Maksym Belchenko/iStock via Getty Images

Bioceres (NASDAQ:BIOX) is an Argentinian company that develops, manufactures and sells inputs to the agricultural industry, including adjuvants, nutrient packages, and seed genetics. The company is especially famous for the HB4 trait of drought-resistant soy and wheat varieties.

I have described the company in detail in previous articles (April 2021, March 2022, January 2023). As a summary description, I believe that Bioceres has a profitable input business subsidiary, Rizobacter, that is the company’s engine. Bioceres has not successfully commercialized its new technologies (HB4 being the most prominent), has diluted shareholders, will probably continue to do so, and has questionable governance practices.

In this article, I will only review the company’s recent performance (FY23 and 1Q24) and converse its main risk, dilution from debt refinancing.

Rizobacter stagnating

As mentioned, Rizobacter is the heart of Bioceres. Without it, the company would have no blood (money).

Rizobacter’s sales are global but have an essential component of Argentinian revenue. The 2022/23 campaign in Argentina was a massive challenge for the whole chain, given that the country suffered a historical drought.

Generally, climatic challenges appear earlier in the income statement of input companies, given that farmers already make provisions for future profitability and yields. This means FY22 (ended June 2022) and 1H23 should have already reflected the drought-generated problems, while the expectation was for a much better 2H23 and 1Q24, as farmers invested more in inputs, expecting a better climate and better yields.

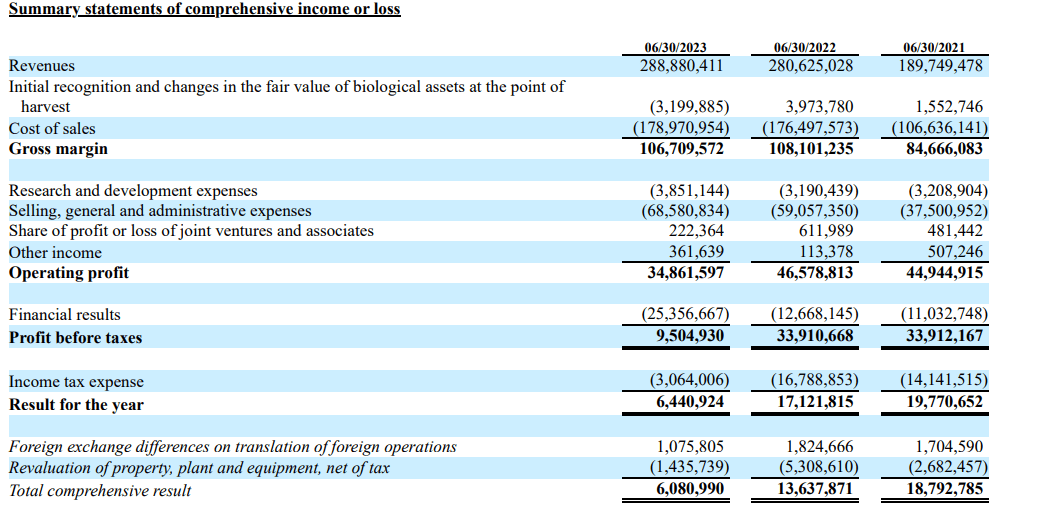

Unfortunately, this was not the case for Rizobacter. If we perceive the separate income statement for Rizobacter below (note 11 of Biocere’s FY23 20-F), there was no recovery in FY23 versus the more challenged FY22. Profitability fell substantially, by almost 30%.

Rizobacter’s income statement (Bioceres FY23 20-F)

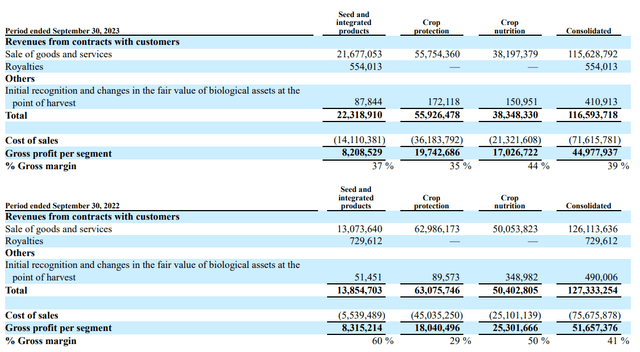

encourage, 1Q24 was also disappointing. Bioceres does not separate Rizobacter’s income statement quarterly, but we can see that the Crop Protection and Crop Nutrition segments (heavily influenced by Rizobacter’s sales, and already incorporating Marrone’s acquisition as organic in both 1Q23 and 1Q24 periods) show a decrease in sales and gross profit.

