster child for the “growth at any cost” tech sector. Like many tech peers, the company has embraced the tough macro environment by increasing its full-year adjusted operating income guidance by nearly 10x since it gave its initial targets. CEO Jack Dorsey has returned as CEO of Square and has outlined goals for even more profitability improvements over the coming years. Even after the recent run-up, SQ remains one of the more compelling picks in the tech sector. While I am downgrading the stock from “strong buy” due to valuation, I remain bullish on the name as the growth story plays out.

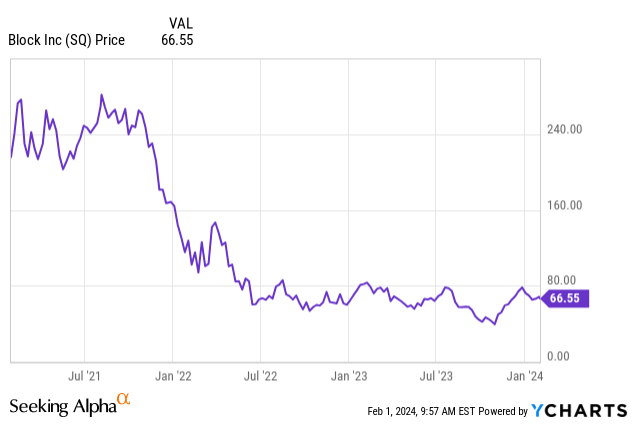

SQ Stock Price

The last few months have seen a perfect storm of tailwinds for SQ stock. The return of Jack Dorsey as CEO of Square, a furious tech rally and projected 2024 rate cuts have helped propel the stock around 100% from October lows.

I last covered SQ in October where I rated the stock a strong buy on account of the valuation and CEO Dorsey’s increased focus since stepping down at X (formerly known as Twitter). The stock is up big since then, but the rally isn’t over.

