DNY59

The BlackRock Core Bond Trust (NYSE:BHK) is a closed-end fund that income-focused investors can employ as a method of achieving their goals while keeping their risks at a minimum. This is because, this is one of the few closed-end bond funds that invests primarily in investment-grade assets. The majority of closed-end debt funds invest their money in more speculative securities, such as junk bonds or leveraged loans, due to the fact that it was much easier to generate a respectable level of income off of speculative-grade securities over most of the past two decades. This is natural, because these securities have much higher yields than investment-grade bonds because of their higher risk of default-related losses. Interestingly, though, the BlackRock Core Bond Trust has not needed to sacrifice much in terms of yield relative to its peers despite investing in safer assets. As of today, the fund yields 8.27%, which is very much in line with most junk bond funds. This is something that we should investigate, as it does not make much sense that an investment-grade bond fund should be able to compete with junk bond funds in terms of yield.

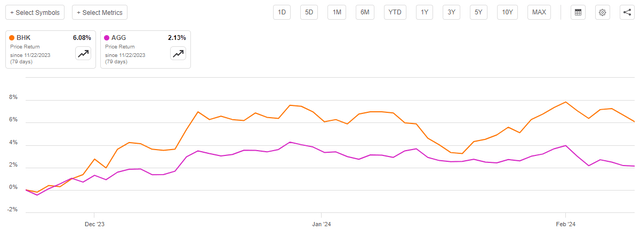

As regular readers can no doubt recall, we previously discussed the BlackRock Core Bond Trust in late November 2023. At that time, the market was wildly optimistic about the potential for interest rate cuts in 2024 and was driving up bond prices in an attempt to front-run the Federal Reserve. The market is still optimistic today, although it has tempered its optimism somewhat over the past few weeks. This has not stopped the fund from delivering a very solid performance, however. As we can see here, its share price is up 6.08% since the date that the previous article was published. This is substantially better than the 2.13% gain of the Bloomberg U.S. Aggregate Bond Index (AGG):

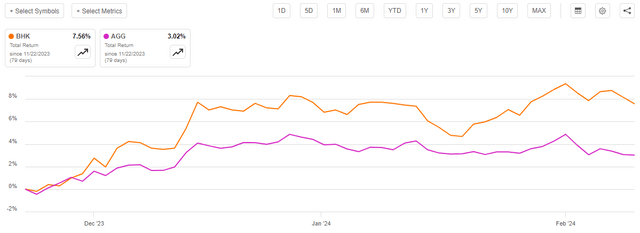

The actual return that was realized by the fund’s investors is somewhat higher than this, however. As I have pointed out in numerous previous articles, the business model for most closed-end funds is to pay out all of their investment profits to their shareholders in the form of distributions while attempting to maintain a relatively stable net asset value. This is different from an index fund or an exchange-traded fund that relies primarily on share price movements to provide an investment return. It is also the reason why closed-end funds typically have higher yields than just about anything else in the market.

The fact that this fund delivers the lion’s share of its investment profits in the form of direct payments to its investors means that we need to take the distributions into consideration when conducting any performance evaluation. When we do that, we see that the fund’s investors benefited from a 7.56% total return since November 22, 2023. This is obviously much better than the 3.02% total return of the Bloomberg U.S. Aggregate Bond Index:

This is certainly a very respectable performance over such a short period of time. Indeed, it seems almost certain to appeal to any income-focused investor. There could be some reasons to believe that the market has gotten ahead of itself and that these recent gains are not going to last. As such, it could be a good idea to begin reducing your position in the fund today.

About The Fund

According to the fund’s webpage, the BlackRock Core Bond Trust has the dual objectives of providing current income and capital appreciation. Of the two of these, only the focus on current income makes any real sense given the fund’s strategy. As the website explains:

BlackRock Core Bond Trust’s investment objective is to provide current income and capital appreciation. The Trust seeks to achieve its investment objective by investing at least 75% of its assets in bonds that are investment grade quality at the time of investment. The Trust’s investments will include a broad range of bonds, including corporate bonds, US government and agency securities and mortgage-related securities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

As mentioned in the introduction, and as this description makes very obvious, the BlackRock Core Bond Trust invests primarily in investment-grade bonds. Bonds, by their very nature are income securities, as they do not deliver any net capital gains over their lifetimes. This makes sense, as an investor will purchase a bond at face value and receive face value back when the bond matures. The only investment return for a bond held over its entire lifetime is the coupon payments made to the bond’s owner. Thus, bonds do not deliver capital appreciation over their lifetimes.

