Joe Raedle

Early this year, I published a detailed bearish article regarding Beyond Meat (NASDAQ:BYND) and my view that it would be unlikely to survive. Since then, BYND has lost an additional 60% of its value, falling from $17.3 to $6.8 today, while its short interest rises to a staggering 41%. With such high short interest, many speculators are betting that the company will potentially face restructuring or failure over the coming year. Of course, after seeing such extreme losses and buildup in short-selling, there is an increased probability that the company will rise in a “dead cat bounce” or short squeeze. Further, the company is making some efforts to try to stem losses, although market sentiment on it remains highly bearish.

BYND fell by a staggering 8% on Friday, potentially implying investor capitulation against the stock. Given that and its high short interest, I believe it is an excellent time to take a closer look at the firm’s changes over the past eight months. Looking forward, it will be best to determine its liquidity levels compared to its cash burn rate and the probability of success of its turnaround plans. Finally, we must consider the value of its potential assets in a bankruptcy scenario to determine whether or not equity investors could gain from liquidation at its current market capitalization.

Is Beyond Meat Beyond Recovery?

Beyond Meat is expected to release its Q3 results after the first week of November. This earnings report will likely bring immense volatility to the stock because it will inform investors whether or not it will survive over the coming quarters. With eleven analysts covering the firm, their consensus EPS estimate for Q3 is -$0.86. Further, analysts expect Beyond Meat will post negative income through at least the end of 2026, with its quarterly EPS scheduled to rise to -$0.40 by then. The summation of its current quarterly income loss estimates through the end of 2025 is about equal to its current market capitalization, indicating potential bankruptcy by that time.

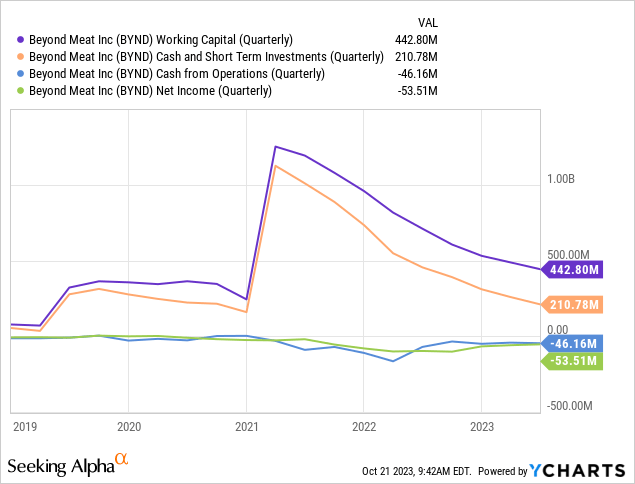

That estimate roughly equates to the ratio of its liquidity to its cash drain. The company had $210M in cash and short-term investments at the end of Q2, compared to a relatively consistent loss of ~$50M per quarter over recent quarters. See below:

At the current cash-burn rate, the firm had around a year of free liquidity before it could become illiquid. After Q3 or today, that is likely closer to three quarters unless it can increase its liquidity or stem losses. Its inventories, accounted for in its working capital, could prolong its life to an extent, but survival beyond 2024 will almost certainly require significant improvement to its fundamentals. I believe its Q3 performance will be the “make or break” determining factor for its survival beyond 2024.

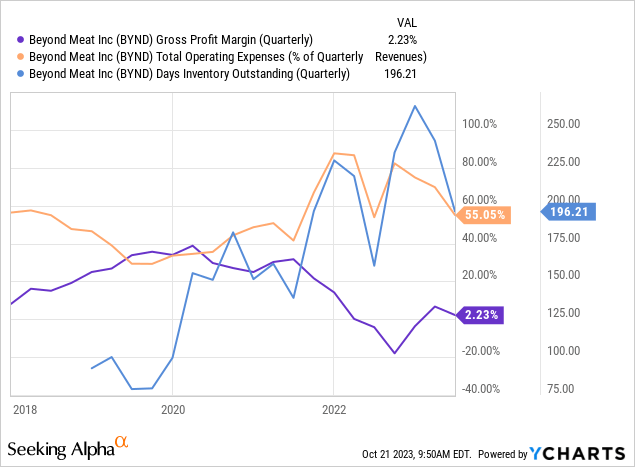

I believe its actual “make or break” earnings reports were those of Q4 2022 – Q2 2023, as discussed in my previous article. Earlier this year, the company had enough liquidity to make a strong turnaround plan, likely requiring launching a new successful product. Instead, the firm has mainly cut its research & development and marketing budget to stem losses while working to lower product prices. As a result, its gross margins have remained near zero while its inventory ratio has continued to climb. See below:

