Jonathan Knowles

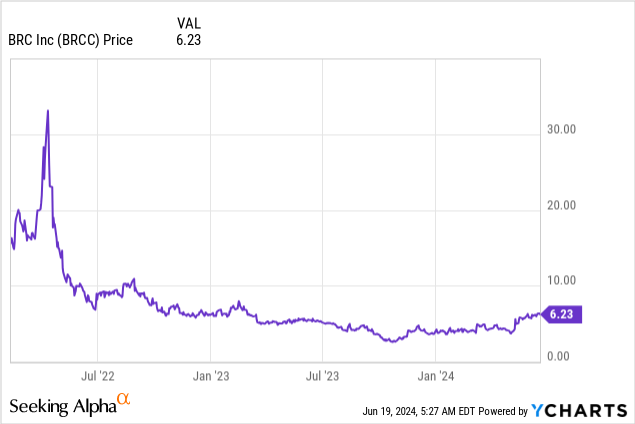

Increasingly as tech and AI plays become more crowded trades this year, we become encouraged to look in other sectors for tremendous growth stories. Among “legacy” industries that are showing enormous growth, BRC Inc. (Black Rifle Coffee Company) (NYSE:BRCC) – which I’ll refer to here on out as simply BRC – is one surprising growth story.

The coffee company, primarily a wholesale business with a burgeoning retail/cafe arm, has seen its share price soar nearly 50% this year: outperforming a number of technology stocks. And while it remains a “show me story” as it undergoes a business transition this year, I’m intrigued enough by this story to add it to my watch list and am bullish on its prospects for the long haul.

In short: I’m initiating BRC at a bullish rating. I am not recommending an immediate buy on this stock, as it has soared tremendously year to date, unless your time horizon is multi-year (in which case, I am positive on the longer-term outlook for this company). But there’s a great chance to be opportunistic here and buy this stock on the next major dip.

A coffee company made by veterans

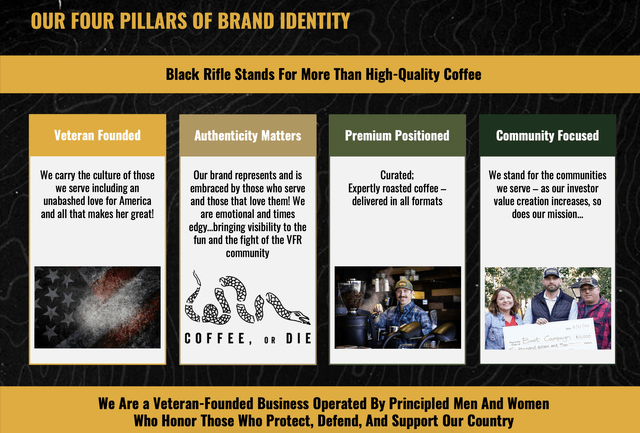

Perhaps what is singularly impressive about BRC is the fact that it has taken a (let’s face it) commoditized and undifferentiated coffee industry and placed a unique brand behind it. The company’s founder, Evan Hafer, is a former Green Beret who founded the company in 2015 (and took it public in early 2022, which is a very quick rise from startup to major player).

The slide below, taken from a January investor presentation, showcases the company’s core brand identity:

BRC core brand identity (BRC January 2024 Investor Presentation)

BRC’s product portfolio, meanwhile, runs the gamut of packaged coffee products. Alongside standard 12oz bags of whole grain coffee, the company sells a line of cold brew and instant coffee products, which are marketed primarily in convenience stores and gas stations.

BRC wholesale product portfolio (BRC January 2024 Investor Presentation)

One of the biggest growth areas for the company, meanwhile is in coffee pods. The company recently signed a major distribution agreement with Keurig Dr Pepper (KDP), the multinational food conglomerate that is the manufacturer of its eponymous Keurig coffee pods, the leading coffee pod brand in the industry.

Speaking to this deal on the recent Q1 earnings call, founder Evan Hafer noted as follows:

On top of our core business achievements, we are also excited to announce our partnership with Keurig Dr Pepper. Partnering with an iconic company like KDP is a testament to our team’s efforts and the growing impact of our brand throughout the beverage industry. As was announced a few weeks back, we’ve entered into a long-term agreement for manufacturing and licensing of our single-serve pods with KDP.

We are well on our way to becoming a best-in-class CPG brand. And this partnership will not only accelerate our growth across our current portfolio, but also give us the ability to innovate within the CPG sector through access to new channels we are currently not serving. In turn, the success and profitability of our business allows us to continue to drive the mission of supporting veterans, active duty military, first responders and their families.”

Incredible wholesale growth and profit inflection

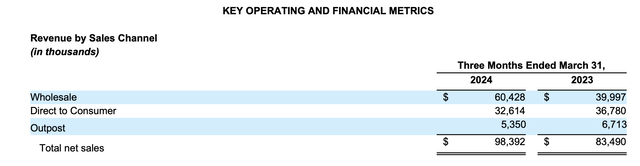

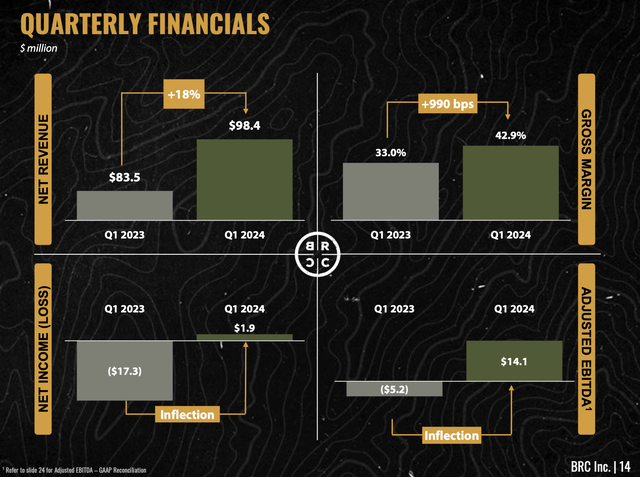

Needless to say, the Keurig deal – and the surge in BRC’s share price since that deal and Q1 earnings were announced – is a testament to this company’s enormous growth potential. In its most recent Q1 earnings, total revenue for the company grew 18% y/y to $98.4 million (again, we marvel at the fact that this company, barely 10 years old in a very competitive industry, managed to grow to a ~$400 million annualized revenue scale in such a short amount of time), and beat Wall Street’s expectations of $97.1 million (+16% y/y).

