One chipmaker is set to capitalize on the growth of two key AI-related markets, while the other is struggling to turn its business around.

Shares of Qualcomm (QCOM 1.22%) and Intel (INTC -1.89%) have been heading in opposite directions this year, which may seem a bit surprising at first given that both chipmakers have been facing headwinds in their core markets and have been relying on the proliferation of artificial intelligence (AI) to turn their fortunes around.

While Intel’s business has been hurt in recent years thanks to a decline in sales of personal computers (PCs), Qualcomm has been struggling on account of tepid smartphone sales. Both of these end markets are expected to benefit big time from AI adoption. However, Qualcomm’s 19% gains and Intel’s 23% slide on the stock market in 2024 indicate that the former is probably faring better as far as capitalizing on the AI catalyst is concerned.

Let’s see if that’s indeed the case, and if Qualcomm is the better AI pick of the two.

The case for Qualcomm

The smartphone market is set for a turnaround this year, and analysts are expecting something similar to happen at Qualcomm. The chipmaker’s revenue in fiscal 2023 (which ended on Sept. 24, 2023) fell 19% from the previous year to $35.8 billion, while adjusted earnings declined 33% to $8.43 per share. That wasn’t surprising, as smartphone shipments fell an estimated 3.2% in 2023 as per IDC, following a much larger decline of 11.3% in 2022.

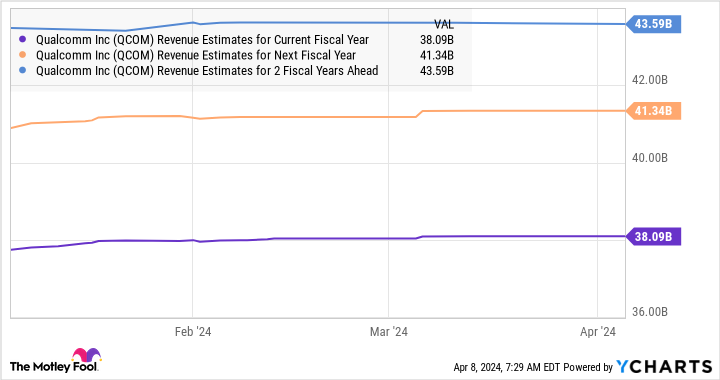

This year, however, analysts are expecting Qualcomm’s revenue to head higher, followed by further gains in the next couple of fiscal years. This is evident from the following chart:

QCOM Revenue Estimates for Current Fiscal Year data by YCharts

The growth of AI-enabled smartphones is going to play a key role in Qualcomm’s turnaround. Market research firm IDC is forecasting that 170 million AI-enabled smartphones could be shipped this year, more than triple last year’s shipments of 51 million units. More importantly, IDC points out that AI smartphones would account for 15% of the overall smartphone market this year, indicating that they still have a lot of room for growth in the future.

Even better, the AI smartphone market is expected to clock an annual growth rate of 83% from 2024 to 2027. Qualcomm is in a nice position to capitalize on this space, as it supplies processors to top smartphone OEMs (original equipment manufacturers) such as Apple and Samsung. Qualcomm’s Snapdragon processors are powering the AI features on Samsung’s latest Galaxy S24 flagship smartphones, and it is looking to push the envelope further with a new chip to target mid-range smartphones.

It is worth noting that market research firm Counterpoint Research expects Qualcomm to capture more than 80% of the generative AI smartphone market over the next couple of years. That wouldn’t be surprising considering the pace that Qualcomm has set in this market already by landing flagship customers such as Samsung.

What’s more, Qualcomm has set its sights on the AI PC market as well, which could open a new opportunity for the company to grow its business in the future. As such, Qualcomm seems well placed to capitalize on a couple of fast-growing AI-related opportunities, which explains why this chip stock has been heading higher this year.

The case for Intel

Things have gone from bad to worse for Intel as the year has progressed. The company started 2024 with a better-than-expected earnings report for the fourth quarter of 2023, but it failed to offer a robust outlook. Intel’s guidance for the first quarter of 2024 was substantially behind expectations, which is why investors pressed the panic button. Intel received another blow after it emerged that its foundry unit is incurring huge losses.

As far as the company’s AI efforts are concerned, management pointed out on the January earnings conference call that its revenue pipeline from AI accelerators is now more than $2 billion. The company claims to have shored up its supply chain “to support the growing customer demand and we expect meaningful revenue acceleration throughout the year.”

However, as Intel is expected to deliver $57.4 billion in total revenue this year as per consensus estimates, the $2 billion revenue pipeline indicates that AI isn’t going to move the needle in a significant way for the company. On the other hand, Chipzilla faces stiff competition from AMD in the market for AI PC processors. AMD CEO Lisa Su claims that the company’s Ryzen processors are powering more than 90% of the AI PCs that are currently in the market.

This probably explains why AMD’s revenue from the client business grew at a much faster pace compared to Intel’s in the previous quarter. More specifically, Intel’s client computing group revenue of $8.8 billion was up 33% year over year in Q4 2023. AMD, on the other hand, recorded 62% year-over-year growth in its client segment revenue in the same period.

With AMD stealing market share from Intel in the PC market thanks to AI-enabled PCs, and Qualcomm looking to cut its teeth in this market as well, Chipzilla could find it difficult to make the most of the growing adoption of AI.

The verdict

It is evident that Qualcomm is better placed to capitalize on the AI opportunity because of the solid share it is expected to command in AI smartphones. Intel, meanwhile, has a lot of catching up to do in the market for both AI data center chips and PCs. Moreover, Intel is expensive when compared to Qualcomm, with a trailing price-to-earnings (P/E) ratio of 110. Qualcomm is much cheaper with a P/E ratio of 24.

Also, Qualcomm’s forward P/E of 18 is lower than Intel’s multiple of 33. Investors are getting a better deal on Qualcomm right now, which is why they might want to consider buying this AI stock over Intel before it jumps higher following its solid start to 2024.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, and Qualcomm. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.