Bryan Bedder

Co-produced by Austin Rogers.

It was not that long ago that the market believed the Federal Reserve’s narrative of “higher for longer” interest rates. Over and over again on financial media, pundits parroted the Fed’s narrative, helping them do their job of setting the market’s expectations.

In contrast, we have been saying for months that “higher for longer” is totally unsustainable and that the Fed’s hawkish rhetoric should be taken with a hefty grain of salt. That is because Fed officials are always making use of what’s called “forward guidance” to shape market expectations.

We made this argument in October in “‘Higher For Longer’? Don’t Trust The Fed.”

In that article, we cited a quotation from former Fed chairman Ben Bernanke, who wrote in 2015 (emphasis added):

When I was at the Federal Reserve, I occasionally observed that monetary policy is 98 percent talk and only two percent action. The ability to shape market expectations of future policy through public statements is one of the most powerful tools the Fed has.

Since the beginning of this summer, the Fed has only hiked their key policy rate once, and yet, during that time, the 10-year Treasury yield (US10Y) rose as much as 150 basis points! How? Largely through the Fed’s jawboning.

The Fed talked tough so that the market would do a lot of their work for them. And it worked.

But outside of Fed-speak, the real economy had its own ideas. As we covered in “The Recession Is Still Coming,” the U.S. economy has been in a sustained disinflationary trend for over a year. The consumer is weakening, the housing market is frozen from high mortgage rates, and the government’s balance sheet is rapidly deteriorating.

These are not the conditions that necessitate a “higher for longer” scenario!

Recently, billionaire investor Bill Ackman said the same thing that we have been saying: the Fed will cut rates sooner than most people think.

In an appearance on The David Rubenstein Show, Rubenstein posits the consensus view that a recession has been avoided and that rates will not need to be cut for a while.

In response, Ackman says that, while the future is hard to forecast (emphasis added)…

I do think the economy is weakening. We are seeing evidence of that at some of our companies. I have some concerns. There’s been a huge subsidy in terms of low interest rates, and most companies fixed their debt at very low rates, and certainly real estate investors did the same. That works until it doesn’t work. What’s going to be interesting is what happens when people have to reprice their debt. That can have sort of a cliff-appreciate effect, and you’re certainly seeing that in real estate.

So, Ackman’s concerns are twofold: (1) The economy is weakening; and (2) going from ultra-low rates even to moderately high rates involves a huge jump in debt financing costs that will be devastating to heavily leveraged players.

Rubenstein asks what Ackman’s view is on what the Fed is going to do, to which Ackman responds (emphasis added):

I think they’re going to cut rates, and I think they’re going to cut rates sooner than people expect. What’s happening is the real rate of interest keeps increasing as inflation declines. If the Fed keeps rates in the middle 5s and inflation keeps trending below 3%, that’s a very high real rate of interest. That’s having a retarding effect on the economy.

Many businesses and many individuals have the benefit of fixed-rate debt. That fixed-rate, certainly for companies and for commercial real estate starts to roll off. So I think there’s a risk of a hard landing if the Fed doesn’t start cutting rates pretty soon.

The market expects sometime in the middle of next year. I think it’s more likely probably as early as Q1.

Rubenstein brings up the fact that 2024 is an election year, but Ackman says he does not view the Fed as being a political institution. Rate cuts will come simply because the economy forces them to.

While this forecast may seem hopeful and premature, it is actually in line with the historical pattern.

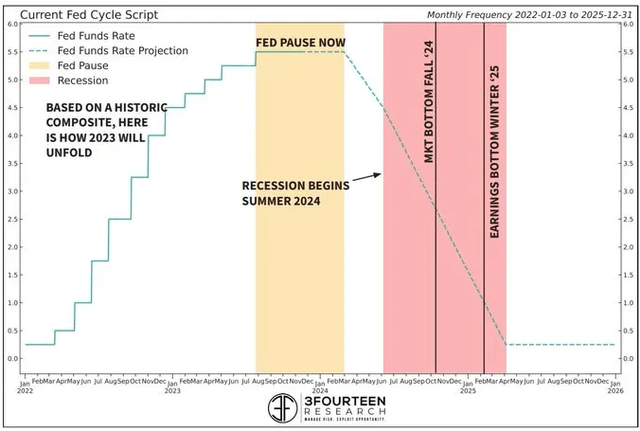

Using the average of past Fed pauses and the period of time before rate cuts and then a recession begins, the first Fed Funds Rate cut should come in March, while the recession begins a few months later.