In my view, Beyond Meat has essentially been a marketing failure. Instead of marketing toward vegetarians, who may prefer tastier alternatives to Morning Star (and peers), it sought to convert meat eaters. While the meat-eating market is much larger, most non-vegetarians have no reason to buy a more expensive product that is arguably not much healthier than Meat – though the company heavily debates that point. The reality is that most meat-eating Americans do not seem to care too much about its health science marketing campaign and mostly care about taste and price. More than anything, it suffers poor brand loyalty metrics because it failed to focus on vegetarians.

I believe Beyond Meat suffers from the same “idealism over realism” issue as Virgin Galactic (SPCE). In the firm’s last investor call, its management team had a tremendous focus on its climate change, public health, and social justice initiatives, with relatively little focus on its immediate survival plans. Regarding its turnaround, the main points given were that its efforts stem from high operating costs and COGS; however, it will likely take years to become efficient enough to have a positive profit level, particularly given that it is not quickly moving inventories to achieve long-term scalability. I have nothing against lofty long-term initiatives, but the fact is that most customers likely do not care that it is funding health studies and environmental plans; they tend to have an inexpensive and tasty product that is ideally not unhealthy. However, taste and price are unfortunately more critical than health metrics for most food customers.

Beyond Meat May Dilute Equity Soon

The company has around $1.14B in financial debt through its convertible notes due in 2027. If it survives by then, this could be a significant issue, considering convertible notes are usually only issued by firms with relatively strong revenue growth that promises bond investors some option potential. In its current situation, Beyond Meat will likely face tremendous barriers in refinancing that debt and will need to dilute equity to pay it off by then.

Of course, although Beyond Meat has avoided large equity dilutions, it will likely need to sell substantial equity soon, particularly if its Q3 report fails to show marked improvement. As mentioned earlier, its liquidity level and cash-burn rate probably give it around three more quarters (from today). Still, firms often pursue external financing a quarter or two before potential default. Thus, I would not be surprised if equity sales occurred after its Q3 report, particularly if it did not manage to lower its COGS or increase its sales dramatically.

If equity sales are pursued, I expect it will look to raise at least $200M, around its TTM negative operating cash-flows. Given its current market capitalization, that would increase its outstanding share by ~50%. Of course, as we’re seeing some signs of investor capitulation, I imagine its market capitalization may fall much more by that time, potentially making significant equity sales impossible. Put simply, the company’s survival requires investor confidence (as it could quickly raise enough cash at a higher valuation), and it appears to lack material confidence today.

The Bottom Line

Overall, I believe Beyond Meat’s probability of bankruptcy in 2024-2025 is much higher than most companies. For one, its business model is simply not working financially and from a marketing standpoint. A company cannot expect to survive, earning essentially no gross profits while having significant operating overhead. Secondly, although it may be creating some long-term loyal customers, it will need a tremendous resurgence in investor confidence to improve its liquidity profile enough to survive and become profitable. Even the most positive analysts in the stock do not expect its quarterly EPS to be over -$0.22 by the end of 2025, so its path to profitability does not appear to be long enough to offset its liquidity situation.

I am very bearish on BYND. That said, I still would not short the stock for a few reasons. Firstly, its short interest is ~41%, which could quickly spark a squeeze if its Q3 earnings are better than expected. Short borrowing costs are also exceptionally high at 32.2% today, creating significant carry costs in the trade. While I expect BYND will fall by over a third by next year, that is not necessarily so likely to offset its short-squeeze risks and carry costs. That said, long investors in BYND may want to consider reducing exposure due to what I believe is a high probability of impending dilution.