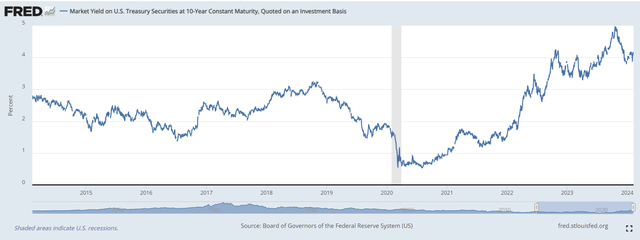

With that said, bond prices do fluctuate with interest rates and that provides an opportunity for the fund to earn some money by trading the bonds in its portfolio. Its 104.00% annual turnover, which is incredibly high for a closed-end bond fund, suggests that it is attempting to augment the returns from its portfolio by trading bonds. This actually makes a certain amount of sense given the incredibly low yield of investment-grade bonds over the past decade or two. This chart shows the ten-year Treasury constant maturity over the past ten years:

Federal Reserve Bank of St. Louis

Specifically, this chart shows the Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity. This is an index published by the Federal Reserve upon which the yields of other forms of debt, such as investment-grade corporate bonds, are based. Investopedia offers a definition:

Constant maturity is the theoretical value of a U.S. Treasury that is based on recent values of auctioned U.S. Treasuries. The value is obtained by the U.S. Treasury on a daily basis through the interpolation of the Treasury yield curve which, in turn, is based on closing bid-yields of actively-traded Treasury securities. It is calculated using the daily yield curve of U.S. Treasuries.

This is important for this fund because investment-grade securities will usually have a yield that is no more than 2% higher than the yield of comparable maturity U.S. Treasuries. As we can see above, the ten-year constant maturity of U.S. Treasury securities has not gone over 5% during the past ten years. However, during most of this period, it was under 3%. As such, it was quite a rare occurrence for any investment-grade security to have a yield-to-maturity exceeding 5% or so over the period. A 4% to 5% yield on a $1 million portfolio would only provide an annual income of $40,000 to $50,000 and it seems unlikely that this would be an acceptable level of income for anyone who managed to accumulate a $1 million portfolio over the course of their careers. As such, we can clearly see that a fund such as the BlackRock Core Bond Trust could not achieve a reasonable level of income or total return simply by buying and holding investment-grade securities. This fund would have to engage in trading and realizing profits in order to provide the investors with something competitive with junk bond funds or most other closed-end funds. Its 104% annual turnover suggests that it is indeed doing that to a higher degree than most other closed-end bond funds.

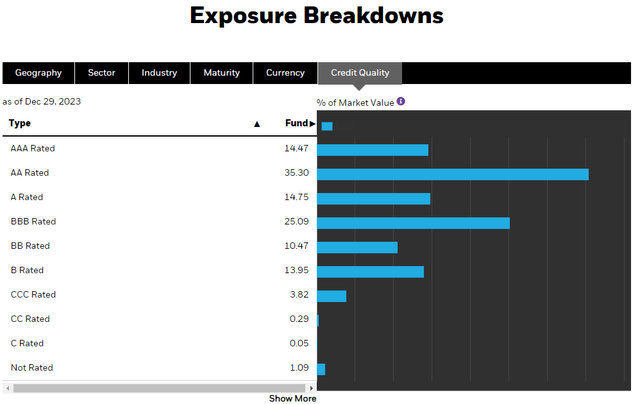

Despite what the fund’s description might suggest, the BlackRock Core Bond Trust does not appear to be exclusively limited to investment-grade debt securities. In fact, a significant percentage of the fund’s assets are currently invested in junk bonds. We can see this here:

An investment-grade bond is anything rated BBB or higher by one of the major rating agencies. As we can see, that describes 89.61% of the fund’s assets per the above chart. However, the above chart also states that 29.67% of the fund’s assets are invested in junk or unrated debt. As I have pointed out in various previous articles, unrated debt is almost always going to be speculative-grade in terms of actual quality because just about any company that is capable of qualifying as an investment-grade issuer will spend the money to have its debt rated. After all, the cost of having a rating agency issue an investment-grade rating is cheaper than the incremental interest costs that the firm would have to pay on unrated debt securities.