BRC growth by channel (BRC Q1 earnings deck)

We note as well that underlying wholesale revenue surged 51% y/y to $60.4 million, with further tailwinds ahead as the distribution agreement from Keurig materializes and starts to benefit the company’s financials.

Moreover: BRC is also at an important inflection point from a profitability standpoint. The company recently underwent an operational overview in which it restructured its headcount to align with its wholesale focus, and signaled that it would temporarily pause expanding its coffeeshop footprint (it calls its branded cafes “Outposts”). Management also curtailed the use of third-party consultants.

BRC Q1 growth and profitability (BRC Q1 earnings deck)

And alongside the opex savings, BRC also saw a massive gross margin lift on the order of 990bps y/y in Q1, taking gross margins to 42.9%. This is impressive in spite of the company’s sales mix shift away from DTC (where margins are higher) and into the wholesale and grocery channel, and the company attributed the lifts to better wholesale processes and terms, lower green (unprocessed) coffee costs, higher pricing and better product mix, and productivity gains. The combination of gross margin lifts and opex savings, meanwhile, pushed BRC to generate a major swing in adjusted EBITDA, up to $14.1 million in the first quarter and representing an enviable 14% gross margin. The company’s guidance calls for $32-$42 million of adjusted EBITDA for the full year, which likely looks light at an 8% midpoint margin against full-year expected revenue of $430-$460 million.

But don’t ignore the risks

With the massive wholesale growth and profitability inflection accounted for, however, we shouldn’t ignore BRC’s risks. I see three key red flags that might prove to be a stumbling block on the company’s trajectory (though long term, I do believe the company will be able to muscle through these issues).

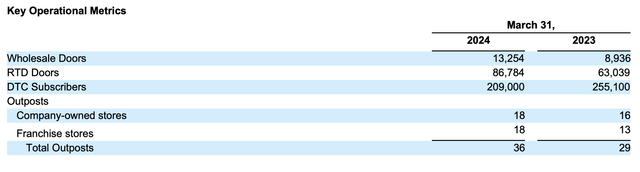

Issue number one is the company’s DTC contraction. Now, management did intentionally pull back on DTC marketing for its web sales as well as pause Outpost (cafe) expansion until 2025. But notably, DTC revenue declined -11% y/y in the first quarter. And in addition to that, as shown in the chart below, DTC subscriber counts to the company’s coffee club also declined -19% y/y to 209k.

BRC core metrics (BRC Q1 earnings deck)

Even if BRC pivots to becoming primarily wholesale, there’s a risk that grocers and other resellers won’t want to take inventory of a declining brand.

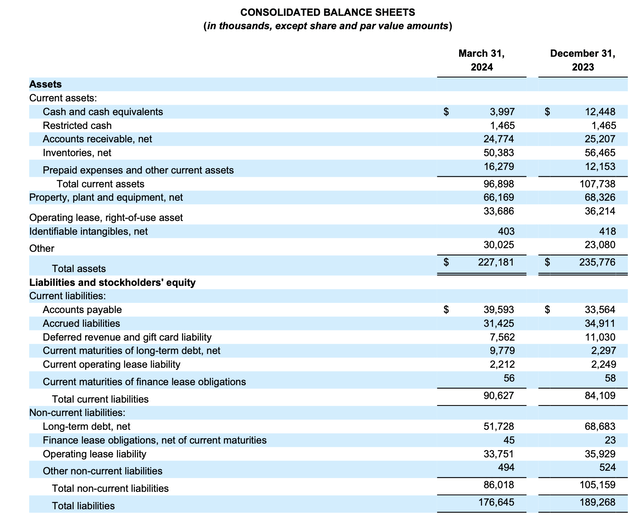

The second major risk: BRC has relatively limited capital. Its most recent balance sheet had only $4 million of cash remaining, and that’s against $52 million of debt – which is a very thin buffer for a company that does $400+ million in annual sales.

BRC balance sheet (BRC Q1 earnings deck)

When the company does decide it wants to restart the cafe expansion plans, it will likely need to raise additional capital in order to fund new locations (or expand its franchising arm). The good news offsetting this is the fact that BRC’s recent profit inflection may be able to stave off some of these low cash balance concerns, as management is guiding to at least 80% free cash flow conversion (as a percentage of adjusted EBITDA) this year, which should put at least $26 million of extra cash on BRC’s books excluding additional capex, even at the low end of the company’s $32-$42 million adjusted EBITDA range.

Lastly, we shouldn’t ignore brand risk. One of BRC’s greatest assets is its differentiated, military-aligned brand that is unabashedly featured in both the company names and the names of its products. But in an increasingly liberalizing world, this orientation may put BRC at odds with certain customer sets and limit its expansion goals.

Key takeaways

I’m still counseling patience for BRC, as the company has already soared YTD. However, over the long haul, I do see continued wholesale door expansion and rising gross margins to continue turning the profitability tide for BRC, which will help to boost its current ~$1.3 billion market cap. Unless you’re a multi-year horizon investor, earmark this stock as a watch list item, but don’t rush in just yet to buy.