SQ Stock Key Metrics

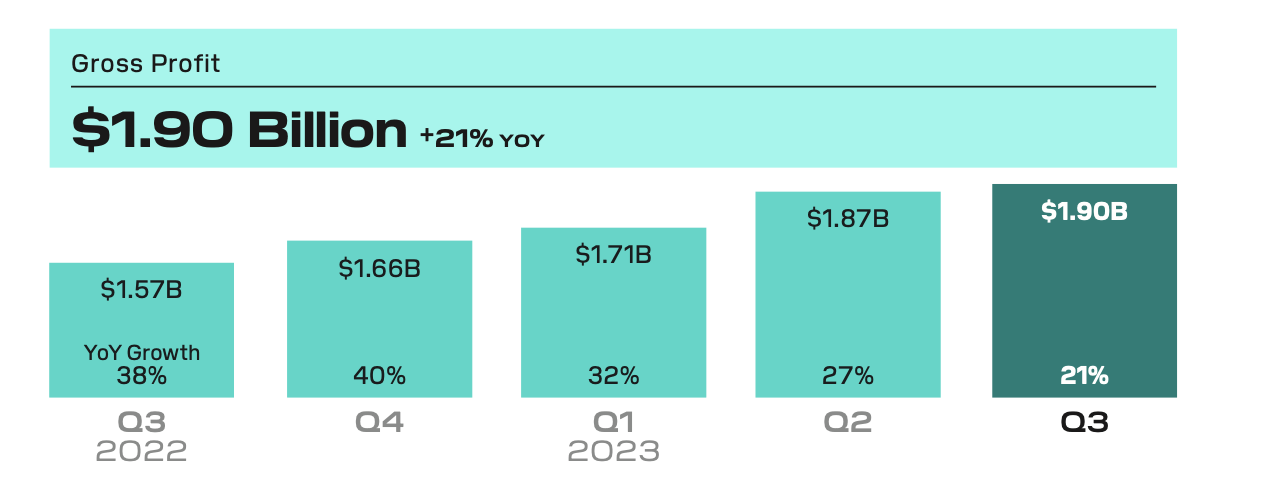

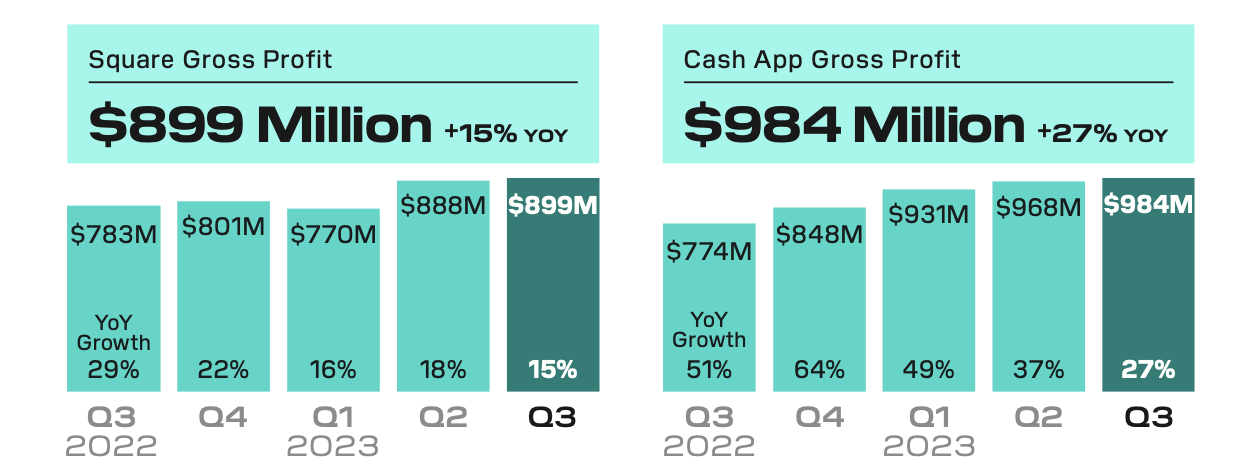

In its most recent quarter, SQ delivered 21% YoY growth in gross profits, in line with management commentary about 21% growth in July.

2023 Q3 Shareholder Letter

SQ saw its Cash App user base reach 22 million monthly active users (‘MAUs’), helping Cash App gross profit to soar 27% YoY. The company’s core Square operations grew by a respectable 15% YoY.