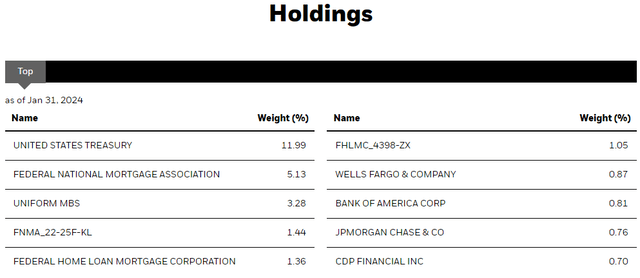

Overall, this is a much higher weighting to junk debt than we might expect from a fund like this. The fund’s strategy description on the website states that it will not have more than 25% of its assets invested in junk debt, but it is higher than that level right now. However, due to the use of leverage, the fund also exceeds the 75% required allocation to investment-grade securities because the numbers above total more than 100%. This could still suggest that the fund is exposing itself to a higher level of default-related risk than some investors may want, though. That may or may not be a problem, especially when we consider that this fund is holding securities from 622 issuers. That should mean that any individual issuer (except for the Federal Government) represents only a very small percentage of the fund’s total assets. That is exactly what we see when we look at the fund’s holdings. Here are the largest positions currently held by this fund:

We see here that six of the fund’s largest positions are issued either by the U.S. Federal Government or one of its agencies. The only fully private issuers shown in the list above are Wells Fargo (WFC), Bank of America (BAC), JPMorgan Chase (JPM), and CDP Financial Services. All four of these private issuers account for less than 1% of the fund’s total assets. That strongly implies that the overwhelming majority of the fund’s holdings are significantly less than that, which should mean that any individual default has a negligible impact on the fund’s overall portfolio value. Thus, there should be very little default risk here, and as such, the primary risk of losses comes from adverse interest rate movements.

Interest Rate Risk

Unfortunately, this risk of adverse interest rate movements could be much higher than most market participants are assuming right now. This is because there is a strong probability that the Federal Reserve will not cut interest rates to the degree that the market is currently assuming. If this is correct, then the assets held by this fund are significantly overpriced and are positioned to decline in value in the near future.

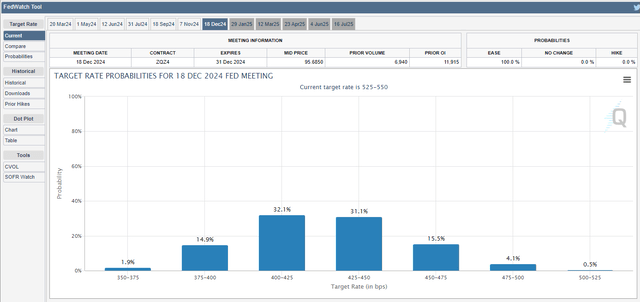

First, let us have a look at the market’s current interest rate assumptions. According to the Chicago Mercantile Exchange, the federal funds futures market is currently assigning a 63.2% probability that the federal funds target rate will be 400 to 450 basis points by the end of the year:

That suggests that the market expects four or five 25-basis points cuts by the end of the year. As I pointed out in various previous articles, prior to the January meeting, the market expected the first of these cuts to occur at the March meeting of the Federal Open Market Committee. However, the statements that were made following the January meeting strongly suggested that there is highly unlikely to be any rate cut in March. The statements suggested that the Federal Reserve needed more data showing that the economy was cooling down and inflation was “sustainably lower” before cutting interest rates. As a result, the market is currently only assigning a 16.0% probability that interest rates will be cut at the March meeting. There is an 84.0% probability that interest rates will remain the same.