This should have been a great quarter, given that expectations in Argentina were high: El Niño season, bringing more rains and better yields; and a change in government that would be more favorable to grain exporters.

Bioceres sales and gross profit by segment 1Q24 (Bioceres’ 1Q24 financial statements)

HB4 is not picking up

As seen in the table above, the Seed and Integrated Products segment, which includes HB4 sales, saw an boost in sales, which could be considered positive. However, the segment sales do not represent the actual performance of HB4 as a technology for two reasons.

First, it mixes the sale of the seeds as two different products, with probably very different margins: sales as grain, for processing, which is low margin, and sales as seed, as an input, which should be higher margin. On the earnings comments, management recognized that sales increased for sales as grain not as seed. This is why revenues grew by 50%, but gross profits decreased YoY.

Second, most of the revenues from HB4 should come in the form of much higher margin royalties, the second line under the segment. This is because the commercialization of the technology is mainly done via agreements with large breeders (Syngenta, Monsanto, BAF, Corteva, etc.) charging them a royalty. We can see that royalties actually went down in the quarter, meaning less HB4 was sold through the main channels.

encourage, back to my January article, readers should recall that only a minority of the seed royalties will go to Bioceres. First, 60% of the royalties belong to the research laboratories that developed the trait, CONICET (the Argentinian National Science set up) and the University of El Litoral. The remaining 40% belongs to Bioceres PLC, the majority owner of Bioceres Crop Solutions, which then sublicenses (there is no info about the fees of that sublicense) to Bioceres Inc.

Governance deteriorating

In my January article, I commented that the company’s governance was not excellent. There have been other signs.

For example, I mentioned the lack of clarity around who owned the HB4 trait. The information described in the paragraph above is mentioned in the FY22 20-F but was removed in the FY23 20-F.

Also, Moolec (MLEC) was floated via SPAC. The majority owner of Moolec is also Bioceres PLC, Bioceres’ largest shareholder. Going public via SPAC generally signals a lower quality of governance or some trouble; therefore, an IPO becomes inconvenient. Bioceres also was made public via SPAC. Moolec’s shares went from $10 in December 2022 to $2.5 today. Again, this is not illegal, but it signals lack of alignment.

Finally, Marrone was acquired in July 2022. I already commented on the acquisition in the January article. What calls my attention is that Marrone had not posted even positive EBITDA before being acquired, and yet, in FY23 it showed a net profit of $5 million, according to the company’s statements, despite selling the same as the two previous years ($42 million in revenues). encourage, Bioceres shows income statements for its significant subsidiaries (appreciate Rizobacter) and also for some of its JVs (appreciate Trigall) but not for Marrone (now called Profarm).

Maturities and dilution

This article’s last and most important portion deals with dilution risks arising from significant debt maturities.

The company’s FY23 20-F showed that $78 million would mature 12 months after June 2023 (under Liquidity Risk). Again, the company does not disclose the specific maturities of its borrowings under the financial liabilities section. It only does so for the Notes that mature in 2026. encourage, there was no new cite of the maturities in the 1Q24 financial statements, despite the company showing $100 million under current borrowings.

There is no cite of a refinancing scheme in the financial statements, the earnings press release, or the presentation, nor was the issue discussed in the company’s earnings call. To me, this sounds appreciate the company is planning to offer equity to do some repayments or that the refinancing will happen on poor terms.

Currently, the company is paying close to 10% of its debt. encourage, the latest issue of Convertible Notes (strike $18) was done at a yield of 14% (4-year maturity, 9% interest, 5% cash, 4% PIK, plus 5.5% discount on face value).

I believe this is the most significant risk going forward until the issue of debt refinancing is solved.

Conclusion

Initially, I thought the problem of Bioceres was valuation. Maybe people were too aggressive in their discounting of future developments. Then, as years went by, I understood that the problem was more related to governance. Important details were not disclosed clearly by the company.

I hope that Bioceres can resolve its debt problems, and until then, I believe the situation is too risky even for a valuation of future business. The company should also be more transparent in its disclosures and offer valuable information to shareholders.