And, if this cycle conforms to the average of previous market cycles, the stock market should bottom sometime in Fall 2024 while earnings trough in late 2025.

But that is for the stock index average. In many recessions, not all stocks refuse.

We think the coming recession will be a mild to moderate one, not a devastating crash akin to the Great Financial Crisis of 2008-2009. In fact, we think that it could look similar to the early 2000s recession after the Dot Com bubble burst.

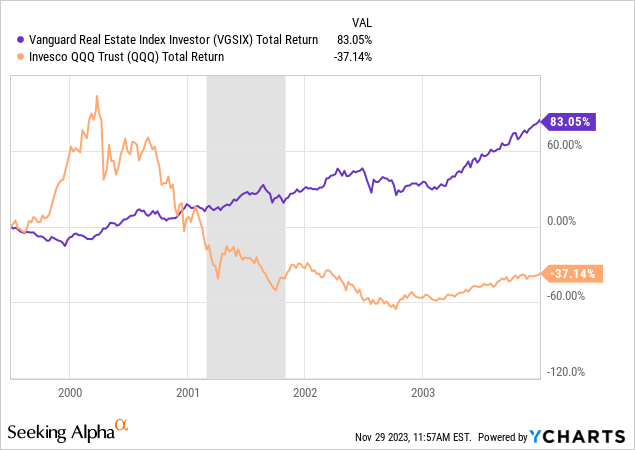

In 1999, the Vanguard Real Estate Index Fund (VGSIX) dropped by as much as 11.5% while tech stocks in the Nasdaq (QQQ) index soared. But once that Dot Com bubble began to unwind, tech stocks began a downward slide to digest their lofty valuations while real estate stocks rose right through the recession.

Real estate investment trusts, or REITs, sold off only modestly, along with the rest of the stock market, after the 9/11 terrorist attack. By the end of 2001, though, the real estate sector was already back near its pre-9/11 high.

Why did real estate stocks rise even through a recession? Because the primary reason for REITs’ selloff in 1999 was not weak fundamentals. It was rising interest rates along with fading interest in real estate in favor of tech stocks.

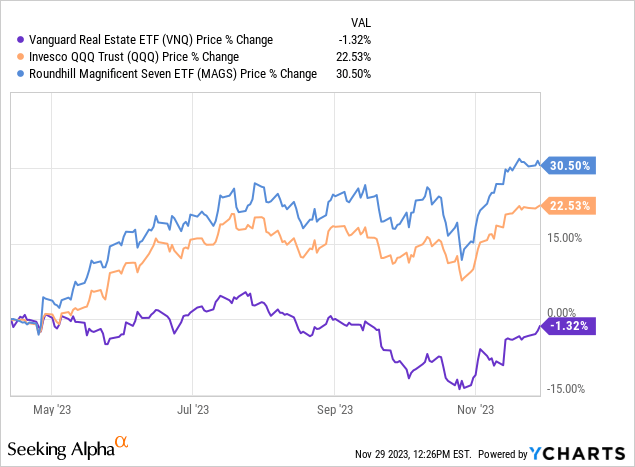

Today, similar to 1999 and early 2000, interest rates have almost certainly peaked, and REITs have begun to rebound. But unlike that period of time, tech stocks have not begun to correct from their lofty valuations, at least not yet.

The Vanguard Real Estate ETF (VNQ) is still significantly below its previous high, while the tech stocks in the QQQ and Magnificent 7 (MAGS) are close to making new highs, if they haven’t already.

While history doesn’t repeat, we think 2024 could “rhyme” with the early 2000s recession, reversing the recent performance trend and seeing REITs crush tech stocks in total returns – at least for a year or two.

Of course, the future is unknowable, and economic forecasts can be wrong, just appreciate weather forecasts.

But, at this point, we believe this to be the most likely scenario for 2024.