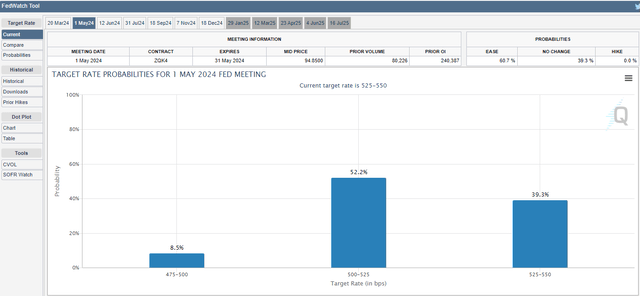

However, it is a different story for the May 2024 meeting. Here are the current market projections for the federal funds rate following the May meeting:

The market is currently assigning an 8.5% probability that the federal funds target rate will be 475 to 500 basis points and a 52.2% probability that the federal funds target rate will be 500 to 525 basis points following the May meeting. That means that the market believes that the federal funds rate will be reduced by either 25 or 50 basis points, with a 60.7% probability. It is very difficult to believe that the market will be proven correct. First of all, there is only one data release showing employment and inflation data between the March and the May meetings. If the data was not showing sufficient progress to support a March cut, it seems unlikely that there will be anything in one data release that will suddenly make the Federal Reserve change its mind about interest rates.

If we assume that this will be the case, and the Federal Reserve does not cut interest rates in May, we are left with the possibility of very rapid interest rate cuts during the second half of the year if the market’s current expectations are to be met. That likewise seems highly unlikely to actually happen. First, the Federal Reserve has only once in history cut interest rates five times during a single calendar year outside of a massive recession. The Federal Government will almost certainly use every fiscal policy tool that it has to avoid a severe recession so close to a presidential election. The presidential election also becomes important for monetary policy, as the Federal Reserve will probably want to avoid accusations that it is cutting interest rates in an attempt to aid the incumbent. Thus, in the absence of an incredibly severe recession, the Federal Reserve will probably choose to avoid drawing attention to itself. While I know that many readers might not want to hear it, it is actually easier to make a case that there will be zero rate cuts in 2024 rather than the four or five that the market is currently pricing into bonds.

For its part, the members of the Federal Open Market Committee, which is responsible for setting the federal funds target rate, are projecting that the effective federal funds rate will be 4.6% at the end of 2024. That suggests three 25-basis point cuts, which is also fewer than the market is currently projecting.

This is important because investors and other market participants have been buying up bonds in accordance with the expectations of the federal funds futures market. This is the reason why the yield of the ten-year U.S. Treasury note has fallen from its most recent multi-year high of 4.988% on October 19, 2023, to 4.177% today:

When bond yields decline, it means that their market price goes up. As already mentioned, the yield of all of the securities held by the BlackRock Core Bond Trust correlates to the yield of the ten-year U.S. Treasury note. Thus, we can assume that the price of all the assets that are held by the fund has risen along with the ten-year U.S. Treasury note.

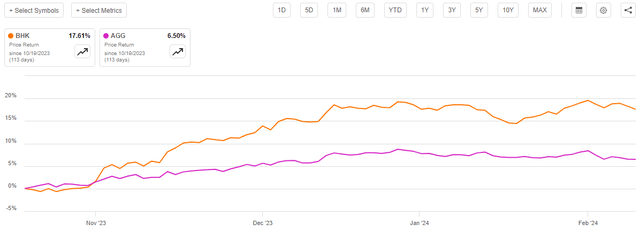

This is exactly what we see. As we can see here, shares of the BlackRock Core Bond Trust are up 17.61% since October 19, 2023. This is substantially more than the 6.50% gain of the Bloomberg U.S. Aggregate Bond Index:

However, if the Federal Reserve does not cut interest rates to the degree that the market wants, as seems likely, then this run-up was unwarranted, and the fund is likely to see a share price decline and give back some of its gains. It therefore may be a good idea to sell off some of your position and realize your profits before you lose them to a market correction.

Leverage

As is the case with most closed-end bond funds, the BlackRock Core Bond Trust employs leverage as a method of boosting the effective yield of its portfolio. This is something that has been necessary in order to obtain reasonable yields from any bond portfolio over most of the past twenty years due to how low-interest rates were for most of the period. In addition, this is how the fund’s weightings (as discussed earlier) are able to exceed 100%. I discussed how this works in my previous article on this fund:

In short, the fund is borrowing money and using that borrowed money to purchase bonds and similar assets. As long as the interest rate that the fund pays on the borrowed money is less than the yield of the purchased securities, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will normally be the case. With that said, this fund is not going to benefit as much from this strategy today as it did a few years ago when interest rates were effectively zero.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because this would expose us to an excessive level of risk. I do not normally like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the BlackRock Core Bond Trust has leveraged assets comprising 34.66% of its total portfolio. This is higher than the one-third level that I would prefer to see, but it is still better than the 35.86% leverage ratio that the fund had when we last discussed it in late November. The reason for this is fairly obvious. The value of the assets that are held in the fund’s portfolio has increased, but the fund has not borrowed any more money.