2023 Q3 Shareholder Letter

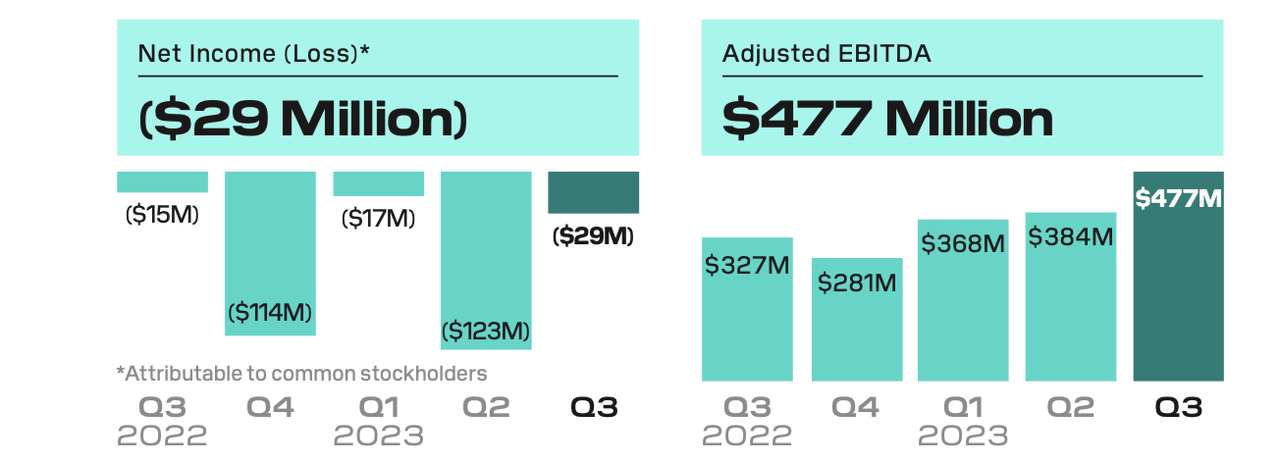

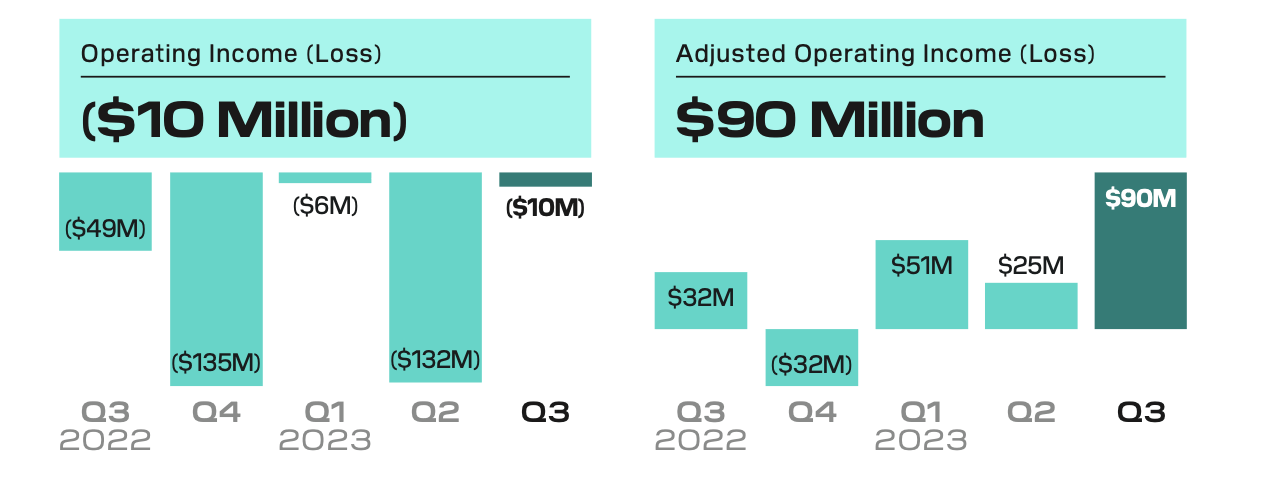

The company generated $90 million in adjusted operating income, the highest over the past year. I note that adjusted operating income does not add back equity-based compensation but is mainly focused on one-time acquisition integration costs.

2023 Q3 Shareholder Letter

Inclusive of equity-based compensation, adjusted EBITDA came in quite strongly at $477 million (I note that there was also an additional $25 million in interest income). Contrary to whatever negative perception one might have about the company’s profitability, SQ is flowing cash.

SQ ended the quarter with $6.7 billion of cash and investments versus $4.1 billion of debt. Together with the solid profitability, SQ has a strong balance sheet position.

Looking ahead, management has guided for up to 19% YoY growth in gross profits with adjusted EBITDA expected to come in strong at up to $450 million. It is stunning that management is now guiding for up to $1.68 billion in adjusted EBITDA, up from their $1.3 billion target initially given in the fourth quarter of 2022. Their $225 million adjusted operating income is also notably higher than the initial target for a $150 million adjusted operating loss. Like many tech names, SQ responded to the 2022 tech crash by showing an intense focus on profitability.

But management didn’t stop there. Management also gave preliminary 2024 targets for $2.4 billion in adjusted EBITDA (representing 42.9% YoY growth) and $875 million in adjusted operating income (representing 289% YoY growth). Again, I reiterate that adjusted operating income is not inclusive of equity-based compensation and is thus somewhat comparable to GAAP net income. Management also gave some long-term targets, outlining expectations for “least mid-teens gross profit growth and a mid-20% Adjusted Operating Income margin” in 2026. I will admit, however, that this guidance is difficult to understand given that 2024 targets suggest a 36% adjusted operating income margin (based on adjusted EBITDA) but management is suggesting that margins will continue “improving” to that mid-20s target by 2026. On the conference call, management clarified even further that “Block and each ecosystem must show a believable path to Gross Profit Retention of over 100% and Rule of 40 on Adjusted Operating Income.” The implied message might be that management is willing to shut down underperforming businesses in order to improve overall profit margins. These guidance targets and management commentary are in stark contrast with the company’s “growth at any cost” reputation prior to this year.