Particularly Attractive REIT Opportunities

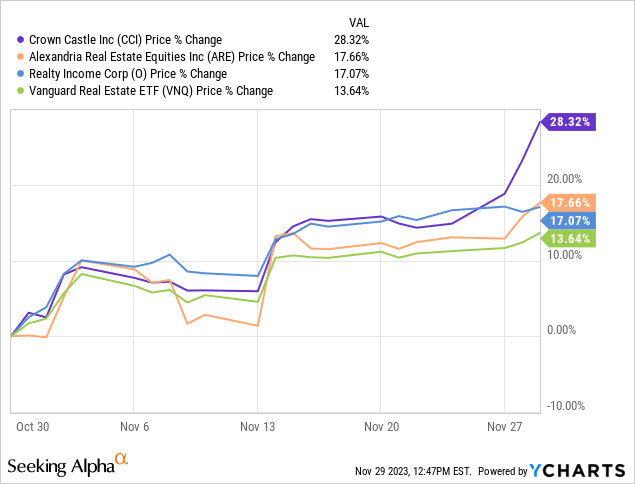

There are many appealing buying opportunities in the REIT realm right now, but there are a handful that have outperformed since the recent price trough in late October.

We think these could be some of the highest flyers into 2024 as well.

First off, Crown Castle Inc. (CCI) is a name we have pitched over and over again this year. We feel as though we repeat ourselves sometimes on CCI, because the case for it is so simple.

There is a lot of unappreciated value in CCI’s huge network of U.S. telecommunications infrastructure, which includes over 40K towers, ~120K small cells, and ~85K route miles of fiber.

As the cost of debt has risen along with interest rates, the market has soured on CCI and especially its capital-intensive fiber segment, in which the REIT is investing billions of dollars at low initial cash yields that are expected to eventually turn into double-digit yields on cost.

Activist investor Elliott Management recently announced that they had boosted their stake in CCI to over $2 billion (>4% of market cap). One of their ideas is to explore a sale of CCI’s fiber segment, which, according to an Axios report, could be worth $11-15 billion.

Candidly, we don’t know whether such a sale would be beneficial on the net, but we think the exploration will ultimately result in shareholder value creation however it turns out.

Alexandria Real Estate Equities, Inc. (ARE) is another REIT we have pitched many times. appreciate CCI, the market has dramatically underappreciated the value in ARE’s Class A life science portfolio.

The market seems to think that the new hybrid work arrangement will hurt ARE either directly by reducing tenant demand for life science properties or indirectly by resulting in a big boost in office conversions into life science. We think both fears are misguided.

Even if scientists and researchers are able to work from home more often in today’s environment, that does not make commercial life science space obsolete. Physical experiments still need to be conducted, analyzed, and stored.

As for the uptick in office-to-life science conversions, it is important to recall the age-old principle of value in real estate: location, location, location. ARE’s state-of-the-art buildings are embedded within the nation’s leading innovation clusters and are typically located adjacent to top research universities. The world’s best biotech companies want to be located in the world’s best research facilities, not the cheapest.

Finally, Realty Income Corporation (O) is by far the biggest net lease REIT and is often considered the gold standard in the space. Its net leases typically include only about 1% average annual rent increases while its average lease term sits at around 10 years. That makes net lease REITs some of the most rate-sensitive real estate stocks, and O is among the most rate-sensitive among them.

But as we can see in the chart above, as long-term interest rates come down, O soars. We see no reason why that trend would stop as interest rates refuse advance.

Moreover, O enjoys the enviable status of having the highest credit rating in the net lease REIT space, with A- and equivalent ratings. That creates a big cost of capital advantage that will only be accentuated by lower interest rates.

There are of course just three examples among many others.

Closing Note

Bill Ackman just gave the view that we have been espousing for months:

- The economy is weakening, the consumer is running out of spending power, a recession is coming, and the Fed will be cutting rates sooner than the market thinks.

We have been continuously buying REITs as their prices have dropped, which means we fortunately picked up shares at some fantastic prices over the last few months. But even after the November rally, there remain some very attractive buying opportunities among REITs.

We continue to accumulate REIT shares with the conviction that REITs should savor a huge rebound in the coming years.