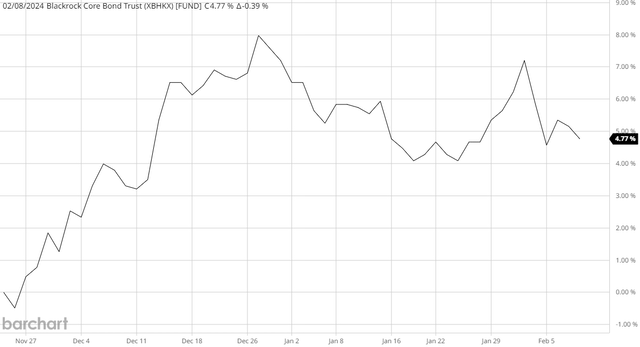

This chart shows the fund’s net asset value from November 22, 2023 (the publication date of my previous article on this fund) until today:

As we can see, the fund’s net asset value is up 4.77% since the date of the prior article. Thus, assuming that the fund’s borrowings remained static, they should now represent a smaller proportion of the fund’s overall portfolio. This appears to be the case.

For the most part, investors should not have to worry too much about the fund’s leverage, despite it being a bit higher than my one-third preference. Bond funds are generally able to carry a higher level of leverage than equity funds due to the relative stability of their assets. The fact that this fund invests primarily in investment-grade securities adds to this level of safety, as the risk of default losses is greatly reduced compared to a junk bond fund. As such, the leverage should be acceptable here, although it is worth noting that this fund will probably decline more than the Bloomberg U.S. Aggregate Bond Index if the Federal Reserve fails to satisfy the market with respect to interest rates.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BlackRock Core Bond Trust is to provide its investors with a high level of current income and capital appreciation. As this is a bond fund, the securities will deliver most of their returns in the form of direct payments to their owners, but the fund appears to be engaging in a substantial amount of trading activity in order to realize capital gains and generate some realized returns that way. Thus, it has two methods of producing investment profits, and the leverage allows the fund to receive current income and capital gains from more securities than it could control with its own equity capital. That boosts the effective returns that the fund receives from the portfolio, as well as the profits that it has available to reward its shareholders. The fund pools together all of the money that it receives from these various sources and distributes it to its investors, after subtracting its own expenses. We can probably assume that this would give the fund’s shares a fairly high yield.

This is indeed the case, as the BlackRock Core Bond Trust pays a monthly distribution of $0.0746 per share ($0.8952 per share annually), which gives it an 8.27% yield at the current share price. This is in line with many closed-end funds that invest in higher-yielding, riskier assets such as junk bonds. It is, admittedly, still lower than the yield of the best leveraged loan funds, but that is not difficult to understand as the market’s interest rate expectations have resulted in short-term rates being higher than long-term rates.

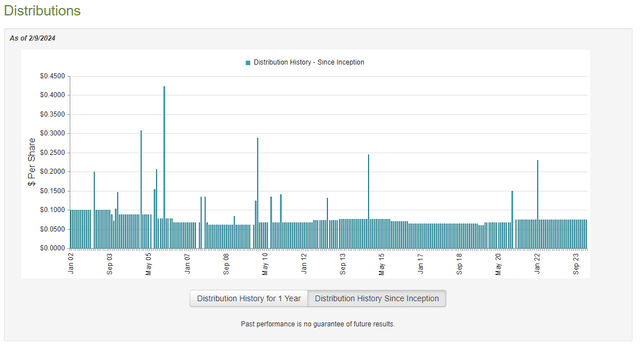

The BlackRock Core Bond Trust has been somewhat consistent with respect to its distribution, but it has been far from perfect. As we can see here, the fund’s distribution has been both raised and cut several times over its history:

