Each quarter, professional hedge fund managers, some of the biggest names on Wall Street, release regulatory filings that say what they bought or sold. Wall Street celebrity and billionaire investor Bill Ackman, who runs Pershing Square (PSHZ.F 1.18%), made some big moves during the fourth quarter of 2023.

According to Pershing Square’s 13-F filing, the fund sold notable amounts of shares from three of its holdings. That’s a big deal, considering Pershing Square only holds eight stocks.

What might Ackman’s big trades mean about where the stock market could go? Here is what you need to know.

What did Bill Ackman do?

Pershing Square holds a total of eight stocks. I wrote about them earlier this year. They are listed below, from the highest current value in the portfolio to the lowest :

- Chipotle Mexican Grill

- Restaurant Brands International

- Hilton Worldwide

- Howard Hughes Holdings

- Alphabet (Class C)

- Canadian Pacific Kansas City

- Alphabet (Class A)

- Lowe’s

As you can see from the list above, Bill Ackman has favored consumer-driven stocks. Chipotle and Restaurant Brands International are food stocks, followed by consumer discretionary blue-chip stocks like Lowe’s and Hilton Worldwide.

However, Ackman sold notable parts of Chipotle, Hilton, and Lowe’s in the fourth quarter. Pershing Square sold 128,610 shares of Chipotle (13.49%), 1.12 million shares of Hilton (10.91%), and 5.82 million shares of Lowe’s (82.37%).

In other words, Pershing Square sold over a tenth of Chipotle and Restaurant Brands International and almost completely sold out of Lowe’s.

What might these sales mean?

There are two interesting takeaways from Ackman’s moves with Pershing Square. The fund didn’t offset the sales with any purchases, so Pershing Square essentially raised cash. This part is speculation and should be taken with a grain of salt, but it could mean that Ackman views either the broader market or the stocks he sold as overvalued.

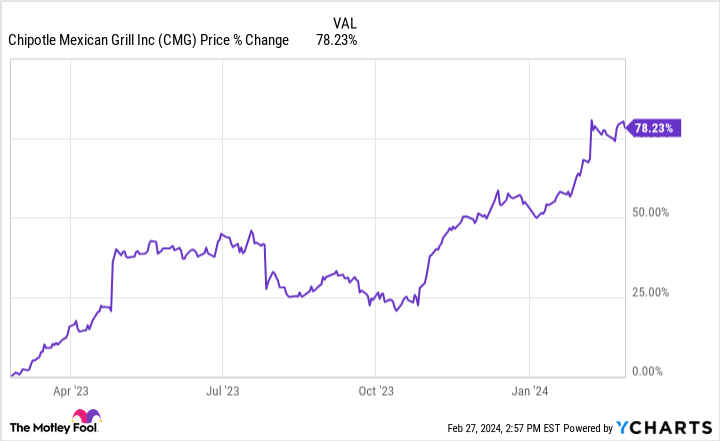

After all, Chipotle is up almost 80% over the past year and went on a run during Q4, when Pershing Square sold its shares:

It might also indicate that Ackman sees weakness in the U.S. consumer and isn’t optimistic about people spending money on new home projects and eating out at restaurants. Household debt is at an all-time high, and data from Primerica indicates that the middle class in the U.S. is struggling after inflation-ravaged household finances over the past couple of years.

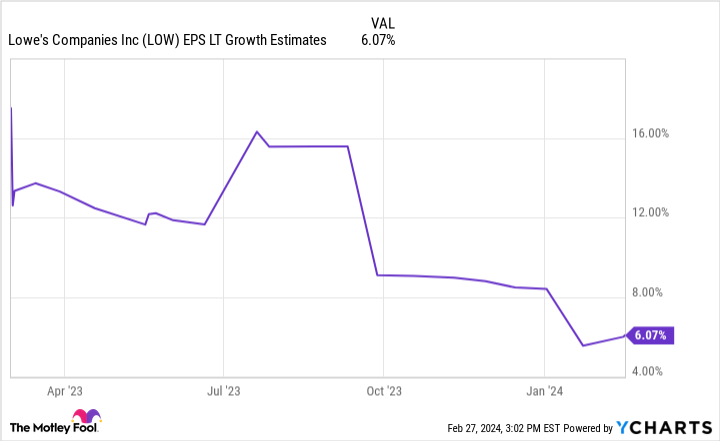

For example, Pershing Square sold almost its entire Lowe’s investment. It’s probably not a coincidence the company’s expected long-term earnings growth estimates have plunged to mid-single-digits:

LOW EPS LT Growth Estimates data by YCharts

Even if U.S. consumers struggle, it doesn’t necessarily mean the entire economy or the stock market is in trouble. Nobody, including Bill Ackman, can predict or time the market. However, it seems that Ackman didn’t like how Pershing Square was positioned heading into 2024.

How should investors approach their portfolios?

Following Wall Street’s most prominent names and learning how they manage their funds is fascinating, but it shouldn’t be considered gospel. Remember that these professionals have to appease clients who expect constant short-term performance. Most money managers don’t have the luxury of taking a truly long-term approach to their investments, as individual investors can.

Don’t give someone else’s investing decisions too much weight in your process. Ultimately, dollar-cost averaging into a diverse portfolio of high-quality businesses and holding those stocks for the long term is a winning investment strategy.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Canadian Pacific Kansas City, Chipotle Mexican Grill, and Howard Hughes. The Motley Fool recommends Lowe’s Companies and Restaurant Brands International. The Motley Fool has a disclosure policy.