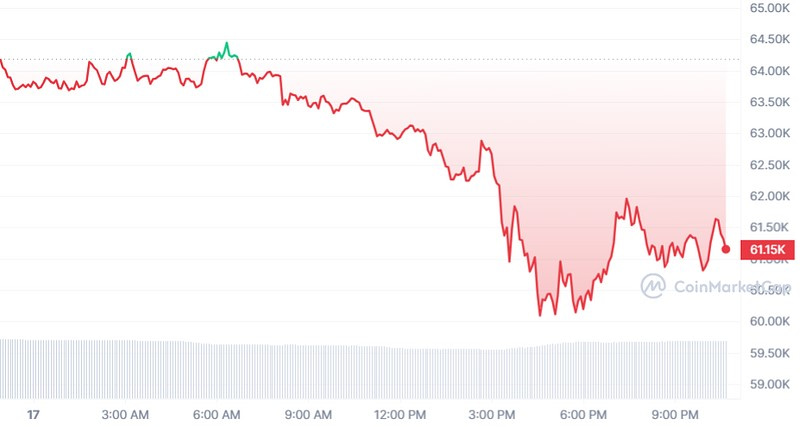

Bitcoin (BTC-USD) briefly slid below the $60K level for the first time since early March on Wednesday afternoon, as volatility increased ahead of the highly anticipated halving event.

The cryptocurrency’s price dropped as much as 5% to $59.8K before recovering slightly to $61.3K.

“The halving event has historically been a significant milestone for Bitcoin, as it reduces the rate at which new coins are created,” said Tobi Opeyemi Amure, a cryptocurrency analyst at Trading.Biz.

“The halving event has historically been a significant milestone for Bitcoin, as it reduces the rate at which new coins are created,” said Tobi Opeyemi Amure, a cryptocurrency analyst at Trading.Biz.

“While short-term volatility is expected, the long-term implications of the halving could be positive for Bitcoin’s price, as it further emphasizes the cryptocurrency’s scarcity.”

The recent pullback has seen Bitcoin (BTC-USD) fall nearly 20% from its record high of $73.8K reached in mid-March. Other major cryptocurrencies also experienced selling pressure:

- Ether (ETH-USD) -3.1%

- Solana (SOL-USD) -2.2%

- Cardano (ADA-USD) -4%

- Dogecoin (DOGE-USD) -4.4%

The increased volatility comes as the market anticipates the quadrennial halving event, which is expected to occur as soon as Friday. Many view the halving as a bullish catalyst for Bitcoin’s price, as it reduces the supply of new tokens entering circulation.

However, analysts had previously warned that immediately before and after the halving; however, Bitcoin tends to weaken for approximately 15 to 45 days.

The weakness in crypto prices also impacted crypto-related stocks, with several companies experiencing declines:

- MicroStrategy (MSTR) -6.8%

- Coinbase Global (COIN) -4.7%

- HIVE Digital Technologies (HIVE) -2.8%

- Bit Digital (BTBT) -2.8%

- Marathon Digital (MARA) -0.3%

- Riot Platforms (RIOT) -0.2%

As the halving event draws closer, investors and enthusiasts alike will be closely monitoring Bitcoin’s price action and the broader cryptocurrency market. The event’s outcome may provide valuable insights into the future trajectory of digital assets and their role in the evolving financial landscape.