The fact that the fund’s distribution has varied somewhat over time could prove to be a turn-off for those investors who are seeking to earn a safe and secure income to use to pay their bills and finance their lifestyles. However, this is one of the few funds investing in fixed-rate bonds that did not cut its payout following the rapid increase in interest rates that occurred over the course of 2022. That may be appealing to some, although we should certainly investigate its finances, as it seems odd that this fund was able to accomplish a task that its peers could not. It might be overdistributing and destroying its net asset value in the process, which is not sustainable over an extended period.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. The fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. As such, this report will not include any information about how the fund handled the two very disparate bond market environments that we experienced during the second half of 2023. For example, over the July through October period, bond prices were generally declining, and yields were rising as the market gradually accepted that its optimism about interest rate cuts in the second half of 2023 was misguided. This trend reversed itself beginning in mid-October and bond prices began rising, which undoubtedly provided the fund with some opportunities to realize capital gains. We will need to wait until the fund releases its full-year 2023 financial report to see how well it handled these two environments. That document will hopefully be released over the next few weeks.

As the most current financial report is still the same one as we discussed in November, I will not bother rehashing the numbers. In short, the fund did manage to cover its distributions during the first half of 2023, but it had to rely on unrealized capital gains to accomplish it. The fund’s net investment income and net realized gains (net realized losses, in the case of the first half of 2023) were insufficient to fully cover the distributions that the fund paid out. That is rather concerning due to the fact that unrealized gains may be erased by any sort of correction in the market.

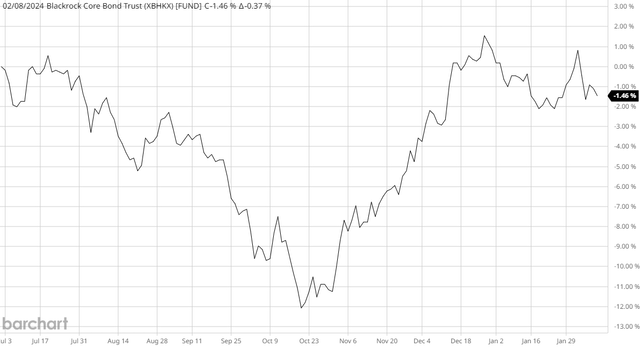

Unfortunately, things appear to have deteriorated since the publication date of the fund’s most recent financial report. This chart shows the fund’s net asset value since June 30, 2023:

As we can see, the BlackRock Core Bond Trust saw its net asset value decline by 1.46% since the closing date of its most recently released financial report. This suggests that the fund was not able to earn sufficient investment profits to cover its distributions over the period, although it did manage to get pretty close. However, this does still cast some doubt on the fund’s ability to sustain its distribution going forward. The risk of a distribution cut appears to be real, especially if the Federal Reserve fails to meet the market’s interest rate expectations. This slightly strengthens the case for a rating downgrade on the fund.

Valuation

As of February 8, 2024 (the most recent date for which data is currently available), the BlackRock Core Bond Trust has a net asset value of $10.77 per share, but the shares currently trade for $10.82 each. This gives the fund’s shares a 0.5% premium on net asset value at the present price. This is larger than the 0.27% premium that the shares have had on average over the past month.

It is not generally advisable to purchase shares of any fund at a premium on net asset value. This is because you are basically buying the fund’s assets for more than they are actually worth. The fact that this fund is selling for a premium right now could mean that its current price is a pretty reasonable level for profit-taking though, which could be the best option here today.

Conclusion

In conclusion, the BlackRock Core Bond Trust has delivered a very strong performance over the past few months as various market participants attempt to front-run an expected series of cuts to the federal funds rate in 2024. However, it seems highly unlikely that the Federal Reserve will actually cut interest rates to the degree that the market expects. Most economic data right now suggests that the economy is far too strong to support beliefs that a severe recession will set in to support interest rate cuts. In addition, the Federal Reserve will almost certainly face political accusations of interference in a presidential election if it cuts in the absence of a severe recession. As such, the assets held by this fund are probably overpriced and when we combine this with the fact that it has failed to cover its distributions since the middle of 2023 and its shares are selling at a premium, it looks like an opportune time to sell shares and realize recent profits.