In order to exert discipline towards these goals, management has set a hard cap of 12,000 people. Given that the company currently has a headcount of over 13,000, that implies some rounds of cost-cutting to occur between now and the end of next year.

With SQ now generating tangible cash flow, management has authorized a $1 billion share repurchase program. I expect the company to execute this program, even if the company does not have a history of aggressive repurchases in the past.

Is SQ Stock A Buy, Sell, or Hold?

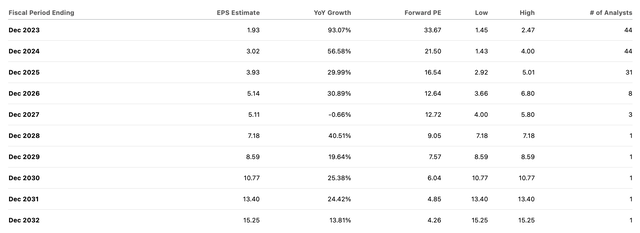

Consensus estimates show some skepticism about management’s ability to hit their target for 20% top-line growth in 2026.

Yet even based on these estimates, SQ was trading at just 13x 2026 consensus earnings estimates.

Investors may be wary of chasing SQ after the rise from the lows. However, SQ traded as one of the cheapest fintech stocks at the lows and continues to trade as one of the cheapest names today. The low valuation can be ascribed to negative investor perception of business model quality – but those perceptions may change given the company’s resilient top-line growth as well as indications of a resurgence in cryptocurrency interest. Based on 10% long-term net margins (not too far off management’s guidance for 20% adjusted operating margin in 2026), 20% revenue growth, and a 1.5x price-to-earnings growth ratio (‘PEG ratio’), I could see the stock trading at around 3x sales, implying solid upside between growth and multiple expansions.

What are the key risks? The company operates in highly competitive sectors, with strong competitors like Toast, Inc. (TOST) and Lightspeed Commerce Inc. (LSPD) in POS, as well as PayPal Holdings, Inc. (PYPL) versus their Cash App. It is possible that growth rates decelerate meaningfully and management is unable to execute on their guidance for 20% top-line growth in 2026. Deceleration to 10% to 15% growth would yield somewhere between lackluster and OK investor returns. The stock’s recent run-up has made it crucial that management execute against guidance in order to generate strong returns – this point explains why I am downgrading the stock from “strong buy” to “buy.” SQ has made Bitcoin and blockchain a strategic priority in the past (the company is named Block after all) which might increase the risk profile. Just as we saw banks like Signature Bank crash due to their association with cryptocurrency, it is possible that SQ carries a similar “black swan” risk. It is not clear if any potential long-term growth from cryptocurrency is worthwhile if it ends up compressing valuation multiples for the overall company.

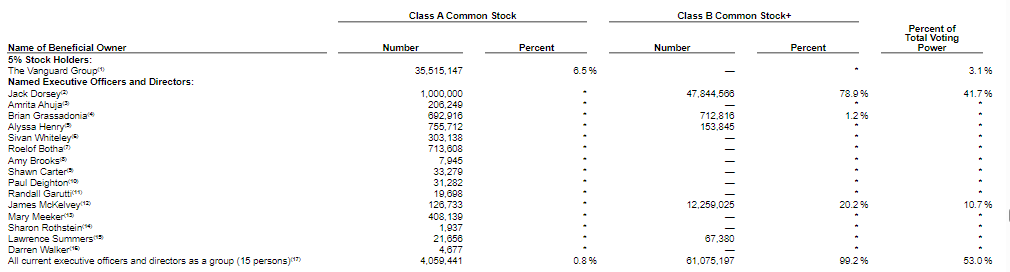

I once again point out that CEO Dorsey is the largest shareholder, owning an astounding 48.8 million shares worth around $3.6 billion.

2023 DEF14A

While it may feel like we are late to the party, the valuation is still compelling for long-term growth investors. SQ remains a buyable owner-operator kind of stock that has a solid upside if management can deliver on 2026 targets. I rate the stock a buy and expect multiple expansions ahead as the market warms up to strong fundamental prospects.