After experiencing a brutal crypto winter in 2022, Bitcoin (BTC -0.29%) experienced quite a rebound last year. The Dow Jones Industrial Average, S&P 500 index, and Nasdaq Composite all posted double-digit gains last year as investor sentiment around the overall state of the economy started to strengthen. As such, crypto experienced some renewed interest, and Bitcoin surged over 150%.

Yet despite Bitcoin’s robust return last year, many believe that 2024 could be even better. One of the primary reasons for such a positive outlook is the looming approval of spot Bitcoin exchange-traded funds (ETFs). This is an important development, because the approval of spot Bitcoin ETFs would add some much-needed validation to the crypto landscape from regulatory authorities.

However, earlier this week SEC Chairman Gary Gensler posted to X (formerly Twitter) notifying the public that the government agency’s account had been hacked — causing many to question if approval for the ETFs were imminent or not.

Let’s dig into what happened, and why it matters for Bitcoin and crypto investors at large.

What just happened?

On Jan. 9, Gensler posted the following statement to his profile on X:

The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

— Gary Gensler (@GaryGensler) January 9, 2024

This is a big issue for a few reasons. First, hacks in general can be pretty jarring. But seeing a government agency’s social media profile become compromised adds an entirely new level of shock as it pertains to cybersecurity.

Second, the content around the hack is perhaps equally important. Crypto investors have been speculating that the SEC is going to approve several spot Bitcoin ETFs any day now. As such, Bitcoin has witnessed some increased trading activity.

However, given the comments above, investors were left confused and sentiment around the lingering approvals started to wane. Unsurprisingly, Bitcoin briefly experienced a sell-off.

Image source: Getty Images.

A long, drawn out saga

The day following the social media hack, a link appeared on the SEC’s website stating that applications for eleven spot Bitcoin ETFs had been approved. But to add more drama to an already erratic situation, the link was removed shortly after it was initially posted.

Thankfully, by the morning of January 11, investors received the clarity they were looking for. As of market open on Thursday, several spot Bitcoin ETFs began trading — including those from Cathie Wood‘s Ark Invest and BlackRock.

Where is Bitcoin going from here?

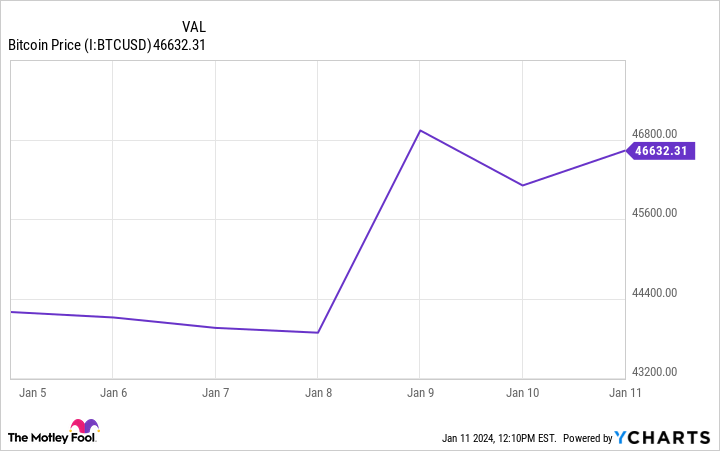

Bitcoin Price data by YCharts

The chart above illustrates that although Bitcoin experienced a brief sell-off following the SEC hack, the token has not dropped off a cliff by any means. In fact, several hours following Chairman Gensler’s post, the price of Bitcoin started to recover. Moreover, as of Thursday morning Bitcoin ticked up nearly 2% as spot ETFs hit the exchanges.

Whether it is regulatory validation, renewed interest in crypto at large given overall positive outlooks on the economy, or the expected Bitcoin halving this year, there are many reasons to keep an eye on the crypto token right now. Nevertheless, the approval of spot Bitcoin ETFs is a major milestone for the crypto landscape and it will be exciting to see if Bitcoin begins to land on the radar of more institutional investors.

While I personally think 2024 will be the year Bitcoin eclipses the $100,000 price point, a prudent action for crypto investors is to keenly monitor the activity among these ETFs.

Adam Spatacco has positions in Coinbase Global. The Motley Fool has positions in and recommends Bitcoin and Coinbase Global. The Motley Fool has a disclosure policy.